County Gov Consolidation Financial Form: A Comprehensive Guide

Overview of county gov consolidation financial form

The county gov consolidation financial form serves as a pivotal document in the strategic integration of local government services within a county. This form is essential for outlining the expected financial implications of merging departments or services. It plays a crucial role in ensuring a transparent and accountable decision-making process, as it quantifies the fiscal realities of consolidation.

The importance of this financial form cannot be understated. It not only aids government officials in making informed decisions but also enhances public confidence by providing a clear picture of anticipated budget impacts. Key purposes include streamlining operations, reducing costs, and improving service delivery. The financial form acts as a blueprint, guiding counties toward operational efficiency.

Understanding the consolidation process

County government consolidation refers to the process where multiple local government entities merge into a single entity, thereby eliminating redundancies and enhancing the efficiency of service delivery. This approach can result in significant savings for taxpayers, as pooling resources often lowers operating costs. Additionally, consolidation can stimulate economic growth by creating unified policies and streamlined services.

The key stages in the consolidation process include an initial assessment to evaluate the potential benefits and challenges, engaging relevant stakeholders to gather input and foster support, and a final decision-making phase where all collected data culminates in a structured plan.

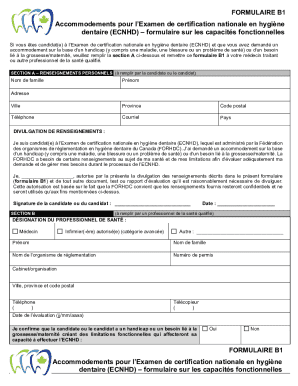

Detailed breakdown of the financial form

The county gov consolidation financial form consists of several critical sections designed to collect necessary fiscal data. Key sections may include Revenue Projections, which outline expected income from taxes, grants, and other sources, and Expenditure Estimates, which detail anticipated costs associated with services and operations. Each section is tailored to ensure a comprehensive understanding of the financial landscape pre- and post-consolidation.

Revenue Projections: Expected income from various sources.

Expenditure Estimates: Detailed anticipated costs.

Net Savings: Calculation of overall financial impacts.

To complete the form accurately, a range of documentation is required. This includes current budgets, historical financial data, and operational statistics. Utilizing templates can simplify this process, offering examples that clarify expectations for each section.

Filling out the financial form

Completing the county gov consolidation financial form requires a methodical approach to ensure accuracy and compliance. Start by gathering necessary information, which includes identifying reliable financial data sources and compiling previous years' budget reports. Collaborating with financial officers can also enhance the quality of data collected.

Proceed to fill out each section of the form systematically. Revenue Estimates should be derived from a thorough analysis of current income sources, while Expense Forecasts must be based on a detailed review of operating costs. Engaging with department heads to gain insights into potential changes is also crucial.

Revenue Estimates: Carefully project anticipated revenue streams.

Expense Forecasts: Accurately estimate future expenses based on historical data.

Collaboration with departments: Involve department heads for detailed insights.

Common mistakes to avoid include overestimating revenue projections, which can lead to budget shortfalls, and underreporting expenses, which creates a misleading financial outlook.

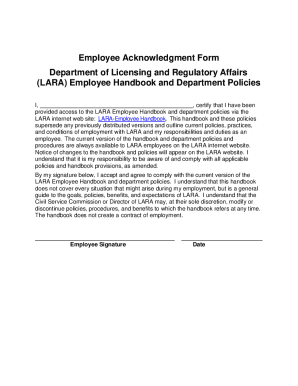

Editing and finalizing the form using pdfFiller

Once the county gov consolidation financial form is filled out, using a platform like pdfFiller facilitates seamless editing and finalization. Upload the document to pdfFiller's interface, where various editing tools allow you to adjust fields, add comments, or correct any inaccuracies easily.

The importance of electronic signatures in the submission process cannot be overstated. After populating the form, ensure all relevant stakeholders have signed off on the document electronically. This not only expedites the approval process but also keeps records secure and easily accessible.

Upload the form: Effortlessly upload to the pdfFiller platform.

Edit tools: Utilize editing tools for any necessary adjustments.

eSign the document: Ensure all signatures are collected electronically.

Collaboration and review process

Engaging stakeholders in the review of the county gov consolidation financial form is critical for fostering a collaborative atmosphere and ensuring all viewpoints are considered. Using pdfFiller, set up sharing sessions where team members can review the document simultaneously, providing feedback and suggestions in real time.

Final approval steps should involve a thorough review to guarantee compliance with local government regulations. Documenting the approval process within pdfFiller allows for an audit trail that can be referenced in future discussions or evaluations.

Collaborative sessions: Organize team reviews for efficient feedback.

Compliance check: Ensure adherence to local regulations.

Documentation: Securely record approvals within pdfFiller.

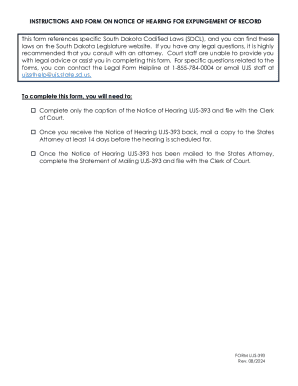

Tracking and managing the financial form after submission

Post-submission, it is vital to monitor the status of your county gov consolidation financial form. pdfFiller offers tracking capabilities that allow users to check whether the form has been received and processed. This transparency keeps all parties updated and ready to act if further information is needed.

Record management best practices involve securely storing completed forms within pdfFiller’s cloud storage. Establishing an organized audit trail ensures that all documentation is readily accessible for future reference or audits.

Submission tracking: Keep tabs on the status of submitted forms.

Secure storage: Use pdfFiller’s cloud storage for safety and accessibility.

Audit trail: Maintain records for compliance and reference.

FAQs about county gov consolidation financial form

Addressing frequently asked questions can alleviate concerns during the completion of the county gov consolidation financial form. If you need assistance, resources or support from financial officers can provide clarity. Regular updates of these forms are essential, especially following budgetary changes or new fiscal year projections.

After submission, it's crucial to maintain communication with stakeholders to assess any follow-up requirements or additional information that might be requested.

Assistance: Don’t hesitate to seek help from financial experts.

Update frequency: Revisit forms regularly to align with changing budgets.

Post-submission steps: Follow up for any additional requests or information.

Additional tips and best practices

Leveraging pdfFiller features enhances document management regarding the county gov consolidation financial form. Utilizing cloud storage allows for easy access and sharing among team members, ensuring that everyone involved remains on the same page.

Integration options with other county government systems can streamline processes. Regular consultations with accountants and financial officers ensure accuracy and compliance throughout the consolidation process, reinforcing the overall integrity of the financial form.

Cloud storage: Make documents easily accessible to all stakeholders.

System integrations: Improve operational efficiency through technological synergy.

Consultation: Regularly engage with financial experts for best practices.

Real-world case studies

Examining successful county government consolidations provides valuable insights into the effectiveness of the financial form. For instance, the case of [County Name], which consolidated its health and social services, shows how strategic mergers led to significant savings and improved service delivery for residents.

Impact analyses following such consolidations often highlight financial benefits, including reduced administrative costs and enhanced revenue generation opportunities. These examples illustrate the potential of well-executed consolidation efforts supported by meticulous financial documentation.

Case study: [County Name] - Successful consolidation of health services.

Financial outcomes: Documented savings and improved efficiency.

Learning points: Importance of thorough financial planning.