Application for Summary Instalment Form: A Comprehensive Guide

Understanding the summary instalment application process

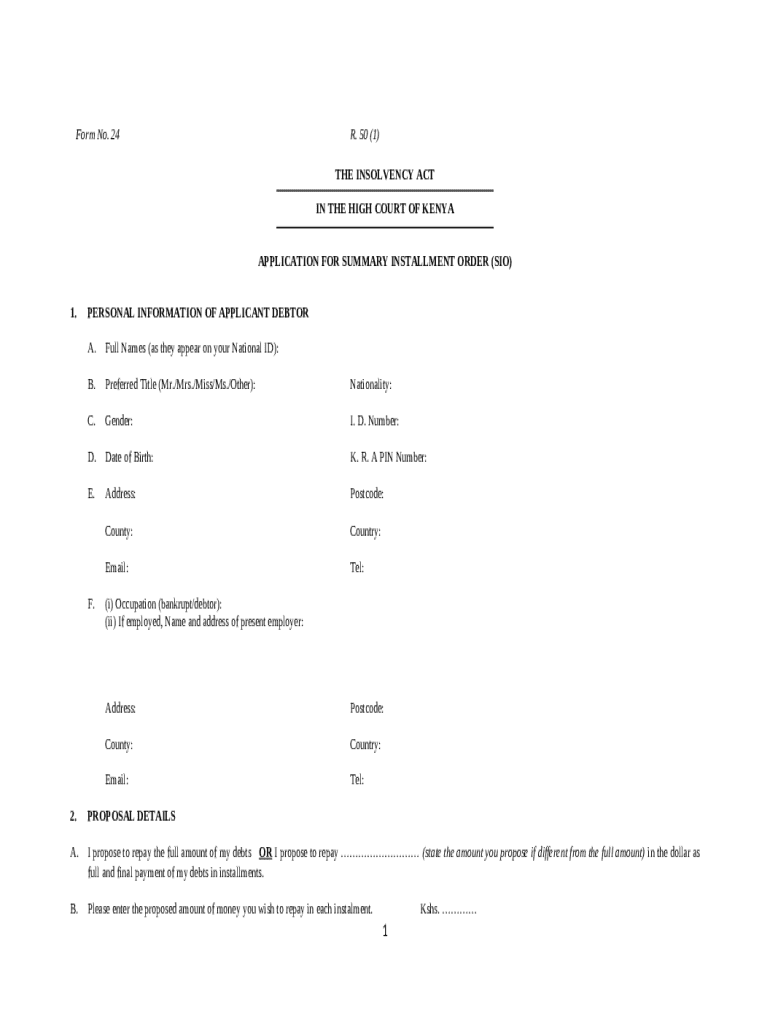

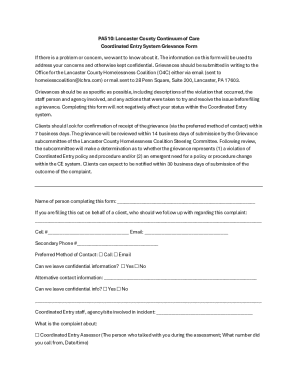

A Summary Instalment Order (SIO) is a legal mechanism designed to help debtors manage their debts by allowing them to propose a repayment plan that spans over several months. The application for summary instalment form serves as the initial step in this process, guiding individuals through the necessary information required for a structured debt management plan.

The significance of the summary instalment application cannot be overstated; it provides a formal avenue for debtors to present their case to creditors and the Official Receiver for approval. Through this application, debtors can potentially reduce the pressure of multiple debts by consolidating them into a single manageable instalment structure.

Individuals facing financial difficulties, particularly those who have unsecured debts, like credit cards or personal loans, may qualify for this process. Understanding the eligibility criteria, such as income thresholds and debt limits, is crucial for a successful application.

Key components of the summary instalment form

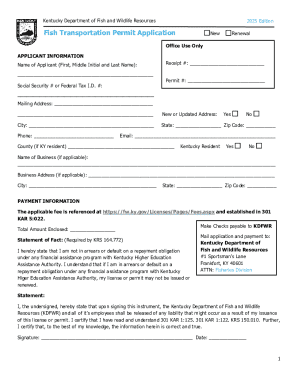

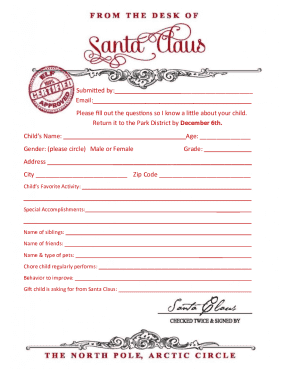

The summary instalment form is structured with specific sections that solicit critical information from the applicant. The first section typically covers personal information, such as name, address, and contact details, ensuring the applicant's identity is verified. Next, the financial information section requests details regarding income, expenses, and existing debts, which are crucial for assessing the debtor's capacity to meet an instalment plan.

An equally essential part of the form is the Statement of Affairs, a comprehensive overview of the debtor's financial situation. This includes listing assets, liabilities, and a breakdown of financial commitments. Applicants must attach supporting documents, such as proof of income, bank statements, and any relevant correspondence with creditors.

Personal Information: Collect your details, ensuring accuracy.

Financial Overview: Document income sources, expenses, and debts.

Statement of Affairs: Provide a full account of assets and liabilities.

Commonly asked questions about the form often revolve around document requirements and how to accurately reflect one’s financial situation. Applicants are encouraged to be as transparent as possible, as the clarity of information directly impacts the approval process.

Step-by-step guide to completing the application for summary instalment form

Completing the application for summary instalment form requires a systematic approach. Step one involves gathering all necessary documents. Essential documentation includes pay stubs, tax returns, and records showing regular income sources. Debt verification documents, such as statements from creditors, should also be included.

Step two is filling out the personal information section. It is vital to ensure that all details are accurate, as discrepancies can lead to delays or rejection of the application. Double-check for any spelling errors or incorrect numerical entries. Then, in step three, the financial overview must be completed carefully; calculating total income and expenses helps in creating a realistic repayment plan.

Step four involves preparing the Statement of Affairs, where transparency is paramount. Clearly state all assets and liabilities, keeping in mind that detailed disclosures can build trust with the Official Receiver and creditors alike. In step five, review your entire application against a checklist to ensure nothing is omitted or unclear. Finally, step six is crucial for submission—options include online submissions via platforms like pdfFiller or postal delivery, depending on your preference.

Tools and resources for effective form management

Utilizing advanced tools can significantly enhance the application experience. Interactive features on pdfFiller allow users to edit PDFs smoothly and leverage eSignature options to speed up completion. Such tools ensure that each document is properly managed and can be signed electronically, creating a seamless submission process.

Collaboration tools are equally important, especially for individuals applying as part of a team or family unit. These features enable multiple users to work on the application simultaneously, ensuring that all pertinent data is included and reducing the potential for errors.

Frequently asked questions (FAQs) regarding the summary instalment application

FAQs around the summary instalment application often concern the procedure’s timeline. Typically, the application process lasts several weeks, contingent on the completeness of the submitted information. After submission, applicants are usually notified about their application status, which can either lead to approval or requests for additional information.

How long does the application process take? Typical processing times can vary between weeks to months.

What happens after submission? You will be contacted with updates or further instructions.

Can I modify the submitted application? Generally, modifications must be requested through the Official Receiver.

What are the costs involved? Fees can vary; it’s advisable to consult the Official Receiver’s guidelines.

Official receiver: roles and responsibilities

The Official Receiver plays a pivotal role in processing applications for summary instalment orders. They are responsible for reviewing submitted forms, ensuring compliance with legal stipulations, and making decisions regarding approvals. Their assessments guide debtors towards appropriate repayment plans and help maintain satisfactory arrangements with creditors.

Additionally, the Official Receiver provides valuable support services to assist applicants. This includes clarifying application requirements, addressing common concerns, and facilitating communication between debtors and creditors. Their expertise is essential for guiding individuals through what can often be a complex administrative process.

Understanding fees associated with summary instalment applications

Understanding the potential fees associated with the summary instalment application is crucial for budgeting. Typical costs may include application processing fees, legal advisor fees, and potential costs related to document retrieval or service charges from third parties. Familiarizing oneself with these expenses allows applicants to prepare effectively.

Payment options vary, with some applicants opting for in-person payments, while others may prefer electronic transfers. In some cases, financial assistance or fee waivers may be available to those who qualify, thus reducing the financial burden during application.

Additional forms related to summary instalment applications

Aside from the main application for the summary instalment form, several related forms may be required throughout the process. These can include forms for debt verification, changes to planned payments, or forms for changes in personal circumstances. Understanding how to access and effectively utilize these supplementary forms is key for a comprehensive application experience.

Moreover, it's advisable to keep abreast of any updates regarding these forms, as regulations and procedures may evolve, impacting your submission process. Leveraging platforms like pdfFiller can help track and manage these documents efficiently.

User experiences: insights from individuals who have applied

Many individuals have successfully navigated the application for summary instalment form, sharing their experiences and challenges faced along the way. Success stories often emphasize the importance of thorough preparation and the value of utilizing available resources effectively. Frequent feedback underscores that understanding the complexities of each form section directly influences the ease of the application process.

Lessons learned include the need for clarity in financial disclosures and the significance of seeking assistance, either from experienced advisors or through supportive online platforms. By capturing the essence of user experiences, prospective applicants can glean important insights that may enhance their own journey.

Stay updated: follow us for more resources and updates

For ongoing resources and support regarding the application for summary instalment form, staying connected through social media and subscribing to updates from pdfFiller can prove beneficial. This engagement not only provides insights into document management news but also fosters an enriched environment for sharing tips and experiences among users.

Contact information for direct assistance

Should you require direct assistance with the summary instalment application, pdfFiller offers support options tailored to users' needs. Potential inquiries can be made through their customer service channels, ensuring that your questions regarding form completion and submission are addressed efficiently. Navigating the application process can be intricate, and having access to support services enhances the likelihood of a successful outcome.