Get the free Business loan application must-haves

Get, Create, Make and Sign business loan application must-haves

Editing business loan application must-haves online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application must-haves

How to fill out business loan application must-haves

Who needs business loan application must-haves?

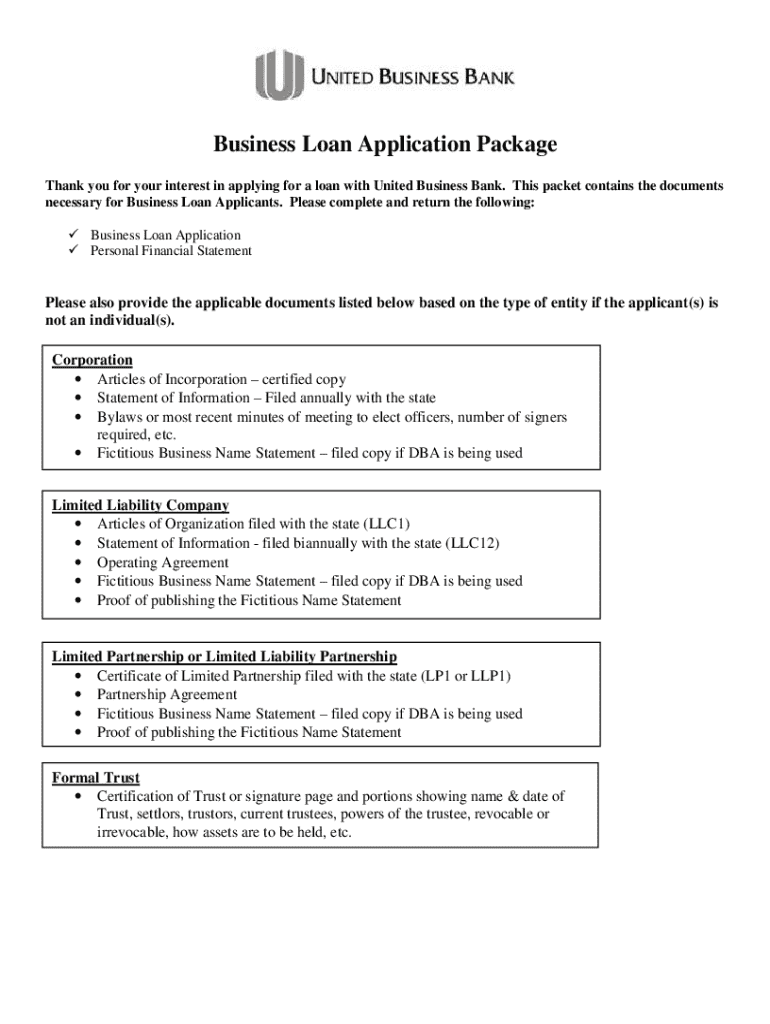

Business Loan Application Must-Haves Form

Understanding business loans

A business loan is a type of financial product that provides capital to businesses for operational needs, expansions, or other critical funding requirements. Essentially, it serves as a lifeline for both startups and existing enterprises requiring liquidity to seize opportunities or improve cash flow.

The importance of business loans in driving growth cannot be overstated. They give entrepreneurs the resources needed to launch new products, expand their market reach, or invest in technologies that enhance productivity. An effective loan can translate into significant competitive advantages, directly impacting a company’s capacity to grow and succeed.

Key requirements for business loan applications

Securing a business loan involves several key requirements that potential borrowers must prepare for. These requirements can generally be divided into essential documents needed for the application and the evaluation of creditworthiness.

Essential documents

Creditworthiness

Lenders assess creditworthiness as a way to determine the likelihood of repayment. This includes personal credit scores, which not only reflect individual financial responsibility but also influence the perception of the business's risk. Additionally, the business’s credit history provides a broader context about its financial behaviors, highlighting patterns that can either instill confidence or raise red flags in the lending process.

Having a strong credit profile is invaluable. Lenders prefer borrowers with a good history of managing debts and obligations, as this is a strong indicator of future reliability.

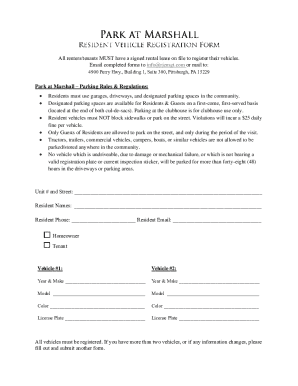

The must-haves for a business loan application form

When filling out the business loan application form, providing detailed and accurate information is crucial. The information presented must reflect the true nature of the business and its financial standing.

Complete business information

Financial information

Purpose of the loan

A clear statement outlining the intended use of the loan is vital. Lenders want to understand how the funds will be utilized and the projected benefits that will arise from the loan. This clarity can significantly improve eligibility by aligning business goals with the lender’s requirements.

Specific instructions for the business loan application form

Filling out the business loan application accurately is critical for smooth processing. Each section of the application must be approached methodically to avoid delays or errors.

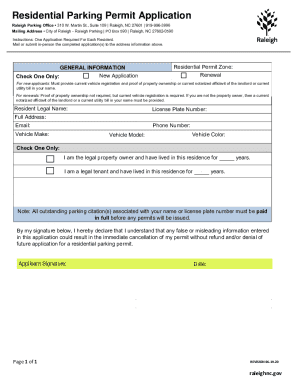

Filling out the application

Each application form will typically start by requesting basic information about the business, such as its legal name and address. Providing data clearly and consistently is paramount. Common pitfalls to avoid include incomplete information and inconsistent data across different documents.

Editing the form

With pdfFiller, editing your application form is a seamless process. The platform allows you to easily add or remove information without needing extra tools or printing out documents. This digital flexibility ensures your form is always up to date.

Signed and submitted

It's essential to ensure that the application is signed before submission. The eSigning feature on pdfFiller simplifies this process and allows for quick and secure electronic signatures. That's especially important in today’s fast-paced business environment, allowing users to manage signing processes without delays.

Managing your business loan application

Once your business loan application has been submitted, the management of the overall process becomes critical. Staying informed and tracking the application’s progress ensures you are prepared for any follow-up or additional information requests from lenders.

Tracking application progress

Maintaining communication with lenders throughout the application process is vital. This ensures you are aware of any updates or potential issues. Using tools available in pdfFiller, you can monitor your document status, keep your application organized, and receive notifications regarding its progression.

Collaborative review process

Involving partners or financial advisors in the review of the application can lead to a more thorough submission. Utilizing pdfFiller's collaboration tools allows multiple stakeholders to review and provide feedback, ensuring nothing essential is overlooked.

Frequently asked questions (FAQs)

Navigating through business loan applications can generate numerous queries. Here are some frequently asked questions that borrowers often encounter.

What if have a low credit score?

Having a low credit score doesn't automatically disqualify you from obtaining a loan, but it may limit your options to alternative lenders who may charge higher interest rates. It’s advisable to improve your credit score before applying if possible.

How long does the application process take?

The duration of the business loan application process varies significantly based on the lender. Some lenders can approve loans within days, while traditional banks may take several weeks for a thorough review.

Can apply for multiple loans at once?

While you can apply for multiple loans, it's essential to consider how this may impact your credit score. Multiple hard inquiries may be generated, potentially affecting your creditworthiness in the eyes of lenders.

What to do if my application is denied?

If your application is denied, obtain feedback from the lender on the reasons for the denial. Based on that, you may need to address specific issues before reapplying or exploring alternative financing options.

Final considerations before submitting your application

Before submitting your application, it's crucial to review everything meticulously. Inaccurate information can lead to delays or denials.

Reviewing for accuracy

Consulting financial advisors

Consider consulting with a financial advisor for personalized guidance tailored to your business needs. For instance, they can aid in refining your business plan or improving your financial statements.

Preparing for lender’s questions

Be prepared to address potential questions from lenders regarding your business model, financial forecasts, and security. The more informed and prepared you are, the better the chances of securing the loan.

The role of pdfFiller in your loan application process

In today’s fast-paced business environment, pdfFiller stands out as an invaluable tool for managing your business loan application. Its cloud-based platform offers a streamlined approach to document creation, allowing you to work from anywhere at any time.

Benefits of using a cloud-based platform for document management

Utilizing pdfFiller means you can access your applications, make necessary edits, eSign, and share files with collaborators all from one platform. This centralization enhances productivity and minimizes the potential for errors.

Ensuring security and compliance

In terms of security, pdfFiller adheres to strict compliance standards to ensure that your data remains secure and confidential throughout the process of creating and managing loan documents.

Accessing forms anytime, anywhere

You can work with your business loan application form from any device, providing the flexibility that modern entrepreneurs need. Whether in the office or at home, pdfFiller allows you to keep abreast of your loan process.

Advanced tips for a successful business loan application

To stand out in your application, certain strategies can enhance the overall effectiveness of your submission.

Highlighting unique business attributes

Demonstrating what differentiates your business can be a powerful persuader. Whether it’s unique products, exemplary service, or a disruptive business model, clearly articulating these features can set your application apart.

Making a strong case for your loan need

When justifying your request, it’s important to present data that shows how the loan will facilitate business growth or improvement. Present specific projections that clearly articulate return on investment to bolster your case.

Preparing for follow-up discussions or interviews with lenders

Demonstrating preparedness for any discussions with potential lenders shows that you are serious about your loan application. Be ready to discuss your business model, financial data, and projections thoroughly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business loan application must-haves directly from Gmail?

How can I modify business loan application must-haves without leaving Google Drive?

How do I edit business loan application must-haves straight from my smartphone?

What is business loan application must-haves?

Who is required to file business loan application must-haves?

How to fill out business loan application must-haves?

What is the purpose of business loan application must-haves?

What information must be reported on business loan application must-haves?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.