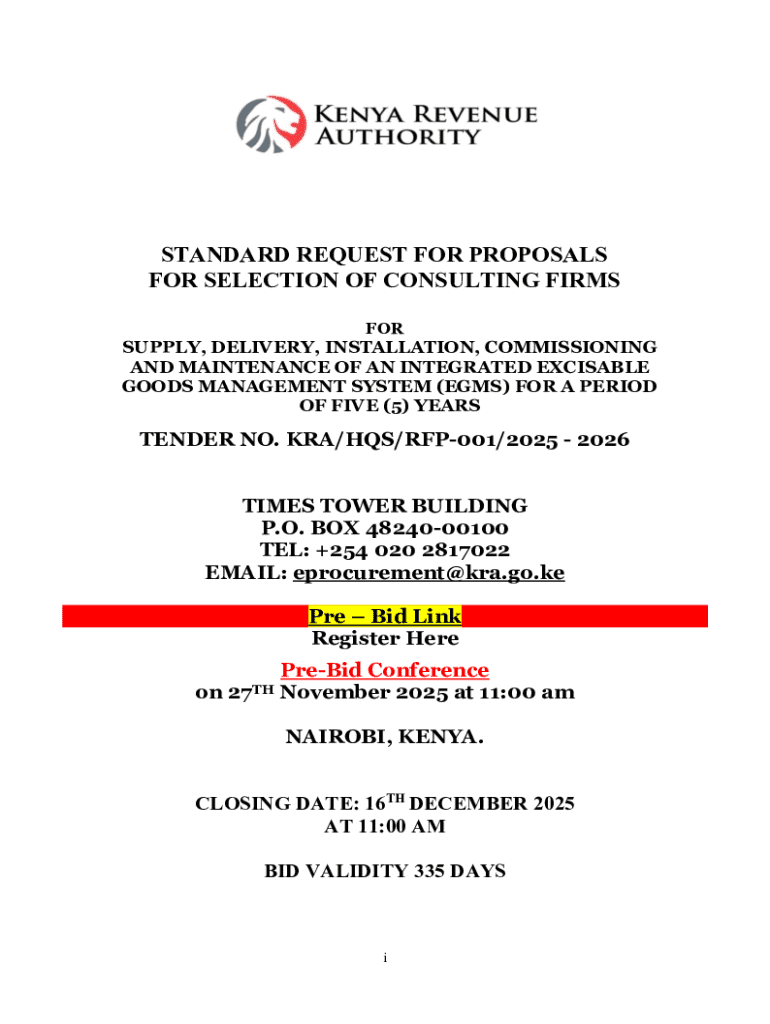

Get the free Kenya Revenue Authority - Tenders Kenya 2025

Get, Create, Make and Sign kenya revenue authority

Editing kenya revenue authority online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kenya revenue authority

How to fill out kenya revenue authority

Who needs kenya revenue authority?

Understanding Kenya Revenue Authority Forms: A Comprehensive Guide

Understanding the Kenya Revenue Authority (KRA) forms

The Kenya Revenue Authority (KRA) plays a vital role in tax administration in Kenya, ensuring the collection of revenue to fund government activities. KRA forms serve as essential tools for individuals and businesses to report their income, taxes, and exemptions accurately. Filling out these forms with precision is crucial, as misinformation can lead to penalties and issues with tax compliance. Understanding the common types of KRA forms is the first step towards ensuring effective tax management.

Specific KRA forms available

Income Tax Returns

Income Tax Returns are essential for declaring income earned by individuals and corporations. Any taxpayer who earns above a specific threshold is obligated to file these returns annually. Proper understanding of allowable deductions and tax rates is crucial for accurate reporting, ensuring taxpayers only report what is necessary and don’t incur unwarranted tax liabilities.

VAT Returns

Value Added Tax (VAT) Returns must be completed by any business registered under VAT. Compliance with VAT regulations not only enhances business credibility but also avoids penalties. Common errors might include misreporting sales or failing to keep accurate records. Knowing what to include in your return can make the process smoother.

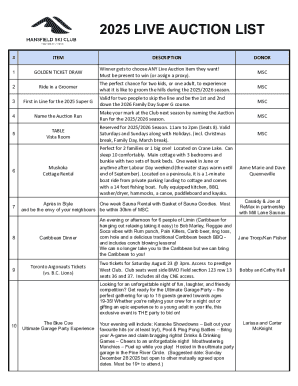

Excise Duty Returns

Excise duty applies to specific goods and services, such as cigarettes and alcohol. The Excise Duty Returns require businesses to calibrate their sales information, taxes due, and exemptions accurately. Here's a step-by-step guide: determine your applicable products, record quantities sold, calculate total excise duty, and report all on the designated form.

P9 Forms for employee tax returns

The P9 form is crucial for employers in Kenya to report tax for their employees. Available from KRA, it must be filled accurately to reflect employee earnings and withholdings. Employers must gather all relevant payment and tax documentation before filling out this form to ensure compliance with tax codes.

How to access KRA forms online

Accessing KRA forms has been simplified through the KRA online portal. Start by visiting the official KRA website, then navigate to the 'Downloads' or 'Forms' section. Here, you can locate specific forms relevant to your needs, such as Income Tax Returns or VAT Returns. Forms are usually available in PDF format for easy access and printing.

Additionally, third-party platforms like pdfFiller also offer KRA form availability, providing tools for direct access and manipulation of the forms.

Interactive tools for filling KRA forms

pdfFiller enhances the KRA form-filling process By offering advanced features to edit PDFs and electronic signing of documents, users can effortlessly complete their KRA requirements. The platform includes tools that allow users to highlight essential sections, insert text boxes, and even add calculations where necessary. This ensures that all details are precise and comply with tax requirements.

For collaborative teams, pdfFiller’s real-time feedback tools allow multiple users to work on a document simultaneously. You can share documents securely, making it easier to manage large projects that involve several stakeholders.

Step-by-step instructions for completing KRA forms

Gathering necessary information before filling out

Before filling out any KRA form, ensure you have all the necessary personal and business information at hand. This usually includes your PIN, identification documents, bank statements, and records of previous filings. For income tax, businesses should prepare financial statements, while VAT filers need detailed reports of both input and output VAT.

Detailed walkthrough for each form

Each KRA form will have specific sections that require attention. Individuals should ensure their personal details are filled out accurately, and business entities must maintain precise records of income sources. For instance, when filling out the VAT form, lists of taxable sales and inputs must clearly match amounts on invoices.

Common pitfalls and how to avoid them

Frequent errors in filling KRA forms include incorrect calculations, missing signatures, or failing to include required documents. To avoid these pitfalls, double-check your calculations and ensure all supporting documentation is attached before submitting your form.

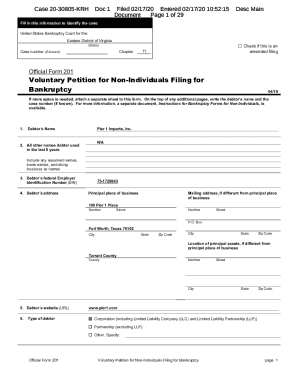

Filing and submitting KRA forms

Methods of submission

KRA forms can be submitted either online through the KRA portal for quick processing or physically at any KRA office for those who prefer in-person assistance. Online submissions have proven to be faster and more efficient, allowing for electronic tracking of submission status.

Important deadlines to remember

Each KRA form corresponds to specific deadlines essential for compliance. Missing these deadlines can result in penalties. For example, income tax returns are typically due by June 30 each year, while VAT returns are due on the 20th of every month. Keeping a calendar of these dates can help prevent late submissions.

Post-submission steps

Checking submission status

After submission, it’s crucial to verify that your KRA form has been processed. This can be done through the KRA online portal, where you can track the status of your returns and payments, ensuring that all information is accurate and up to date.

Understanding feedback on your submission

In cases where a submission is rejected, understanding the reason behind it is vital. Common issues could be incorrect PIN numbers, arithmetic errors, or missing documents. Once identified, these issues can be rectified with the assistance of professional services if needed, allowing for a smooth re-submission process.

Specialized assistance with KRA forms

Given the complexity involved in tax compliance, seeking professional services for KRA form assistance can be immensely helpful. Platforms like pdfFiller not only offer user-friendly tools for filling and submitting forms but also provide expert guidance through the process. Utilizing these resources ensures that submissions are accurate and timely.

User testimonials highlight efficiency and satisfaction with services from pdfFiller, proving that leveraging technology simplifies managing tax documentation.

FAQ section on KRA forms

Many tax payers have queries regarding KRA forms and processes. A common concern revolves around where to seek help if you encounter difficulties while filling forms. KRA offers a contact center for assistance, while pdfFiller’s resources can provide tutorials and customer service support to navigate these complex forms.

Another frequent question deals with the repercussions of mistakes on KRA forms. Such errors could lead to penalties, incorrect tax payments, and even legal consequences if not rectified promptly. Staying updated with tax regulations and procedures helps mitigate these risks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in kenya revenue authority without leaving Chrome?

Can I create an eSignature for the kenya revenue authority in Gmail?

How do I edit kenya revenue authority straight from my smartphone?

What is Kenya Revenue Authority?

Who is required to file Kenya Revenue Authority?

How to fill out Kenya Revenue Authority?

What is the purpose of Kenya Revenue Authority?

What information must be reported on Kenya Revenue Authority?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.