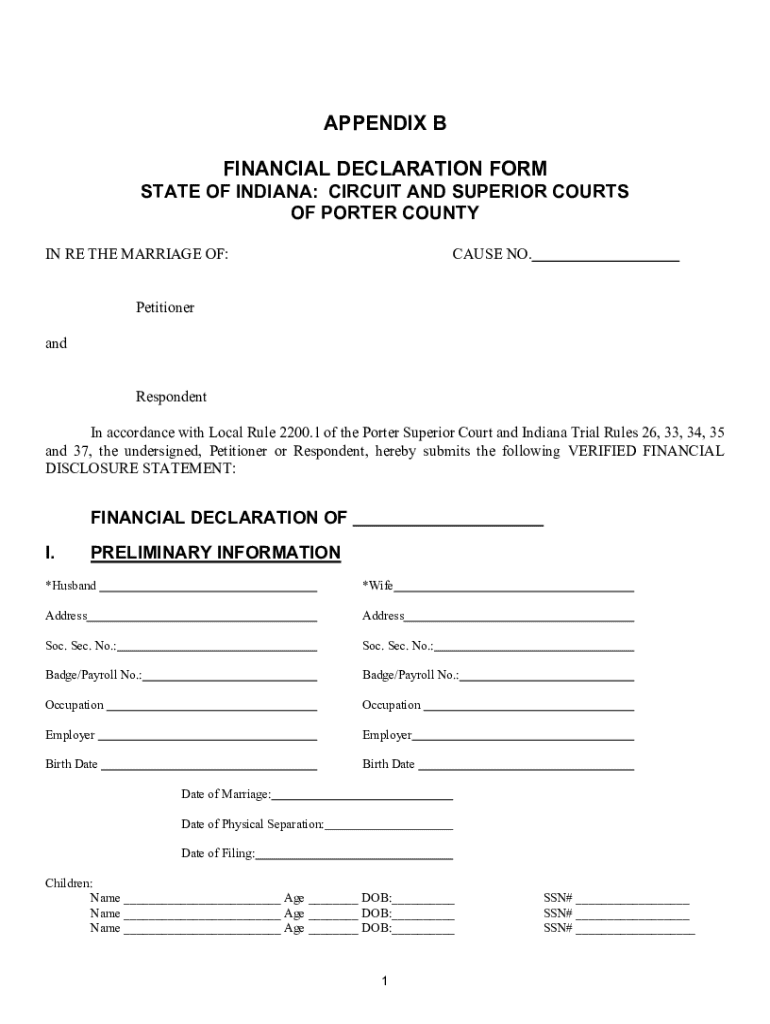

Get the free FORM Financial Declaration Form - Porter (00068407).DOC. File

Get, Create, Make and Sign form financial declaration form

How to edit form financial declaration form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form financial declaration form

How to fill out form financial declaration form

Who needs form financial declaration form?

How to fill out a financial declaration form

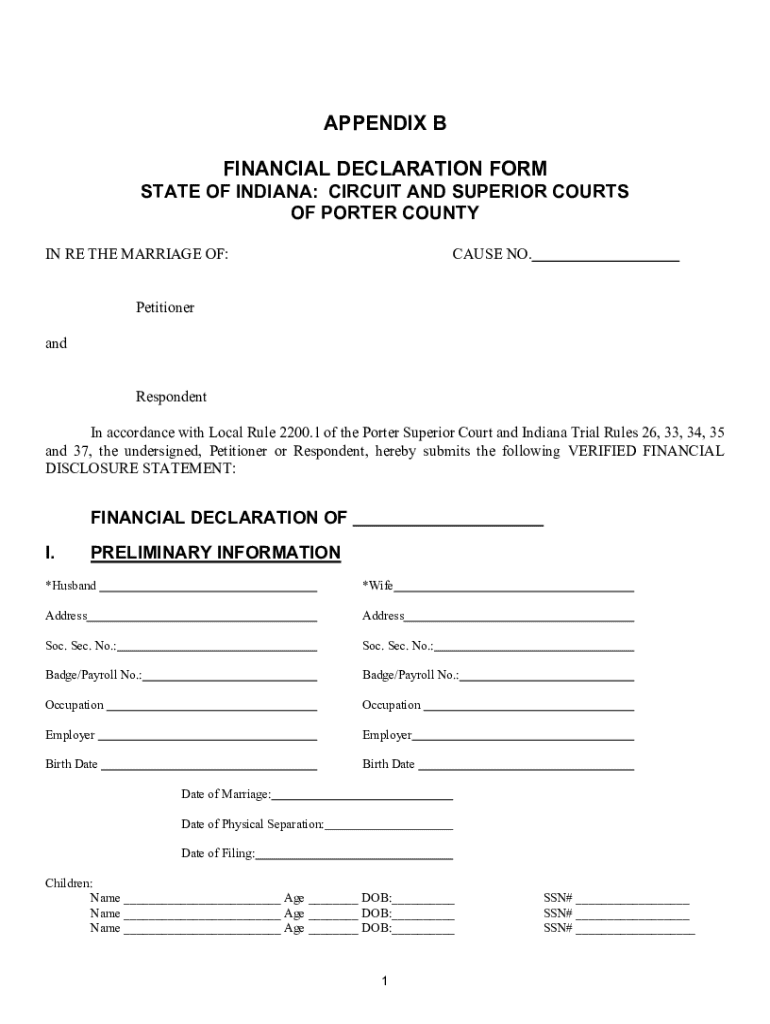

Understanding the financial declaration form

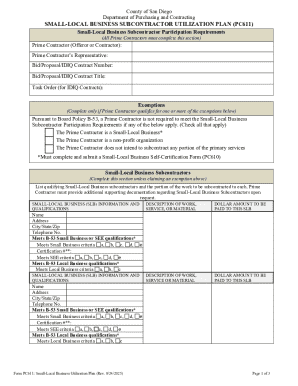

A financial declaration form is a crucial document that outlines a person's or an entity's financial situation. It serves to provide transparency regarding income, expenses, and overall financial health. This form is commonly required in several contexts, such as applying for loans, grants, or during legal proceedings. Institutions often rely on this document to evaluate an applicant's eligibility for financial products or services.

The primary purpose of the financial declaration form is to ensure that all financial dealings are conducted honestly and are based on solid information. For instance, lenders require this data to determine whether an individual can repay borrowed money, while legal authorities may need it to assess financial obligation in court cases. In all these situations, accuracy and completeness of the information provided is paramount.

Key components of the form

Preparing to complete the financial declaration form

Before diving into filling out the financial declaration form, it’s essential to gather all necessary documentation. This preparation will significantly ease the process and ensure that no crucial information is overlooked. The required documentation typically includes recent bank statements, pay stubs or income statements, and tax returns. These resources furnish the data needed to complete sections regarding income, assets, and liabilities accurately.

Understanding the required information is also vital. Terminology like assets, liabilities, gross income, and net income should be well understood. Assets are essentially things you own that hold monetary value, while liabilities represent what you owe. Gross income is your total earnings before any deductions, whereas net income is what you take home after such deductions. Familiarity with these terms will empower you to fill out the form confidently and accurately.

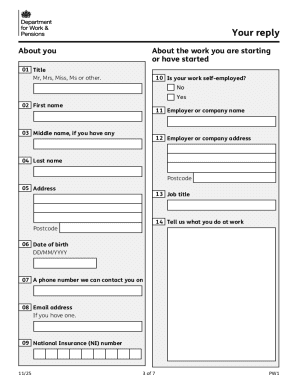

Step-by-step guide to filling out the financial declaration form

Begin by filling in your personal information accurately. Typical details required include your name, contact details, and identification information, which may vary based on the form's context. Providing accurate personal details is crucial, as this forms the basis for your identity verification.

Next, report your income. Detail all sources of income, including salaries, investment earnings, and any freelance work. When estimating income from variable sources, such as freelance projects, use your most recent earnings as a guide and provide an average if your income fluctuates significantly.

Declare your assets next. This section consists of all items of value you own, including real estate, vehicles, and accounts with balances. Proper appraisals must be done to establish the current market value of these assets, which should be reported accurately.

Moving on to liabilities, list all debts and ongoing financial obligations. This includes mortgages, loans, credit card debt, and any other formal agreements that require repayments. Accuracy in this section is as important as it is in reporting assets.

Finally, review and validate the information you have entered. This step is crucial as it prevents errors that could lead to complications. Check for completeness and correctness, ensuring all necessary fields are filled out and the figures you’ve declared correctly reflect your financial situation.

Editing and managing your financial declaration form

Once you've completed the financial declaration form, you might find that edits are necessary. pdfFiller offers robust tools suitable for editing PDF forms, enabling you to make changes quickly and easily. Utilizing such features not only helps maintain accuracy but also boosts your confidence in the documentation you’ve submitted.

In terms of saving and sharing the form, pdfFiller provides various formats such as PDF and DOC. This versatility allows you to select a format that best suits your needs. When it comes to secure sharing, the platform offers options that facilitate collaborative reviews seamlessly, ensuring that all involved parties can access the information without compromising security.

eSigning the financial declaration form

The eSigning process is essential in today’s digital document landscape. Electronic signatures hold legal validity and are widely recognized across many jurisdictions. By signing your financial declaration form electronically, you ensure that your consent is formally documented without the hassle of printing and scanning.

To eSign using pdfFiller, begin by navigating to the digital signature feature within the platform. This step involves adding your digital signature directly to the form. If others need to sign as well, you can easily invite them to do so, facilitating a smooth process of securing all necessary approvals.

Common mistakes to avoid when completing the financial declaration form

One of the most frequent errors is exaggerating or underreporting income or assets. Such inaccuracies can have serious repercussions, not only delaying your application but potentially leading to accusations of fraud. It’s vital to present a truthful picture of your financial situation to all relevant entities.

Another mistake is omitting necessary information. It’s a good idea to have a checklist of common items that must be reported to ensure nothing gets overlooked. Lastly, failing to keep your financial declaration current is a critical error. Making regular updates ensures optimal transparency and reflects any changes in your financial status accurately.

Frequently asked questions (FAQs)

What should you do if you make a mistake on your form? The answer lies in carefully reviewing the document before submission. If an error is noticed after the fact, promptly reach out to the involved institution to inform them and correct the mistake to avoid complications.

Different institutions utilize your financial declaration form for various purposes. Banks may assess your readiness for loans, while government agencies might evaluate your eligibility for assistance programs. Understanding these uses can help tailor your form for the intended audience.

Interactive tools for financial declarations

To enhance your experience in completing a financial declaration form, leveraging pdfFiller's interactive tools is beneficial. The platform offers calculators, templates, and customizable features that streamline the form completion process, making it user-friendly and efficient.

Using technology to your advantage can simplify navigating complex forms. pdfFiller's features are designed to provide an intuitive user experience, ensuring that you can fill out, edit, and manage your financial documents with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form financial declaration form from Google Drive?

How can I edit form financial declaration form on a smartphone?

How do I edit form financial declaration form on an iOS device?

What is form financial declaration form?

Who is required to file form financial declaration form?

How to fill out form financial declaration form?

What is the purpose of form financial declaration form?

What information must be reported on form financial declaration form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.