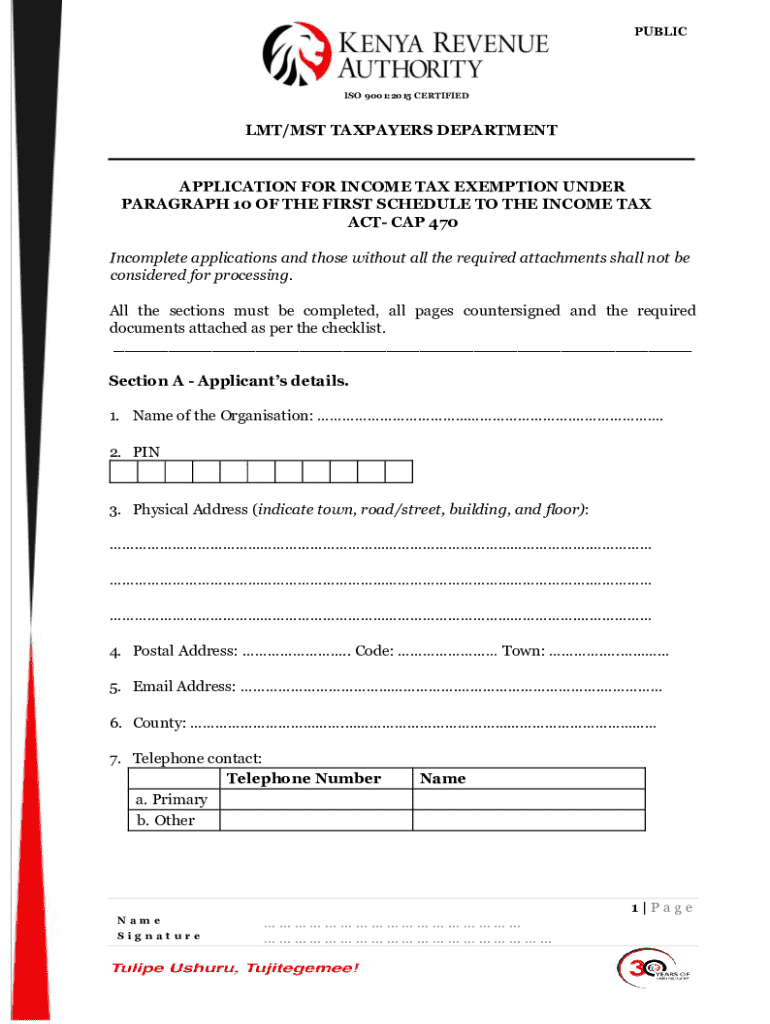

Get the free Income Tax Exemption Application Form - kra go

Get, Create, Make and Sign income tax exemption application

How to edit income tax exemption application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax exemption application

How to fill out income tax exemption application

Who needs income tax exemption application?

Income Tax Exemption Application Form - A How-to Guide

Understanding income tax exemption

Income tax exemption refers to the portion of income that is not subject to taxation, allowing individuals and entities to reduce their overall tax liability. This exemption can significantly impact one's financial situation, creating savings that can be invested elsewhere. Understanding the nuances of income tax exemptions is crucial for all taxpayers who wish to optimize their financial strategies.

Eligibility criteria for income tax exemption

Eligibility requirements for income tax exemption depend on various factors, including income level, age, and specific life circumstances. Generally, individuals or families earning below a set income limit may qualify for exemptions. Those with disabilities or favored statuses may also be eligible for advantageous tax considerations.

A common misconception is that everyone is eligible for income tax exemptions regardless of their financial situation. In reality, certain thresholds must be met, and these can vary based on jurisdiction. It's essential to review the specific criteria outlined by the IRS or your local tax authority annually.

Essential documents needed

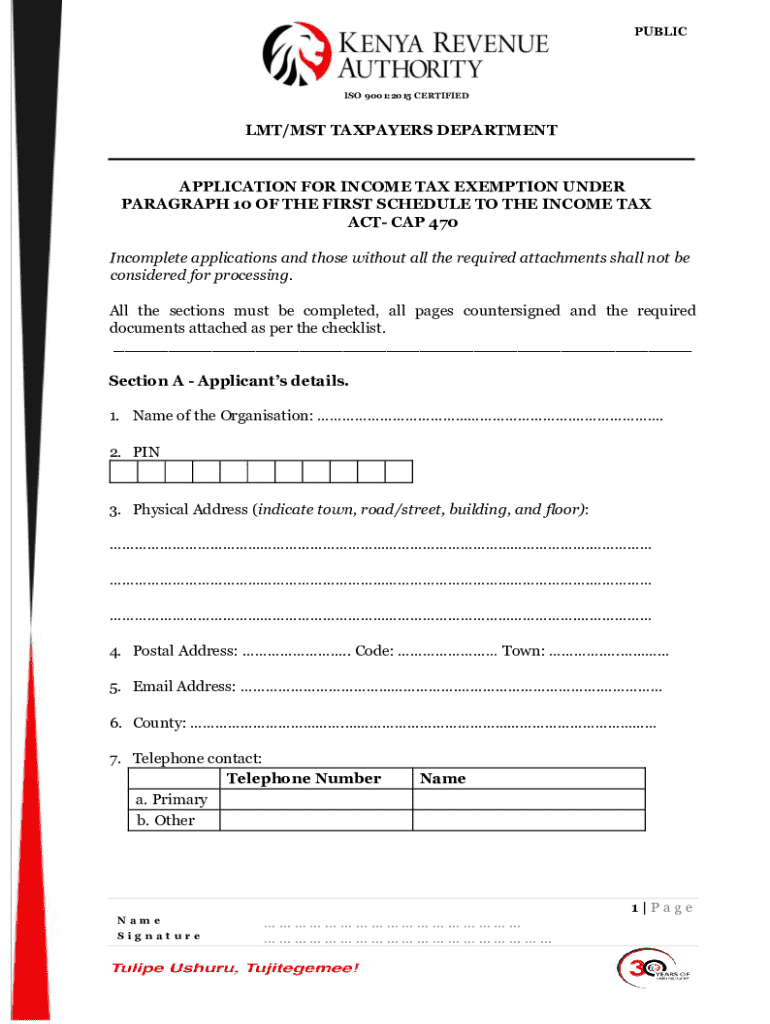

Preparing for an income tax exemption application requires careful attention to documentation. Key documents typically include proof of income, which could be recent pay stubs, tax returns from previous years, or benefit statements. Identification documentation like a Social Security number or driver's license is also necessary to verify identity.

Other potential forms might include tax exemption certificates and proof of eligibility for specific exemptions. Gathering these documents efficiently can be simplified by making a checklist before you start. This ensures that no critical documents are missed during the application process.

Step-by-step guide to filling out the income tax exemption application form

Filling out the income tax exemption application form can seem daunting, but following a step-by-step approach helps clarify the process. Accessing the application form through pdfFiller is the first step. Once you have the form, carefully examine each section to ensure accuracy.

Begin with personal information including your full name, address, and Social Security number. Next, provide income information detailing all your sources of income. Follow this by selecting the applicable tax exemption categories that apply to your situation, making sure each is clearly marked.

Common pitfalls in this section include miscalculating income, failing to update personal information, or providing incomplete exemptions. Double-checking each entry does wonders in avoiding these errors.

Interactive tools for form management

pdfFiller offers a plethora of interactive tools designed to simplify the document management process, especially while filling out the income tax exemption application form. Users can utilize editing features to fill out forms, edit text, and even sign documents digitally, making the process incredibly efficient.

Key functionalities include eSignature capabilities that allow users to sign documents seamlessly, as well as collaboration tools for those working in teams. This collaborative environment nurtures discussion and feedback on the forms, enhancing accuracy and completeness.

Submitting your application

Once your income tax exemption application form is completed, the next crucial step is submitting it. Users generally have two options: online submissions through services like pdfFiller or physical mailing. When opting for online submission, ensure you follow the guidelines provided to prevent delays.

If choosing to mail your application, it's advisable to send it to the address designated by your local tax department, which is often stated on the form. Adding certified mail tracking can help ensure your application reaches its destination and can provide peace of mind regarding its status during the processing period.

After submission: what to expect

After you submit the income tax exemption application, it’s essential to understand what happens next. Typically, processing timelines can vary widely, often ranging from several weeks to months. It's vital to remain patient, and tracking your application status can give you insights into any potential concerns.

Once your application is reviewed, you will either receive an approval notice detailing your exemptions or a denial letter stating the reasons. If approved, keep all related documents in an organized manner for future reference and possible audits.

Frequently asked questions (FAQs)

Many applicants have questions about the income tax exemption application process, especially concerning eligibility and documentation. Some common concerns include how to determine if one qualifies, what specific documentation is needed, and the appropriate avenues for submitting applications.

Ensure that you have reviewed the key requirements and FAQs outlined on the IRS or local tax authority's website for the most accurate information tailored to your specific situation.

Troubleshooting common issues

Despite best efforts, applicants sometimes face delays or denials of their income tax exemption applications. Common reasons may include missing documents, inaccuracies in the provided information, or not meeting eligibility criteria.

To resolve these issues, reach out to your tax authority or consult their FAQs. They can provide guidance on how to rectify the issues. If complexities arise, seeking assistance from a tax professional may also be beneficial to ensure accuracy in future applications.

Leveraging pdfFiller for ongoing document management

pdfFiller not only supports users through the income tax exemption application process but also provides tools for ongoing document management, making it easier to maintain organized records. Case studies demonstrate how clients have improved their tax filing efficiency by using online document management platforms.

Features such as automatic document storage, secured sharing options, and a user-friendly interface empower individuals and teams to maintain an orderly approach to tax preparation year-round, ensuring compliance and peace of mind come tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit income tax exemption application on an iOS device?

How do I complete income tax exemption application on an iOS device?

How do I edit income tax exemption application on an Android device?

What is income tax exemption application?

Who is required to file income tax exemption application?

How to fill out income tax exemption application?

What is the purpose of income tax exemption application?

What information must be reported on income tax exemption application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.