Get the free PROVISION-OF-MEDICAL-GROUP-LIFE- ...

Get, Create, Make and Sign provision-of-medical-group-life

How to edit provision-of-medical-group-life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out provision-of-medical-group-life

How to fill out provision-of-medical-group-life

Who needs provision-of-medical-group-life?

Provision of Medical Group Life Form: A Comprehensive Guide

Understanding the provision of medical group life form

The provision of medical group life form is essential for organizations looking to offer life insurance benefits to their employees. This form facilitates the enrollment process and ensures that both policyholders and beneficiaries understand their rights and responsibilities under the insurance policy.

Group life insurance differs significantly from individual life insurance. It provides coverage to a collective group of people, usually tied to their employment or belonging to a specific organization. This can lead to lower premiums and increased accessibility for employees, making it a valuable benefit.

Eligibility criteria for medical group life insurance

Eligibility for medical group life insurance varies based on the organization and specific policy terms. Typically, employees must meet certain conditions to enroll, often including full-time employment status and a probationary period.

In addition to employee guidelines, families and dependents may also be eligible for coverage. Organizations seeking to provide such benefits must ensure they meet insurance provider mandates, which often include a minimum number of members.

Common exclusions include specific high-risk activities, certain medical conditions, and pre-existing health conditions, which may limit or exclude coverage. It's crucial for applicants to disclose complete medical histories to avoid complications during the approval process.

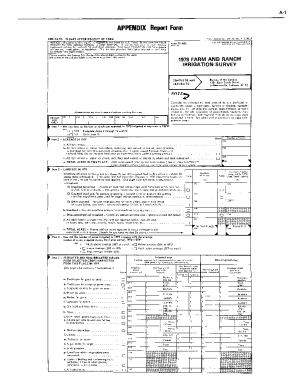

Components of the medical group life form

The medical group life form contains several critical sections that ensure both the insurer and insured understand the terms of the policy. The personal information section requires detailed identification and contact information.

Another key section is the medical history disclosure. Accurate health information is vital in determining coverage eligibility and premium rates. This data helps insurers evaluate risk and establish coverage terms.

The beneficiary designation section is critical as it lays out who will receive the death benefit. Choosing beneficiaries requires careful consideration, as it can have long-lasting implications on financial security for loved ones.

Completing the medical group life form

Completing the medical group life form accurately is paramount. Start by gathering all necessary information, including previous health records and identification documents. This preparation will streamline the completion process.

Each section requires clarity and detail. Be particularly attentive to medical history, as any inaccuracies could result in complications or denial of coverage. After filling it out, take the time to review your form carefully.

Electronic signatures and submissions

In an increasingly digital world, electronic signatures are becoming the standard in document management. pdfFiller simplifies the process of signing the medical group life form, allowing users to eSign documents quickly and securely.

The benefits of eSigning include enhanced efficiency, reduced paper waste, and the ability to manage documents from anywhere. To eSign the medical group life form on pdfFiller, navigate to the form, fill it out, and use the eSigning tool to complete the process.

Post-submission procedures

After submitting the medical group life form, tracking your application status is essential. Most insurers provide online portals for applicants to monitor the progress of their submissions easily.

The approval process can vary, but generally, you can expect a response within a few weeks. If your application is denied, understanding the common reasons for denial — such as incomplete medical histories or missing information — can help address issues effectively.

Managing your medical group life insurance

Managing your medical group life insurance is an ongoing process. Conducting an annual review of your policy helps ensure all information is current and reflective of any life changes, such as marriage, divorce, or the birth of children.

Additionally, using pdfFiller to manage your insurance documents can enhance your organization and access to important paperwork. Features like document editing, filing, and easy sharing streamline your document management experience.

Additional considerations and FAQs

Common questions about the provision of medical group life form often involve eligibility, coverage details, and the process of filing claims. Familiarizing yourself with these can ease concerns and provide clarity.

Resources for further information can include the insurer’s website, state insurance departments, or financial advisors. Understanding the nuances of group life insurance can help mitigate potential pitfalls and ensure proper coverage.

The importance of professional guidance

Consulting with an insurance agent or legal advisor can be invaluable, especially when navigating complex situations or understanding your rights as a policyholder. Professionals can offer personalized advice based on your unique circumstances and the nuances of different policies.

In cases involving unique coverage needs, such as those related to chronic health conditions or specific occupational hazards, professional insight ensures informed decision-making. Having the right support can lead to better long-term outcomes for both you and your beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit provision-of-medical-group-life online?

Can I sign the provision-of-medical-group-life electronically in Chrome?

How do I edit provision-of-medical-group-life on an Android device?

What is provision-of-medical-group-life?

Who is required to file provision-of-medical-group-life?

How to fill out provision-of-medical-group-life?

What is the purpose of provision-of-medical-group-life?

What information must be reported on provision-of-medical-group-life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.