Get the free KRA Tax Compliance Certificate DetailsPDF

Get, Create, Make and Sign kra tax compliance certificate

Editing kra tax compliance certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kra tax compliance certificate

How to fill out kra tax compliance certificate

Who needs kra tax compliance certificate?

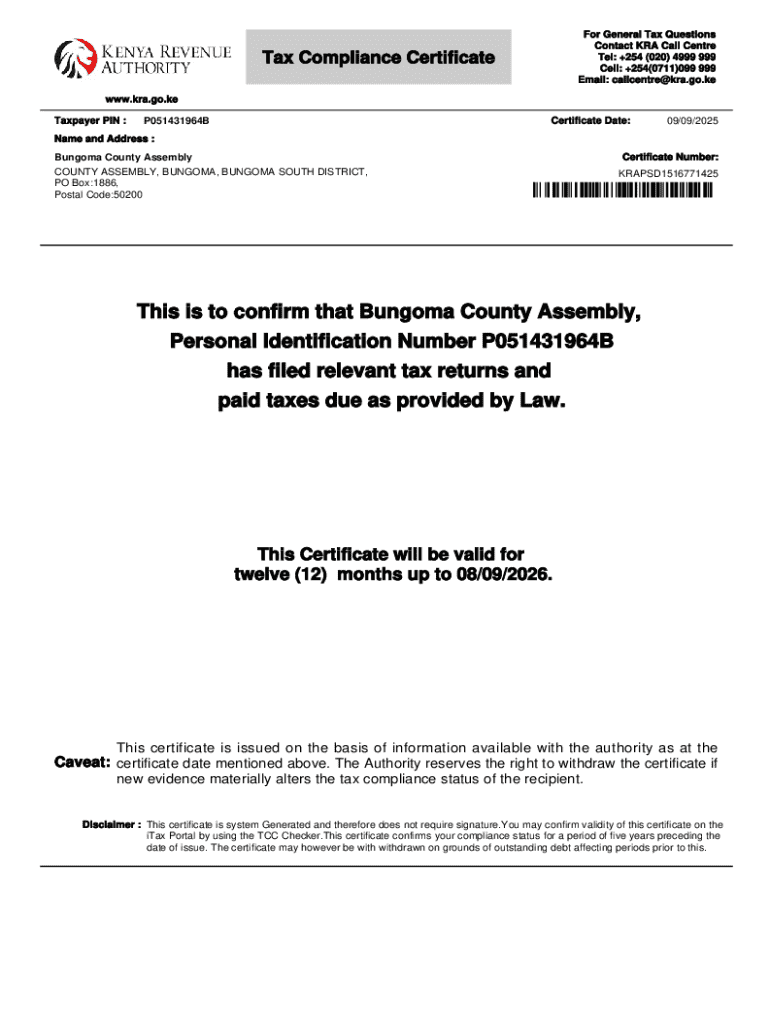

Understanding the KRA Tax Compliance Certificate Form

What is a KRA tax compliance certificate?

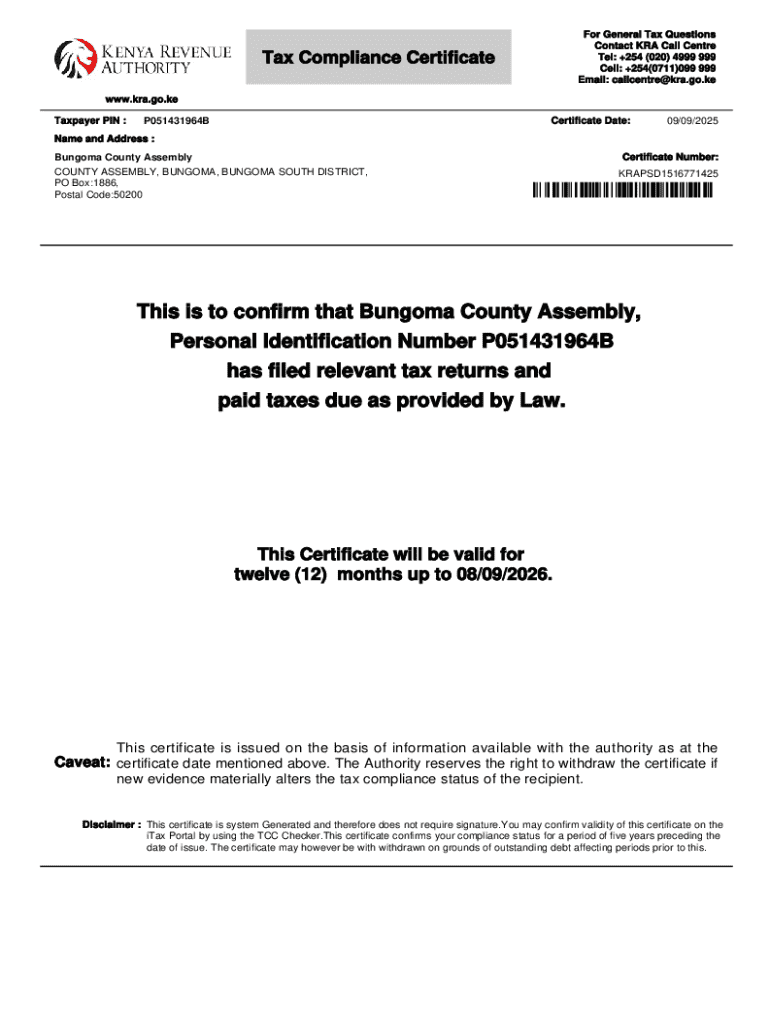

A KRA tax compliance certificate is an essential document issued by the Kenya Revenue Authority (KRA) that affirms that a taxpayer has met their tax obligations. This certificate serves as proof of tax compliance and is crucial for individuals and businesses looking to conduct various transactions, particularly those requiring legal and financial credibility.

Maintaining tax compliance is vital not just for legal adherence but also for building trust within the financial ecosystem. A valid tax compliance certificate is often a prerequisite for securing loans, applying for government contracts, or even engaging in international transactions.

Duration and renewal process

The KRA tax compliance certificate typically remains valid for one year from the date of issue. It is important to understand the renewal process to ensure uninterrupted compliance. Taxpayers must keep track of their certificate's expiry date and initiate the renewal process before it lapses to remain compliant and avoid penalties.

Renewing the tax compliance certificate involves confirming that all due taxes are paid, followed by an online application through the KRA portal. Continuous compliance with tax regulations is vital for smooth renewal; any outstanding tax obligations may hinder or delay the renewal process.

Common scenarios requiring certification

Several scenarios necessitate acquiring a tax compliance certificate. These include bidding for government tenders, applying for loans from financial institutions, and initiating the registration of a company. Failing to present a valid certificate in these situations can lead to unfavorable consequences, such as losing business opportunities or facing legal ramifications.

Eligibility criteria

Not everyone can apply for a KRA tax compliance certificate. Primarily, only registered taxpayers, which include individuals and entities with a valid KRA PIN, are eligible. They must have filed their tax returns and cleared any outstanding tax obligations before applying for the certificate.

To successfully apply, applicants need to gather essential documents, such as a copy of their KRA PIN certificate, recent tax returns, and evidence of any paid taxes. These documents serve as proof of compliance and facilitate a smoother application process.

Step-by-step application process

Applying for a KRA tax compliance certificate involves several straightforward steps:

Some applicants may encounter challenges during the process, such as delays in processing or issues with document submission. It’s advisable to keep track of application timelines and maintain open communication with KRA for any clarifications.

Tracking your application status

Once the application has been submitted, it is crucial to track its status. Taxpayers can check the status of their application online via the KRA portal, where regular updates are provided regarding progress. Understanding expected timelines for approval is imperative; typically, applications can be processed within a few days to weeks, depending on specific circumstances.

If an application is denied, it's important not to panic. Common reasons for rejection may include incomplete documentation or outstanding tax obligations. Applicants can rectify issues by addressing the concerns raised in the denial notification and reapplying, or they may choose to appeal the decision through the appropriate channels with supporting evidence.

Understanding importation & exportation compliance requirements

When engaging in import and export activities, understanding tax obligations is vital. Tax compliance certificates play a significant role here as they serve as proof that the involved entities are compliant with tax laws. This becomes particularly important, especially during customs clearance processes where proof of tax compliance must be provided to avoid penalties.

Importers and exporters must be aware of the specific tax percentages applicable to their goods and timely payment of these taxes to maintain compliance. A tax compliance certificate can greatly ease this process by providing necessary documentation that reassures customs officials of compliance.

Exploring tax exemption opportunities

Tax exemptions may be available under certain conditions, and the compliance certificate can play a role in accessing these benefits. Identifying the types of tax exemptions applicable to different income, businesses, or activities can provide significant tax relief.

Businesses interested in exploring these exemptions must submit an application along with their tax compliance certificate to KRA or relevant government bodies. Understanding how to navigate this application process can facilitate favorable outcomes.

Tax compliance for Kenyans living abroad

Kenyans living abroad also have specific tax compliance obligations that require understanding the implications of foreign income as it relates to Kenyan tax laws. Such individuals must remain aware of their tax liabilities and the requirements for obtaining a tax compliance certificate even while residing outside the country.

Navigating compliance issues while living and working overseas can be challenging. However, it’s essential to file annual tax returns and seek advice if necessary, to ensure they're compliant with both local and international taxation systems.

Interactive tools and resources

Utilizing calculators and assessment tools can significantly help taxpayers estimate their tax obligations and compliance needs more accurately. Many of these resources are available on the KRA website and can assist taxpayers in managing their filings and understanding their financial responsibilities.

Additionally, FAQs regarding KRA tax compliance certificate applications provide common answers to pressing questions. Taxpayers can seek clarification on specific requirements and processes, which can greatly simplify their compliance journeys.

Empowering users with pdfFiller

pdfFiller serves as a powerful platform for seamlessly filling out the KRA tax compliance certificate form. With user-friendly templates, individuals and businesses can complete their documentation quickly, enabling eSigning and collaboration from anywhere.

Furthermore, pdfFiller allows users to manage and store compliance documents securely in the cloud, ensuring easy access and organization. With this comprehensive solution, managing tax compliance becomes a streamlined process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify kra tax compliance certificate without leaving Google Drive?

Where do I find kra tax compliance certificate?

How can I fill out kra tax compliance certificate on an iOS device?

What is kra tax compliance certificate?

Who is required to file kra tax compliance certificate?

How to fill out kra tax compliance certificate?

What is the purpose of kra tax compliance certificate?

What information must be reported on kra tax compliance certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.