Get the free The Unclaimed Financial Assets Authority (UFAA) Invitation ... - ufaa go

Get, Create, Make and Sign form unclaimed financial assets

How to edit form unclaimed financial assets online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form unclaimed financial assets

How to fill out form unclaimed financial assets

Who needs form unclaimed financial assets?

Understanding and Completing the Form for Unclaimed Financial Assets

Understanding unclaimed financial assets

Unclaimed financial assets refer to money or property that the rightful owner has not claimed or accessed for a specified period. This can include payroll checks, stocks, property policies, and credit balances, which may be held by state governments due to inactivity or inability to locate the owner. It's estimated that billions of dollars in unclaimed property exists across the United States, waiting to be returned to their rightful owners.

Assets can become unclaimed for several reasons such as a change in address, failure to cash checks, or simply forgetting about existing accounts. When assets are unclaimed, they are often turned over to government authorities, where they can be safeguarded until the owner comes forward to claim them. Claiming these assets is crucial not just for recovering lost finances but also for asset management and financial planning.

Overview of the unclaimed financial assets form

The unclaimed financial assets form serves as the primary vehicle through which individuals can claim their lost or forgotten assets. This form is essential as it formalizes the request to access those unclaimed assets held by the state or other entities. It captures all necessary information to facilitate the verification process and aid in the return of funds or property.

When filling out this form, it is vital to provide accurate and detailed information. Errors or omissions can delay the claim process or result in rejection. Several types of assets are typically covered by this form, including bank accounts, insurance policies, uncashed checks, and other forms of property that might have gone unaccounted for.

Where to find the unclaimed financial assets form

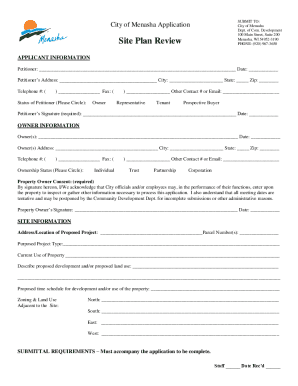

Accessing the unclaimed financial assets form is straightforward as it is available through various channels. Here's a step-by-step guide on how to locate it online:

For ease of use, pdfFiller provides centralized access to many of these forms with features that allow users to complete them quickly. By using pdfFiller, you can streamline the process, edit, and digitally sign your form without needing to print it.

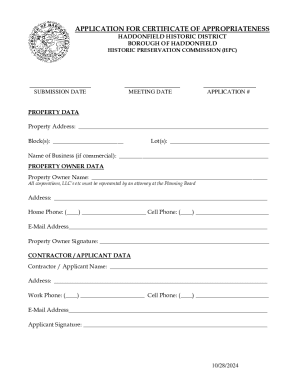

Step-by-step instructions for filling out the form

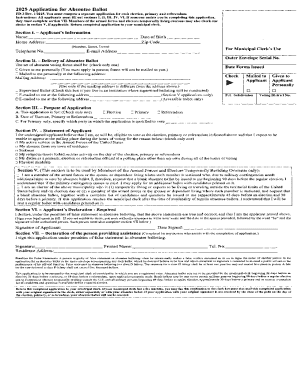

Filling out the unclaimed financial assets form requires precise information to ensure your claim is processed efficiently. Key information typically includes your personal identification details and the specifics of the asset you are claiming.

### Required information: - **Personal Identification Details**: Full name, address, date of birth, and Social Security number. - **Asset Information**: Description of the asset, account number, and any supporting documentation.

### Breakdown of Each Section: - **Section A**: This section captures your personal information. Double-check for typos or inaccuracies. - **Section B**: Here, you should include details about the asset you are claiming, making sure to be as specific as possible, including dates if known. - **Section C**: Verification is essential; this section often includes a declaration or signature confirming the information provided is true.

Accuracy is paramount when filling out the form. Ensure that you cross-reference your information. Common mistakes include incorrect personal details or asset descriptions, which can lead to delays.

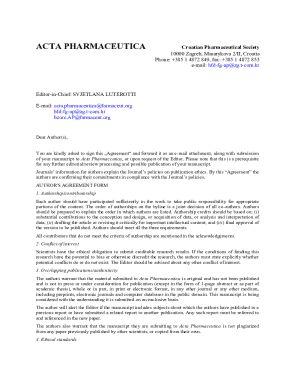

Editing and signing the form with pdfFiller

pdfFiller offers comprehensive tools that simplify the process of editing the unclaimed financial assets form. Once you've downloaded the form, you can use pdfFiller’s platform to modify any text, add checkboxes, and fill in blanks conveniently.

### Adding eSignatures: - **Step 1**: Open your completed form in pdfFiller. - **Step 2**: Click on the 'Signature' option. - **Step 3**: You can choose to draw your signature, type it, or upload an image of your signature. - **Step 4**: Place the signature in the designated area.

Collaboration tools in pdfFiller also enable you to share the document with others for review or input, ensuring that multiple parties can contribute to the form's accuracy before submission.

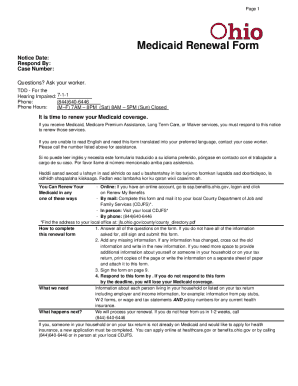

Submitting the form: what you need to know

Once your unclaimed financial assets form is complete and signed, it's time for submission. You generally have two options: online submission or mailing the form physically. Online submissions are often faster, but you should verify your state's preferences.

Tracking your submission status varies by state, but typically, you can check online on the same portal where you submitted your claim. Knowing the expected response times is important; therefore, review your state’s guidelines on how long the process may take and whether or not follow-up is necessary.

Managing your unclaimed financial assets post-submission

After submitting your claim, you might wonder what happens next. Generally, your claim will be reviewed by state officials, and you may receive communication if additional information is needed or when a decision has been made.

To keep track of everything efficiently: - Organize all related communications and documents related to your claim in a dedicated folder. - Follow up on your claims status as necessary, especially if the expected timeframe has lapsed without communication.

Understanding potential outcomes is also key. You might receive your funds directly, or additional verification steps may be necessary. In both cases, staying proactive and engaged will help you navigate the process more smoothly.

Frequently asked questions about unclaimed financial assets

Many individuals have questions about unclaimed financial assets and the claiming process. Common concerns include: - How do I know if I have unclaimed assets? - What kinds of assets can be claimed? - How long will it take to receive my assets once I submit my claim?

These questions often stem from myths about unclaimed property, such as the belief that only large sums are returned or that the claim process is unnecessarily complex. To clarify any uncertainties, many government sites provide resources and FAQs that can assist you further.

Interactive tools and resources

If you're on the search for missing money, numerous state-specific searching tools will help you locate potential unclaimed assets. By entering some basic information, you’ll be able to discover assets that may be due to you.

Additionally, pdfFiller’s document management features allow you to keep track of forms, assists in organizing important financial documents, and offers FAQs and support resources that can further enhance your experience. Utilizing technology is crucial for effective financial management.

Success stories: individuals who claimed their assets

Many individuals have successfully claimed their unclaimed financial assets, leading to financial relief and opportunities. For example, one individual discovered a forgotten savings account from a previous job, leading to a significant payout that helped fund their education.

Testimonials from users illustrate the ease of using the form and pdfFiller’s functionality. By streamlining the process, these individuals managed to reclaim funds they never expected to receive, affirming the benefits of handling unclaimed property.

Advancing financial wellness through asset management

Incorporating unclaimed financial assets into your overall financial strategy is essential. Not only can it provide immediate financial benefits, but it can also enhance long-term financial planning. Regularly checking for unclaimed assets can uncover hidden financial resources and contribute to overall wealth management.

Staying vigilant and proactive ensures that as life changes occur, you’re not overlooked, and all potential assets remain accounted for. Leveraging technology, like that available at pdfFiller, facilitates effective financial management and promotes a more informed approach to handling your finances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form unclaimed financial assets without leaving Google Drive?

How do I make changes in form unclaimed financial assets?

How do I complete form unclaimed financial assets on an Android device?

What is form unclaimed financial assets?

Who is required to file form unclaimed financial assets?

How to fill out form unclaimed financial assets?

What is the purpose of form unclaimed financial assets?

What information must be reported on form unclaimed financial assets?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.