Get the free washington-state-durable-financial-power-of-attorney-form. ...

Get, Create, Make and Sign washington-state-durable-financial-power-of-attorney-form

How to edit washington-state-durable-financial-power-of-attorney-form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out washington-state-durable-financial-power-of-attorney-form

How to fill out washington-state-durable-financial-power-of-attorney-form

Who needs washington-state-durable-financial-power-of-attorney-form?

Washington State Durable Financial Power of Attorney Form - How-to Guide

Understanding durable financial power of attorney

A durable financial power of attorney (DPOA) is a crucial legal document that grants a designated agent the authority to manage financial decisions and transactions on behalf of another individual, referred to as the principal. This type of power of attorney remains effective even if the principal becomes incapacitated, ensuring that their financial matters are handled without interruption. The importance of a DPOA cannot be overstated—especially for those planning for the unexpected, as it provides peace of mind knowing that someone they trust can step in when necessary.

One key difference between durable and non-durable powers of attorney lies in its durability; while a non-durable power of attorney ceases upon the principal’s incapacity, a durable one withstands such circumstances. This makes the durable version essential for individuals looking to safeguard their financial interests during health crises or situations that may limit their ability to make sound decisions.

Legal framework in Washington State

In Washington State, the legal framework governing powers of attorney is primarily outlined in the Revised Code of Washington (RCW) Chapter 11.125. This legislation recognizes the importance of these legal instruments and sets forth the requirements for creating valid powers of attorney. Under Washington law, any individual of sound mind and legal capacity can appoint a durable power of attorney, ensuring the document aligns with state regulations.

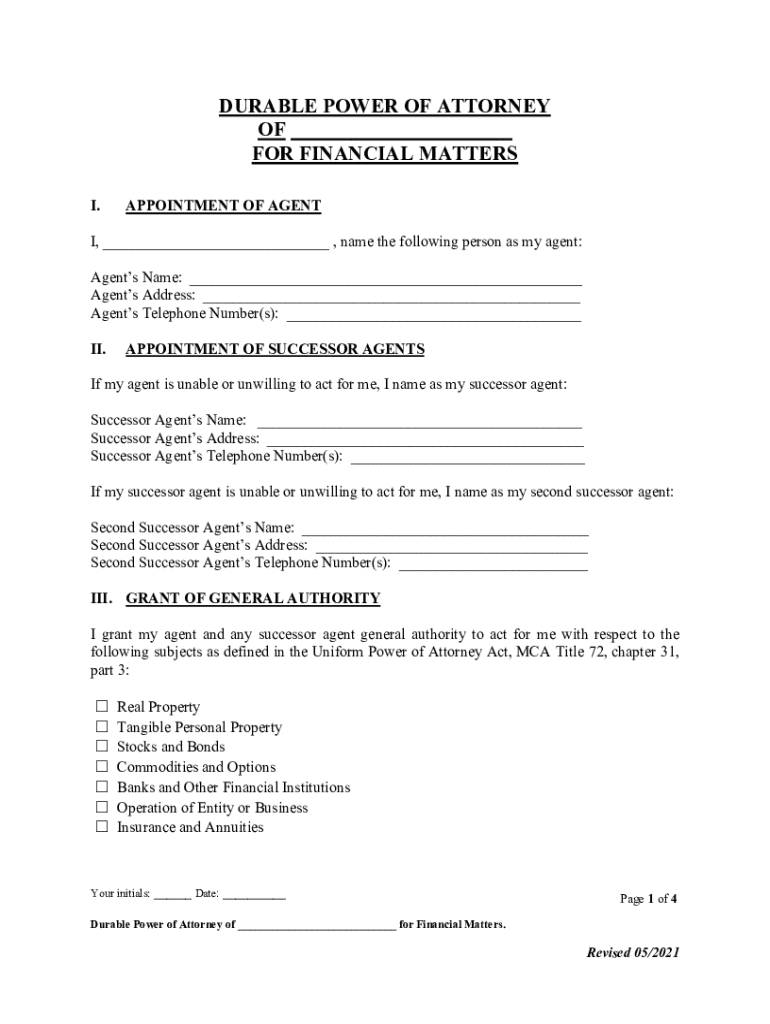

To ensure your DPOA is legally compliant, it must include specific language affirming its durability. Additionally, the principal’s signature must be executed in front of a notary public or signed by witnesses, as stipulated in Washington statutes. Choosing an appropriate agent is equally significant; the agent, often a relative or trusted friend, should be someone who is reliable and capable of managing financial matters effectively.

Detailed insights into the Washington State durable financial power of attorney form

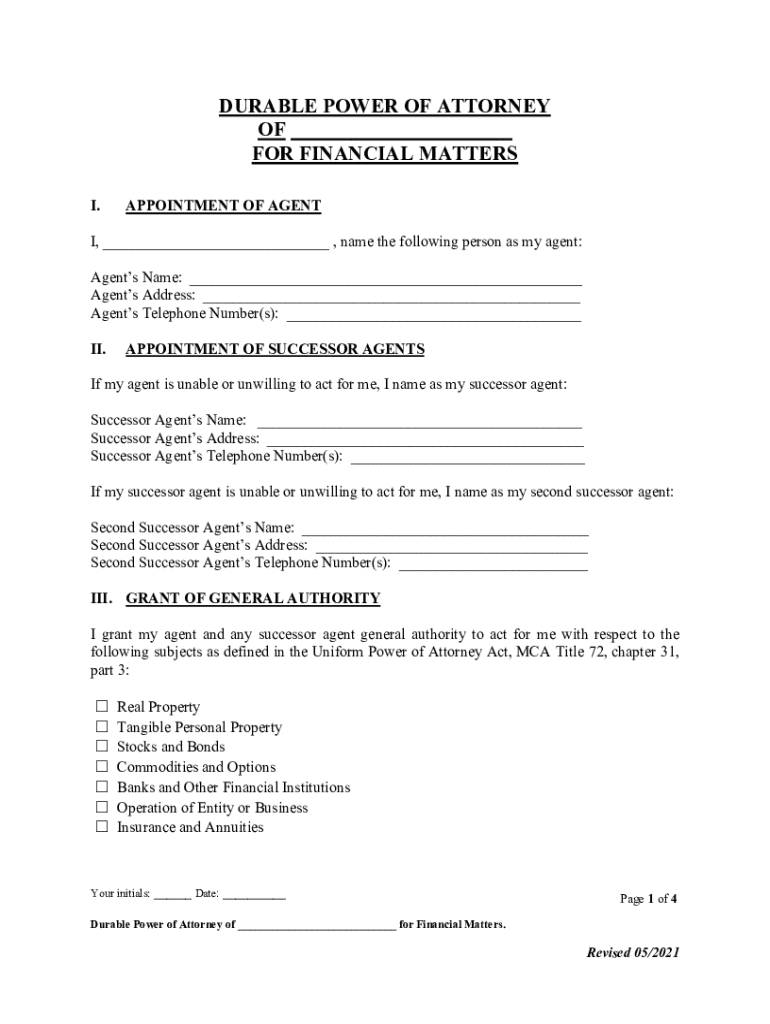

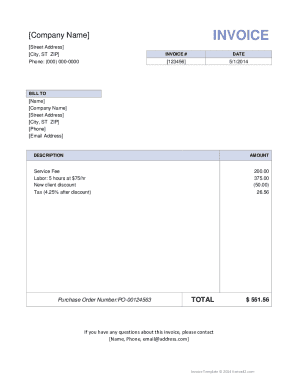

The Washington State durable financial power of attorney form serves as the cornerstone for executing a DPOA. This form allows the principal to designate an agent who will act on their behalf regarding financial matters. Crucially, this form encompasses several key sections that must be thoroughly understood and properly filled out.

Key sections within the form include:

Additionally, it is crucial that the form is signed and notarized. Without proper authentication, the document may be deemed invalid, leading to complications when the agent attempts to act on the principal’s behalf.

Step-by-step instructions for filling out the form

Filling out the Washington State durable financial power of attorney form involves several key steps, each designed to ensure that all necessary information is correctly provided. Here's a breakdown of the process:

Tips for editing and managing your durable financial power of attorney

Once you have completed the Washington State durable financial power of attorney form, it’s essential to manage and edit it effectively. A platform like pdfFiller can greatly simplify this task. By utilizing pdfFiller, users can edit PDF forms effortlessly, making it easy to update information as circumstances change, such as a change of address or agent.

Collaboration is another advantage of using this tool. If you're working with family or close friends, multiple individuals can access and contribute to the editing process, ensuring that everyone is on the same page. To facilitate easy access, pdfFiller also allows users to store documents securely in the cloud, making retrieval straightforward when needed.

Common mistakes to avoid when filling out the form

Filling out the Washington State durable financial power of attorney form is pivotal, and avoiding common pitfalls is vital. One frequent mistake is failing to clearly define the powers granted to the agent. Vague language can lead to confusion or disputes later, particularly if your agent operates outside your intended scope. Additionally, forgetting to update the form when life circumstances change—such as a marriage, divorce, or the death of your chosen agent—can lead to complications.

Another critical error involves ignoring the witnessing and notarization requirements. Failing to have the form properly signed and notarized may jeopardize its validity. It’s imperative to adhere strictly to Washington State’s laws regarding these processes.

FAQ: Common questions about the Washington State durable financial power of attorney

When considering a Washington State durable financial power of attorney form, many potential principals have questions. Understanding these common inquiries can help demystify the process. For instance, one major question is what happens if you don’t have a durable financial power of attorney. In such cases, if you become incapacitated, the court may have to appoint a guardian to manage your finances, which may not align with your preferences.

Another FAQ addresses revocation; can you revoke a DPOA? Yes, a principal retains the right to revoke this document at any time as long as they are mentally competent to do so. This process involves creating a formal revocation document and notifying the agent. Many also wonder if a lawyer is required for creating this document. While it is highly advisable to consult an attorney to ensure your document complies with state laws, it is not a requirement. Lastly, it’s crucial to clarify that this form primarily concerns financial decisions and does not affect medical decision-making.

Interactive tools and resources available on pdfFiller

pdfFiller offers various interactive tools that facilitate filling and signing the Washington State durable financial power of attorney form. Users can benefit from features that allow them to customize and fill out forms efficiently, ensuring that all necessary fields are completed correctly. Additionally, pdfFiller offers enhanced document management capabilities that keep your documents organized and easily accessible.

For individuals looking to create other related legal forms, pdfFiller provides access to templates that can assist in drafting various legal documents. These templates save time and help ensure compliance with legal standards, allowing users to navigate their documentation needs with confidence.

Real-life scenarios: The impact of having a durable financial power of attorney

Understanding the practical implications of having a durable financial power of attorney can be illustrated through real-life examples. Consider a case study where an individual experienced a sudden health crisis, leaving them incapacitated. Having a DPOA in place allowed their designated agent to manage their finances, pay bills, and make crucial financial decisions without delay, alleviating stress during an already challenging time.

In another testimonial, a family shared how having a durable power of attorney simplified decision-making during a relative's prolonged illness. The appointed agent was able to handle banking and property matters seamlessly, ensuring the family could focus on supporting their loved one without getting overwhelmed by financial obligations.

Important reminders for residents of Washington State

For residents filing their Washington State durable financial power of attorney form, it’s essential to keep track of submission deadlines and updates. Regular reviews of all financial documents are recommended to ensure they reflect current circumstances and intentions. It’s advisable to revisit your DPOA every few years or after major life events like marriage, divorce, or the death of a trusted agent.

Moreover, residents in need of assistance can locate their local county offices—such as Clark County—where professionals can provide guidance on completing, submitting, and managing powers of attorney. Keeping informed and proactive with your financial planning is vital, as personal circumstances can change unexpectedly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete washington-state-durable-financial-power-of-attorney-form online?

How do I edit washington-state-durable-financial-power-of-attorney-form online?

How do I fill out the washington-state-durable-financial-power-of-attorney-form form on my smartphone?

What is washington-state-durable-financial-power-of-attorney-form?

Who is required to file washington-state-durable-financial-power-of-attorney-form?

How to fill out washington-state-durable-financial-power-of-attorney-form?

What is the purpose of washington-state-durable-financial-power-of-attorney-form?

What information must be reported on washington-state-durable-financial-power-of-attorney-form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.