Get the free Where's My Amended Return?Internal Revenue Service

Get, Create, Make and Sign where039s my amended returninternal

Editing where039s my amended returninternal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out where039s my amended returninternal

How to fill out where039s my amended returninternal

Who needs where039s my amended returninternal?

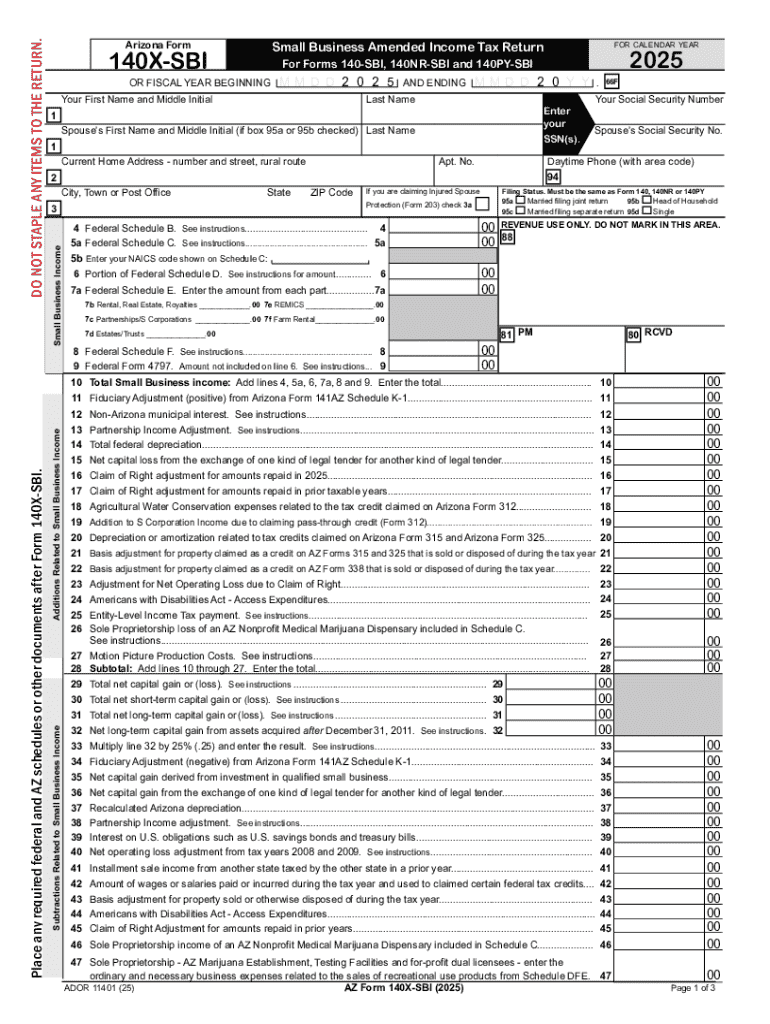

Where's My Amended Return - Internal Form

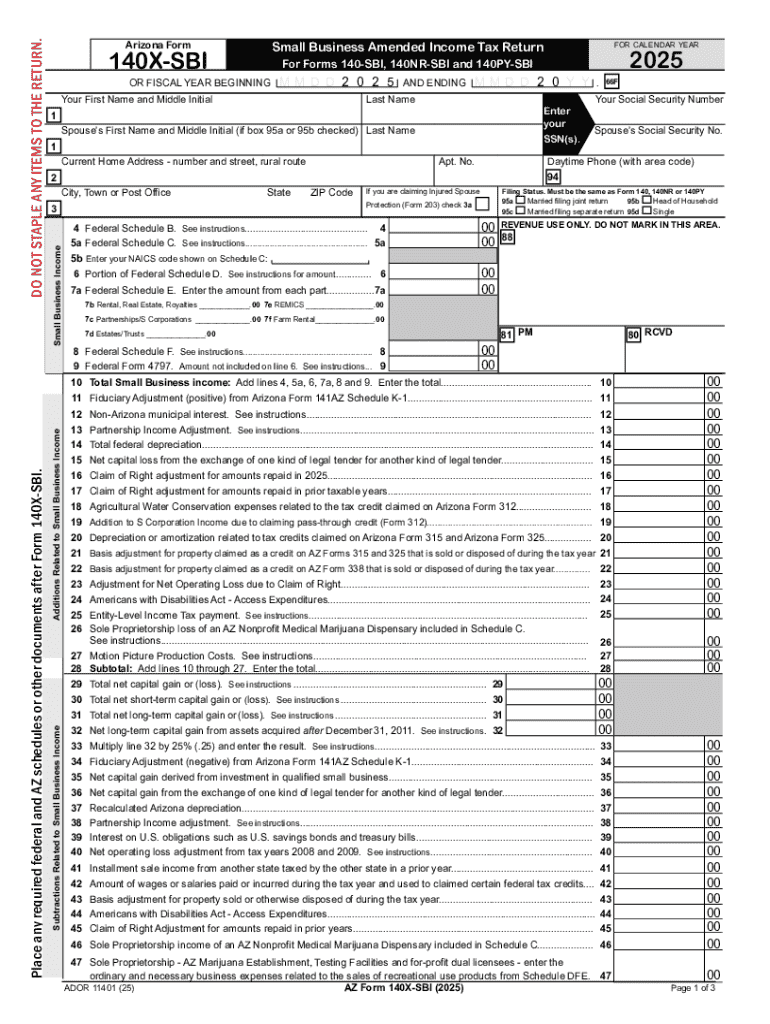

Understanding your amended tax return

An amended tax return is a document you file to correct errors on your original tax return. The IRS offers Form 1040-X specifically for this purpose. It is vital for taxpayers to understand their amended return status, as there can be numerous reasons for filing the form, including changes in income, deductions, or credits that could significantly affect tax liability.

Tracking the status of your amended return is crucial. Taxpayers often worry about delays or missing refunds, leading to anxiety regarding their tax affairs. In this guide, we will walk you through how to file your amended return and check its status efficiently.

How to file an amended return

Filing an amended return using Form 1040-X necessitates a precise approach. Start by clearly indicating the tax year you are amending at the top of the form. Complete the new amounts and provide explanations for each change in Part II. Pay careful attention to ensuring that all supporting documents are accurate.

Common mistakes to avoid include not signing the form, mismatches in Social Security numbers, and failing to explain why you're amending your return. Double-check all entries to prevent unnecessary delays in processing.

Where to check your amended return status

To track your amended return, utilize the IRS online tool 'Where's My Amended Return.' This platform allows you to view the status of your amended return within 3 weeks of submission.

If you prefer a more personal touch or have issues accessing the online service, you can contact the IRS directly. Be prepared for longer wait times during peak seasons and ensure you have the necessary information handy to facilitate the communication.

Troubleshooting common issues

Sometimes, you might encounter complications with your amended return. Delays can arise from incomplete forms or additional verification processes initiated by the IRS. It’s imperative to keep track of any correspondence from them, which can serve as a guide to resolving outstanding issues.

If your status hasn’t updated in the suggested timeframe, it’s best to reach out directly to the IRS. Efficient communication can help in addressing your concerns and understanding your current standing.

Managing follow-up actions

Once your amended return is filed, it's important to understand the expected timeframe for processing. Typically, you can expect updates within three weeks for status checks, while refunds may take much longer if claimed. It’s essential to keep a close eye on your financial documents during this waiting period.

By keeping track of any changes and using efficient management practices, you can navigate any complexity that comes with the tax amendment process more effectively.

Enhancing your document management with pdfFiller

pdfFiller is designed to help users streamline their document creations and management needs effectively. With features that include editing, signing, and collaborating on documents, individuals can access their tax forms seamlessly from any device. This capability is especially beneficial for users that require versatility in managing important financial documents.

Using pdfFiller effectively can significantly enhance your workflow around tax documentation, leading to a more organized and less stressful tax season.

Frequently asked questions (FAQs)

Common queries about amended returns often involve the implications of errors or the process of filing. It's vital to have clarity on these points as they can greatly impact a taxpayer’s financial health.

If you utilize pdfFiller for your form submissions, you can quickly access help regarding specific users' concerns and how to navigate the platform for the best outcomes.

User testimonials and success stories

Many users have found success in managing their tax amendments through pdfFiller. Real stories illustrate how the platform has transformed document management processes for individual users, firms, and organizations alike.

These testimonials highlight the user-friendly features of pdfFiller that cater directly to managing tax-related documents, ensuring that users can seamlessly navigate the complexities of tax amendments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit where039s my amended returninternal on a smartphone?

Can I edit where039s my amended returninternal on an iOS device?

How do I fill out where039s my amended returninternal on an Android device?

What is where039s my amended returninternal?

Who is required to file where039s my amended returninternal?

How to fill out where039s my amended returninternal?

What is the purpose of where039s my amended returninternal?

What information must be reported on where039s my amended returninternal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.