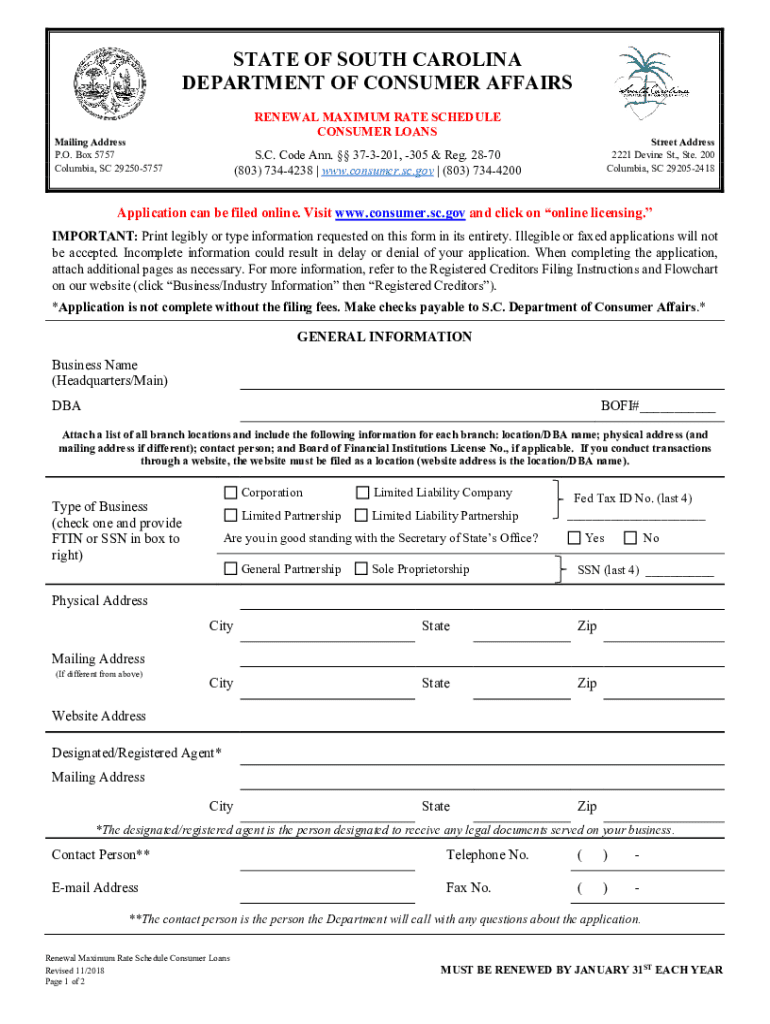

Get the free Renewal Credit Card Disclosure - SC Consumer Affairs - consumer sc

Get, Create, Make and Sign renewal credit card disclosure

Editing renewal credit card disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out renewal credit card disclosure

How to fill out renewal credit card disclosure

Who needs renewal credit card disclosure?

Understanding the Renewal Credit Card Disclosure Form

Understanding the renewal credit card disclosure form

A renewal credit card disclosure form is a document provided by credit card issuers to inform cardholders about any changes to the terms of their credit card agreement upon renewal. This form is designed to ensure transparency, allowing consumers to stay updated on interest rates, fees, and rewards structures. Often bundled with regular statements or sent as a standalone notice, the renewal disclosure is critical for informed financial decision-making.

It's essential for credit cardholders to pay attention to these disclosures because they can directly impact a consumer's overall financial health especially as market conditions fluctuate. Understanding the nuances of these documents can help individuals avoid unexpected charges and maximize their benefits.

Renewal credit card disclosure forms typically arrive 45-60 days before the renewal date of your credit card. It's important to review these documents diligently, as any agreement you’ve signed may be influenced by changes outlined in this form.

Key components of the renewal credit card disclosure form

The renewal credit card disclosure form contains several key components that every cardholder should understand, as they dictate how the credit card operates. This section delves into important sections of the disclosure that are indispensable for managing your credit card effectively.

By knowing these components thoroughly, you can effectively plan your spending and manage your credit card account, thus increasing your financial literacy and discipline.

Step-by-step guide to accessing your renewal credit card disclosure form

Accessing your renewal credit card disclosure form can be done through various channels. Here’s how you can easily locate this important document.

Whether digital or printed, having your renewal credit card disclosure form at hand allows you to stay proactive about your financial responsibilities and options.

How to fill out and edit the renewal credit card disclosure form

Although the renewal credit card disclosure form is generally informational and does not require you to fill out any response sections, reviewing it thoroughly is crucial. Follow these steps to effectively manage and edit the form if necessary.

Utilizing pdfFiller’s tools can enhance your comprehension of the document while allowing you to keep all your notes and information accessible and organized.

Signing and managing your renewal credit card disclosure form

While the renewal credit card disclosure form may not require a signature to be valid, you might still want to acknowledge receipt. This is especially important if you're confirming understanding of the new terms and conditions.

Being organized not only simplifies document management but also promotes a solid understanding of your credit card's renewal terms.

Interactive tools and resources

Navigating credit card terms and understanding financial statements can be complicated. However, through various interactive tools and resources, consumers can enhance their decision-making process.

By utilizing these resources, cardholders can make smarter, more informed choices that align with their financial goals.

Related topics to explore

Understanding your renewal credit card disclosure form is just one aspect of a broader financial literacy journey. Here are some related topics that can help deepen your knowledge.

By expanding your knowledge in these areas, you can equip yourself with the tools necessary for effective financial management.

Binding arbitration and legal considerations

Understanding binding arbitration clauses in credit card agreements is similarly essential. Such clauses often stipulate that disputes must be settled through arbitration rather than traditional court proceedings.

Staying informed about these legal considerations can help you navigate challenges that may arise in your credit card experience.

Downloadable resources

For those eager to take practical steps in managing their credit card agreements, various downloadable resources are available.

Making use of these resources can greatly simplify your credit management process and increase your confidence in handling financial matters.

Credit card comparison and choice

Choosing the right credit card involves careful consideration of various factors. A credit card that suits one person may not be ideal for another.

By approaching credit card selection methodically, you can find a card that aligns with your lifestyle and financial habits, ultimately promoting better spending habits and financial wellness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find renewal credit card disclosure?

How do I fill out renewal credit card disclosure using my mobile device?

How do I edit renewal credit card disclosure on an Android device?

What is renewal credit card disclosure?

Who is required to file renewal credit card disclosure?

How to fill out renewal credit card disclosure?

What is the purpose of renewal credit card disclosure?

What information must be reported on renewal credit card disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.