Get the free Shareholder Account Nominee or broker transfer request form

Get, Create, Make and Sign shareholder account nominee or

How to edit shareholder account nominee or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out shareholder account nominee or

How to fill out shareholder account nominee or

Who needs shareholder account nominee or?

Understanding Shareholder Account Nominee or Form

Understanding nominee shareholders

A nominee shareholder serves as a legal owner of shares on behalf of another party, called the beneficial owner. This structure is commonly utilized within corporate frameworks to protect the identity of the true owner and simplify share management. Nominee shareholders are particularly significant in jurisdictions with strict privacy laws, as they allow individuals or entities to maintain anonymity in their investment activities. However, it’s essential to recognize that nominee shareholders bear certain legal responsibilities and rights linked to the shares they hold.

Utilizing a nominee shareholder offers distinct advantages, especially for investors seeking discretion. The primary benefit is anonymity; by using a nominee, personal details and ownership stakes are shielded from public records, enhancing privacy. Additionally, nominee shareholders simplify share management by handling administrative responsibilities, such as keeping records in the share register and ensuring compliance with corporate governance norms.

The structure of a nominee account

Setting up a nominee account involves key components that support effective share management. The account must be established through a formal process, requiring specific documentation to verify both the nominee and the beneficial owner’s identity. Commonly needed documents include identification, proof of address, and the articles of incorporation for corporate accounts. This collection of information is crucial for compliance with anti-money laundering regulations and ensures legal integrity in ownership.

Nominee accounts can take various forms, typically categorized into individual and corporate accounts. Individual nominee accounts serve single shareholders, whereas corporate nominee accounts represent multiple stakeholders or entire organizations. Furthermore, investors often face the choice between local and offshore nominee shareholders, each offering different taxation and regulatory implications. Local accounts conform to domestic laws, while offshore accounts may provide enhanced privacy benefits and tax advantages.

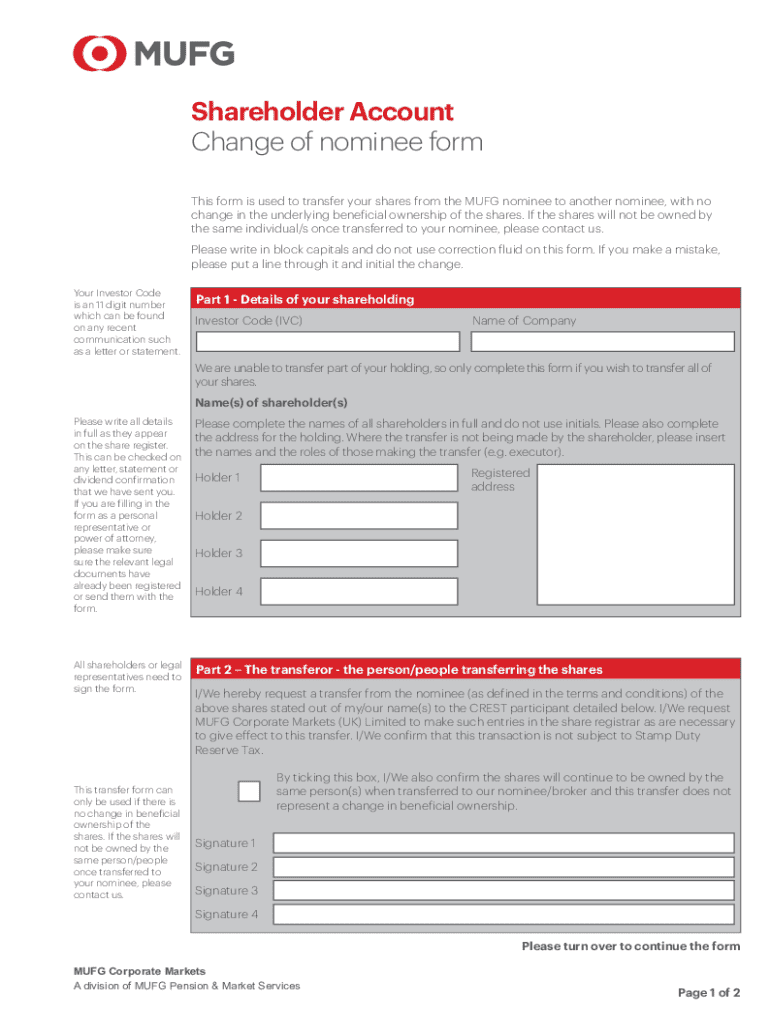

Filling out the shareholder account nominee form

Successfully completing the shareholder account nominee form requires careful attention to detail. The first step is gathering necessary information such as identification documents—like passports—and details of the company involved. It is also important to include particulars about other shareholders if applicable. Less attention to these preliminary steps can lead to significant issues later in the account creation process.

Once you have gathered all necessary information, filling in the form should be handled with care. Employ clear data entry methods to ensure all information is accurate, as inaccuracies can delay processing or even invalidate the form. Common mistakes include misspelled names and incorrect identification numbers, which are often overlooked. After completion, reviewing the form to double-check all fields is essential, as errors can lead to complications that may require additional documentation or resubmission.

Managing your nominee account

Once your nominee account is active, accessing and managing it is crucial for tracking your shares and confirming your rights as a shareholder. Logging into your account typically involves secure authentication to ensure that only authorized individuals can access sensitive information about shareholdings. Effective management practices include regular monitoring of share value, dividends, and any corporate updates that may affect your investment.

Understanding your shareholder rights as a nominee is essential. While you may hold shares as a nominee, the beneficial owner retains specific rights, including voting rights and the right to access pertinent company information. It's vital to maintain communication with the beneficial owner to ensure transparency and compliance with shareholder obligations. Any changes in shareholding, such as transfers or sales, must also be managed appropriately, ensuring full adherence to both legal requirements and internal policies.

Navigating general meetings as a nominee shareholder

Participating in general meetings as a nominee shareholder involves a specific process. Nominee shareholders attend meetings and have the right to vote, but they often do so through proxy representation. For this to occur smoothly, the proxy must be prepared with proper documentation, including a letter of representation that clearly states their authority to act on behalf of the beneficial owner during voting.

During general meetings, nominee shareholders are entitled to access certain information and maintain transparency about discussions and decisions that directly impact the shares they represent. Understanding the complexities of your role in these discussions is significant, ensuring that the interests of the beneficial owner are effectively communicated and represented throughout the meeting processes.

Legal considerations and transparency

The legal framework surrounding nominee shareholders includes important documents like the Declaration of Trust. This document outlines the relationship between the nominee and the beneficial owner, specifying responsibilities and rights. The Declaration is essential to affirm ownership claims and protect the interests of the parties involved. As such, maintaining compliance with these legal frameworks is crucial to avoid disputes or liabilities.

Corporate transparency is being increasingly emphasized by regulatory bodies globally. Companies must comply with regulations that often scrutinize the use of nominee shareholders to prevent practices like money laundering. As a nominee, understanding the implications of recent regulations is vital. This compliance not only protects the nominee and the beneficial owner but also enhances the reputation and trustworthiness of the corporate structure.

Nominee shareholders in the context of corporate governance

Navigating complexities in corporate governance highlights a key distinction between nominee shareholders and Persons with Significant Control (PSC). While both are integral in corporate structures, their roles and implications differ substantially. Nominee shareholders represent shares on behalf of others without publicly declaring ownership, while PSCs must be identified and disclosed as they hold significant influence or control over the company’s decisions.

The role of nominee shareholders can be crucial in shaping corporate strategy, especially in instances where they influence decisions or shareholder relations. Understanding these dynamics helps ensure that companies utilize their resources effectively while aligning management decisions with shareholder interests. Nominee shareholders can serve as a vital link in corporate governance, demanding a careful approach to ensure alignment between legal responsibilities and the interests of the beneficial owners.

Understanding section 793 notices

A Section 793 Notice serves as a critical tool for shareholders in providing transparency about ownership. This notice requests details of share ownership to ensure compliance with disclosure requirements stipulated by corporate governance laws. As a nominee shareholder, it's essential to respond to these notices accurately, as failing to do so can result in legal implications for both the nominee and the beneficial owner.

Best practices for responding to Section 793 Notices include preparing the necessary information well in advance, ensuring clarity in responses, and adhering strictly to stipulated timelines. This due diligence not only protects the nominee and the beneficial owner but also fortifies the corporate structure's integrity. Engaging with legal counsel can also be valuable, ensuring all disclosures align with current regulations.

Tools and resources for nominee shareholders

Managing documents and forms effectively is essential for nominee shareholders, and utilizing tools such as pdfFiller can enhance this process dramatically. pdfFiller offers features for filling out and editing shareholder documents seamlessly, allowing users to maintain accuracy in their submissions. The platform's eSignature capabilities further facilitate quick transactions, ensuring that necessary approvals are obtained efficiently.

Collaboration is also key when managing nominee accounts. pdfFiller enables users to share access to documents and collaborate in real-time, streamlining the process for individuals or teams. This functionality not only simplifies the management of documentation but also provides tools for tracking changes, ensuring all modifications are clearly documented and easily accessible.

Expert tips for successful management of nominee accounts

Maintaining organized and thorough records is fundamental to the successful management of nominee accounts. Effective record-keeping not only includes documentation of share transfers and sales but also ensures all legal documents and communications are easily retrievable. This diligence protects the interests of both the nominee and the beneficial owner, fostering a secure and compliant shareholding environment.

To maximize the benefits of using a nominee shareholder, consider strategic reasons for opting for nominee holding. This includes enhanced privacy, ease in managing diverse investments, and optimizing tax implications. Situations often associated with these benefits include managing offshore investments, consolidating share management for multiple investors, and maintaining confidentiality in strategic decisions. Recognizing these scenarios will allow shareholders to fully leverage nominee arrangements for their investment goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my shareholder account nominee or directly from Gmail?

How can I edit shareholder account nominee or from Google Drive?

How do I make edits in shareholder account nominee or without leaving Chrome?

What is shareholder account nominee or?

Who is required to file shareholder account nominee or?

How to fill out shareholder account nominee or?

What is the purpose of shareholder account nominee or?

What information must be reported on shareholder account nominee or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.