Get the free SG UK Kick-out Plan 23 (UK Four)

Get, Create, Make and Sign sg uk kick-out plan

How to edit sg uk kick-out plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sg uk kick-out plan

How to fill out sg uk kick-out plan

Who needs sg uk kick-out plan?

Your Guide to the SG UK Kick-Out Plan Form

Understanding the SG UK Kick-Out Plan

A kick-out plan is an innovative investment vehicle offered by banks and financial institutions, allowing investors to plan an exit at predefined levels of market performance. The SG UK Kick-Out Plan is therefore tailored specifically for clients looking to invest with specific goals, primarily aimed at providing a structure that offers the potential for returns while limiting risks.

By defining a kick-out level—often connected to a stock market index like the FTSE 100—investors set a target that will enable them to exit their investment early if the predefined performance is achieved. This setup not only engages the investor with the market but also provides clarity on potential gains and risks.

Eligibility for SG UK Kick-Out Plans

Before applying for the SG UK Kick-Out Plan, it's crucial to understand the eligibility criteria. Generally, both individual and team applicants may qualify, but specific age and residency requirements exist, ensuring that only eligible investors participate.

Residency in the UK or having an established UK bank account is usually required. Additionally, potential investors might be subjected to financial assessments to determine their suitability for such investment plans. These requirements help ensure that participants fully understand and can manage the risks associated with kick-out plans.

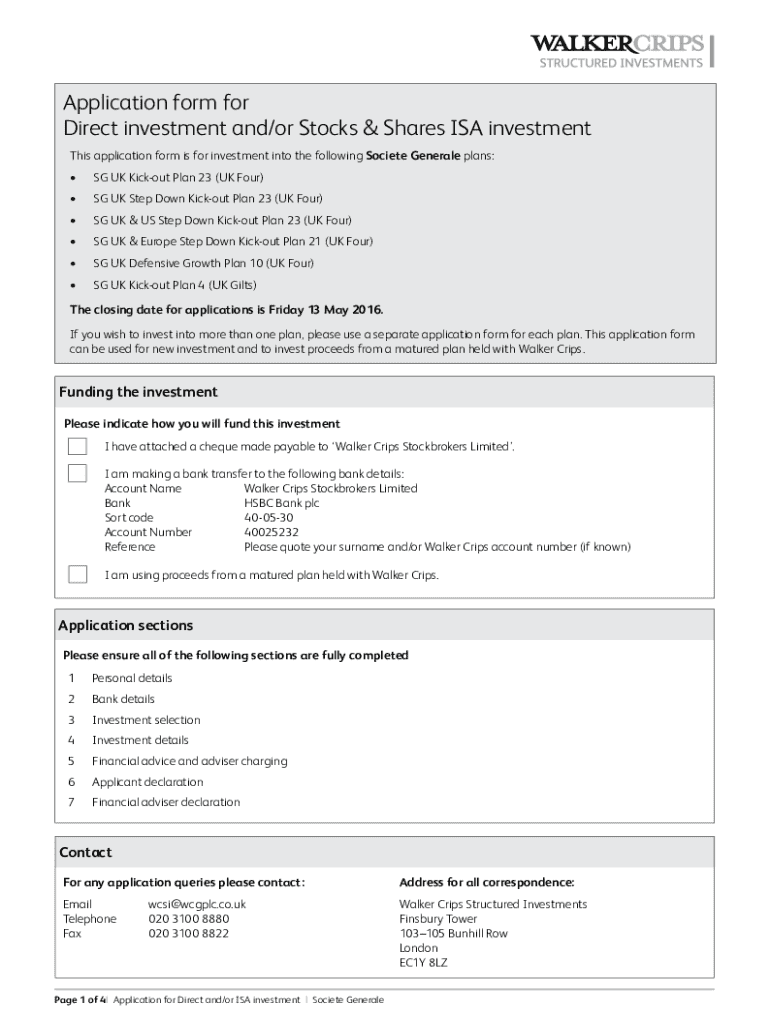

The SG UK Kick-Out Plan Form: An Overview

The SG UK Kick-Out Plan form is a detailed document containing essential components that guide the application process. It comprises sections for personal details, where applicants provide their identification information, and a financial section that outlines the investment they intend to make. Understanding what each part means is vital for a smooth application process.

Moreover, the terminology used in the form can often seem complex. Terms like 'kick-out feature', which indicates when exits can be made, and financial jargon need to be clearly understood to facilitate accurate completion of the form.

How to fill out the SG UK Kick-Out Plan Form

Filling out the SG UK Kick-Out Plan form accurately is crucial for successful application. First, gather all required documents before starting. The process begins with completing personal information. Ensure your name, address, date of birth, and contact details are correctly filled in with up-to-date data.

When providing financial details, state your source of funds and how much you intend to invest. Be transparent; inconsistencies can lead to complications. Understanding financial terms is equally essential—make sure that each term aligns with your understanding to avoid misinterpretation.

Interactive tools for your kick-out plan

To enhance your experience with the SG UK Kick-Out Plan form, pdfFiller provides interactive tools that simplify the document editing, signing, and submission process. Utilizing PDF editing features on pdfFiller can empower you to customize your application to fit specific needs, ensuring that all details are tailored for accuracy.

Moreover, eSigning options available on pdfFiller guarantee security and legality when managing your documents. This cloud-based platform facilitates collaboration, enabling multiple team members to work on the form simultaneously, thus streamlining feedback and revisions.

Managing your kick-out plan submission

Once you submit the SG UK Kick-Out Plan form, what happens next? Understanding the approval timelines is essential for managing expectations. Typically, you can expect to hear back regarding your application status within a few weeks, depending on the complexity of the submission.

In the event that you need to modify your submission, knowing when and how to request changes can help you avoid missed opportunities. Ensure all requests are made promptly and clarify any alterations to underscored terms and investments.

Understanding risks and rewards

Like any investment product, the SG UK Kick-Out Plan comes with its share of risks and rewards that must be evaluated carefully. Particularly, market volatility can impact the returns linked to kick-out plans. These plans often tie returns to indexes, such as the FTSE 100, and understanding the factors influencing these indices is vital for sound investment decisions.

Risk assessment should take into account both market conditions and financial goals. Assessing your financial landscape is crucial when weighing long-term goals against potential short-term gains available through kick-out plans.

Frequently asked questions (FAQ)

As you explore the SG UK Kick-Out Plan Form, you might have several pressing questions. Understanding the application process can help make informed decisions. One common query is regarding the duration of the process, with most applications processed within a few weeks; however, complexities can arise that may alter this timeline.

Another frequent question pertains to the ability to withdraw applications. Once submitted, it may be possible to retract an application, but clarity on the withdrawing process is essential to navigate complications seamlessly.

Security and privacy considerations

Security is paramount when submitting sensitive documentation like the SG UK Kick-Out Plan form. Protecting your information starts with utilizing secure submission methods. Familiarizing yourself with best practices, such as using strong passwords and avoiding public Wi-Fi networks, can significantly enhance your data protection.

Additionally, pdfFiller incorporates robust security measures to safeguard your data throughout the submission process. Compliance with regulatory standards not only protects your information but also provides peace of mind during your investment journey.

Expert tips for navigating kick-out plans

For those venturing into the world of kick-out plans, seeking professional advice can be a game changer. Investors should consider consulting with a financial advisor, especially if they are new to investment products. Advisors can tailor strategies that accommodate individual risk tolerance and financial objectives.

In addition, staying informed on financial trends can prove beneficial. Regular monitoring of changes in market conditions affecting kick-out plans will better equip you for strategic decision-making. By blending expert advice with current market knowledge, investors can maximize their chances of achieving their financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete sg uk kick-out plan online?

How do I edit sg uk kick-out plan online?

How can I edit sg uk kick-out plan on a smartphone?

What is sg uk kick-out plan?

Who is required to file sg uk kick-out plan?

How to fill out sg uk kick-out plan?

What is the purpose of sg uk kick-out plan?

What information must be reported on sg uk kick-out plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.