Get the free IRS Seeks Comments on Form 8851: Summary of Medical ...

Get, Create, Make and Sign irs seeks comments on

Editing irs seeks comments on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs seeks comments on

How to fill out irs seeks comments on

Who needs irs seeks comments on?

IRS seeks comments on form: A guide to engaging with the IRS on tax forms

Understanding the IRS's initiative on form changes

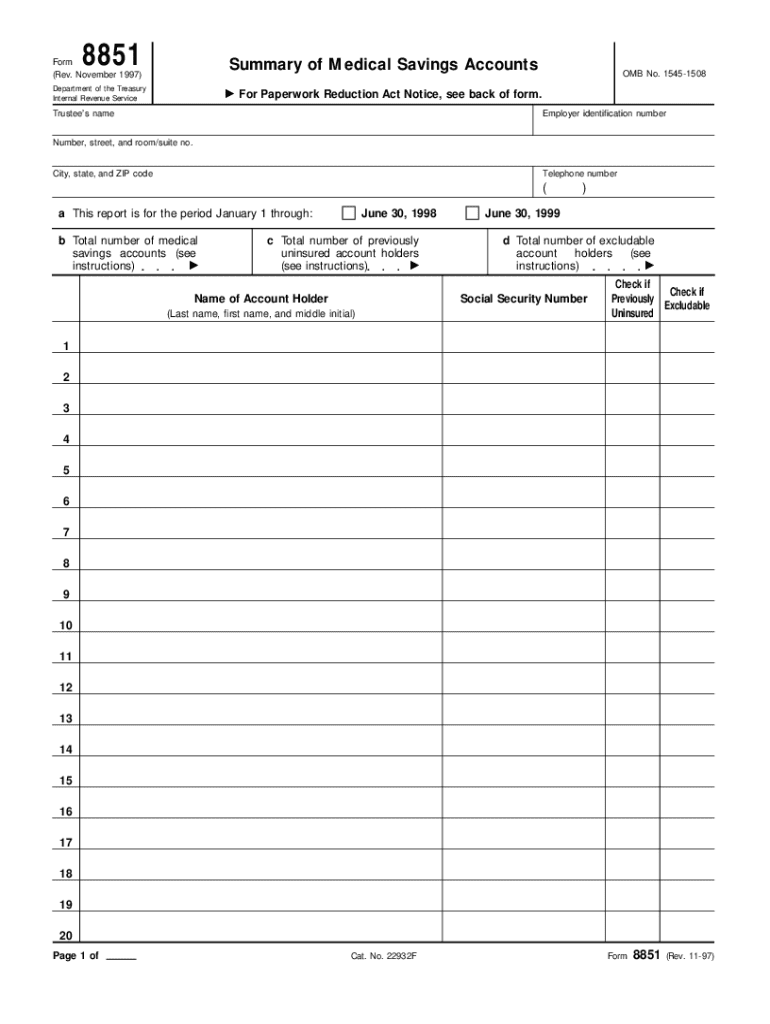

The IRS's commitment to soliciting public input on form changes is a crucial part of enhancing the tax filing experience. By inviting comments from taxpayers, the IRS recognizes the importance of incorporating real-world insights into the development and revision of its forms. Historical context shows that over the years, public feedback has led to significant improvements and streamlining of processes, making tax compliance less cumbersome for everyone involved.

Currently, several tax forms are under review, with the IRS encouraging feedback to guide their updates. This initiative includes key forms that affect a wide range of populations, including individual taxpayers, non-profit organizations, and businesses. With proposed changes aiming to simplify processes and reduce errors, open comments will help identify any areas of concern from the community.

Community feedback is invaluable in this process. Tax forms are not just bureaucratic tools; they directly impact the lives of taxpayers and organizations. Feedback shapes critical aspects, such as clarity in instructions, additional line items to accommodate specific situations, or removing redundancies. Past examples include changes made to Form 1040 based on suggestions that aimed at clarifying eligibility requirements for tax credits and deductions.

Detailed insights into specific forms

Among the forms under review, Form 990 is crucial for non-profit organizations, and the IRS aims to refine its instructions and reporting requirements. Key proposed changes include a clearer classification of expenses and income, which could help charities provide better transparency in their financial practices. Streamlined reporting means non-profits could spend less time on paperwork and more time serving their missions.

Additionally, Form 1040 is being reviewed for highlighted modifications intended to simplify individual tax filings. Proposed amendments range from restructuring certain sections to enhancing clarity around tax credits for families. The changes are significant, especially for taxpayers who might face confusion around eligibility, ultimately aiming to reduce errors when submitting returns. This could play a pivotal role in improving taxpayer compliance and satisfaction.

Forms like Form 1065, for partnerships, and Form 4562, for depreciation and amortization, also need attention. Adjustments to these forms could lead to clearer guidance for reporting partnership income or claiming depreciation, enhancing compliance for small business owners and partnerships.

How to submit your comments effectively

Submitting comments to the IRS requires careful preparation to ensure your insights are both clear and impactful. Begin by structuring your feedback with a clear introduction stating your qualifications or perspective. This will help the IRS understand your position and the context of your comments. Next, identify specific issues with the forms or propose your suggestions, ensuring each point is conveyed with clarity and concise language.

Avoid common pitfalls, such as vague statements or overly complex jargon. Your feedback should be straightforward, focusing on actionable suggestions that could enhance usability. Make sure to emphasize how your feedback aligns with the greater goal of improving taxpayer experience and compliance.

Comment submission channels vary, including online portals, email, and traditional mail. Ensure that you check the IRS's official website for specific instructions and deadlines; submitting your comments promptly will guarantee that your voice is included in the review process.

The role of pdfFiller in document management and feedback submission

As you prepare to submit feedback regarding IRS forms, pdfFiller is an excellent resource for seamless document creation and editing. With its user-friendly interface, you can easily manage your comments document. The platform provides various features that allow you to draft, edit, and format your feedback efficiently, ensuring it looks professional before submission.

pdfFiller also facilitates collaboration, allowing teams to work together on feedback submission in real-time. This collaborative feature means you can invite others to review or contribute their insights, making your comments more robust. Moreover, with eSigning options, you can electronically sign and securely share the document, eliminating the need for printing or mailing.

Accessing, editing, and managing form templates becomes hassle-free with pdfFiller. By utilizing its extensive library of IRS forms, users can fill in the required fields directly, making the overall feedback submission journey smoother and more efficient.

Engaging with the IRS: best practices for ongoing participation

To remain effective in your engagement with the IRS, staying informed of future changes is essential. Signing up for the IRS newsletters is a practical step for individuals and organizations seeking to receive updates directly from the agency. This proactive approach ensures that you are kept in the loop regarding upcoming reviews and opportunities for public comment.

In addition to individual efforts, building community engagement around tax forms can amplify your voice. Engaging with various community forums or groups can enable shared experiences and collective insights. This group feedback may yield more significant influence as the IRS considers revisions, aligning the needs of multiple stakeholders for more comprehensive changes.

Real-world impact of feedback on IRS decisions

The influence of public comments on IRS decision-making is not merely hypothetical; there are tangible examples showcasing how effective public feedback has led to significant form revisions. For instance, modifications to the process of reporting contributions to charities are a result of user suggestions aimed at improving clarity and reducing reporting errors. Organizations have noted better filing experiences and fewer alerts concerning errors after their input was integrated into form designs.

Looking to the future, understanding trends in feedback implementation can provide insight into where the IRS might focus its attention. Current movements towards digital innovation and streamlined processes indicate a willingness to adapt and evolve based on user input. Anticipating areas where the IRS may seek further community engagement can ensure that constituents remain ahead of the curve in actively contributing to discussions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the irs seeks comments on in Chrome?

Can I edit irs seeks comments on on an iOS device?

Can I edit irs seeks comments on on an Android device?

What is irs seeks comments on?

Who is required to file irs seeks comments on?

How to fill out irs seeks comments on?

What is the purpose of irs seeks comments on?

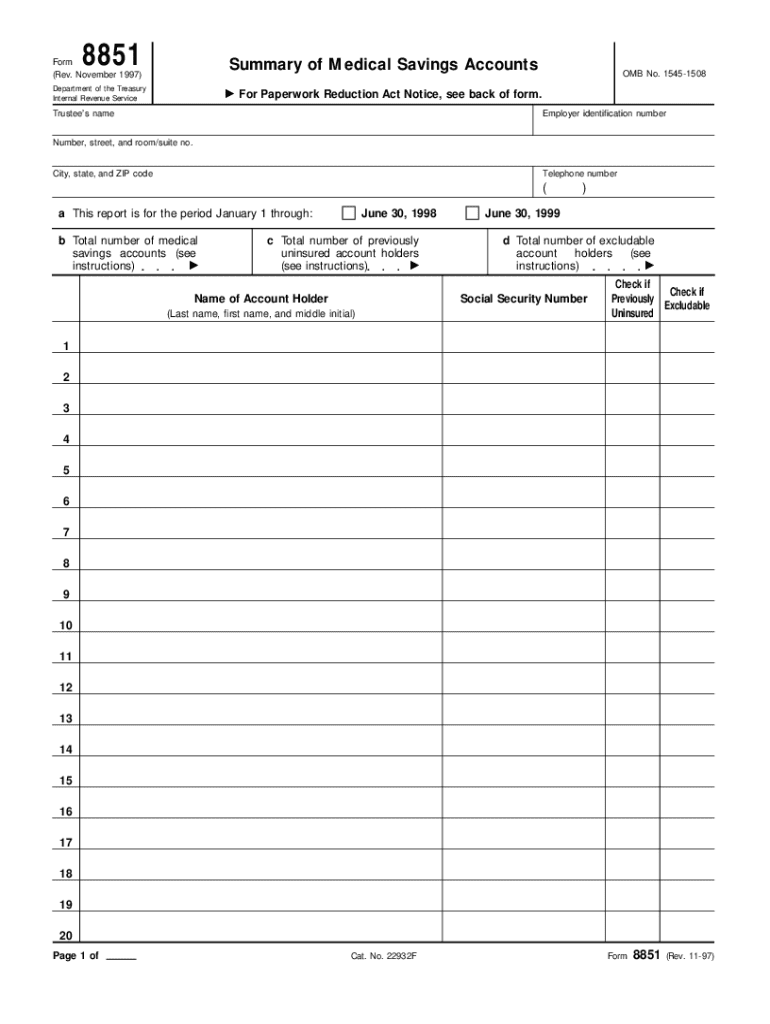

What information must be reported on irs seeks comments on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.