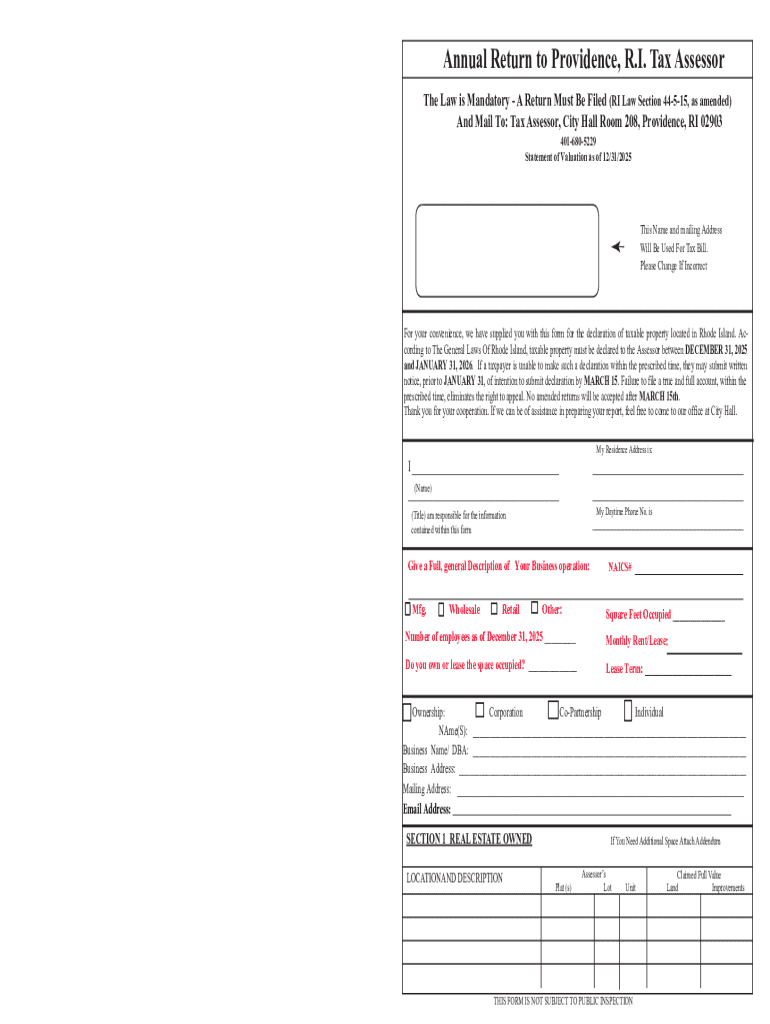

Get the free 2026 Annual Return to North Providence R.I. Tax Assessor

Get, Create, Make and Sign 2026 annual return to

Editing 2026 annual return to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 annual return to

How to fill out 2026 annual return to

Who needs 2026 annual return to?

2026 Annual Return to Form: A Comprehensive Guide

Understanding the 2026 annual return

The 2026 Annual Return is a crucial document for both individuals and organizations, as it serves as the formal report of income, deductions, and taxes owed to the government. This filing not only reconfirms your compliance with U.S. tax laws but also plays a significant role in determining your future tax obligations and potential refunds. Preparing and filing this annual return accurately and on time is vital to avoid penalties and ensure you receive any applicable credits or refunds.

Incorrect or late filings can lead to unnecessary complications. The return must be completed based on a multitude of factors, including your income sources, expenses, and potential deductions. Ensuring accuracy and timeliness will positively impact your financial health, allowing you to manage your obligations efficiently. From individuals, nonprofits to larger corporations, everyone must acknowledge the importance of the annual return.

Key dates for the 2026 annual return

For the 2026 annual return, understanding the essential tax dates and deadlines is vital for compliance. These deadlines vary for individuals and businesses, ensuring that everyone is aware of their obligations and can prepare adequately. Generally, personal tax returns for the tax year 2025 are due by April 15, 2026, unless there’s an extension involved. However, the specifics can change slightly depending on weekends or holidays.

Businesses, including LLCs and corporations, must also adhere to different deadlines based on their tax structures. For instance, C corporations typically need to file their returns by March 15, 2026, while S corporations enjoy an extended deadline of April 15. Keep in mind, other notable financial events, such as major tax reforms or any new regulations that may come into effect, might influence these deadlines, so always stay updated with IRS announcements.

Preparation for completing your annual return

Before filling out your 2026 annual return, gathering the necessary documentation is vital. Completeness is key—collect W-2s, 1099s, and any receipts for deductible expenses. Accurate record-keeping simplifies the filing process and ensures you can claim all possible deductions confidently. If you’re claiming credits, gather proof for those as well, as each item can potentially add value to your tax return.

Once you have your documents in order, assess your financial situation. Understanding your income sources, whether they include salaries, dividends, or rental income, will guide how you report this income. Evaluating your deductions and credits applicable to your situation, such as those related to education or home ownership, can significantly impact your taxable income and potential refunds.

Steps to filling out the 2026 annual return

Completing your annual return can seem daunting, but breaking it into manageable steps makes the process easier. For individuals, start by selecting the appropriate form based on your income situation—typically, this will be Form 1040 or one of its variants. Each section of the form should be filled out carefully and accurately, ensuring that all numbers are tallied correctly.

Use the instructions provided by the IRS for clarity on what numbers go where. Review your entries multiple times to catch any errors before submission. On the business side, depending on whether you're filing as a corporation, partnership, or LLC, you’ll choose the corresponding form like 1120 for C corporations or 1065 for partnerships. Accurately reporting income and filling out essential deductions will streamline the review and approval process.

Common mistakes to avoid when filing your annual return

While preparing your 2026 annual return, it’s crucial to be vigilant about common errors that can lead to complications later. Frequent mistakes include incorrect Social Security numbers, missing signatures, or not reporting all income sources—something that could trigger an audit. Paying attention to details such as correct mathematical calculations and accurate form selection can save you a lot of headaches.

Always double-check your entries and ensure that all documents are included with your submission. Utilizing software for e-filing can also minimize human error. Remember, taking extra time to review your return can result in a smoother filing process, ultimately saving you from unnecessary back-and-forth with the IRS or other tax authorities.

FAQs about the 2026 annual return

As tax season approaches, expect several inquiries regarding the 2026 annual return due dates and payment schedules. Individuals typically wonder about the precise tax deadlines for 2026, which usually fall on April 15, assuming no holidays interfere. Those filing as business entities often have unique requirements, which could include different deadlines based on their filing structure.

Utilizing technology to simplify your filing

In today's digital world, utilizing technology can simplify the often-complicated process of filing your 2026 annual return. Tools like pdfFiller offer a cloud-based platform that not only allows users to edit PDFs but also provides functionalities for electronic signatures and collaboration on documents. This means that once you gather your essential tax documents, you can easily edit and finalize them all in one place.

pdfFiller also boasts interactive features that help users track and manage their tax documents, ensuring that everything is organized and easily accessible. This reduces the likelihood of missing critical files or deadlines, granting users a straightforward way to maintain compliance and keep their filing process smooth.

When you’re ready to file

When it’s time to submit your 2026 annual return, having a checklist of final steps can add a layer of assurance. Ensure that your form is complete, all required documents are attached, and you've recorded any necessary payments or deductions correctly. If filing electronically, make sure to keep copies of your submitted forms and confirmation emails for your records. For those opting for paper filing, double-check that you've signed and dated the return accurately.

Support and resources

Accessing professional help can be invaluable if you're feeling pressured or unsure about any part of the filing process. Whether seeking a CPA for more complex filings or simply wanting to clarify specifics about deductions and credits, assistance is always available. Remember, organizations often have materials that provide insights and updates about tax regulations, making them useful resources during tax season.

Furthermore, pdfFiller offers an array of support options for users encountering filing questions or issues. Their customer care team can guide you through any processes that might appear unclear, ensuring you leverage their platform efficiently.

The bottom line

Filing your 2026 annual return accurately and on time is not just a legal obligation but a crucial aspect of personal and business financial health. Timely filings potentially lead to refunds, compliance with tax laws, and peace of mind. Understanding the process and utilizing resources like pdfFiller ensures you stay organized, informed, and equipped in maneuvering through your tax obligations with confidence.

Embracing technology while being mindful of deadlines will streamline your overall experience with filing. Always prioritize accuracy and seek assistance when needed to ensure your 2026 annual return is a smooth process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 2026 annual return to in Gmail?

How can I edit 2026 annual return to on a smartphone?

How do I edit 2026 annual return to on an Android device?

What is 2026 annual return to?

Who is required to file 2026 annual return to?

How to fill out 2026 annual return to?

What is the purpose of 2026 annual return to?

What information must be reported on 2026 annual return to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.