Get the free sbi account opening form for resident individuals part 1

Get, Create, Make and Sign account opening form for resident individuals part 1

How to edit sbi account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sbi account opening form

How to fill out account opening form for

Who needs account opening form for?

Your guide to the account opening form

Understanding the account opening form

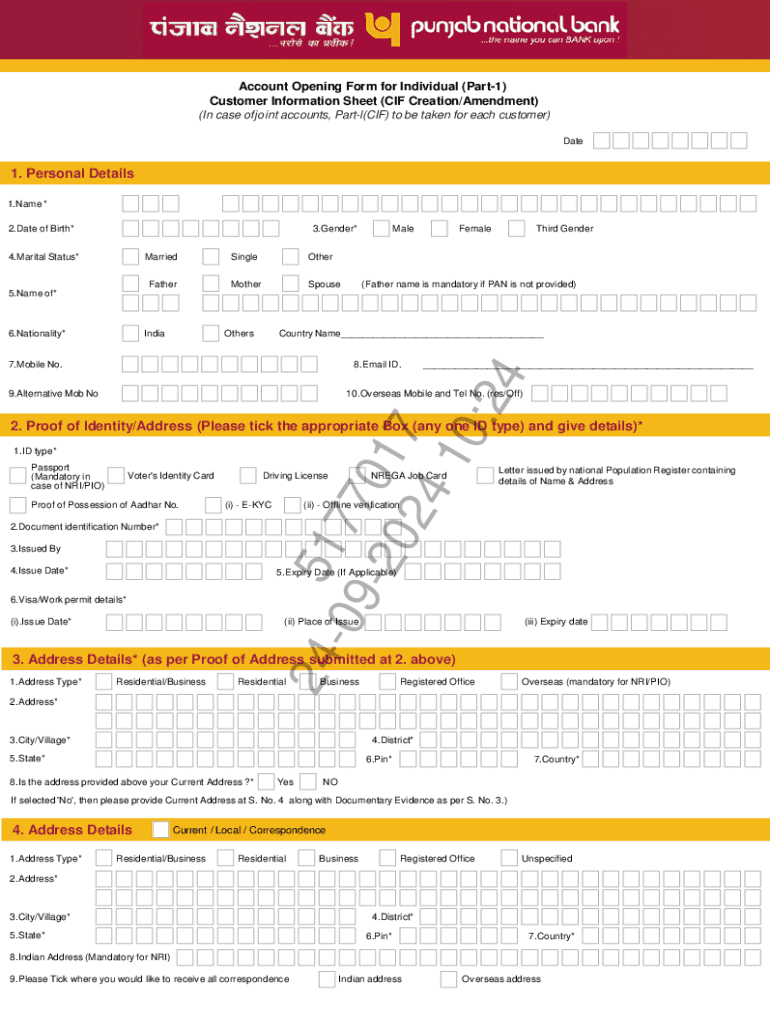

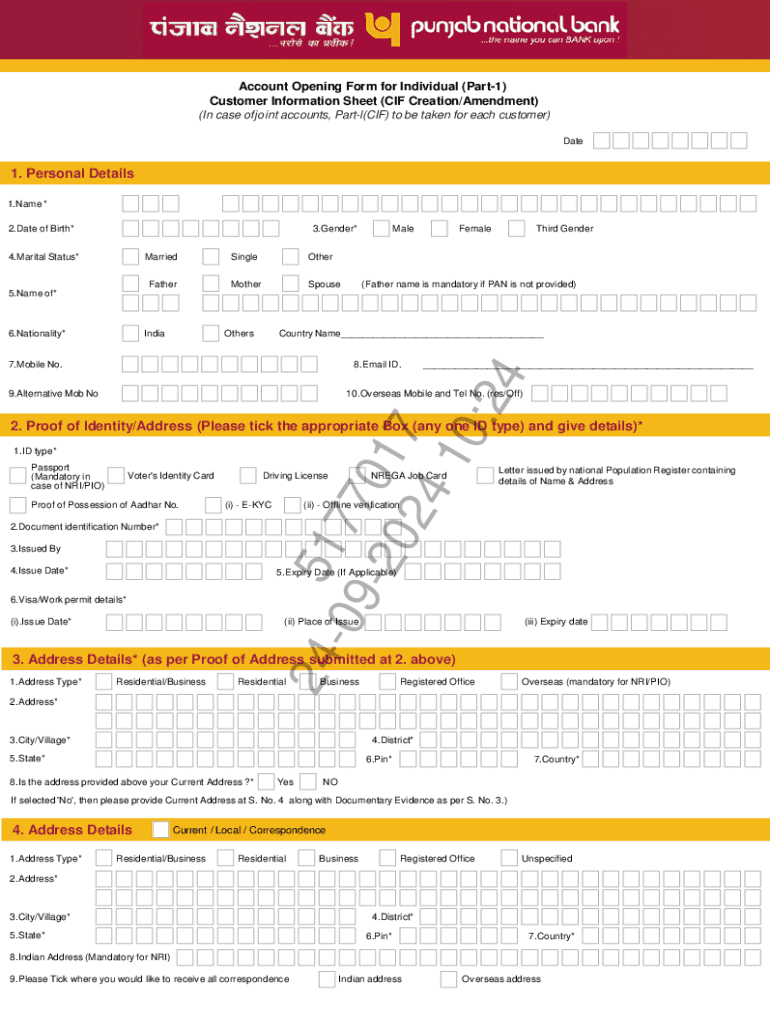

An account opening form is a crucial document that allows individuals and businesses to establish a financial relationship with banks or financial institutions. Its main purpose is to gather essential information, enabling the institution to verify the applicant’s identity and comply with regulatory requirements.

Accurate information is vital when filling out this form; any errors or omissions can lead to delays in account approval or even cause a rejection. Different types of accounts, such as savings accounts, checking accounts, investment accounts, and business accounts, all have specific opening forms tailored to their requirements.

Key components of an account opening form

Account opening forms typically consist of various sections that collect necessary details. The first is the personal information section, which includes your full name, contact details such as email, phone number, and address, along with your date of birth. This information helps the institution to recognize and reach out to the account holder.

Another critical area is identification documentation, where you must provide valid IDs like a driver’s license or passport to verify your identity and address. Financial information gives insight into your economic background, including employment details, purchase preferences, initial deposit amount, and any financial goals you wish to achieve.

Lastly, the consent and agreement section is vital, as it ensures that you understand the terms and conditions associated with your account, along with acknowledging the institution's privacy policy. This transparency is essential for establishing trust.

How to access the account opening form

Finding the account opening form is typically straightforward. First, visit your financial institution’s website. Most banks and financial services have a dedicated section for new accounts where you can locate the form. Look for a 'New Accounts' link or similar nomenclature.

Once you find the form, it can often be downloaded and printed. For those who prefer a more streamlined approach, you may also fill out the form online directly on the institution’s website. If you need to submit it, most institutions accept methods such as in-person submission at a branch, emailing the completed forms, or using an online submission portal.

Steps to complete the account opening form

Completing the account opening form involves several crucial steps to ensure accuracy. Start by gathering all necessary information before beginning. Collect your personal details, identification forms, and any financial information you may need to provide.

Next, fill out your personal details accurately, ensuring each field is completed correctly. After that, attach all identification documentation, clearly labeled as required. Financial information can involve more thought; consider your employment and financial goals carefully before inputting this data. Finally, sign and date the form before submitting it.

Common mistakes to avoid include not signing the form, overlooking sections, or providing outdated documents, which can lead to delays.

Interactive tools to enhance form submission

Using tools like pdfFiller can significantly enhance the process of filling out and submitting your account opening form. With pdfFiller, you can easily edit, fill, and sign the form from any device, making it particularly convenient.

One of the standout features includes the ability to save progress and revisit your forms later, which is especially beneficial when gathering various documents. Moreover, pdfFiller allows for collaboration, enabling you to share the form with team members or family members who may need to review or provide input before finalizing the submission.

Frequently asked questions about the account opening form

Common queries arise surrounding the account opening form, such as what to do if you make a mistake. If an error occurs, it’s best to cross out the mistake neatly and provide the correct information without damaging the form's legibility.

Another common concern pertains to the timeframe taken to open an account. This can vary, but typically, institutions process applications within a few business days once the completed form is submitted. Many users also wonder about filling out the form on mobile devices—most banks now offer mobile-friendly forms for accessibility.

More templates like this

In addition to the account opening form, there are various other financial forms that may serve similar purposes. For instance, investment account opening forms are designed specifically for entering the investment market and have slightly different requirements compared to traditional banking forms.

Business account opening forms are tailored for entrepreneurs and companies, ensuring that business regulation compliance is addressed. Lastly, trust account forms define the terms under which trust funds are managed, focusing on legal obligations and distribution of assets.

Additional features of pdfFiller for document management

Beyond just filling and signing forms, pdfFiller provides a comprehensive suite of document management tools. You can track the status of your submitted forms to stay informed about the approval process. This is especially useful for individuals who need to monitor several applications concurrently.

You can also organize and store forms for future use, helping you maintain a well-structured filing system. Whether you need to revisit an old form or prepare documentation for a new account, having everything electronically stored simplifies your workflow.

Testimonials and user experiences with pdfFiller

Many users have shared positive experiences when it comes to submitting their account opening forms through pdfFiller. They highlight the seamless navigation and clear instructions as major benefits of the platform, eliminating confusion or uncertainty typically associated with form submissions.

Real-life examples convey how users successfully filled out complex forms without hassle, receiving their account approvals in a timely manner. The overall user satisfaction focuses on the ease of use and the efficiency that comes with managing their documents in one cloud-based location.

Conclusion: The benefits of using pdfFiller for your account opening needs

Utilizing pdfFiller transforms the traditional account opening experience into a streamlined process. The ability to access, edit, and submit documents from anywhere ensures that you can complete your account opening form without any hassle. Enhanced security measures also confirm that your personal data remains safe during the submission process.

Overall, pdfFiller aids in creating an efficient and compliant document submission environment, making it a valuable resource for individuals and teams looking to manage their financial documents effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in sbi account opening form without leaving Chrome?

How do I fill out sbi account opening form using my mobile device?

How do I fill out sbi account opening form on an Android device?

What is account opening form for?

Who is required to file account opening form for?

How to fill out account opening form for?

What is the purpose of account opening form for?

What information must be reported on account opening form for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.