Get the free how to fill out form 8889

Get, Create, Make and Sign form 8889 instructions

How to edit form 8889 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to fill out

How to fill out instructions for form 8889

Who needs instructions for form 8889?

Instructions for Form 8889: Your Comprehensive Guide

Understanding Form 8889

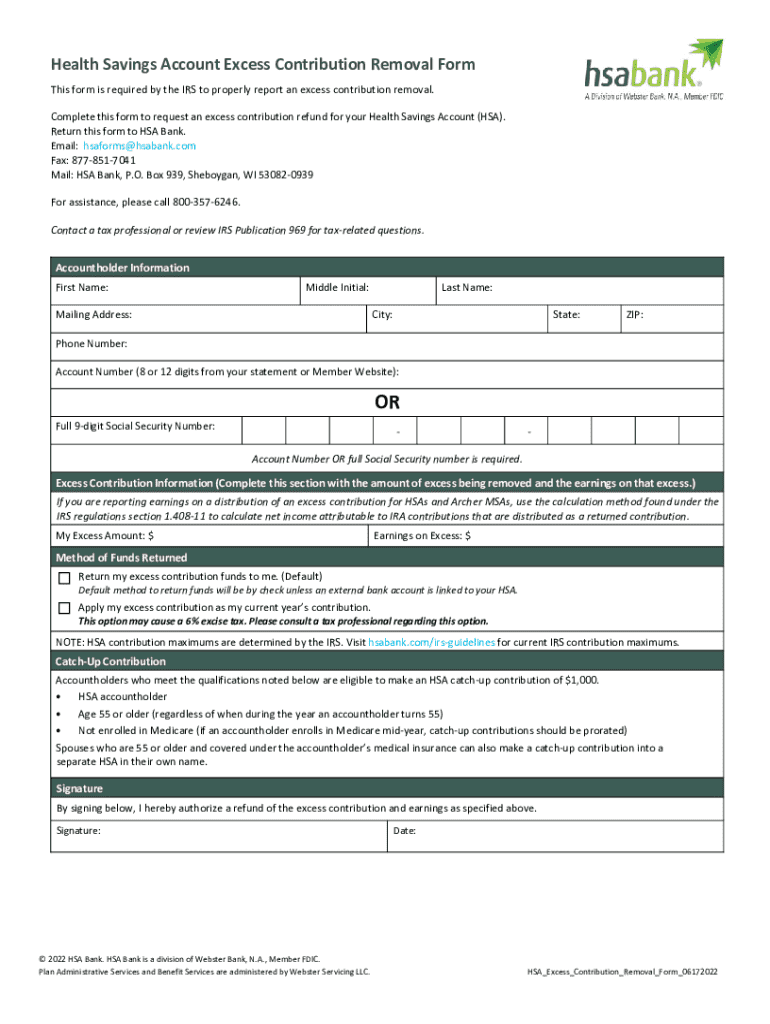

Form 8889 is essential for individuals managing Health Savings Accounts (HSAs). Its purpose is to report contributions to and distributions from your HSA, providing crucial information to the IRS for determining tax liabilities and potential savings. This form is pivotal not only for compliance but also for ensuring that you maximize the tax benefits associated with HSAs.

Key terms associated with Health Savings Accounts include 'qualified medical expenses,' which are expenses that can be paid tax-free from your HSA, and 'eligible individuals,' referring to those who meet specific criteria under IRS regulations to open and contribute to an HSA.

Who needs to file Form 8889?

Filing Form 8889 is typically required for all individuals with an HSA. This includes those who made contributions to the account during the tax year and those who took distributions to cover qualified medical expenses. If your spouse is also eligible and has an HSA, you'll need to complete separate forms for each account.

Certain scenarios mandate filing this form, such as when you exceed the allowable contribution limits established by the IRS, or if you receive any distributions that do not qualify as medical expenses. In summary, if you have an HSA, be prepared to fill out Form 8889 at tax season.

Preparing to fill out Form 8889

Before you dive into completing Form 8889, gathering all necessary documents is crucial. This preparation ensures accurate reporting of your HSA contributions and distributions. Essential documents include W-2 forms from employers reflecting any HSA contributions, statements from HSA providers showing contributions and distributions, and receipts for any qualified medical expenses paid from your HSA.

Understanding the sections of Form 8889 is also critical. The form comprises three parts: Part I covers HSA Contributions, Part II focuses on HSA Distributions, and Part III addresses Additional Tax. Each section serves a distinct purpose, guiding you through reporting contributions and distributions accurately while also clarifying any additional tax you might owe.

Step-by-step instructions for completing Form 8889

Filling out Part I is your first step. Here, you report all contributions made to your HSA during the tax year. You'll need to identify the total amount contributed and ensure that it falls within the limits—$3,650 for individuals and $7,300 for families in 2023. If you made contributions over the allowable limit, calculate the excess amount, as it may incur penalties.

Moving on to Part II, this section is where you report distributions, detailing amounts withdrawn from your HSA. You must categorize these distributions as either taxable or non-taxable. Most distributions used for qualified medical expenses are non-taxable, while those withdrawn for other purposes may be subject to taxes and penalties.

In Part III, you must understand the implications of any additional tax owed. If you have made excess contributions, you may incur a 6% penalty on that excess. This part guides you through determining the total tax liabilities and provides room for reporting any adjustments.

Common mistakes to avoid when filling out Form 8889

Errors in Form 8889 can lead to unwanted tax penalties or missed tax savings. A common mistake is incorrect reporting of contributions or distributions. Failing to report all distributions or manually calculating the amounts can lead to discrepancies, making it crucial to verify each line before submission.

If you've submitted Form 8889 with errors, you can correct mistakes by filing an amended return, commonly known as Form 1040-X. This process allows you to rectify any errors and reclaim potential tax benefits effectively.

Tips for accurate filing

To ensure accurate filing, consider the following best practices: double-check all figures, ensure that all contributions and distributions correspond to your financial statements, and maintain thorough documentation of your qualified medical expenses. Using a checklist can help you stay organized and minimize the risk of errors.

Tips and tools for managing Form 8889 with pdfFiller

Utilizing pdfFiller can significantly simplify the process of managing Form 8889. The platform's editing and collaboration features allow you to fill out, edit, and share the form seamlessly. You can navigate through the interactive tools, enabling you to tackle each section methodically while ensuring that all entries are accurate.

Moreover, pdfFiller provides secure document management and eSigning functionalities that keep your sensitive information safe. This security is particularly valuable when submitting forms that include personal tax information, allowing you to focus on maximizing your tax savings without worrying about data breaches.

Frequently asked questions (FAQs) about Form 8889

Some common queries regarding Form 8889 revolve around filing requirements, deadlines, and potential corrections. Many individuals wonder if they need to file if they didn't use their HSA during the year. The answer is typically yes, as your HSA contributions need to be reported regardless of distributions.

Understanding the tax implications surrounding HSA contributions and distributions is crucial as well. For instance, while contributions can be deducted, penalties may apply if distributions are not for qualified medical expenses. Gaining clarity on these rules can prevent costly mistakes.

Additional resources for Form 8889

For official IRS resources, it's vital to access the IRS website for the latest guidelines and publications regarding Form 8889. Staying updated with any regulatory changes ensures you're compliant and can take full advantage of tax benefits. Additionally, consider engaging with community forums or tax filing services for more tailored assistance on complex inquiries.

Utilizing community resources can offer insights from fellow filers and tax professionals, allowing you to understand common issues and effective strategies for managing your HSA and associated tax forms better.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify how to fill out without leaving Google Drive?

How do I execute how to fill out online?

Can I create an electronic signature for signing my how to fill out in Gmail?

What is instructions for form 8889?

Who is required to file instructions for form 8889?

How to fill out instructions for form 8889?

What is the purpose of instructions for form 8889?

What information must be reported on instructions for form 8889?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.