Get the free What Beneficial Ownership Means for Small-Biz Clients

Get, Create, Make and Sign what beneficial ownership means

How to edit what beneficial ownership means online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what beneficial ownership means

How to fill out what beneficial ownership means

Who needs what beneficial ownership means?

What Beneficial Ownership Means Form: A Comprehensive Guide

Understanding beneficial ownership

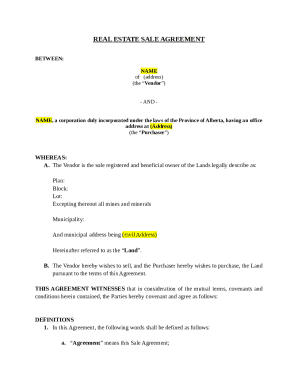

Beneficial ownership refers to the ultimate ownership of a company or asset, even if the ownership is held through various intermediaries or other entities. In essence, a beneficial owner is anyone who enjoys the benefits of ownership, such as the right to sell, benefit from income, or exercise control over a company without necessarily being listed as the owner on legal documents. This concept is crucial in distinguishing between legal and beneficial ownership, primarily in financial and corporate contexts.

The importance of beneficial ownership in business law cannot be overstated. It plays a vital role in promoting transparency and accountability in corporate governance. By identifying the true owners of companies, regulators can prevent illicit activities such as money laundering, tax evasion, and other forms of financial crime. Moreover, understanding beneficial ownership helps foster a fair business environment where individuals and governments can trust that ownership is disclosed accurately.

The significance of beneficial ownership reporting

Beneficial ownership reporting holds significant importance under the Corporate Transparency Act (CTA), a federal law aimed at increasing transparency in business ownership. This legislation mandates that corporations, limited liability companies (LLCs), and similar entities must report their beneficial owners to the Financial Crimes Enforcement Network (FinCEN) to tackle financial crimes. By knowing who the real owners are, law enforcement agencies can more effectively track illicit activities and enforce compliance.

The benefits extend beyond compliance; small businesses and larger enterprises gain from the legitimate assurance that they are operating in a transparent manner. By mitigating fraud and illicit behavior, businesses can foster trust with customers and partners, ultimately leading to healthier economic growth. Additionally, beneficial ownership reporting improves the security and clarity for investors, who can make informed decisions devoid of hidden interests that may affect the stability of their investments.

Who needs to report beneficial ownership?

The requirement to report beneficial ownership applies to various entities, including corporations, limited liability companies (LLCs), and partnerships. These entities must disclose their beneficial owners, generally defined as individuals who directly or indirectly own 25% or more of the entity or have substantial control over it. This requirement aims to establish a baseline standard for corporate transparency across the United States.

However, there are exemptions to this rule. Certain entities such as publicly traded companies, regulated financial institutions, and nonprofits are often not required to file beneficial ownership information. Understanding the nuances of these exemptions is critical for compliance and ensuring accurate reporting.

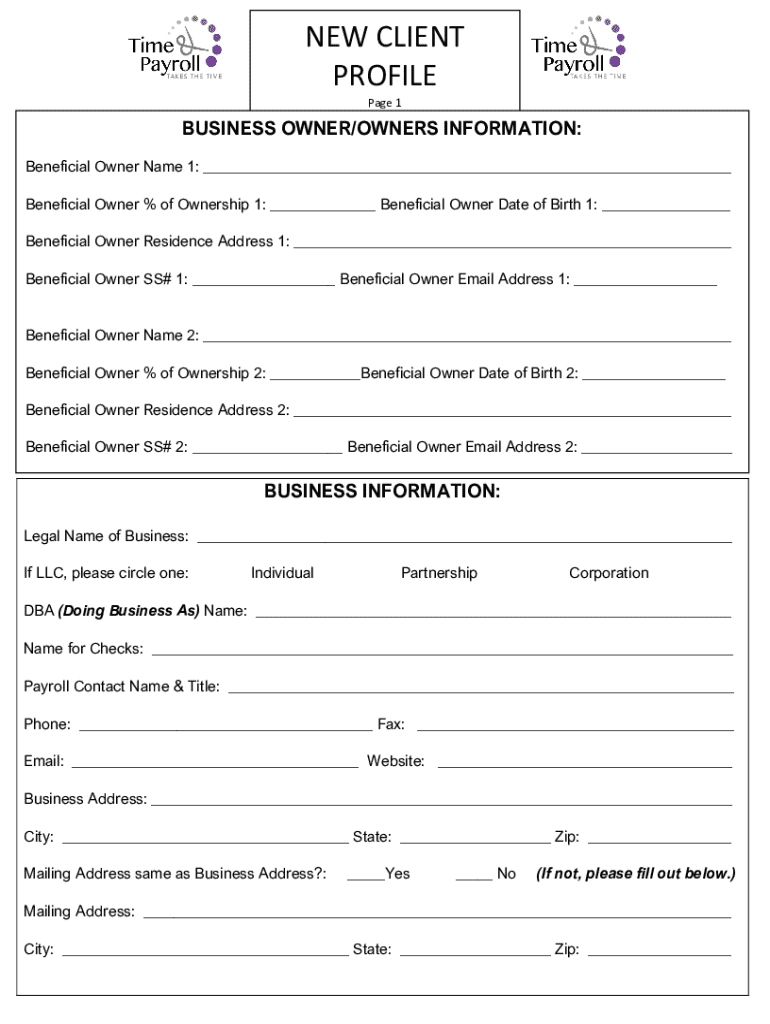

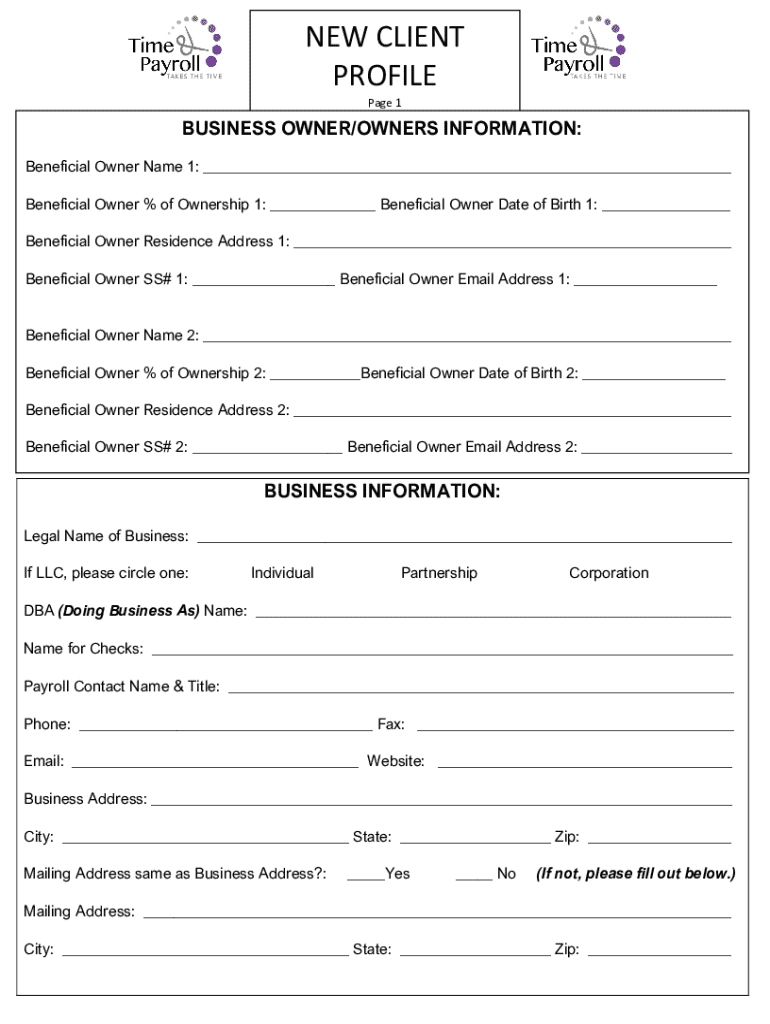

How to fill out the beneficial ownership form

Filling out the beneficial ownership form involves several essential steps. First, it is critical to understand the form itself, which typically consists of sections designed to capture key ownership details of the reporting company and its beneficial owners. This form is not only a regulatory requirement but also a vital tool for wrapping transparency around corporate structures.

Here’s a step-by-step breakdown of how to complete the form accurately:

It’s important to avoid common mistakes such as inaccurate reporting of names or ownership interests, or forgetting to include all beneficial owners. Double-checking your entries can prevent potential regulatory issues or penalties down the line.

Key information to include in the beneficial ownership form

When preparing the beneficial ownership form, it's crucial to provide precise information about each beneficial owner. This not only illustrates compliance but also contributes to the overall integrity of ownership data. Key details include identifiable information about each beneficial owner, such as their full legal name and any documented identification numbers.

Moreover, an address and contact information for each owner must be included, along with a clear description of the nature and extent of their ownership interest in the reporting company. Providing accurate verification details is also necessary; companies must ensure that they have up-to-date records regarding each beneficial owner to maintain compliance and adhere to the requirements stipulated by FinCEN.

Utilizing pdfFiller for beneficial ownership forms

pdfFiller is an exceptional platform that streamlines the process of managing beneficial ownership forms. With its robust editing and customization features, users can easily tailor forms to meet their specific requirements. The platform allows users to complete forms with precision, ensuring compliance with applicable regulations and standards.

Furthermore, pdfFiller offers eSigning options, which not only enhance security but also simplify the process. Users can confidently sign and submit their beneficial ownership forms digitally, thereby reducing delays and paperwork. Collaborating on forms within teams managing multiple filings is also made easy, fostering a more efficient workflow.

Frequently asked questions (FAQs) about beneficial ownership

Understanding the requirements surrounding beneficial ownership can raise numerous questions. One common query relates to the consequences of failing to report beneficial ownership accurately. Companies may face severe penalties, including significant fines or legal action from regulatory bodies, particularly when intentional misreporting is identified.

Another concern is the protection of beneficial ownership information. The regulations generally stipulate strict access controls to safeguard this sensitive data. Furthermore, companies may wonder about the penalties for incorrect reporting, which again emphasizes the need for accurate and thorough documentation. Regular updates to beneficial ownership information are also essential, as changes in ownership require prompt reporting to maintain compliance.

Case studies: What beneficial ownership means for different sectors

Different sectors experience the implications of beneficial ownership differently. For start-ups, clear disclosure of beneficial ownership can be pivotal for securing funding. Investors are increasingly scrutinizing ownership structures to ensure transparency and accountability before making financial commitments. Start-ups that cultivate a practice of transparency often foster more robust investor relationships.

On the other hand, established companies have their own unique considerations regarding beneficial ownership. They may face increased scrutiny to uphold their reputations as responsible corporate citizens. Nonprofits also benefit from the guidelines around beneficial ownership. Though they are often exempt from reporting, understanding ownership structures is vital for maintaining trust and accountability with stakeholders.

The future of beneficial ownership regulations

Looking ahead, emerging trends indicate a significant shift towards enhanced ownership transparency. As governments worldwide strengthen regulations surrounding beneficial ownership, U.S. companies must adapt to remain compliant. The impact of global regulatory changes also influences U.S. business practices, compelling entities to adopt transparent policies proactively.

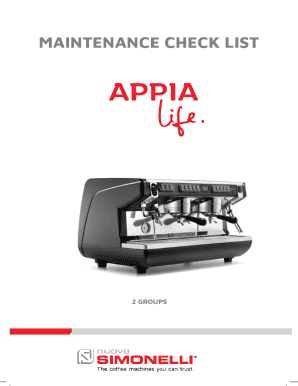

Technology plays a pivotal role in facilitating beneficial ownership reporting. Innovations in digital platforms allow for seamless data capture and verification, making it easier for companies to meet reporting requirements. As regulatory frameworks evolve, leveraging advanced technological solutions will be essential in maintaining compliance and ensuring the accuracy of beneficial ownership information.

Interactive tools to enhance your understanding of beneficial ownership

To further your grasp of beneficial ownership, interactive tools can be incredibly valuable. Engaging with quizzes can test your knowledge and pinpoint areas requiring further understanding. Ownership calculators can help visualize how various ownership stakes impact control and decision-making.

Additionally, enhanced interaction with FAQs can provide swift answers to common queries regarding beneficial ownership regulations and requirements. Utilizing these tools can ensure you stay informed and compliant in this evolving landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit what beneficial ownership means online?

How do I edit what beneficial ownership means straight from my smartphone?

How do I complete what beneficial ownership means on an iOS device?

What does beneficial ownership mean?

Who is required to file beneficial ownership information?

How to fill out beneficial ownership information?

What is the purpose of beneficial ownership information?

What information must be reported on beneficial ownership?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.