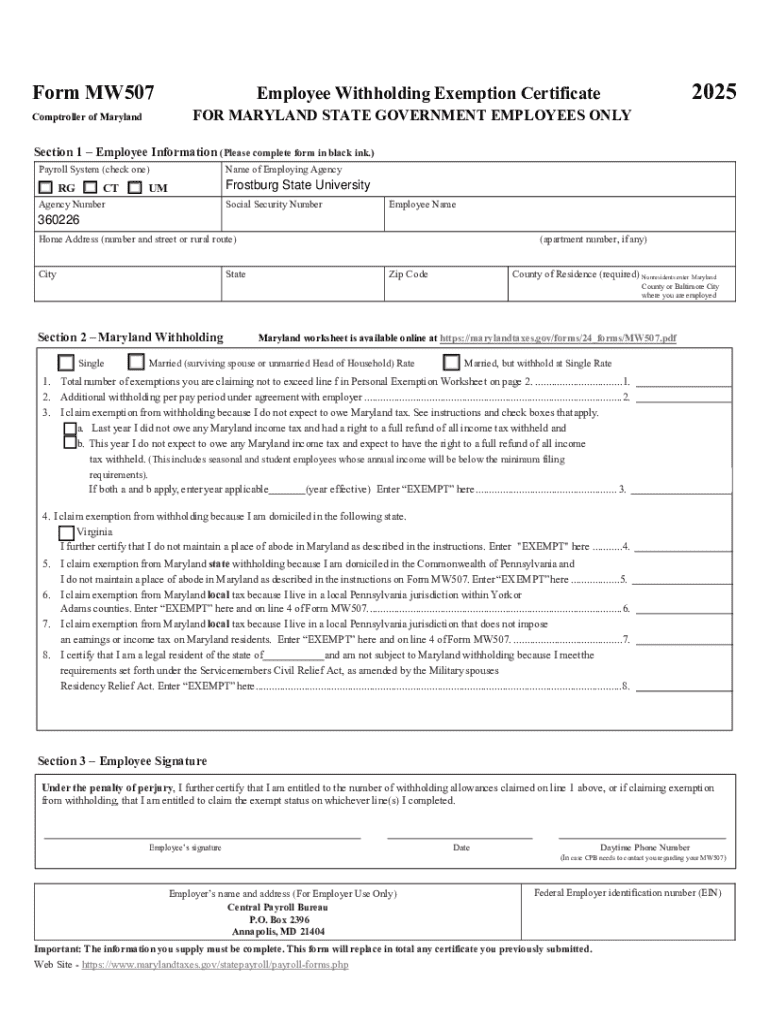

Get the free Sage: State Tax form MW507

Get, Create, Make and Sign sage state tax form

Editing sage state tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sage state tax form

How to fill out sage state tax form

Who needs sage state tax form?

Comprehensive Guide to the Sage State Tax Form

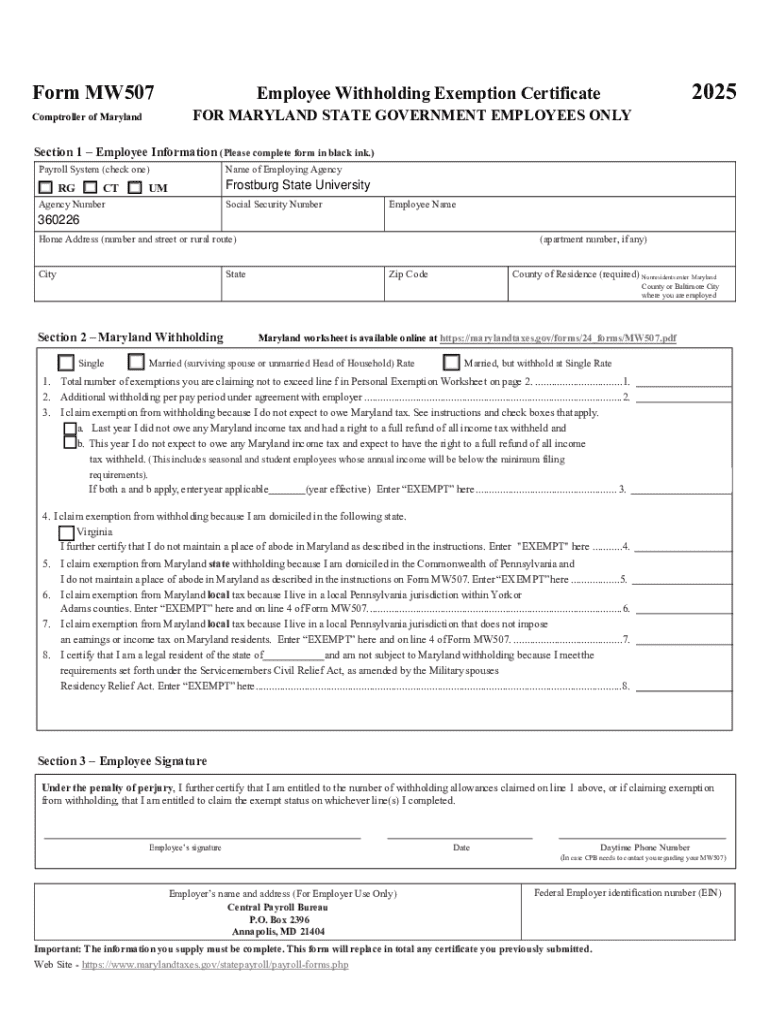

Understanding the Sage State Tax Form

The Sage State Tax Form serves a critical role in enabling taxpayers to accurately report their state income taxes, encompassing various tax obligations based on individual circumstances. This form is essential for individuals and businesses alike, as it assists in determining how much tax is owed or if a refund is due. Utilizing the Sage State Tax Form not only simplifies the filing process but also provides a structured approach to reporting income, deductions, and credits.

What sets the Sage State Tax Form apart from other tax forms is its adaptability to track state-specific requirements and potential credits unique to specific regions. Alongside its compatibility with various tax regulations, using it through a platform like pdfFiller offers additional benefits such as enhanced accessibility and ease of use, allowing users to fill out and manage their forms digitally. This capability enhances collaboration, especially for teams working on business tax filings.

Who needs to use the Sage State Tax Form?

The Sage State Tax Form targets a wide audience, primarily individuals filing their personal state taxes, as well as small business owners who need to report business income and related deductions. This diverse applicability is crucial, as varying income levels and business structures necessitate specific forms of reporting that this tax form addresses effectively.

Eligibility criteria typically include income thresholds and residency requirements. For individuals, most states set a minimum income level that must be exceeded to necessitate the form. Likewise, businesses that operate within the state must adhere to specific operational requirements. Understanding your eligibility ensures that taxpayers avoid penalties associated with incorrectly filed tax forms or neglecting their tax obligations entirely.

Preparing to fill out the Sage State Tax Form

Before you begin filling out the Sage State Tax Form, certain information and documentation are essential to ensure a smooth process. You will need to gather personal identification details such as Social Security numbers, as well as records of income from various sources, including W-2s and 1099s. Additionally, it is crucial to compile any applicable deductions and credits, like child tax credits or state-specific deductions, which directly affect your total tax due.

Creating an account on pdfFiller enhances your tax preparation experience significantly. The platform provides a user-friendly interface that simplifies form filling, allowing users to save progress, access forms on the go, and utilize various helpful features. To set up your account, simply visit the pdfFiller website, click on 'Sign Up,' and follow the prompts to create your account. This will also grant you access to a host of tools designed to assist in both tax preparation and overall document management.

Step-by-step instructions for filling out the form

Filling out the Sage State Tax Form can seem daunting, but a detailed breakdown of each section simplifies the process. The first section typically requires personal information such as your name, address, and Social Security number. Completing this accurately is vital, as it ensures your tax records are correctly linked to your identity.

The second section revolves around assessing your income. Here, you'll input various sources of income along with any relevant documentation. Continuing to deductions and credits, ensure you accurately report any that apply to you, as this directly impacts your total tax liability. Conclusively, the tax calculation section will help you determine amounts owed or refund eligibility. Thorough attention to detail in every part is crucial to avoid mistakes.

To ensure accuracy, familiarize yourself with common pitfalls, such as mathematical errors or incorrect Social Security numbers. Utilizing pdfFiller’s array of editing tools helps catch these errors before submission, allowing you to correct any inaccuracies seamlessly.

Editing and customizing the Sage State Tax Form

One of the remarkable features of pdfFiller is its robust editing capabilities. Users can easily modify existing fields on the Sage State Tax Form, add new fields if necessary, and insert signatures and comments directly into the document. This level of customization is particularly beneficial for firms or teams that may require additional notes or specific annotations for different clients.

For those who often require multiple copies of the Sage State Tax Form, pdfFiller allows users to create templates that streamline the process for repetitive use. This feature is especially advantageous for businesses with multiple employees needing to file forms, ensuring consistency and accuracy across submissions. Collaborating with team members within the platform allows for collective management of these forms, enhancing efficiency.

Incorporating electronic signatures

In today’s tax filing landscape, incorporating eSignatures on the Sage State Tax Form has become essential. Electronic signing ensures legal validity while significantly enhancing convenience. This is particularly important for both businesses and individuals who prioritize timely filings and quick turnaround times. Utilizing pdfFiller’s eSignature tool allows users to sign their documents safely and efficiently, without the need for printing or scanning.

The process of eSigning within pdfFiller is user-friendly. Simply navigate to the document in question, select the eSignature option, and follow the step-by-step prompts. This streamlining of signature processes not only ensures that your forms are filed promptly but also offers peace of mind knowing your documents are secured and verifiable.

Submitting the Sage State Tax Form

Once the Sage State Tax Form has been accurately filled out and signed, understanding the submission process is crucial. Depending on your state’s regulations, there are typically several methods available for submission, including e-filing directly through the state’s website or mailing a hard copy. Each method has its advantages, often with e-filing providing quicker processing times and immediate confirmation of receipt.

Tracking the status of your submission can also alleviate stress during tax season. pdfFiller provides features that allow users to monitor their form submission status, ensuring peace of mind that your documents have been properly submitted and received by the state tax authority. Keeping track of these records is essential not only for your personal organization but also for resolving any potential disputes or questions that may arise later.

Frequently asked questions (FAQs)

Navigating the complexities of the Sage State Tax Form can raise several questions among users. A common query revolves around how to address mistakes made after submitting the form. Typically, you will need to file an amendment with your state tax authority to correct any errors, ensuring that you maintain compliance with tax laws.

Additionally, many users wonder about available resources for further support. pdfFiller offers extensive help documents and a customer support team ready to assist with any specific concerns related to tax form preparation and submission. Leveraging these resources can help clarify uncertainties and ensure a smooth process.

Leveraging pdfFiller for enhanced document management

Using pdfFiller not only streamlines the process of filling out the Sage State Tax Form but also revolutionizes document management overall. By creating an organized filing system within the platform, users increase their efficiency in retrieving and managing tax forms and other critical documents. This organized approach can save valuable time, especially during peak tax season when every moment counts.

Utilizing pdfFiller’s cloud-based document management capabilities allows you to access your forms anytime and anywhere. This flexibility is invaluable for both individuals and teams who may need to collaborate on tax documents, ensuring that everyone has access to the most up-to-date files. The combination of accessibility and organized document management positions pdfFiller as an essential tool for comprehensive tax preparation.

Final thoughts on utilizing the Sage State Tax Form via pdfFiller

The Sage State Tax Form plays a pivotal role in the state tax filing process, ensuring that taxpayers meet their obligations effectively. By executing this task through the pdfFiller platform, users emerge with a streamlined experience that not only simplifies the process but also integrates enhanced tools for managing documentation and electronic signatures.

The benefits of utilizing this method extend beyond mere filing — they encompass a comprehensive approach to tax management, encouraging efficiency and thorough organization. By prioritizing these practices, taxpayers position themselves for success, ensuring they remain compliant with state tax laws and prepared for potential audits. Embracing modern solutions like pdfFiller empowers users to navigate their tax obligations without undue stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in sage state tax form without leaving Chrome?

How can I fill out sage state tax form on an iOS device?

Can I edit sage state tax form on an Android device?

What is sage state tax form?

Who is required to file sage state tax form?

How to fill out sage state tax form?

What is the purpose of sage state tax form?

What information must be reported on sage state tax form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.