Get the free M-BANKING APPLICATION FORM

Get, Create, Make and Sign m-banking application form

How to edit m-banking application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out m-banking application form

How to fill out m-banking application form

Who needs m-banking application form?

A comprehensive guide to -banking application forms

Overview of -banking applications

Mobile banking, often referred to as m-banking, facilitates banking transactions through mobile devices, allowing users to manage financial activities at their fingertips. As technology advances, m-banking enhances accessibility, providing convenience that traditional banking methods cannot match. With the rise of smartphone adoption, individuals are increasingly relying on mobile banking applications for their everyday banking needs.

Current trends indicate that m-banking usage is skyrocketing, particularly among millennials and Gen Z, who prefer digital solutions over brick-and-mortar services. According to recent studies, over 75% of banking customers have used mobile banking services in the past year, suggesting a shift in consumer behavior towards digital platforms.

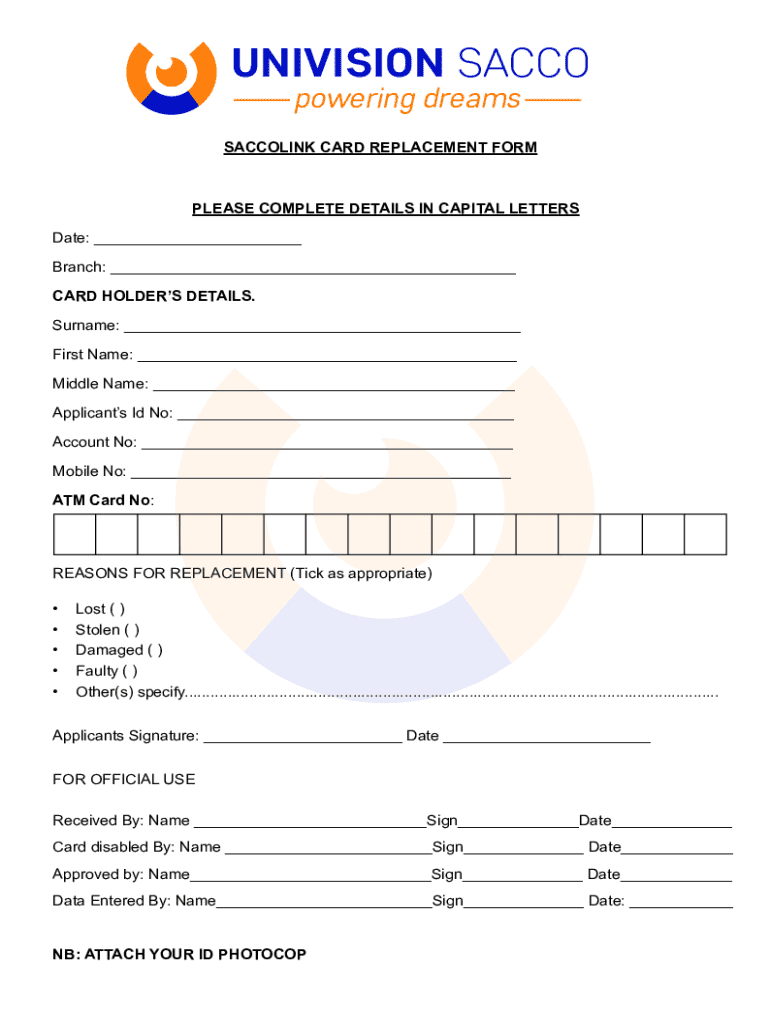

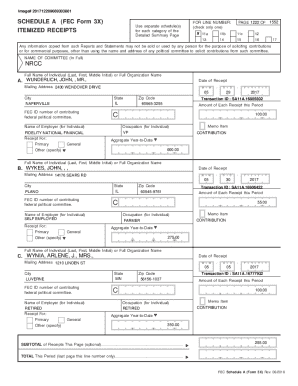

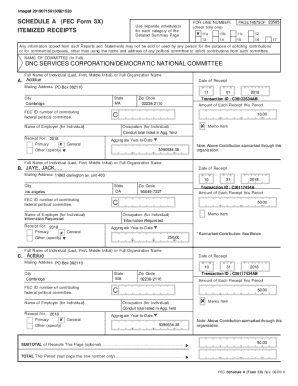

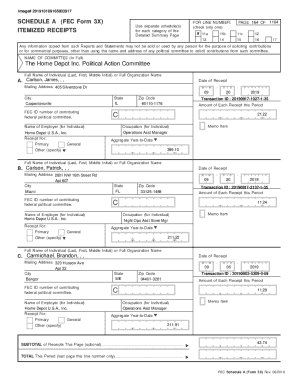

Understanding the -banking application form

The m-banking application form serves as the gateway for users to access banking services via their mobile devices. This application is crucial as it helps banks collect essential information to set up an account and verify the identity of the applicant, ensuring security and compliance with regulations.

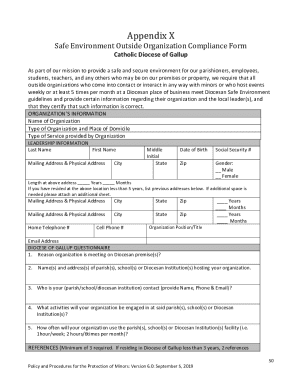

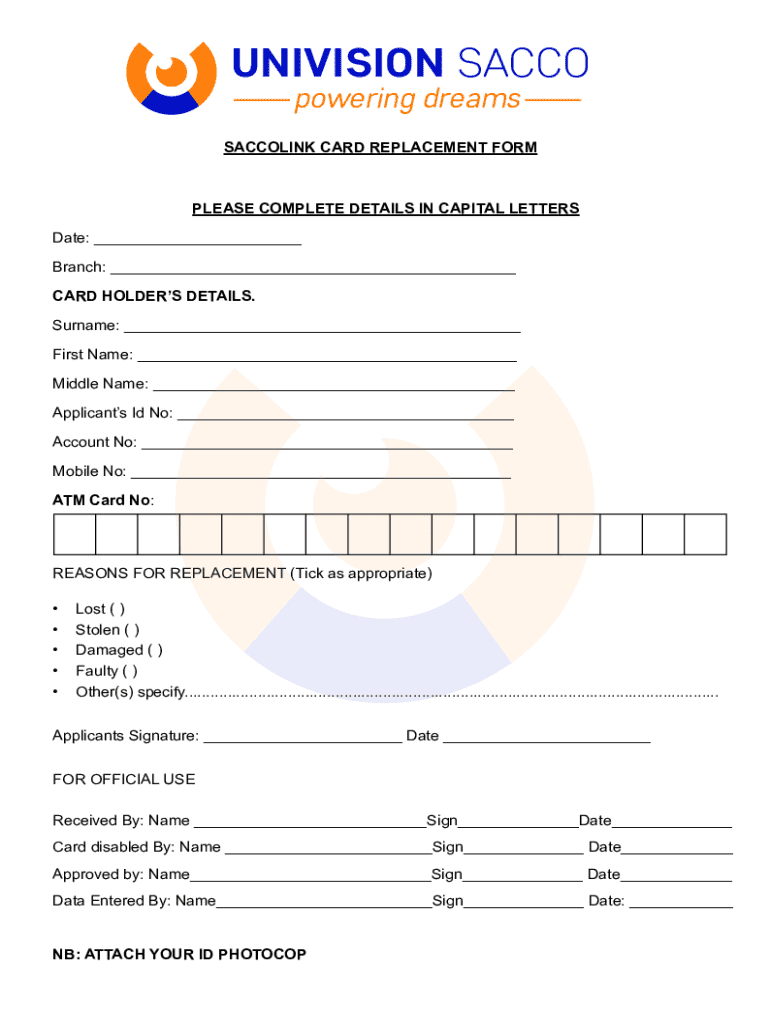

Typically, m-banking application forms require various types of information that serve to establish the user's identity and assess their financial profile, which includes personal, financial, and identification details. Providing this information accurately is vital. Below is a breakdown of the information that one usually needs to submit.

Step-by-step guide to filling out the -banking application form

Completing the m-banking application form accurately is key to a smooth registration process. Here’s a step-by-step guide to help you fill it out properly:

Section 1: Personal information

Begin by entering your full name as it appears on your legal documents. Ensure to include your current residential address, complete with city, state, and zip code. Don’t forget to add your email address and phone number, as they will be used for future communications from your bank.

Section 2: Financial details

In this section, provide an accurate overview of your financial situation. This includes information about your income level, employment status, and monthly expenses. It's critical to be honest here because any mismatches during verification could delay your application.

Section 3: Supporting documents

Collect and prepare all necessary identification documents to accompany your application. This usually includes government-issued identification and proof of residence, such as utility bills. Most banks allow you to upload electronic copies directly through the m-banking app for ease of submission.

Section 4: Review and verify

Before submitting your application, review every section carefully. Check for typographical errors or incomplete fields. Minor mistakes can lead to processing delays or outright denials. Validation of all input is essential to ensure your application proceeds without issues.

Interactive tools for -banking application process

Utilizing interactive tools can enhance your m-banking application experience significantly. Platforms like pdfFiller offer various features that simplify the document management process.

Document editor features in pdfFiller

pdfFiller’s document editor provides users with robust editing tools, allowing you to annotate or add necessary information directly within the m-banking application form. This capability helps in ensuring that no detail is overlooked.

Additionally, pdfFiller offers eSigning capabilities. This functionality allows you to electronically sign your application without the hassle of printing and scanning, making the process quicker and more efficient.

Collaborating with teams

If you’re working in a team, pdfFiller enables you to share the application form with others for input or revision. This collaboration ensures that everyone’s feedback is considered, improving the quality and accuracy of the completed document.

Common mistakes to avoid

When filling out the m-banking application form, certain errors tend to crop up frequently. Identifying these common pitfalls can save applicants time and frustration.

Some common mistakes include providing inaccurate contact details, omitting important financial disclosures, or failing to submit required identification documents. Always double-check all sections of the application for completeness.

Frequently asked questions (FAQs) about -banking applications

Understanding the nuances of the m-banking application process can be challenging. Here are some frequently asked questions that can help clarify common concerns.

Security and privacy measures

Security is a significant concern when submitting personal information through digital platforms. Banks employ various security measures to protect users' information but individuals must also play their part.

pdfFiller ensures document safety during the m-banking application process by offering secure storage and encryption. Each document is protected through advanced technologies that maintain privacy and confidentiality.

Managing your -banking application post-submission

Once you submit your m-banking application, it’s essential to keep track of its status. Many banks provide users with an online portal where you can check your application’s progress.

Be prepared to respond promptly to any follow-up requests from the bank, such as additional documentation or verification steps. Timely responses can help speed up the processing of your application and minimize delays.

Best practices for using mobile banking applications

Once your m-banking application is approved, maintaining a secure and efficient mobile banking experience is crucial. Start by setting up your m-banking profile securely. Use strong, unique passwords and enable two-factor authentication wherever possible.

Also, regularly check for and install updates for your banking app to ensure that you have the latest security features. Finally, be vigilant against common scams; avoid clicking on suspicious links and report any unauthorized activity as soon as possible.

Conclusion: streamlining your -banking experience with pdfFiller

Leveraging a comprehensive tool like pdfFiller can transform how you approach the m-banking application process. The platform empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

By utilizing the features offered by pdfFiller, users can enhance accessibility and efficiency when dealing with their m-banking applications, ultimately encouraging a more streamlined approach to personal finance management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete m-banking application form online?

How do I make edits in m-banking application form without leaving Chrome?

How do I complete m-banking application form on an iOS device?

What is m-banking application form?

Who is required to file m-banking application form?

How to fill out m-banking application form?

What is the purpose of m-banking application form?

What information must be reported on m-banking application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.