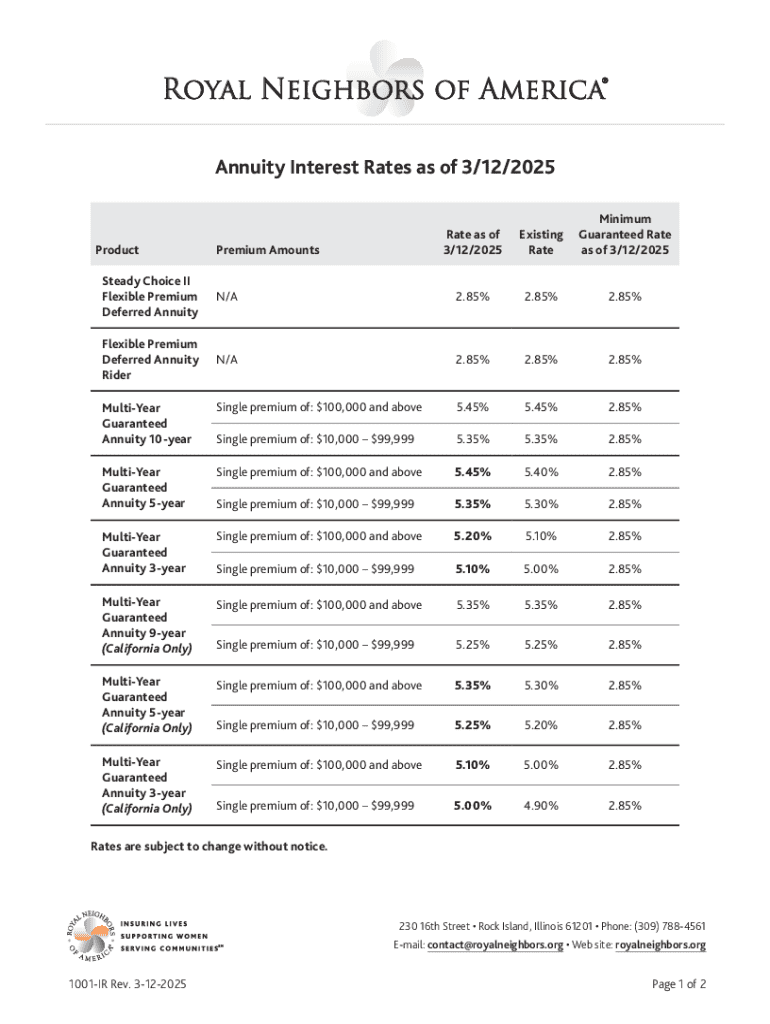

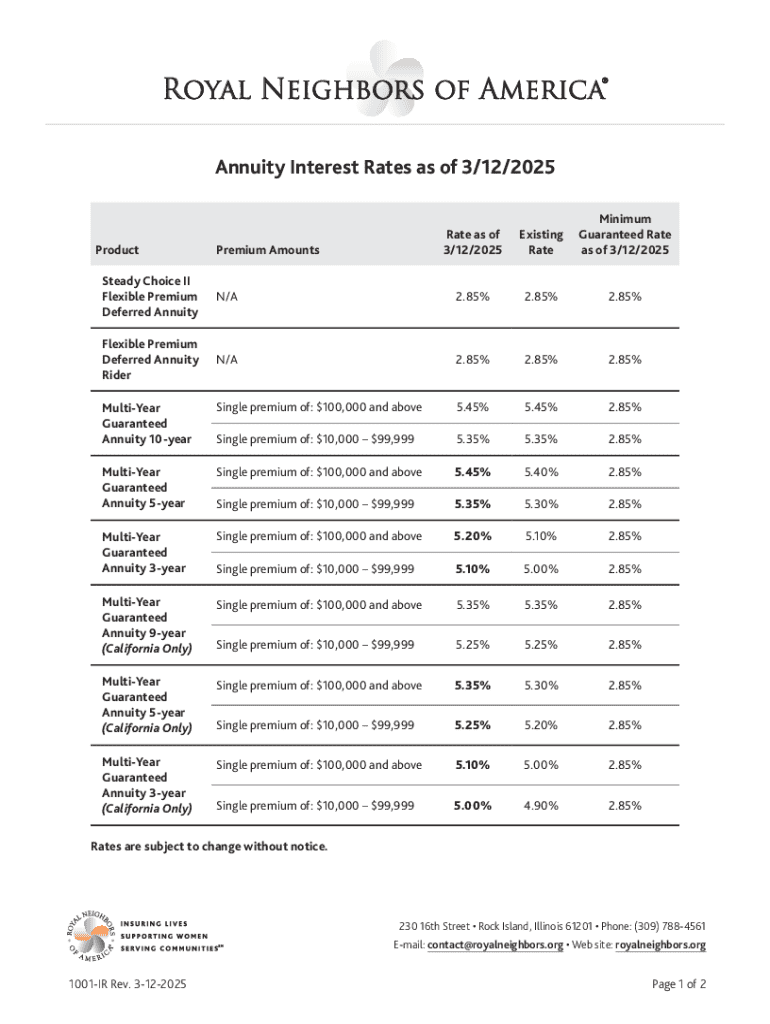

Get the free Royal Neighbors Annuity Interest Rates as of 3/12/2025, Form 1001-IR

Get, Create, Make and Sign royal neighbors annuity interest

How to edit royal neighbors annuity interest online

Uncompromising security for your PDF editing and eSignature needs

How to fill out royal neighbors annuity interest

How to fill out royal neighbors annuity interest

Who needs royal neighbors annuity interest?

Navigating the Royal Neighbors Annuity Interest Form: Your Comprehensive Guide

Understanding annuities

An annuity is a financial product that allows you to accumulate funds over time and then convert that amount into a stream of income, usually during retirement. Its primary goal is to provide individuals with financial security by managing risks associated with savings and investments.

Different types of annuities serve various needs, including fixed, variable, and indexed annuities. Fixed annuities offer a guaranteed rate of interest over time, ensuring stability and security. On the other hand, variable annuities allow for investment in a range of options, potentially yielding higher returns but with increased risk. Indexed annuities blend elements from both, providing growth opportunities linked to a specific market index while maintaining some safety.

Understanding these types is essential in financial planning because they not only offer different benefits but also help secure one's future against uncertain economic conditions.

Royal Neighbors annuities: Overview

Royal Neighbors of America offers a distinctive approach to annuities, aiming to provide peace of mind for its members through competitively structured products. One key feature of their annuities is the multi-year guarantee, which offers the security of predictable returns over a fixed period.

Opting for Royal Neighbors means gaining access to unique benefits that traditional insurance organizations may not provide, such as community-based support and a focus on family values. Their annuity offerings often come with built-in provisions that ensure you can manage your account value effectively throughout its maturity.

When comparing Royal Neighbors' annuity options to traditional offerings, their focus on member happiness, joy, and engagement stands out, making it an appealing choice for many individuals seeking a reliable way to prepare for future financial needs.

Benefits of using the Royal Neighbors annuity interest form

The Royal Neighbors Annuity Interest Form is designed with user experience in mind, providing a streamlined application process that enhances clarity and transparency. This ensures that you fully understand the terms of your annuity contract without hidden provisions that could affect your account value down the line.

Another significant advantage of utilizing this form is the accuracy it promotes in your annuity applications. Given the complex nature of financial services, any inaccuracies in your application can lead to delays in processing or complications regarding your life insurance coverage. By embracing Royal Neighbors’ form, you help secure a smoother transition into your future financial footing.

These benefits collectively contribute to an empowered decision-making process regarding your future during the selection and submission of your annuity interest form.

Step-by-step guide to filling out the Royal Neighbors annuity interest form

Filling out the Royal Neighbors Annuity Interest Form is essential for ensuring you choose the right plan. Follow these steps closely for a seamless experience.

Taking each section seriously not only expedites processing but also paves the way for clear analysis during the approval phase of your annuity application.

Interactive tools: enhancing your experience

pdfFiller enhances the experience of filling out the Royal Neighbors Annuity Interest Form through its interactive features. One great aspect of pdfFiller is real-time collaboration. Individuals can directly involve their financial advisor in the editing process, thus ensuring all aspects are carefully aligned with their future goals.

Moreover, the platform allows for instant edits, which means you can adjust any information on the go. This nimbleness is especially critical for those with rapidly changing financial landscapes. Lastly, document tracking features ensure you stay updated on your application's status, allowing for an organized approach throughout your financial journey.

These interactive tools embody a modern approach to document management, ensuring that users always feel in control and informed throughout their annuity journey.

Common mistakes to avoid when filling out the form

Submitting the Royal Neighbors Annuity Interest Form requires careful attention to detail. Common pitfalls can derail the application process, so here are some mistakes to avoid.

Diligently following these guidelines ensures a smooth experience when engaging with your annuity interest form, which can lead to increased financial security in the future.

How to edit, sign, and manage your annuity interest form

Editing and signing your Royal Neighbors Annuity Interest Form becomes a straightforward task with pdfFiller’s intuitive platform. Start by navigating to the form you wish to complete and use the built-in editing features to modify any sections necessary, ensuring accuracy and clarity.

Once you have made your changes, applying eSignatures is simple. Follow the prompt to apply your signature digitally — ensuring that your approval process is as frictionless as possible. Finally, utilize pdfFiller's document management capabilities to keep your submitted form organized. Monitor your application and manage any follow-up communications as necessary.

With these capabilities, managing your financial documents becomes a hassle-free task.

The importance of keeping your documents organized

Organizing your documents is crucial for maintaining clarity in your financial journey. Best practices for document storage include categorizing forms based on type and date, allowing for easy retrieval when needed. Consider investing in cloud-based storage solutions that provide access from any location, ensuring you have your important documents at your fingertips anytime.

Not only does this organization reduce stress, but it also empowers you to manage your financial portfolio more effectively. Consistent document maintenance allows for strategic decisions surrounding your annuity, premium payments, and policy adjustments.

By embracing these organizational strategies, you can navigate your financial landscape with increased confidence and ease.

Navigating the Royal Neighbors annuity system: what comes next?

Once you have submitted your Royal Neighbors Annuity Interest Form, it enters a review process. Understanding this phase is essential as it determines the next steps in your application. The review usually involves assessing your financial data and annuity selections against their policies.

After submission, remain proactive. You may expect either a confirmation of your application’s acceptance or requests for additional information. Utilize the resources provided by Royal Neighbors for ongoing support. Familiarize yourself with the unique aspects of your annuity contract as each plan may have specific provisions affecting your account value.

This foresight can make a significant difference in your experience with Royal Neighbors as you journey toward securing your financial future.

How pdfFiller stands out in document management

pdfFiller consistently offers a user-friendly interface, simplifying challenges often encountered during document completion. Their platform is designed to cater to individuals and teams, fostering an accessible editing experience, thus making it easy for anyone to navigate through their forms confidently.

Moreover, security measures implemented by pdfFiller ensure that your personal information remains protected throughout the document management process. Regular updates and improvements allow the platform to adapt continuously, meeting the evolving needs of users while maintaining ease of use.

These elements make pdfFiller a standout choice for anyone looking to manage documents efficiently in an increasingly complex financial landscape.

Client testimonials: real experiences with the Royal Neighbors annuity interest form

Hearing from real users of the Royal Neighbors Annuity Interest Form provides clarity and confidence in its functionality. Members frequently share their positive experiences regarding the ease of filling out the form, attributing their successful applications to its intuitive structure.

Success stories highlight how clients navigated challenges with ease, affirming the effectiveness of utilizing both Royal Neighbors’ unique offerings and pdfFiller's capabilities for document management. Many express joy in achieving better financial security as a result of their decisions — cementing the value of taking control over one's financial future.

These testimonials resonate with individuals and teams alike, illustrating the value of taking a proactive role in securing future financial stability through informed decisions and comprehensive document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in royal neighbors annuity interest?

How can I fill out royal neighbors annuity interest on an iOS device?

Can I edit royal neighbors annuity interest on an Android device?

What is royal neighbors annuity interest?

Who is required to file royal neighbors annuity interest?

How to fill out royal neighbors annuity interest?

What is the purpose of royal neighbors annuity interest?

What information must be reported on royal neighbors annuity interest?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.