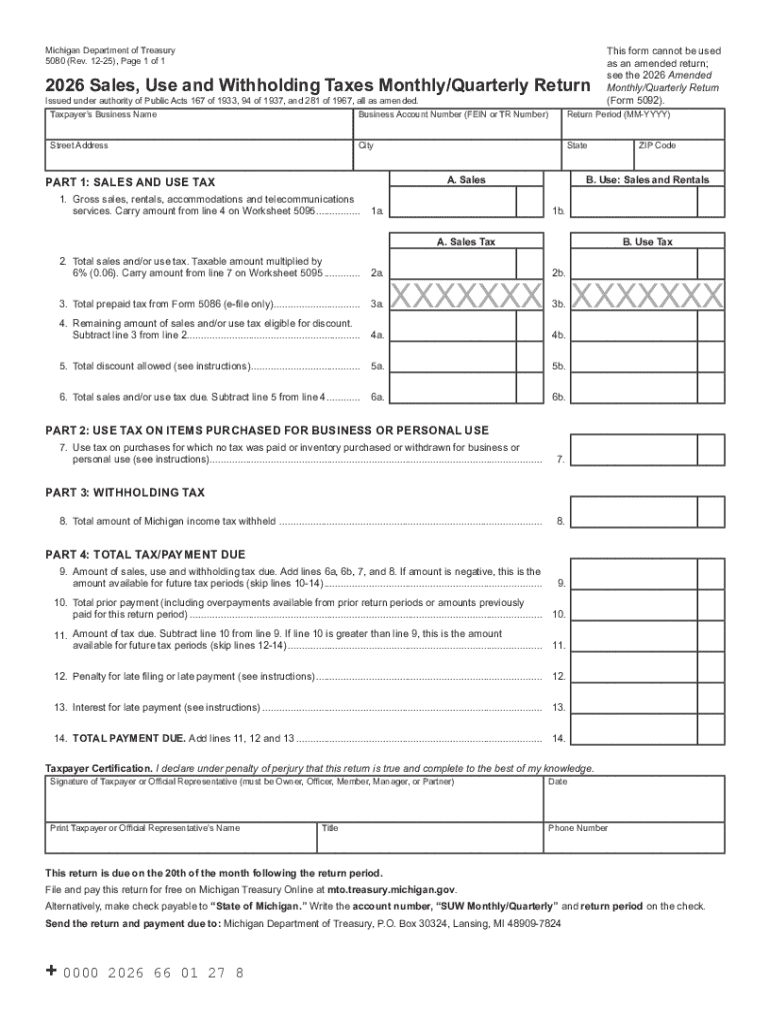

Get the free 2026 Sales & Use Tax Forms

Get, Create, Make and Sign 2026 sales amp use

Editing 2026 sales amp use online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 sales amp use

How to fill out 2026 sales amp use

Who needs 2026 sales amp use?

Comprehensive Guide to the 2026 Sales Amp Use Form

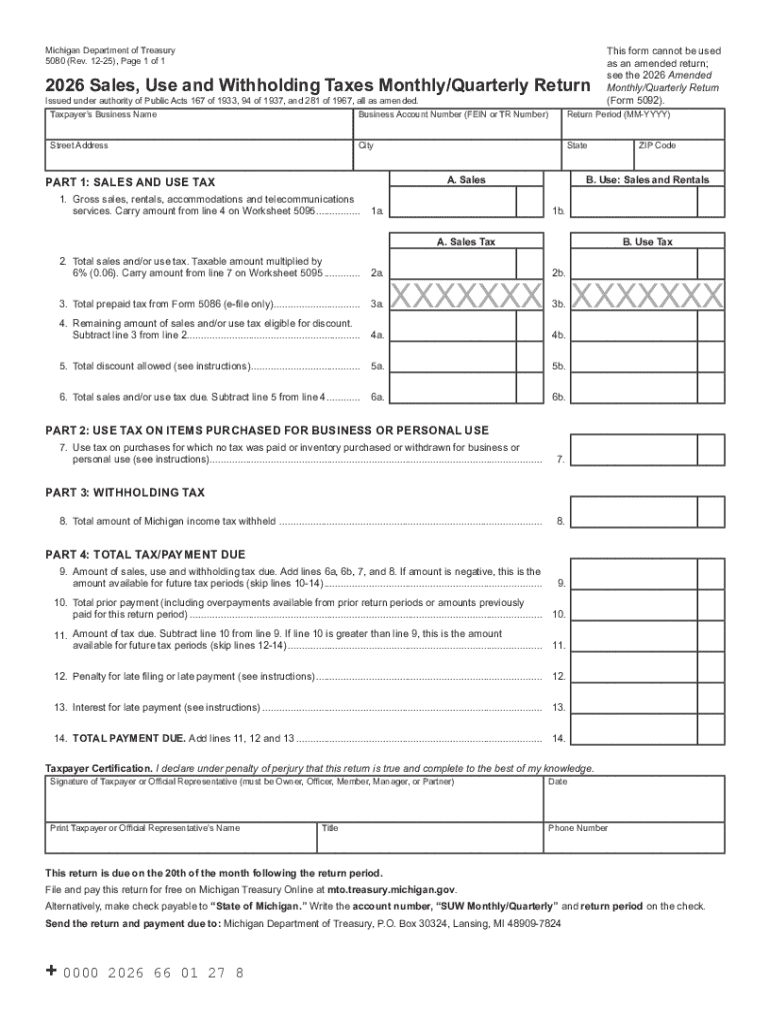

Understanding the 2026 Sales Amp Use Form

Sales and use tax is a crucial revenue source for states and local governments. This tax is imposed on the sale of goods and services, and its purpose is to provide funding for public services such as education, transportation, and healthcare. Accurate reporting and compliance with sales and use tax laws are essential to avoid penalties and ensure that all obligations are met.

The 2026 Sales Amp Use Form serves as a vital tool for taxpayers to report taxable sales, deductions, and exemptions. This form not only helps in keeping accurate records but also ensures compliance with the division of taxation regulations. Compared to previous years’ forms, such as those from 2025 and 2024, the 2026 form introduces several updates reflecting new regulations and necessary adjustments to reporting requirements.

Key components of the 2026 Sales Amp Use Form

The layout of the 2026 Sales Amp Use Form is designed to simplify the reporting process for taxpayers. It is divided into three main sections across different pages that guide users through providing all necessary information.

Illustrative examples of completed sections can significantly aid taxpayers in understanding the proper way to fill out the form. For instance, showing how to document tax exempt sales can prevent common errors.

Step-by-step guide to completing the 2026 Sales Amp Use Form

Before filling out the 2026 Sales Amp Use Form, taxpayers should gather all required documentation. Essential documents may include sales records, exemption certificates, and previous tax returns. Efficient organization of this information can streamline the filing process and minimize the risk of errors.

When filling out the form, each section requires careful attention. Start with the general information, entering business details such as the legal name, address, and taxpayer identification number. Move on to taxable sales, using accurate calculations to report the total amount. Lastly, for deductibles and credits, ensure you familiarize yourself with common categories, such as returns, trade-ins, or discounts, to avoid mistakes.

Common mistakes can include misreporting taxable sales or failing to provide sufficient documentation for deductions. These pitfalls can lead to issues with the tax authority, making a thorough review pivotal before submission.

Submitting the 2026 Sales Amp Use Form

Once the form is completed, taxpayers must choose between electronic submission and paper filing. Electronic filing is often recommended due to increased efficiency and quicker processing times. For example, using platforms like pdfFiller enables users to fill out forms seamlessly and enjoy instant submission, enhancing compliance rates.

It's vital to be aware of critical deadlines for filing to avoid late penalties. Typically, the due date may align with the end of the fiscal year or specific local tax deadlines, and failing to meet these can lead to increased liabilities and stress.

After submission: What to expect

After filing the 2026 Sales Amp Use Form, it's essential to follow up on its status. Taxpayers can track their submission through pdfFiller and prepare for any notifications from their tax authority. These communications can provide valuable insights related to refunds or requests for additional information.

If discrepancies arise after submission, taxpayers should take immediate action to correct any errors. This may include submitting revised forms directly to the tax authorities. Additionally, preparing for possible audits means ensuring that all documentation is organized and accessible, reflecting accurate financial records.

Interactive tools and resources

Utilizing pdfFiller’s features can greatly enhance the process of filling out the 2026 Sales Amp Use Form. Users can access this form online, edit as necessary, and utilize e-signature features for quick and secure submission. This streamlined experience saves time and mitigates the frustration often associated with tax filings.

Furthermore, addressing frequently asked questions about the form can clarify uncertainties. Many taxpayers wonder about the types of transactions to report or how to handle exemptions correctly. Gathering insights from tax professionals can provide best practices that help streamline the process.

Final tips for effective document management

Maintaining organized tax documents is vital for efficient future tax filings. Implement best practices such as filing documents by year and type, utilizing digital storage solutions offered by platforms like pdfFiller, and consistently backing up critical information.

Staying informed about potential tax changes contributes to proactive compliance. Engage with professional websites and agency announcements to ensure that you remain aware of new policies that could affect your business. Being ahead of changes allows for easier adaptions in the filing process.

Conclusion: Empowering document management

Leveraging pdfFiller for your filing needs transforms tax preparation from a cumbersome task into a manageable one. The cloud-based platform allows for seamless editing and organization of documents, with features designed to simplify the entire process. Taxpayers are encouraged to explore the multitude of tools available on pdfFiller to make this year's filing smooth and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my 2026 sales amp use in Gmail?

How do I fill out 2026 sales amp use using my mobile device?

How do I complete 2026 sales amp use on an iOS device?

What is 2026 sales amp use?

Who is required to file 2026 sales amp use?

How to fill out 2026 sales amp use?

What is the purpose of 2026 sales amp use?

What information must be reported on 2026 sales amp use?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.