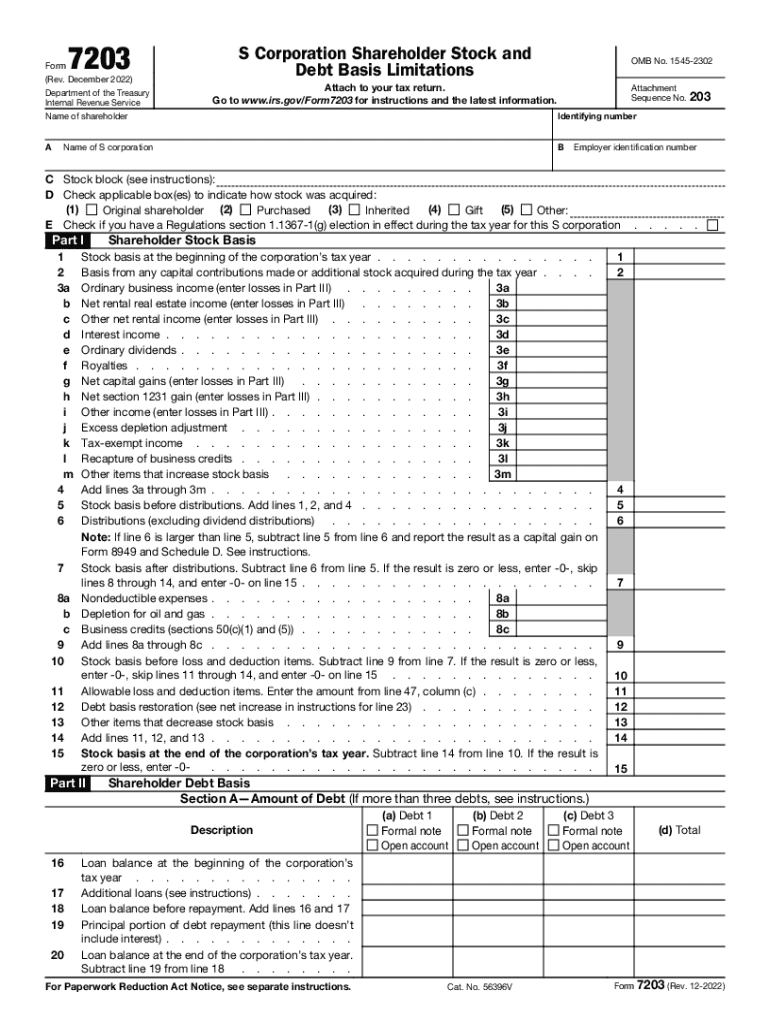

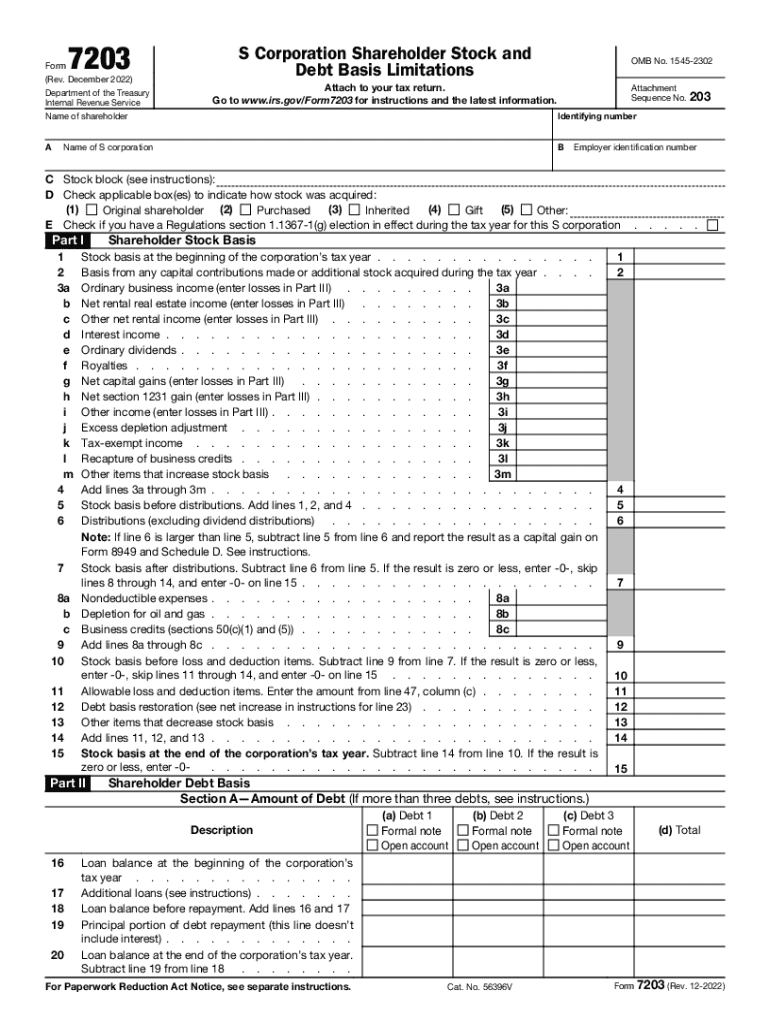

IRS 7203 2022-2026 free printable template

Get, Create, Make and Sign google redact pdf form

Editing IRS 7203 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out IRS 7203

How to fill out form 7203 rev december

Who needs form 7203 rev december?

Form 7203 Rev December Form: A Comprehensive Guide

Understanding Form 7203: What You Need to Know

Form 7203 is essential for certain business owners and shareholders as it helps in reporting their basis in S corporations and partnerships. This form is crucial not only for tax compliance but also for tracking potential distributions and the associated tax implications.

The primary purpose of Form 7203 is to calculate the basis of shareholders or partners in their respective entities. Understanding your basis is vital, especially when it comes to determining the taxability of distributions you receive from the business.

The December revision of Form 7203 includes key updates that allow filers to make more precise calculations regarding their tax liabilities. It integrates better methodologies to report tax losses and track any repayment related to account debt or basis debt, thereby adhering to the latest IRS regulations.

Detailed instructions for filling out Form 7203

Filling out Form 7203 may seem daunting at first, but breaking it down into manageable sections can ease the process. Here’s a step-by-step guide to help you accurately complete the form.

Begin by gathering all necessary documentation, such as financial statements, prior year's tax returns, and any records pertinent to your current basis and distributions. Collecting these documents upfront will streamline the filing process.

Next, fill out each section carefully.

Don’t rush through the review process. Common mistakes include incorrect identification numbers, misreported amounts, and omitted deductions. Double-check your figures to minimize errors and ensure compliance.

How to edit and sign your Form 7203 online

Using pdfFiller’s tools can simplify the editing and signing process. Here’s how to access and utilize Form 7203 on the platform effectively.

Start by accessing Form 7203 on pdfFiller's website. With a user-friendly interface, you can easily navigate to the form you need. Once opened, you will find numerous editing features that enhance usability.

After editing, sign the document electronically using pdfFiller’s eSign feature. Follow these steps to ensure your submission is legally compliant:

Collaborating on Form 7203

Collaborating on Form 7203 is essential if you are working in a team or consulting with business advisors. pdfFiller offers several collaborative features that streamline the process.

To begin, you can share your form with team members by inviting them to edit. This collaborative approach allows multiple users to contribute to the document while maintaining security and access control.

Moreover, the platform allows for real-time collaboration, which enhances efficiency and team dynamics. Commenting features enable immediate feedback, while you can also track changes made by collaborators to ensure accuracy and accountability.

Managing your Form 7203 and related documents

Proper management of Form 7203 and any related documents is crucial for tax readiness. pdfFiller provides innovative tools for organized storage and monitoring.

Creating a dedicated folder for your tax documents can significantly enhance organization. Label and tag files appropriately to make tracking effortless. You can easily search for your forms without wasting time.

After submission, it’s also beneficial to track your status. Understanding what occurs post-submission and maintaining accurate records of your past filings will ensure you are prepared for any future inquiries or audits.

Frequently asked questions about Form 7203

Users often have queries regarding the implications and processes involved with Form 7203. Below are some common questions and their answers.

Additional tips for success

Success in tax preparation can hinge on several best practices. Utilizing available resources and staying informed will put you on the right track. Refer to IRS guidelines and publications frequently for updates.

Moreover, consulting with business advisors can provide tailored advice specific to your business needs and future tax strategy, helping you optimize your tax position.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 7203 without leaving Google Drive?

How do I execute IRS 7203 online?

How can I edit IRS 7203 on a smartphone?

What is form 7203 rev december?

Who is required to file form 7203 rev december?

How to fill out form 7203 rev december?

What is the purpose of form 7203 rev december?

What information must be reported on form 7203 rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.