Get the free House Committee on Financial Services Holds Hearing ... - docs house

Get, Create, Make and Sign house committee on financial

How to edit house committee on financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out house committee on financial

How to fill out house committee on financial

Who needs house committee on financial?

Essential Guide to the House Committee on Financial Form

Understanding financial forms required by the House Committee

The House Committee plays a crucial role in overseeing financial reporting for members and affiliated officials in the U.S. House of Representatives. It ensures that all financial disclosures are made to promote transparency, accountability, and ethical governance. Accurate financial disclosures are vital, not just for meeting legal obligations, but for maintaining public trust. The complexity of financial forms can deter thorough compliance, making it essential for officials to understand the requirements.

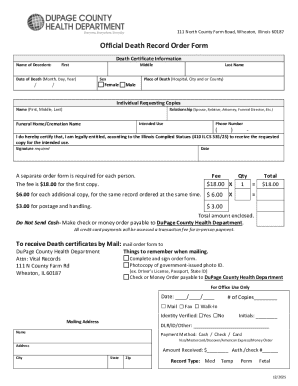

Members of the House are required to submit various types of financial documentation to ensure full disclosure of their financial situation. Among the required forms, the Personal Financial Disclosure Form and Periodic Transaction Reports stand out. These documents serve to provide the public and regulatory bodies with insights into the financial dealings of elected officials, thereby striving to eliminate potential conflicts of interest.

Detailed breakdown of financial form specifications

Navigating the specifics of financial disclosure forms can be daunting without a firm grasp of their requirements. Commonly utilized forms include the Personal Financial Disclosure Form and Periodic Transaction Reports, which serve distinct purposes. For instance, the Personal Financial Disclosure Form requires a comprehensive account of personal assets, liabilities, and income sources. In contrast, Periodic Transaction Reports focus on any significant transactions that could create a conflict of interest.

Each form comes with specific disclosure requirements that instate mandatory reporting of assets and liabilities. This includes real estate holdings, investments, loans, and even gifts or other forms of income over specified thresholds. Non-compliance may lead to serious consequences, thus prompting awareness and diligence in reporting each section accurately. It's also essential to understand exception clauses and reporting thresholds to determine when certain disclosures may or may not be necessary.

Step-by-step guide to completing financial forms

Completing financial forms involves several critical steps, starting from preparatory work to final submission. The preparation process includes assessing what financial information is required and gathering necessary supporting documents. This might involve collecting bank statements, property deeds, and investment summaries, ensuring that all information presented is accurate and complete.

When filling out the form, start with the key sections that capture your financial landscape comprehensively. Common fields often require clear listing of assets, along with their estimated values. Remember to review the completed section for any inaccuracies, as mistakes can lead to non-compliance with reporting requirements. After filling out the form, take the time to review and edit your submission meticulously. Using tools like pdfFiller can facilitate this process, providing a user-friendly interface to ensure your data is accurately reported and polished.

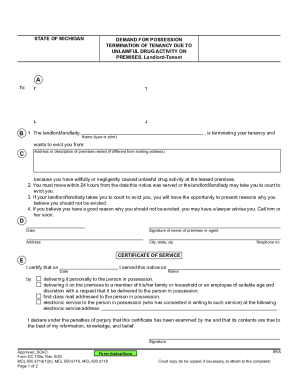

Navigating the submission process

Once your financial forms are completed, the submission process starts. Forms can often be submitted digitally or through paper methods, depending on the requirements set forth by the House Committee. It's crucial to adhere to specified deadlines to avoid penalties or complications. Typically, submissions for financial forms must be made by certain dates before reporting periods end. For example, forms are often due on May 15 of each year, ensuring all filed data is current.

Ensuring confirmation of receipt from the House Committee is also paramount. After submission, await confirmation that your forms have been received and accepted. This not only provides peace of mind but ensures compliance with the obligation to file accurate and timely financial reports.

Tools for financial reporting and form management

Modern tools like pdfFiller can significantly enhance the financial reporting process, offering various interactive tools to simplify form completion. Many users benefit from online calculators dedicated to estimating financial statuses and personalized value assessments based on assets and liabilities. Such features are particularly useful when preparing forms, as they grant users an understanding of their financial standing.

Additionally, pdfFiller offers eSignature and document management features that streamline the entire process. This capability allows users to sign forms electronically, thus speeding up submission times and minimizing the need for physical paperwork. Collaboration tools also ensure that multiple team members can work together effectively, making the submission of financial disclosures seamless and cooperative within legislative environments.

Common issues and oversights in financial disclosure

Despite knowing the requirements, many still fall victim to common issues and oversights in financial form disclosures. One of the most prevalent pitfalls is underreporting assets or omitting significant transactions, which can occur due to misunderstanding the requirements or misjudging their mandatory nature. Regularly updating financial disclosures is also often overlooked, leading to outdated information remaining on record.

Addressing and rectifying errors post-submission is essential. Procedures are in place for amending financial disclosure forms should discrepancies arise. Timely corrections not only mitigate potential disciplinary actions but also reinforce the commitment to transparency by correcting inaccurate public records. Engaging with the committee’s resources or the legislative resource center can offer assistance in this process.

Frequently asked questions about financial forms

Many members, officers, and employees seeking clarity about financial disclosures often have similar inquiries. One common question pertains to the consequences of non-compliance; failure to file accurate financial reports may lead to sanctions or other electoral repercussions. Furthermore, understanding how often forms need to be updated is vital, as members are typically required to submit annual updates to remain compliant.

For candidates running for office, there are additional considerations. They must be thoroughly prepared to face public scrutiny over their financial disclosures, ensuring completeness and accuracy well ahead of submission dates. Candidates should also anticipate heightened attention to any discrepancies, emphasizing the need for meticulousness during the reporting process to establish trust with voters and stakeholders.

Examples of past financial disclosure forms

Analyzing past financial disclosure submissions can offer insights into best practices. Archived submissions demonstrate varied yet successful strategies for filling out financial forms, offering valuable lessons for current and future members. In reviewing these documents, it becomes clear how thoroughness in detail leads to smoother review processes by the House Committee.

Learning from these examples not only enhances understanding but also prepares current fillants to avoid common pitfalls. From successfully reported assets to well-documented transactions, these submissions collectively embody the transparency and integrity expected from governmental representatives. Establishing best practices based on historical data can foster improved compliance over time.

Leveraging pdfFiller for your financial document needs

Using pdfFiller provides a unique advantage when managing financial documents. The platform's features facilitate ease of use, enabling users to edit PDFs, collaborate seamlessly, and eSign forms all from its cloud-based environment. This empowers individuals and teams to efficiently navigate their document processes, whether for the House Committee on Financial Form or other essential paperwork.

Case studies demonstrate successful financial disclosure submissions utilizing pdfFiller’s tools. Users report significant time savings and heightened accuracy during their submission journeys, thanks to the interactive functionalities that ease the entire process. This commitment to accessible comprehensive document management makes pdfFiller an excellent choice for anyone engaged with financial reporting forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my house committee on financial directly from Gmail?

How can I modify house committee on financial without leaving Google Drive?

How do I make edits in house committee on financial without leaving Chrome?

What is house committee on financial?

Who is required to file house committee on financial?

How to fill out house committee on financial?

What is the purpose of house committee on financial?

What information must be reported on house committee on financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.