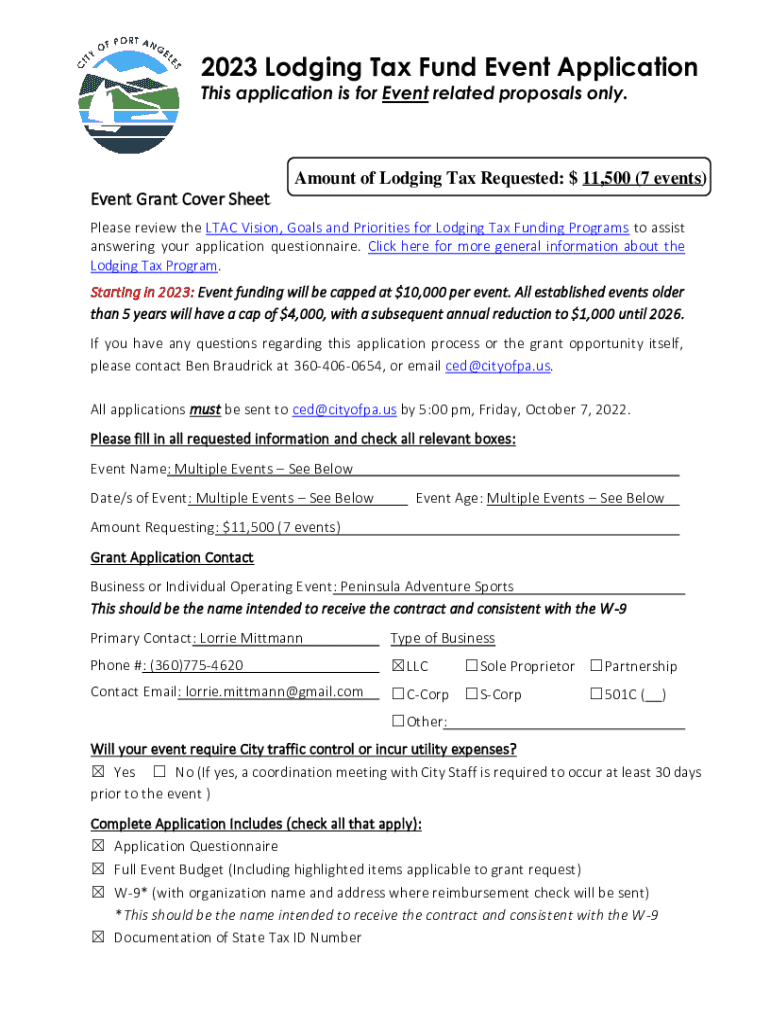

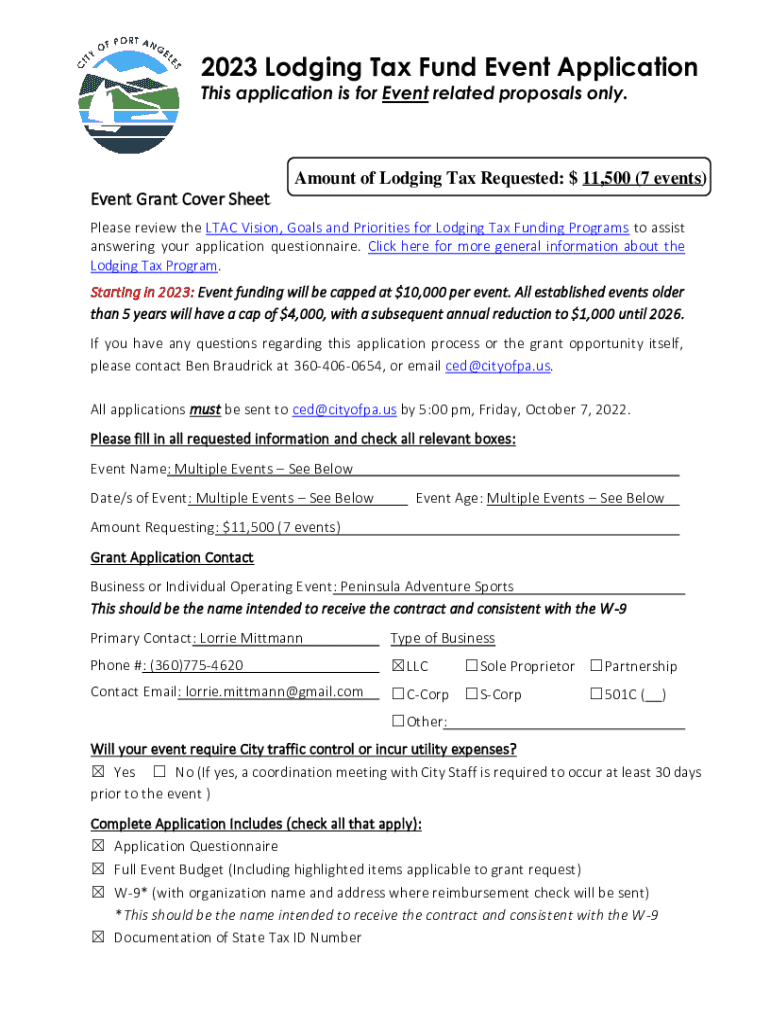

Get the free Form Center2023 Lodging Tax Funds Application

Get, Create, Make and Sign form center2023 lodging tax

Editing form center2023 lodging tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form center2023 lodging tax

How to fill out form center2023 lodging tax

Who needs form center2023 lodging tax?

Mastering the form center 2023 lodging tax form: A comprehensive guide

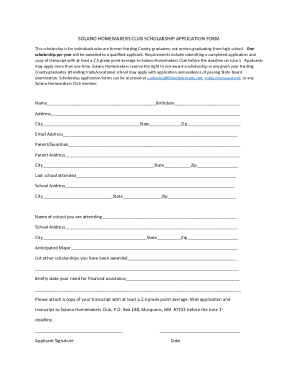

Understanding the 2023 lodging tax form

The 2023 lodging tax form is an essential document for businesses involved in the hospitality industry. Lodging taxes are imposed by local governments on guests staying at hotels, motels, or other lodging facilities. Typically calculated as a percentage of the rental price, these taxes fund various public services, including tourism promotion, infrastructure maintenance, and local amenities. Accurate reporting of these taxes is crucial for compliance and to avoid any potential fines or penalties.

Ensuring accurate reporting is not just a legal obligation; it also reflects the integrity of your business. If your lodging business fails to submit the correct amount or file on time, it may jeopardize your operating license. Additionally, demonstrating fiscal responsibility can enhance your reputation within the community, making it easier to build relationships with both local authorities and guests.

Any individual or business that rents out lodging space, whether it’s a traditional hotel or a short-term rental, needs to file the lodging tax form. This includes independent operators, chain hotels, and even platforms like Airbnb that manage properties on behalf of individual owners. Knowing who must submit this form is the first step toward compliance.

Navigating the form center

The pdfFiller Form Center is designed to simplify the process of accessing and completing forms like the 2023 lodging tax form. It provides an organized space where users can find necessary documents efficiently. The platform not only offers a multitude of forms but also ensures accessibility from any device, making it a reliable choice for busy professionals and teams.

To access the 2023 lodging tax form, simply visit the pdfFiller website and navigate to the Form Center. Users can easily use the search functionality or browse categories relevant to taxes and lodging. This user-friendly design helps minimize the time spent searching for forms, allowing business owners to focus on their operations instead of paperwork.

Some of the most useful features of the Form Center include interactive fillable fields, saving options for later completion, and integration capabilities that allow you to easily share forms with team members. Whether you’re a solo entrepreneur or part of a large organization, the convenience of pdfFiller makes forms like the 2023 lodging tax form accessible and straightforward.

Step-by-step guide to completing the 2023 lodging tax form

Completing the 2023 lodging tax form can seem daunting, but breaking it down into manageable steps will simplify the process.

In the first step, compiling documentation like past lodging tax filings and financial reports is crucial. For instance, making a list of your business details, including the terminal street address and contact information, will streamline the process. Once you understand the requirements and gather your materials, proceed to fill out the necessary fields with accurate information regarding your revenue and tax calculations.

During the form filling process, focus on key sections such as the identification fields and revenue reporting. Pay attention to common mistakes, such as miscalculating tax rates or omitting necessary data. After filling out the form, utilize pdfFiller’s review tools that facilitate final checks of entries and provide smart alerts for incomplete sections.

Editing and managing your lodging tax form with pdfFiller

One of the standout features of pdfFiller is the ability to edit the 2023 lodging tax form directly after it has been filled out. This flexibility is crucial, especially for businesses that require changes in the last minutes. Users can go back, modify entries, or add necessary details quickly and efficiently.

Managing forms is made even easier with pdfFiller’s team collaboration tools. Teams can communicate directly within the platform, ensuring that everyone has access to the most updated version of the lodging tax form. This capability significantly reduces the likelihood of errors stemming from circulating outdated files. As for storage, pdfFiller positions itself as a secure place for all your documents, protecting sensitive information with encryption.

eSigning your lodging tax form

Implementing electronic signatures has revolutionized the way businesses handle document signing. With pdfFiller, add an e-signature to your lodging tax form seamlessly. This not only expedites the submission process but also enhances the overall user experience. By signing digitally, you reduce the physical paperwork and streamline your filing procedure.

The eSigning process is straightforward: once your lodging tax form is completed and ready for submission, simply navigate to the eSigning feature in pdfFiller. Here, you can create a signature or upload your existing one. Once signed, the platform assures legal validity of your eSigned documents, accredited by electronic signature laws across multiple jurisdictions.

Filing your lodging tax form

Filing your completed lodging tax form is as crucial as ensuring its accurate completion. Depending on your location, there are various submission methods available — typically through mail, in-person at designated offices, or electronically. It’s essential to familiarize yourself with your local filing deadlines and requirements to avoid penalties.

Be aware that lodging tax forms often need to be filed on a monthly, quarterly, or annual basis, depending on local regulations. Understanding specific state requirements helps adjust your filing strategy accordingly. For example, some states may require additional documents or supplemental forms for lodging tax submissions. Ensuring compliance with these regulations not only prevents issues but also establishes trust within the local community.

Troubleshooting common issues

While filing the 2023 lodging tax form, various common issues may arise. Users often find themselves asking whether they need to amend a submission or how to correct mistakes after filing. It’s advisable to tackle such concerns by carefully reviewing the FAQs section within pdfFiller, which addresses typical filing questions.

Should mistakes be discovered post-submission, take immediate action by reviewing your local regulations for amendment procedures. In most jurisdictions, it’s possible to file revised returns, ensuring any discrepancies are rectified. Additionally, pdfFiller provides support and resources to guide users through difficult situations related to form submissions, giving you peace of mind.

Additional resources and tools

To further assist users in navigating the lodging tax form process, pdfFiller offers an interactive checklist specifically designed for filing the lodging tax form. This checklist highlights essential tasks to complete before, during, and after form submission, ensuring no aspect is overlooked.

Moreover, users can access links to state-specific regulations and guidelines directly through pdfFiller's platform, giving clarity on varying requirements. Those seeking to deepen their understanding can explore blog and video resources provided by pdfFiller, tailoring their learning experience to fit different preferences.

Connecting with the pdfFiller community

Engaging with the pdfFiller community allows users to share experiences, ask questions, and help one another navigate the nuances of document management. Joining forums and discussion groups empowers users to gain insights based on collective knowledge, discovering best practices for managing forms like the 2023 lodging tax form.

Accessing customer support is also simplified in this community environment. Users can reach out for live assistance or browse through previous discussions to find solutions to common problems. This collaborative atmosphere fosters a support network critical for anyone dealing with tax forms and filing complexities.

Form center overview: explore more templates

Beyond the lodging tax form, pdfFiller provides additional templates related to lodging and taxes, making it a one-stop-shop for various document needs. Whether you are looking for supplementary forms, templates for business operations, or something specific for finance, pdfFiller categorizes forms efficiently, allowing users to find exactly what they need without hassle.

For those who wish to expand their knowledge base, recommended resources for continuous learning can be found easily on the pdfFiller site. By exploring the available options, users can gain broader insight into document management, ensuring they’re well-equipped to handle all types of forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form center2023 lodging tax online?

Can I create an eSignature for the form center2023 lodging tax in Gmail?

How do I complete form center2023 lodging tax on an Android device?

What is form center2023 lodging tax?

Who is required to file form center2023 lodging tax?

How to fill out form center2023 lodging tax?

What is the purpose of form center2023 lodging tax?

What information must be reported on form center2023 lodging tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.