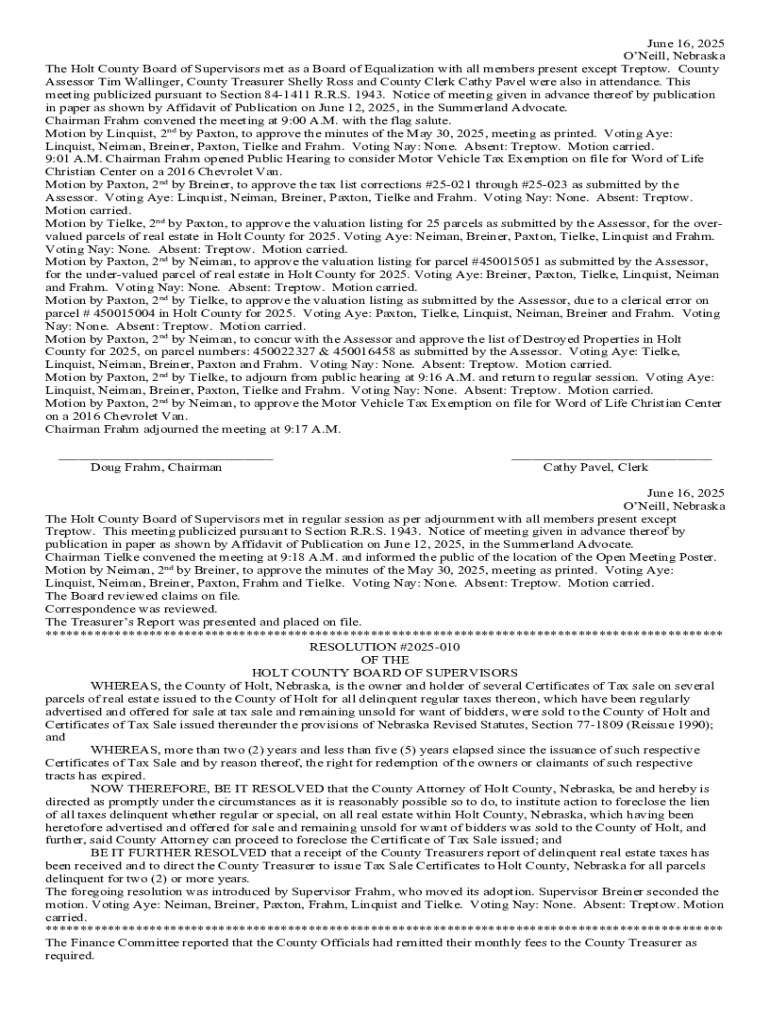

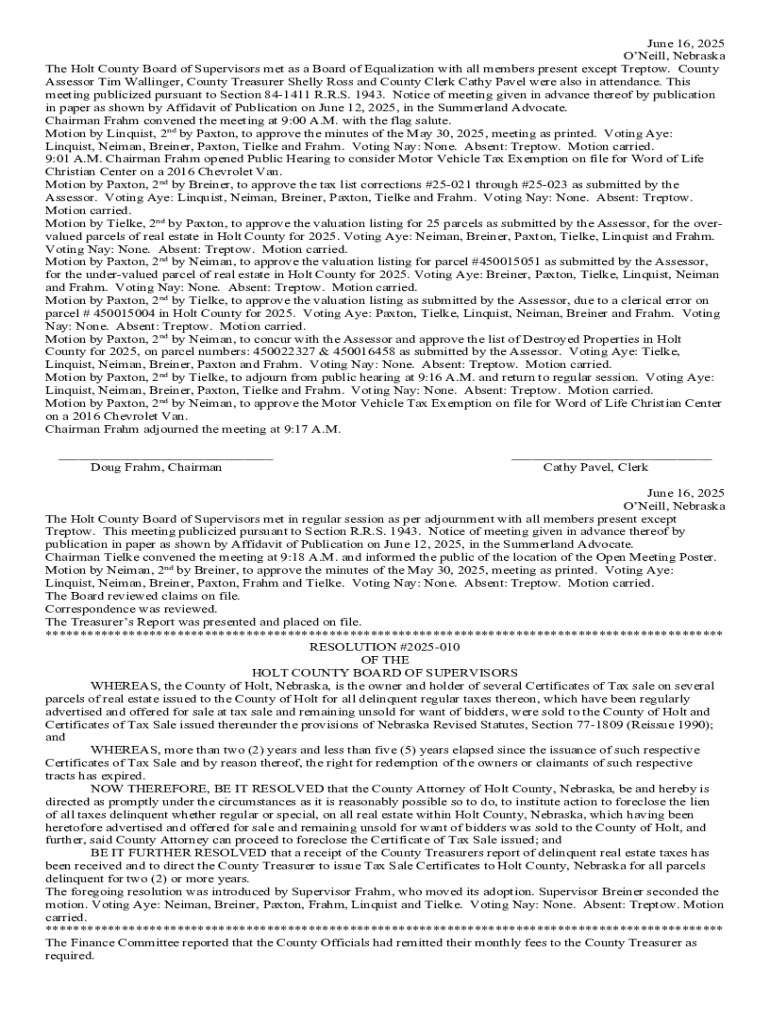

Get the free Assessor Tim Wallinger, County Treasurer Shelly Ross and County Clerk Cathy Pavel we...

Get, Create, Make and Sign assessor tim wallinger county

How to edit assessor tim wallinger county online

Uncompromising security for your PDF editing and eSignature needs

How to fill out assessor tim wallinger county

How to fill out assessor tim wallinger county

Who needs assessor tim wallinger county?

Comprehensive guide to the assessor Tim Wallinger County form

Overview of the assessor Tim Wallinger County form

The assessor Tim Wallinger County form plays a pivotal role in the property assessment process. This form is essential for property owners in understanding how their properties will be evaluated for taxation purposes. The completed form provides the county assessor's office with crucial information necessary for determining property value, ensuring that all taxation policies are appropriately applied.

Users can expect to furnish various details about their properties, such as square footage, property type, and additional features that could impact value. Ensuring accurate and complete information can not only influence property tax rates but might also affect future appeals or protests regarding assessed values.

Key features of the assessor Tim Wallinger County form

The assessor Tim Wallinger County form is structured to facilitate comprehensive data collection. Each section is designed to capture specific details about both the property and the owner, urging filers to provide accurate information. Ensuring that all sections are completed with precise data is significantly advantageous since missing or incorrect details could lead to misvaluation.

The user-friendly design features interactive elements, helping users navigate the digital format seamlessly. Accessibility tools and visual aids enhance the experience, allowing individuals, regardless of their tech savviness, to complete the form without hurdles. This thoughtful layout is particularly beneficial for multi-property owners or teams who may need to assess multiple properties.

Step-by-step guide to completing the assessor Tim Wallinger County form

Completing the assessor Tim Wallinger County form can seem daunting, but with the right preparation, it becomes manageable. Below is a detailed step-by-step guide that simplifies the process.

Collaborative features for teams

The assessor Tim Wallinger County form does not just serve individual homeowners; teams can also benefit significantly from its collaborative features on pdfFiller. Multiple agents or members of a team can work on the form concurrently, ensuring that all significant details are captured accurately without miscommunication.

Utilizing comments and feedback tools within pdfFiller allows team members to review changes, share insights, and suggest edits in real time. This collaborative edge can expedite the process, making it easier to navigate the complexities of property assessment.

After completion, the secured sharing options available ensure that the completed documents can be sent to stakeholders without compromising confidentiality. This feature is especially useful when dealing with multiple properties and various clients.

Tools and resources for managing your assessor Tim Wallinger County form

One major advantage of using the assessor Tim Wallinger County form through pdfFiller is the cloud-based access that facilitates form management. Users can retrieve their forms from any device, streamlining the process whether on a desktop or mobile. This is particularly valuable for those managing multiple properties across different locations.

Storing and organizing forms becomes straightforward with pdfFiller's document management system. Utilize folders and tagging features to categorize forms by property type, submission date, or status should you be managing several submissions at once. Additionally, tracking changes and activity history helps users monitor what edits were made and when, providing clarity and accountability in the process.

Troubleshooting common issues

While navigating the assessor Tim Wallinger County form can feel uncomplicated, challenges may arise. Common submission errors occur due to incomplete fields or incorrect formats. Familiarizing users with troubleshooting steps could alleviate frustration when these instances arise.

Frequently asked questions about the form often touch on deadlines, eligibility for protests, or the implications of incomplete submissions. Engaging with these FAQs provides an opportunity to enhance understanding and ensure thorough compliance with county assessor requirements.

Additional insights

Staying updated on any changes or updates to the assessor Tim Wallinger County form is crucial for users. Recent modifications could include shifts in submission deadlines, new policies implemented by the county assessor’s office, or alterations in requirements for property valuation.

The importance of staying informed extends beyond just filling out the form. Understanding how broader economic factors and county policies influence property taxes can empower users to make strategic decisions regarding property management and financial planning.

Conclusion of the guide

Completing the assessor Tim Wallinger County form may seem overwhelming, but this guide aims to simplify the process, presenting clear steps and collaborative tools. Emphasizing the accuracy and completeness of your submissions can significantly impact property valuation and tax responsibilities, ultimately ensuring that you are fairly assessed and positioned for any future protests regarding county valuations.

Utilizing the resources provided by pdfFiller can make your experience more streamlined, allowing you to focus on understanding property assessments rather than getting bogged down in paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit assessor tim wallinger county online?

How do I edit assessor tim wallinger county in Chrome?

How do I edit assessor tim wallinger county on an iOS device?

What is assessor tim wallinger county?

Who is required to file assessor tim wallinger county?

How to fill out assessor tim wallinger county?

What is the purpose of assessor tim wallinger county?

What information must be reported on assessor tim wallinger county?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.