Get the free Property Tax ExemptionsCook County Assessor's Office

Get, Create, Make and Sign property tax exemptionscook county

How to edit property tax exemptionscook county online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax exemptionscook county

How to fill out property tax exemptionscook county

Who needs property tax exemptionscook county?

Understanding Property Tax Exemptions: Cook County Form Guide

Understanding property tax exemptions in Cook County

Property tax exemptions in Cook County play a crucial role in alleviating the financial burden on homeowners and renters alike. These exemptions are reductions in the assessed value of a property, effectively lowering the property taxes owed. Understanding these exemptions is vital, especially for residents seeking to maximize their savings and ensure they are not overpaying on their property taxes.

For homeowners, the prospect of lowering property taxes is appealing, and for renters, knowing about exemptions may provide insights into how their landlords might manage costs. The Cook County property tax exemption landscape offers various forms of assistance, from standard homeowner exemptions to benefits tailored for seniors and disabled veterans.

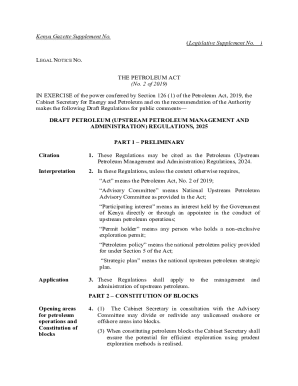

Types of property tax exemptions available in Cook County

Cook County provides several types of property tax exemptions designed to assist specific populations, each with distinct eligibility criteria and application processes. Here’s a breakdown of some important exemptions:

The importance of timely application submission

Submitting your application for property tax exemptions on time is critical. Cook County has established specific deadlines for applications which must be adhered to prevent missing out on potential savings. Each exemption type generally has its own window for applications, often falling within the first half of the year.

Consequences of missing these deadlines can be severe, as late applications are typically denied, resulting in higher taxes that could have otherwise been alleviated. To ensure timely processing, individuals should keep track of each exemption's deadline and prepare their documents well in advance.

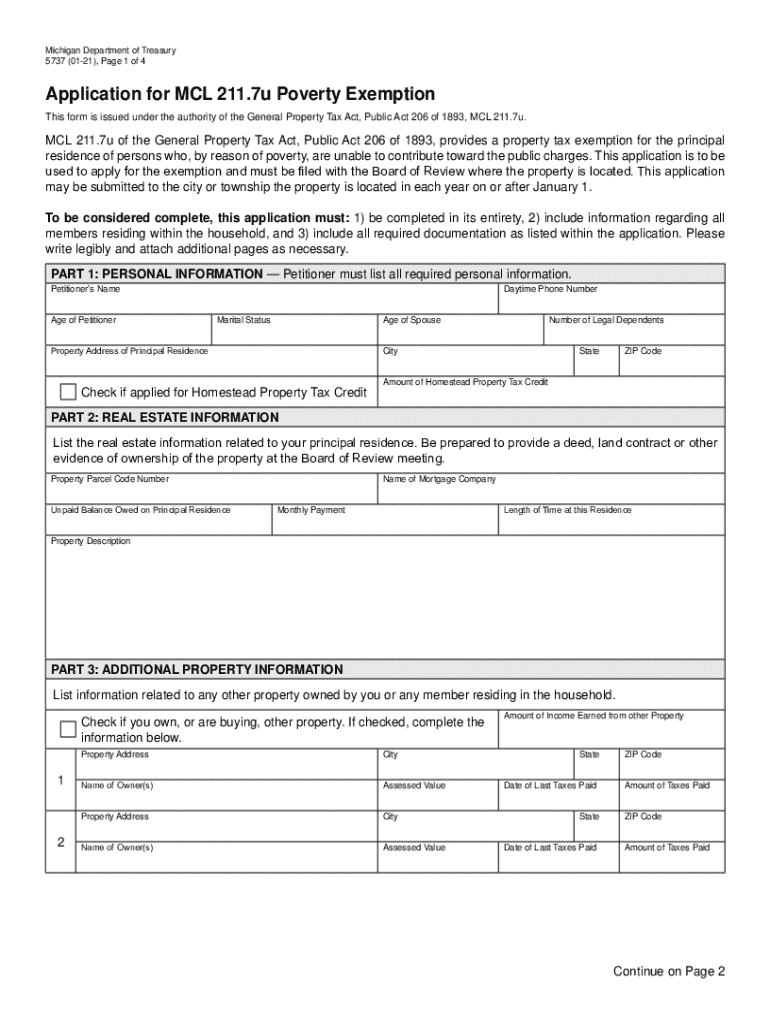

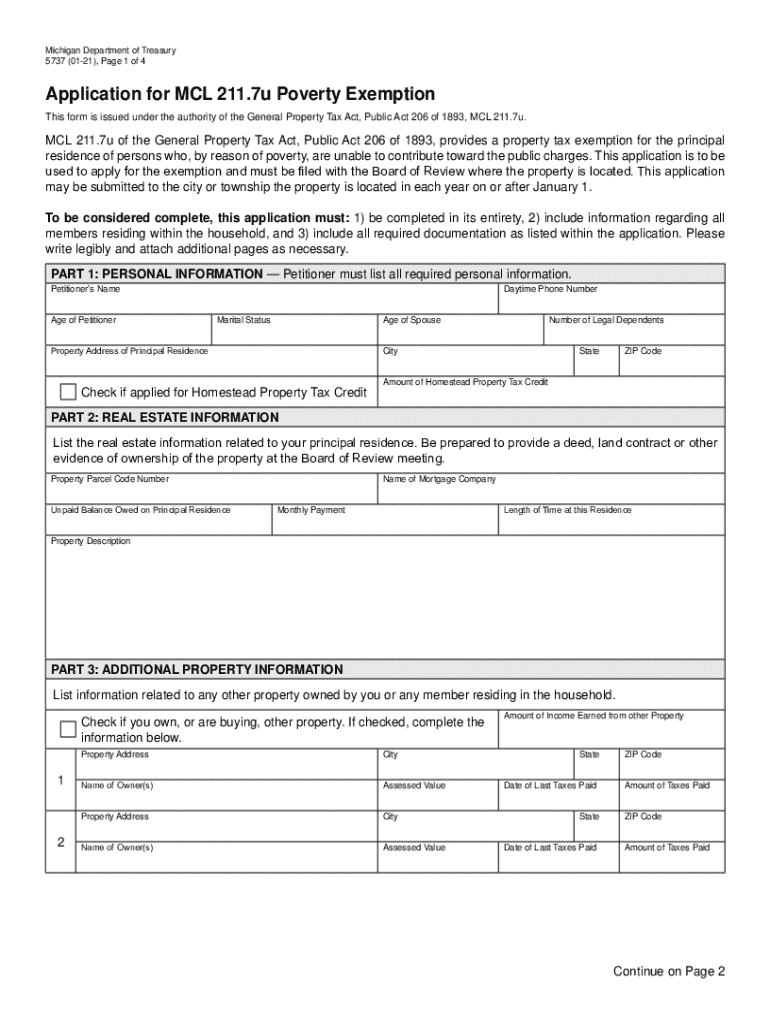

Step-by-step guide to completing the Cook County property tax exemption form

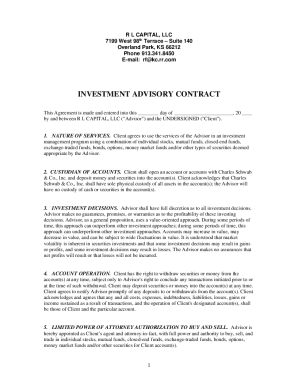

Completing the property tax exemption form requires careful attention to detail and understanding of each section. Accessing the necessary forms is the first step and can easily be done through pdfFiller, where the form is available in a user-friendly PDF format.

Editing and signing your form effortlessly on pdfFiller

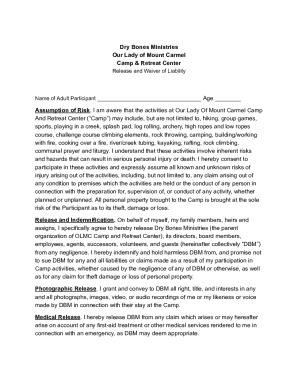

pdfFiller makes it simple to edit and digitally sign your property tax exemption form. By utilizing its wide range of editing tools, users can make adjustments swiftly and accurately. This platform allows for not just editing but also typing directly onto your form which streamlines the fill-out process.

To sign your form, just follow these steps: after you have completed the form, navigate to the signing section of pdfFiller, where you can create a signature using your mouse or upload a pre-saved one. This process is efficient, ensuring your documents are secured and compliant with digital signing standards.

Tracking your application status

Once your application is submitted, it’s natural to want to track its status. To confirm your submission was received, keep documentation indicating that your form was sent. Cook County typically provides a confirmation system, and residents can check online for updates regarding their applications.

Expected timelines for approval can vary significantly based on the exemption type and volume of applications. If you have not heard back within the expected timeframe, it's advisable to reach out to the appropriate office to inquire about your application's status.

Staying informed: notifications and updates

Staying updated about your property tax exemption application can alleviate concerns and help you plan your finances accordingly. A beneficial step is to sign up for notifications from cook county offices regarding filing reminders and updates on your exemptions.

Receiving timely notifications ensures you don’t miss important updates or deadlines, making it simpler to respond quickly. Many resources are available for immediate assistance, including the county's website and various help desks.

FAQs regarding Cook County property tax exemptions

As with any financial process, many individuals have common queries about property tax exemptions. Here are some frequently asked questions:

Final thoughts on navigating property tax exemptions

Navigating property tax exemptions can seem daunting, but taking the time to understand and utilize resources like pdfFiller can significantly ease the process. With the right information, homeowners and eligible individuals can take crucial steps towards securing their exemptions, reducing their overall property tax liability.

Being proactive about applying for these exemptions is essential, as they can lead to substantial savings. With each year, the rules may change, so staying informed is key to ensuring you benefit from all eligible opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property tax exemptionscook county for eSignature?

How do I edit property tax exemptionscook county online?

How do I complete property tax exemptionscook county on an Android device?

What is property tax exemptions cook county?

Who is required to file property tax exemptions cook county?

How to fill out property tax exemptions cook county?

What is the purpose of property tax exemptions cook county?

What information must be reported on property tax exemptions cook county?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.