Get the free Bureau of Financial Institutions - Richmond, Virginia State ...

Get, Create, Make and Sign bureau of financial institutions

Editing bureau of financial institutions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bureau of financial institutions

How to fill out bureau of financial institutions

Who needs bureau of financial institutions?

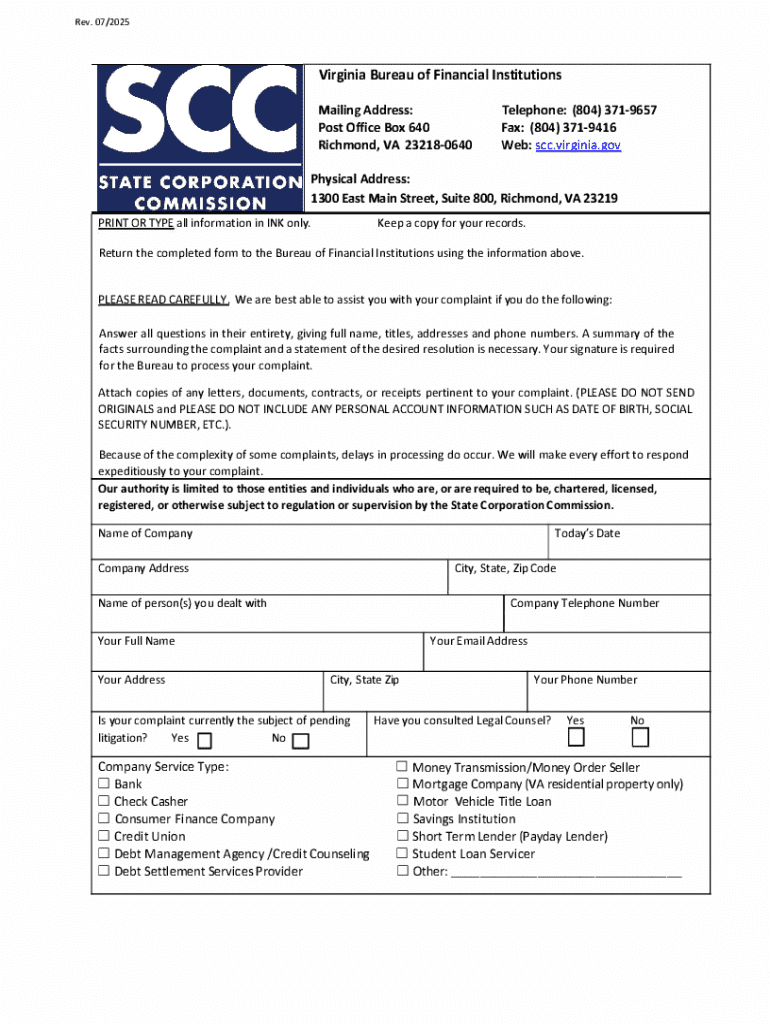

Understanding the Bureau of Financial Institutions Form

Overview of the Bureau of Financial Institutions

The Bureau of Financial Institutions plays a pivotal role in overseeing the health and integrity of financial institutions within a state or jurisdiction. This government entity is tasked with ensuring these institutions comply with regulatory standards, safeguarding consumer interests, and fostering a stable financial environment. As part of its mandate, the Bureau regulates a variety of financial services, including banks, credit unions, and mortgage lenders, all vital components of the economic fabric.

Financial institutions are crucial to the economy as they facilitate payments, provide financing for individuals and businesses, and contribute to economic growth. The Bureau's oversight helps prevent financial crises by ensuring these institutions operate within the framework of laws and regulations designed to protect consumers and maintain public confidence.

One of the key instruments at the Bureau's disposal is the Bureau of Financial Institutions Form. This form serves various purposes, from licensing new institutions to maintaining compliance and addressing consumer issues.

Understanding the Bureau of Financial Institutions Form

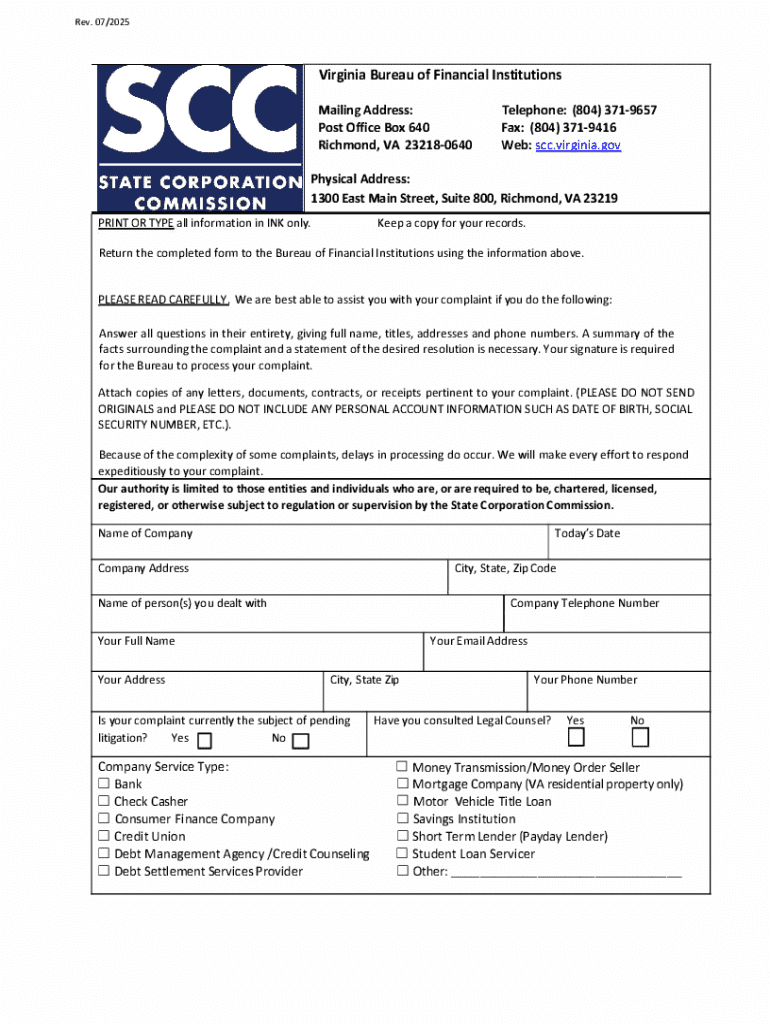

The Bureau of Financial Institutions Form is an essential document used for various regulatory purposes. This form may vary in specifics depending on its intended use, but it fundamentally serves to collect necessary data for the Bureau's records and compliance checks. By filling out this form, institutions and individuals can communicate pertinent information or requests to the Bureau, ensuring that operations conform to established guidelines.

Common uses of this form include applying for a license, renewing an existing license, submitting compliance reports, and addressing consumer issues such as complaints or inquiries regarding specific financial services.

Anyone associated with or utilizing a financial institution—such as administrators, compliance officers, or consumers—may find themselves needing to fill out this form. Understanding its purpose is crucial for navigating the regulatory landscape effectively.

Types of Bureau of Financial Institutions Forms

The Bureau of Financial Institutions provides an array of forms catering to different needs within the financial ecosystem. These can primarily be divided into two categories: regulatory forms and consumer-facing forms.

Regulatory forms are designed for financial institutions, facilitating licensing, registration, and compliance reporting. For example, a licensing application form must be filled out for new banks seeking regulatory approval to start operations.

On the other hand, consumer-facing forms address the needs of the public. This includes forms for filing complaints about a financial institution or inquiries regarding specific services. Each form is carefully designed to ensure that all required information is collected efficiently.

Accessing the Bureau of Financial Institutions Form

Accessing the Bureau of Financial Institutions Form is straightforward, with multiple options available for users. The simplest method is to visit the Bureau's official website, where these forms are typically downloadable in PDF format. This allows users to complete them digitally and save time.

Alternatively, those who prefer physical copies can visit local Bureau offices. They can request forms directly from agency personnel or utilize public kiosks where available. For individuals unable to travel, contacting the Bureau via email or telephone for guidance can also be an effective way to obtain the necessary forms.

Step-by-step guide to filling out the Bureau of Financial Institutions Form

Filling out the Bureau of Financial Institutions Form accurately is crucial for its acceptance and processing. Start by gathering all essential information, including personal identification and pertinent financial details. This data is foundational for various applications like licensing or compliance reporting.

It is important to follow outlined instructions carefully. Each section will typically require specific details such as the applicant's name, contact information, and institutional data if applicable. Be thorough, as incomplete information can lead to delays or even rejection of the application.

To ensure compliance, it is beneficial to familiarize yourself with state-specific regulations that may impact your submission. Consulting resources or even legal experts can provide clarity, particularly on complex cases.

Editing and customizing your Bureau of Financial Institutions Form

With tools like pdfFiller, users can effectively edit and customize their Bureau of Financial Institutions Form with ease. This platform allows for modifications specifically geared towards personalization, enabling users to add text, checkboxes, and signatures seamlessly, ensuring the final document reflects all required information appropriately.

Ensuring signatures are included is essential for the form's validity. Electronic signatures are accepted, given that they meet the regulations set forth within state guidelines. Utilizing online platforms ensures not only compliance with required signatures but also enhances the efficiency of the submission process.

Collaborative features for teams

For teams collaborating on financial documentation, pdfFiller offers a range of collaborative features that facilitate efficient teamwork. Teams can work together in real time, editing content, leaving comments, and tracking changes, which is invaluable for maintaining clarity and accountability throughout the documentation process.

These features foster a more streamlined approach to gathering input and finalizing documents, ensuring that all voices are considered in the submission of forms to the Bureau. Furthermore, the ability to share documents securely ensures that sensitive financial information is kept safe during the collaboration.

Signing your Bureau of Financial Institutions Form

Once the Bureau of Financial Institutions Form is accurately filled out, the next step is signing it. Electronic signatures have gained legal validity, allowing users to sign forms digitally, which expedites the submission process considerably. The Electronic Signatures in Global and National Commerce (ESIGN) Act ensures that eSignatures hold the same weight as traditional signatures.

Using pdfFiller, signing the form electronically is as simple as clicking a button. Users can eSign the document securely within the platform, thereby enhancing efficiency and reducing time spent on paperwork.

Managing your Bureau of Financial Institutions Form

After completing and submitting the Bureau of Financial Institutions Form, ongoing management of the document becomes crucial. Utilizing cloud storage options available through pdfFiller allows users to organize and store their completed forms in a secure, easily retrievable manner. This is particularly helpful for individuals and teams that routinely need access to past submissions for auditing purposes or further reference.

The platform's backup and security features ensure that sensitive financial information is protected from unauthorized access. This is vital for maintaining compliance with regulations and safeguarding consumer information.

Troubleshooting common issues

Even with thorough preparation, issues can arise when dealing with the Bureau of Financial Institutions Form. Common problems include form rejections due to incomplete information or incorrectly submitted documents. If you encounter problems, it is advisable to carefully re-read the form instructions and ensure all required fields are filled accurately.

For further assistance, numerous resources are available, including the Bureau’s website, FAQs, and direct contact options such as phone and email support. Engaging with these resources can help clarify any uncertainties regarding the form and its requirements.

Best practices for financial document management

Successful management of financial documents is key for individuals and institutions alike. Keeping your documents organized is essential to ensure that you can quickly retrieve forms when needed. Regular audits of your submitted Bureau of Financial Institutions Forms can help you maintain compliance and identify any discrepancies in your submissions that may require attention.

Leveraging platforms like pdfFiller aids in enhancing overall document management efficiency. With features for editing, signing, and collaborating, users can navigate the intricacies of financial documentation with confidence, ensuring that all interactions with the Bureau of Financial Institutions remain smooth and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bureau of financial institutions directly from Gmail?

How do I make changes in bureau of financial institutions?

Can I edit bureau of financial institutions on an Android device?

What is bureau of financial institutions?

Who is required to file bureau of financial institutions?

How to fill out bureau of financial institutions?

What is the purpose of bureau of financial institutions?

What information must be reported on bureau of financial institutions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.