Get the free Regulated Financial Institutions-Verify a License - Virginia SCC

Get, Create, Make and Sign regulated financial institutions-verify a

How to edit regulated financial institutions-verify a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out regulated financial institutions-verify a

How to fill out regulated financial institutions-verify a

Who needs regulated financial institutions-verify a?

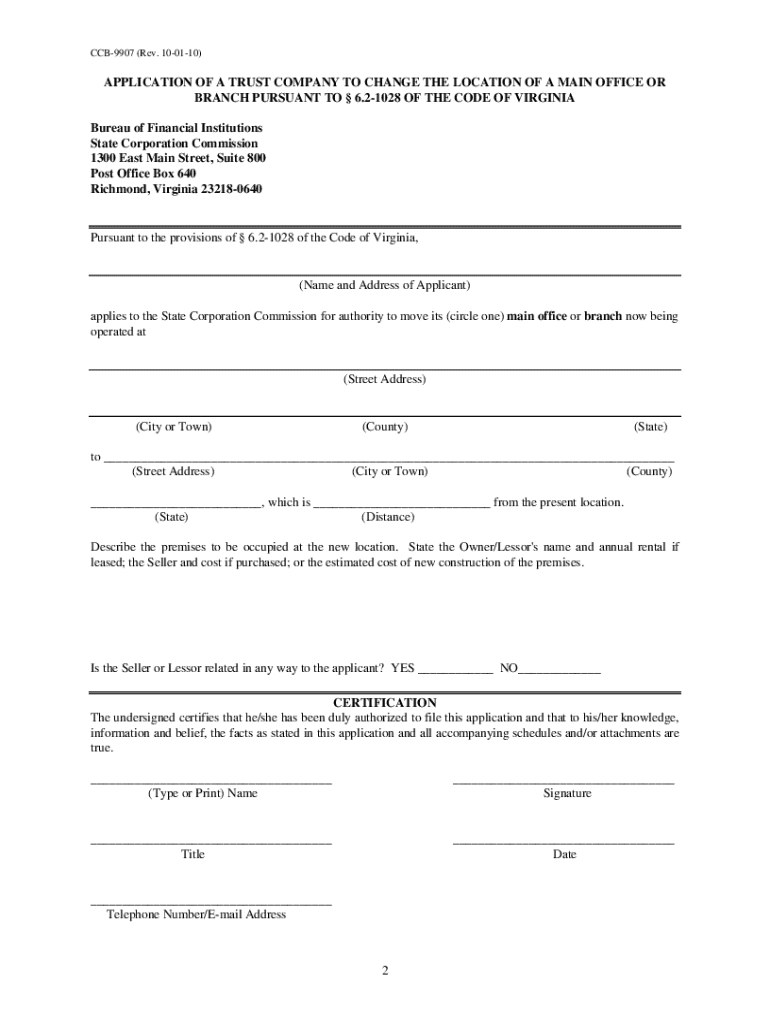

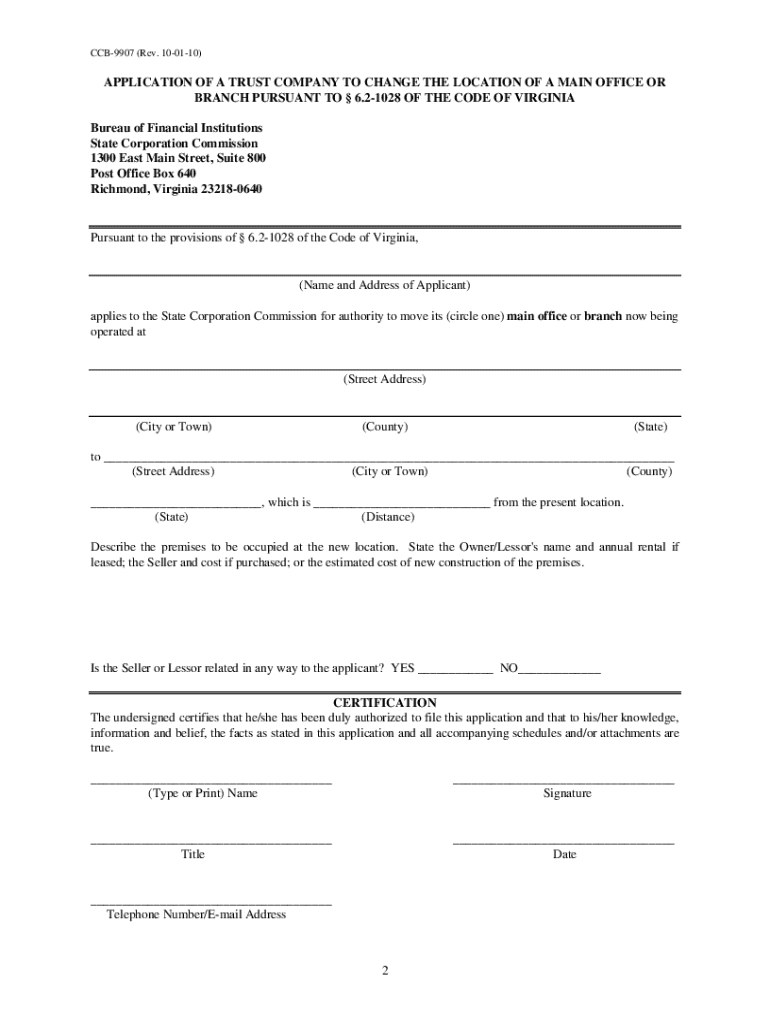

Regulated financial institutions - verify a form

Overview of regulated financial institutions

Regulated financial institutions are key players in the global economy, acting as intermediaries between consumers and financial markets. These institutions are governed by specific laws and regulations designed to maintain the integrity of the financial system, protect consumers, and mitigate risks. Commonly, banks, credit unions, investment firms, and insurance companies fall under this umbrella. Each type of institution serves distinct functions, whether it’s providing loans, managing investments, or offering insurance products.

The importance of these institutions lies not only in their roles but also in ensuring compliance with regulations that mandate the verification of forms. Verifying forms is critical because it safeguards against fraud, ensures accuracy, and upholds regulatory requirements that ultimately protect consumers.

Introduction to form verification

Form verification in financial services is a systematic process that ensures all documents submitted to financial institutions comply with existing regulations and standards. This verification process plays a vital role in maintaining both compliance and operational efficiency. With the regulatory landscape becoming increasingly complex, adherence to rules such as the Dodd-Frank Act and Securities and Exchange Commission (SEC) requirements is crucial.

Common forms across regulated financial institutions include application forms for loans and accounts, compliance documents needed to meet regulatory expectations, and tax-related forms. Each form serves a specific purpose, and accurate verification ensures that all data is correct before it goes into the system.

The verification process

The process of verifying a form within regulated financial institutions involves several key steps. Each piece of documentation must be correctly filled out and validated against compliance benchmarks. Here’s a comprehensive guide on how to navigate through the verification process efficiently.

Best practices for managing documents

Document management is a critical function across all regulated financial institutions. Proper management ensures that documents are easily accessible, accurate, and compliant. Implementing best practices can greatly enhance the efficiency of form verification processes and minimize the risk of errors.

To optimize document management, consider leveraging robust tools like pdfFiller, which offers unique features for editing, eSigning, and collaborating on documents. These tools also help in ensuring data security and regulatory compliance by utilizing cloud storage and advanced encryption methods.

Interactive features for enhanced verification

Interactive tools provided by platforms like pdfFiller enhance the verification experience. Utilizing these can make the otherwise tedious process of form verification more efficient and user-friendly.

Features such as form editing allow users to make necessary adjustments on the go, while eSigning functionalities ensure secure signatures are collected in a compliant manner. Moreover, the collaboration feature allows multiple team members to offer input and approve documents collaboratively. Real-time monitoring keeps users updated on the status of submission and any subsequent requirements.

Troubleshooting common verification issues

Despite a structured verification process, issues can arise during form submissions. Whether it be due to missing information, incorrect data entries, or compliance failures, it's vital to possess problem-solving strategies to effectively troubleshoot these common issues.

When facing form verification challenges, consider these common problems and their workable solutions. Often, these issues can be easily corrected by double-checking data and ensuring complete submissions.

FAQs about form verification in financial institutions

Many users frequently have questions regarding the form verification process. Understanding the common inquiries can aid in better navigation throughout the verification journey. Below are some frequently asked questions concerning form verification in regulated financial institutions.

Conclusion and next steps

In summary, verifying forms within regulated financial institutions is an essential activity that enhances compliance, accuracy, and trust. By following the outlined verification processes and adopting best practices, users can achieve a smoother and more efficient documentation experience.

pdfFiller provides an all-in-one document management solution, allowing users to easily edit PDFs, eSign, collaborate, and manage documents efficiently. Exploring the range of financial verification services offered by pdfFiller can empower individuals and teams to optimize their document processes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit regulated financial institutions-verify a online?

How do I edit regulated financial institutions-verify a in Chrome?

How do I edit regulated financial institutions-verify a on an Android device?

What is regulated financial institutions-verify a?

Who is required to file regulated financial institutions-verify a?

How to fill out regulated financial institutions-verify a?

What is the purpose of regulated financial institutions-verify a?

What information must be reported on regulated financial institutions-verify a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.