Get the free Tax & Water Payments

Get, Create, Make and Sign tax amp water payments

Editing tax amp water payments online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax amp water payments

How to fill out tax amp water payments

Who needs tax amp water payments?

Comprehensive Guide to the Tax & Water Payments Form

Understanding the Tax & Water Payments Form

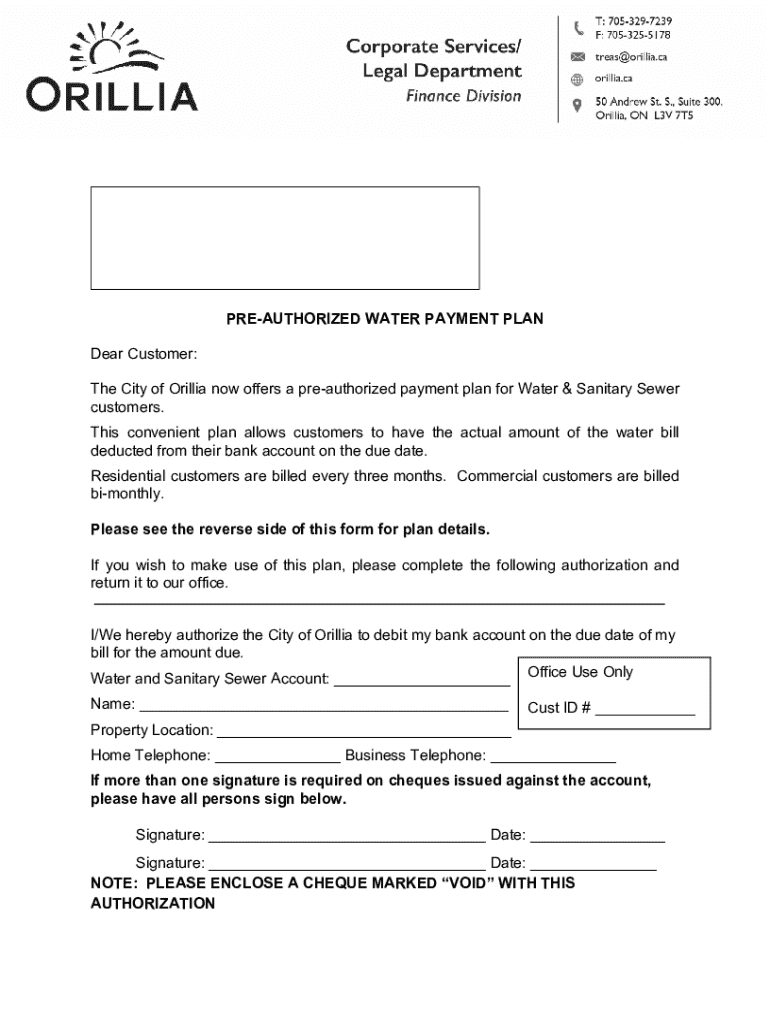

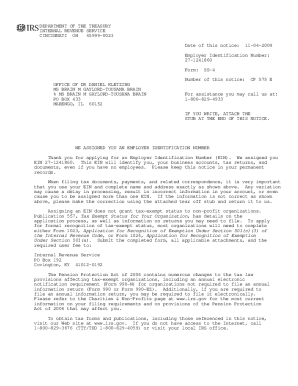

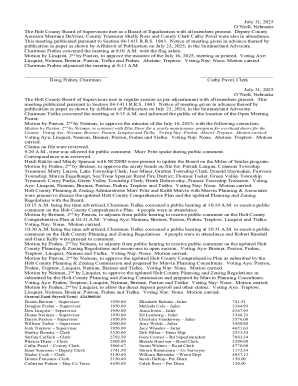

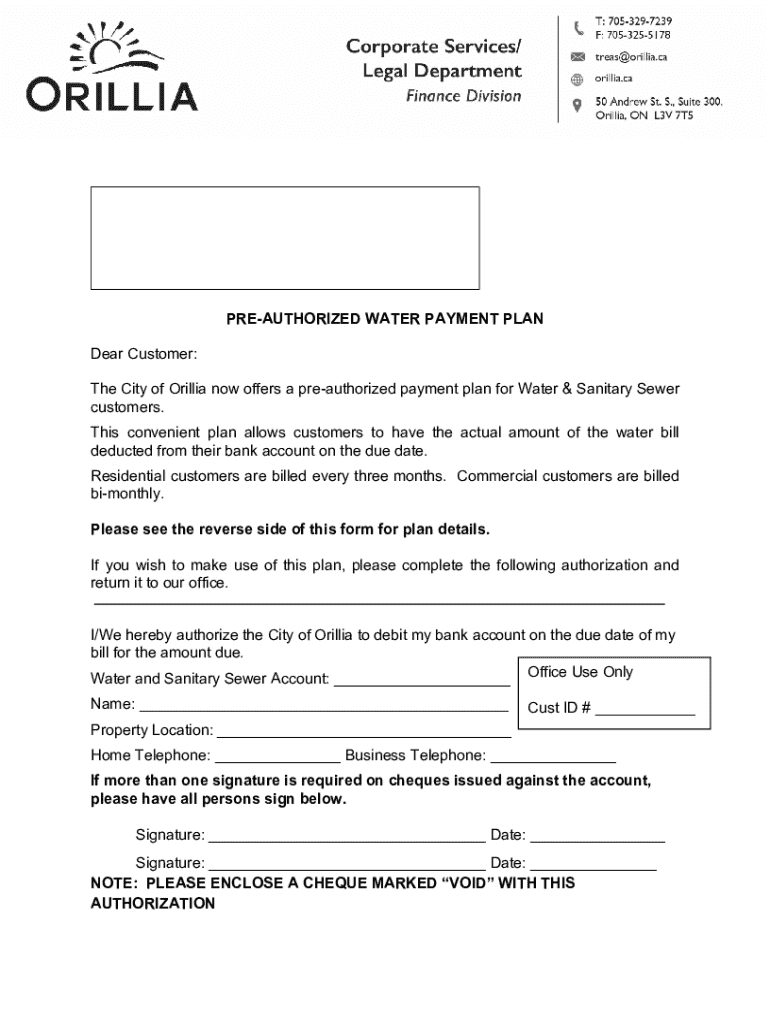

The Tax & Water Payments Form is a crucial document for homeowners and tenants, enabling them to make necessary payments for real estate taxes and water utilities. These payments are often assessed on an annual basis and can significantly affect personal finance. Accurate submission of this form ensures you avoid penalties and can manage your obligations effectively.

Getting your submissions right is vital not only for compliance but also for maintaining good standing with your local county and banks. Deadline awareness is critical; late payments can result in fines, increased debts, or even property liens. Individuals must familiarize themselves with local deadlines to avoid these issues.

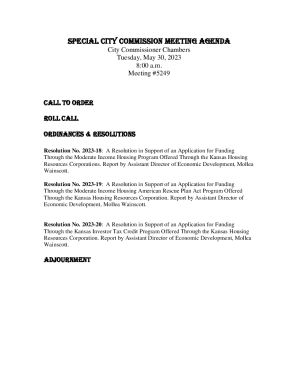

Accessing the Tax & Water Payments Form on pdfFiller

Finding the Tax & Water Payments Form on pdfFiller is straightforward. Navigate to the platform's search bar and type in the form's name. You’ll be directed to various templates that suit your needs. Access can be granted by creating an account or simply logging in if you already have one. Registration is free and enables full access to all the document templates offered.

Utilizing a cloud-based platform like pdfFiller offers numerous benefits. You can fill out, edit, and manage your forms from virtually anywhere—ideal for busy individuals and teams alike. Plus, collaboration features make it easy for multiple users to work on the same document seamlessly, enhancing productivity.

Step-by-step guide to filling out the form

When completing the Tax & Water Payments Form, specific information is required. Essential sections include personal identification such as your name and address, details concerning property assessment, and your utility consumption numbers. Be sure to collect supporting documents that confirm these details to minimize mistakes.

To ensure accuracy in your entries, double-check spelling and numbers against official documents. An interactive checklist on pdfFiller can assist in gathering required data before you even begin filling in the form.

Editing the Tax & Water Payments Form

Once your form is filled out, you may need to make edits. pdfFiller provides a variety of editing tools. This includes text boxes for adding additional information, and annotation features for providing notes where necessary. Use these tools to clarify points or leave reminders for collaborators.

It’s essential to save all versions of your document as you make changes. This allows for easy retrieval of previous drafts in case any important information is lost. Utilizing pdfFiller’s version control feature ensures that you won’t accidentally overwrite essential data.

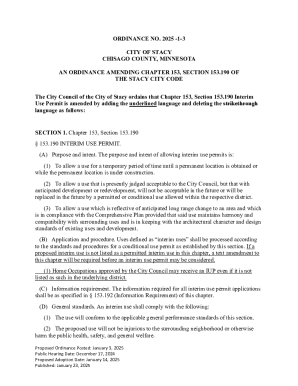

eSigning the Tax & Water Payments Form

Having an electronic signature on your Tax & Water Payments Form is essential for formal acceptance. Electronic signatures are not just convenient; they also offer a layer of security and authenticity. On pdfFiller, signing your document is simple: select the eSignature option and follow the prompts to sign digitally.

pdfFiller ensures that your signature is protected with advanced encryption methods. This means your signature is stored securely, accessible only by you, and ensures that your transaction remains confidential.

Submitting your Tax & Water Payments Form

After signing your Tax & Water Payments Form, it’s time to submit it. pdfFiller offers multiple methods for submission, including email submissions directly to your county’s tax office, and options for direct mailing. Depending on local regulations, you may also be able to submit your forms via an integrated system set up by your government agency.

Common issues during submission could include incorrect recipient addresses or missing information. Always verify that your contact details are accurate, and consider setting up a system for tracking your submissions to avoid mistakes.

Managing your Tax & Water Payments

Tracking the status of your submission is crucial to ensure all payments are processed on time. pdfFiller allows you to log in and view the status of your payment, reducing anxiety around due dates. Setting reminders for future payments is equally important to avoid early or late payments that could lead to unnecessary convenience fees.

Creating a payment calendar can simplify your financial obligations. This calendar can mark due dates and remind you of upcoming payments, helping to manage deadlines efficiently.

Tools and features to enhance your experience

pdfFiller is equipped with several interactive tools that can make navigating the Tax & Water Payments Form simpler. Whether you are working independently or as part of a team, collaborative features enable seamless sharing and real-time updates essential for successful document handling.

To enhance your experience further, explore features such as cloud storage for easy access, automated reminders for payment schedules, and an intuitive dashboard that allows you to manage all documents at a glance.

Special considerations

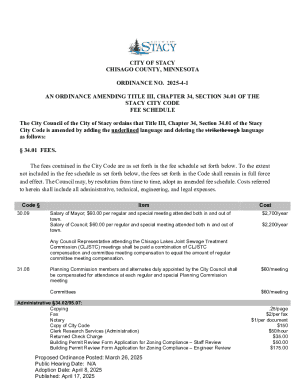

Understanding the convenience fees associated with different payment methods is essential. Various payment processors and banks may charge fees based on the method you select, such as eCheck, credit/debit cards, or direct bank transfers. Being informed about these fees can aid in making more cost-effective decisions.

Consider exploring bill payment assistance programs if you find it challenging to manage your payment obligations. Many counties offer such programs designed to help low-income families or individuals facing financial hardships.

FAQs about the Tax & Water Payments Form

Users frequently have questions related to the Tax & Water Payments Form. Common queries include how to ensure their forms are processed on time, what to do if they missed a payment deadline, and the specifics of filling out certain sections of the form. Addressing these questions is vital to ensure confidence in your submission process.

For more in-depth answers, pdfFiller provides additional resources and options for contacting support staff who can assist you based on specific needs and feedback.

Stay connected with pdfFiller

Engaging with pdfFiller ensures that you remain updated about the latest features, tools, and document templates. You may consider subscribing to updates or participating in community forums to learn from others’ experiences and share your own insights.

Feedback mechanisms are in place for users who wish to contribute to continuous improvement of the pdfFiller platform. Taking part in these can help shape the platform to better meet your needs and preferences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax amp water payments in Gmail?

How can I modify tax amp water payments without leaving Google Drive?

Can I create an electronic signature for signing my tax amp water payments in Gmail?

What is tax amp water payments?

Who is required to file tax amp water payments?

How to fill out tax amp water payments?

What is the purpose of tax amp water payments?

What information must be reported on tax amp water payments?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.