Get the free DISCLOSURE OF LIEN AGAINST REAL PROPERTY DO ...

Get, Create, Make and Sign disclosure of lien against

Editing disclosure of lien against online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disclosure of lien against

How to fill out disclosure of lien against

Who needs disclosure of lien against?

Disclosure of Lien Against Form: A Comprehensive Guide

Understanding liens: What you need to know

A lien is a legal claim or right against a property, usually towards securing the payment of a debt. The primary purpose of a lien is to protect the interests of the creditor by providing them a way to collect what they're owed. Without a proper understanding of liens, you could face severe consequences during property transactions.

There are several types of liens that one should be aware of, including consensual liens (like mortgages), statutory liens (imposed by law), and judgment liens (arising from court judgments). Each type serves different purposes and has different legal implications, making it critical for potential buyers and sellers to be well-informed.

The importance of knowing about liens cannot be overstated. Liens can impact property ownership, transfer, and valuation. A property with undisclosed liens might lead to financial losses, further legal issues, and could even derail real estate deals.

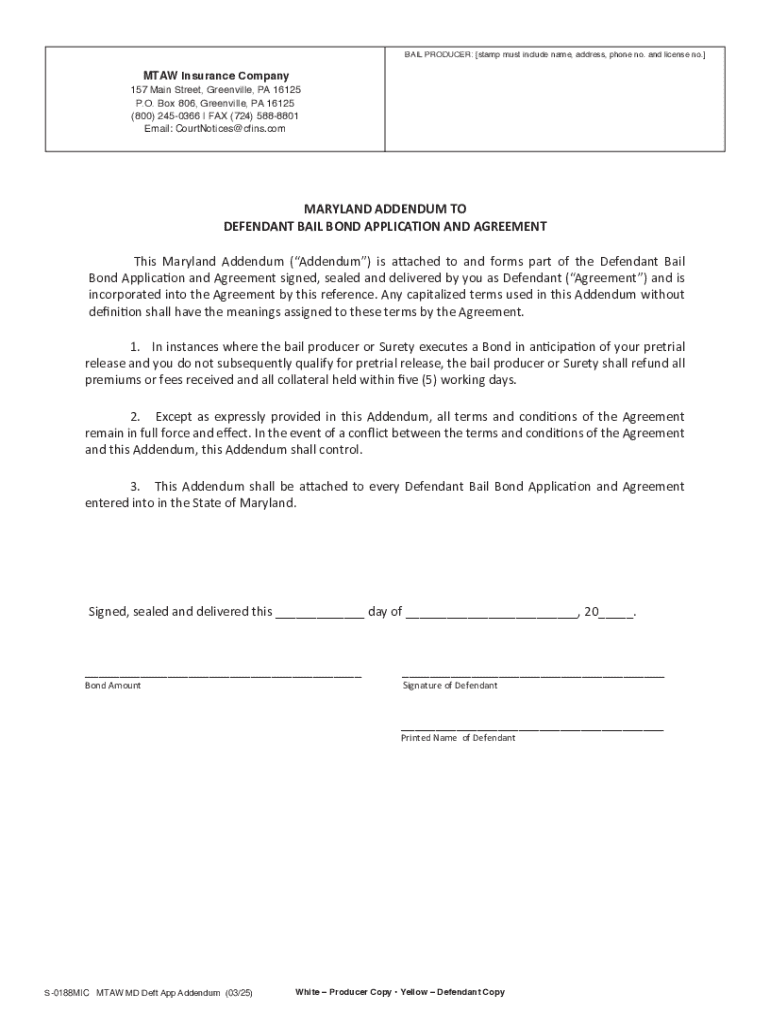

The role of the disclosure of lien against form

The disclosure of lien against form serves a crucial purpose in real estate transactions. This document is used to formally notify parties involved in a property transaction about any existing liens on the property. By doing so, it upholds transparency, ensuring that potential buyers are fully informed about the financial obligations associated with the property.

Failing to disclose a lien can have serious legal implications. It can lead to lawsuits, loss of trust, and financial liabilities. Additionally, the form impacts property value and buyer decisions; undisclosed liens may cause potential buyers to reconsider or negotiate the purchase price, affecting the seller’s bottom line.

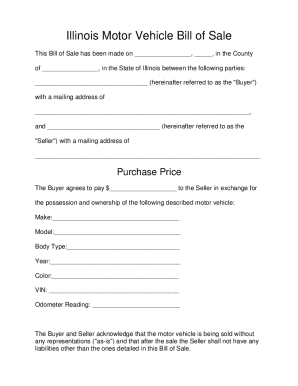

Key components of the disclosure of lien against form

Understanding the key components of the disclosure of lien against form is essential for accurate completion. Essential fields typically include:

Explanations of terms commonly found on the form, such as 'lienor' (the party that holds the lien) and 'mortgage' (a specific type of lien), are also necessary to prevent confusion and ensure completeness.

Lastly, the importance of accurate information cannot be overstated; inaccuracies can lead to disputes and invalidate the disclosure.

Step-by-step guide to completing the disclosure of lien against form

Completing the disclosure of lien against form can seem daunting, but breaking the process down into manageable steps can simplify it significantly.

Step 1: Gathering Necessary Information. Before you start filling out the form, collect crucial documents such as the property deed, lien documents, and any communication with lienors.

Step 2: Filling Out the Form. Carefully fill in each section of the form, ensuring that all information is accurate. Common mistakes to avoid include missing signatures or incorrect lien amounts.

Step 3: Final Review. Once completed, review the form meticulously for any errors or omissions.

Step 4: Notarization Process. Having the document notarized adds an extra layer of legitimacy; seek a notary in your area, and understand that notarization formalizes the agreement and can help prevent future disputes.

Filing and submitting the disclosure of lien against form

The next essential step is filing the form with the relevant authorities. Generally, this would be a county clerk’s office or a similar government entity responsible for property records. Check your local regulations as filing requirements can vary significantly.

Methods for submitting the form include online submission through a government portal, mailing a physical copy, or even in-person submissions, depending on local policies.

Deadlines for submission may also vary, so it’s crucial to be aware of these to avoid penalties. Ensure you consult with local property laws to have clarity on timelines.

Common questions about disclosure of lien against form

Several questions frequently arise about the disclosure of lien against form. If you discover an error after filing, the process to amend your disclosure should be clearly outlined by your local jurisdiction; usually, you will need to file an amendment form.

Not disclosing a lien properly can have significant repercussions, including legal penalties or challenges in future property transactions. Understanding how to navigate these waters is vital for maintaining compliance and protecting your interests.

Tools and resources for managing liens

Utilizing effective document management tools can streamline the lien disclosure process. Platforms like pdfFiller offer integrated solutions for filling out, editing, and managing your disclosure of lien against form.

These cloud-based platforms provide numerous benefits, including ease of access, collaboration features, and options for eSignature, facilitating seamless communication among involved parties.

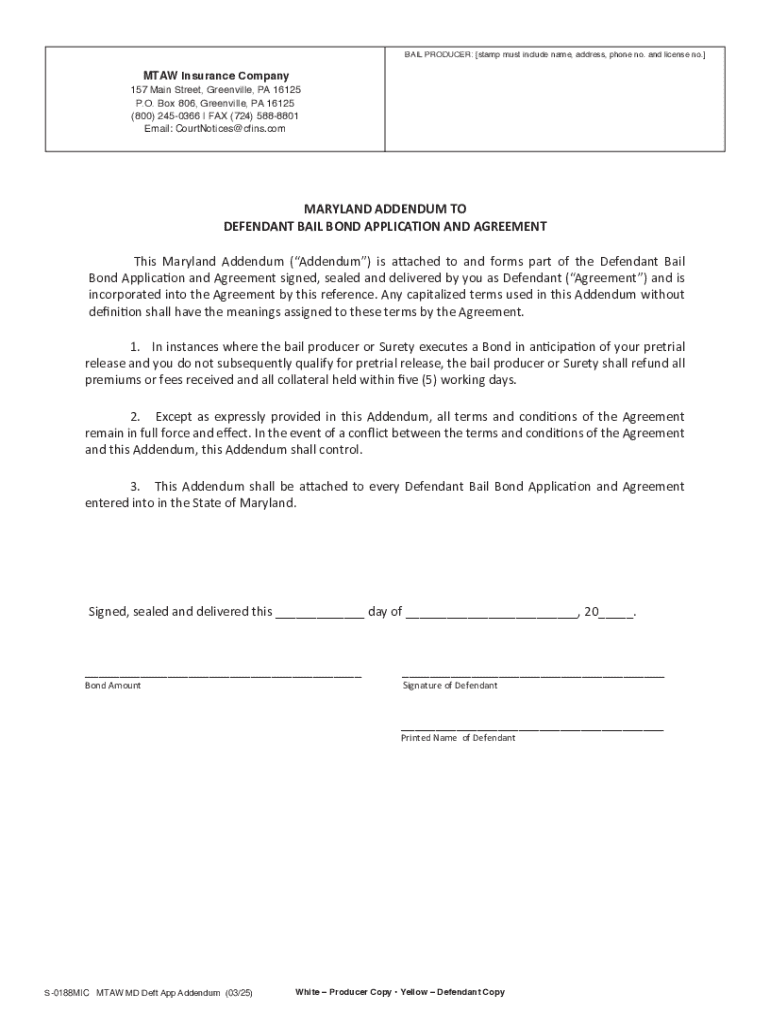

Navigating state-specific regulations

Regulations governing the disclosure of liens can vary considerably from one state to another. For instance, Florida has specific guidelines about lien disclosures, detailed in the 2025 Florida Statutes. It’s crucial to consult these statutes and adhere to them to ensure compliance.

To navigate these state-specific regulations more efficiently, utilize online resources and local legal advice to inform yourself about the particular requirements in your region.

Real-life scenarios: Lien disclosure challenges

Examining real-life scenarios can shed light on common issues that arise with lien disclosures. For example, one case involved a seller failing to disclose a lien, resulting in a lawsuit that led to costly delays and financial losses.

Lessons learned from these issues emphasize the importance of transparency and thorough due diligence in property transactions. It’s vital for both buyers and sellers to understand the significance of a comprehensive lien disclosure.

Conclusion of the lien disclosure process

In summary, executing the disclosure of lien against form with diligence and accuracy is paramount for anyone involved in property transactions. This process not only safeguards your legal rights but fosters trust among buyers and sellers.

Make it a final routine to check all details meticulously and ensure compliance with state-specific regulations before finalizing any real estate deal. A comprehensive checklist addressing all previous components can be a useful tool in this regard.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the disclosure of lien against in Chrome?

How do I edit disclosure of lien against on an iOS device?

Can I edit disclosure of lien against on an Android device?

What is disclosure of lien against?

Who is required to file disclosure of lien against?

How to fill out disclosure of lien against?

What is the purpose of disclosure of lien against?

What information must be reported on disclosure of lien against?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.