Get the free Surety: - MTAW Insurance Company

Get, Create, Make and Sign surety - mtaw insurance

How to edit surety - mtaw insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out surety - mtaw insurance

How to fill out surety - mtaw insurance

Who needs surety - mtaw insurance?

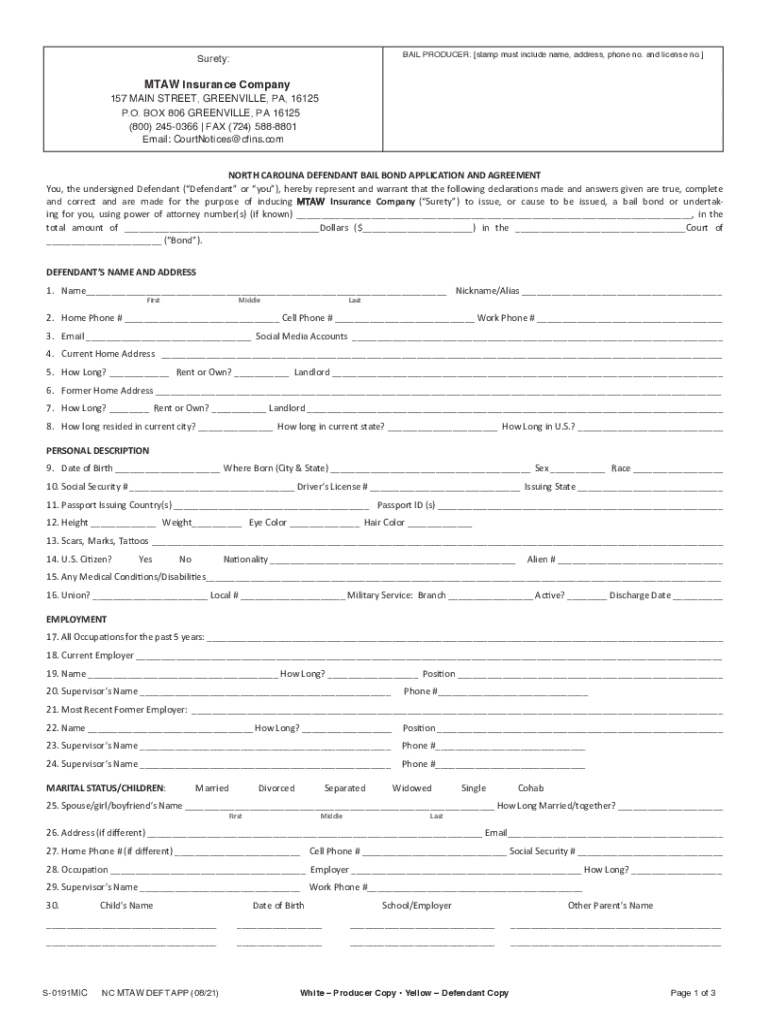

Understanding the Surety - MTaw Insurance Form

Understanding the surety - MTaw insurance form

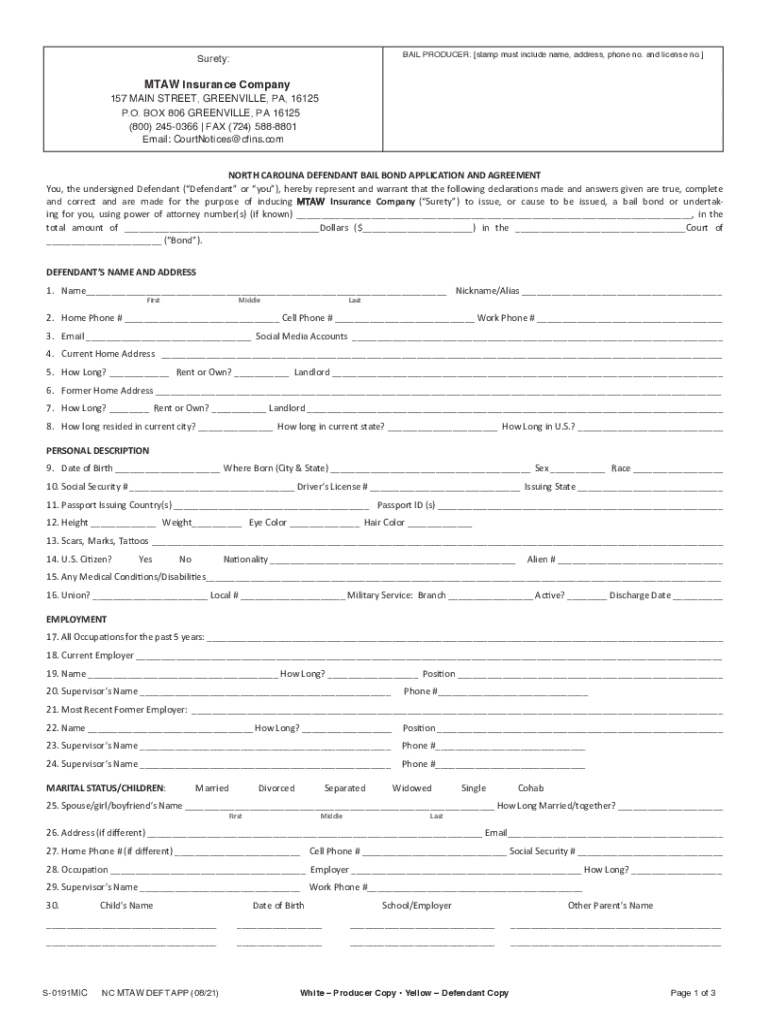

The Surety - MTaw Insurance Form is a crucial document in the world of surety bonding, specifically designed to facilitate agreements between the surety company, the principal, and the obligee in various contractual scenarios. This form serves the primary purpose of ensuring that financial obligations are met, protecting all parties involved if the principal fails to uphold their end of the contract. Within the insurance landscape, the MTaw form upholds significant importance, as it guarantees that obligations under various agreements, particularly in construction and service sectors, are fulfilled, thus safeguarding the parties reliant on the contractor's performance.

The importance of the Surety - MTaw Insurance Form extends beyond mere documentation. Surety bonds, facilitated by such forms, play a critical role in maintaining professional credibility and trust in contractual agreements. This form is essential in diverse fields such as construction, where contractors must guarantee timely and quality completion of projects. A properly filled out MTaw form ensures compliance with legal standards and reinforces the contractor's assurance to meet all stipulated terms and conditions, thereby alleviating potential disputes.

Key components of the MTaw insurance form

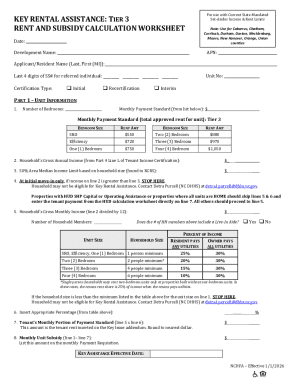

The Surety - MTaw Insurance Form comprises several vital components that are essential for a comprehensive understanding of the insurance agreement. Key details that need to be filled out include personal information, such as the applicant's name, contact details, and business identifiers. Additionally, the form requires comprehensive financial data to assess the applicant’s ability to undertake the obligations stipulated in the contract. Project specifics are also crucial; these include details about the nature of the work, estimated timeline, and total project costs.

Common terminologies associated with the MTaw form include 'surety', which refers to the party guaranteeing the principal's obligations; 'obligee', the entity requiring the bond; and 'principal', the party who is obligated to fulfill the terms of the contract. Understanding these terms is fundamental for applicants to navigate the requisite sections of the form effectively, ensuring they provide accurate information to prevent delays or rejections during the bonding process.

Preparing to complete the form

Before diving into the completion of the Surety - MTaw Insurance Form, gathering the necessary information is paramount. This preparation involves compiling a checklist of essential documents, which should include financial statements, proof of current licensure, a detailed project plan, and any previous surety bonds obtained. Having all required information at hand enhances accuracy and expedites the form-filling process. Additionally, accurate personal information is crucial to avoid any discrepancies that could lead to the rejection of your application.

Understanding eligibility criteria plays a critical role in successfully completing the form. Common misconceptions often arise around insurance eligibility; prospective applicants may assume that previous bond rejections disqualify them from future applications. In reality, focusing on improving the issues that led to past rejections—such as rectifying financial shortcomings or enhancing project planning—can vastly increase one’s chances of being favorably evaluated in the current application.

Step-by-step guide to filling out the form

Filling out the Surety - MTaw Insurance Form requires a methodical approach, as several sections must be completed accurately. The first section typically requests personal information; this includes the applicant's name, address, and contact number. Ensure that all details are current and correctly formatted, as errors here can lead to processing delays. Next, the surety bond details must be outlined, which typically encompass the bond amount and specific terms under which the bond will be active.

The subsequent section requires financial disclosures; complete this by providing up-to-date financial statements, tax documents, and any supporting financial information. This data substantiates your ability to fulfill the obligations outlined in the project agreement. Following this, the project information section requests detailed descriptions of the project, including timelines, costs, and the scope of work. Lastly, ensure you sign the document and include any necessary designees or representatives required by law or in the bond agreement. Each of these steps is vital for a complete application.

Common errors to avoid include incorrect personal details and omissions in project descriptions. Frequently asked questions per section often arise regarding how detailed financial data should be. It's essential to provide complete financial statements to showcase your financial health and capability to fulfill your obligations. Accurate documentation not only expedites the process but contributes to the overall credibility of your application.

Tools and resources for form management

Utilizing tools like pdfFiller for document creation enhances the ease of handling the Surety - MTaw Insurance Form. pdfFiller offers features that are particularly relevant for managing this form, including its user-friendly interface that simplifies the editing, signing, and sharing processes. Accessing the MTaw form on pdfFiller allows users to fill out, save, and send documents securely from any location without printing or the hassle of manual submissions.

For teams working collaboratively, pdfFiller’s collaboration features offer tremendous advantages. Users can share forms with team members, granting specific permissions for editing or viewing, which limits confusion and keeps roles clear. This system supports real-time collaboration, allowing multiple users to work on the document simultaneously, which is particularly beneficial when time-sensitive projects are at stake. By employing these functionalities, teams can enhance the efficiency of document management while ensuring compliance with all necessary terms and conditions.

Submitting the Surety - MTaw Insurance Form

Before submission, it's crucial to conduct a thorough review of the completed Surety - MTaw Insurance Form. Establishing a checklist for final review can assist in identifying any discrepancies. Key aspects to examine include the accuracy of all personal information, completeness of project details, and ensuring all required signatures are included. Taking the time for this last review prevents unnecessary delays in processing and potential rejection due to minor errors.

Once you are confident in the form’s accuracy, the submission process can begin. Submitting electronically is often the most efficient method; follow the precise electronic submission guidelines outlined by the surety company. Alternatives may include mail or in-person delivery, depending on specific requirements. Always inquire about confirmation procedures to guarantee that the application has been received and is under review.

After submission: what to expect

Tracking your application status post-submission is a crucial step in the process. Most surety companies provide a reference number or a tracking link to allow applicants to monitor their submissions. It’s advisable to maintain communication with the surety company and inquire about typical processing times. Having useful contacts and resources available can significantly streamline follow-ups, ensuring you stay informed throughout the review process.

Understanding your next steps following the approval or denial of your application is vital. If approved, the surety company will issue the bond, allowing you to proceed with your project. Conversely, if your application is denied, take the time to request clarification on the reasons leading to the decision. This feedback will provide guidance on how to rectify the situation for future applications. Knowledge of these outcomes helps maintain a proactive approach in managing your surety records and improving future applications.

Tips for success with surety and MTaw insurance

To enhance the success of your Surety - MTaw Insurance Form application, it is crucial to be aware of common pitfalls that applicants often encounter. Frequent mistakes include submitting incomplete information, miscalculating required bond amounts, and misunderstanding terms. Staying informed and prepared will significantly reduce these risks.

Best practices for future applications include maintaining organized financial records, cultivating strong relationships with surety companies, and continuously improving on past applications based on feedback received. Establishing open lines of communication ensures that any questions can be promptly addressed, reinforcing your commitment to meeting all terms and conditions laid out in the bonding agreement.

Interactive tools and support

Providing quick links to essential resources is a great way to guide users in navigating the Surety - MTaw Insurance Form efficiently. Potential users can access relevant articles and guides on the pdfFiller platform, which contains specific instructions and tips for leveraging PDF forms. These resources empower users to complete their forms with confidence, ultimately enhancing their understanding and capability in managing crucial documentation.

Additionally, interactive tools provided by pdfFiller are incredibly helpful. Utilizing templates specifically designed for the MTaw form allows for easy and quick completion. Moreover, implementing collaborative options enables teams to edit and finalize documents efficiently. Such features not only streamline the process but help ensure that all terms, conditions, and legal requirements are met before submitting the form.

Conclusion

The Surety - MTaw Insurance Form is an indispensable document that enhances the reliability and safety of contractual agreements across various sectors. By understanding each aspect of the form, preparing thoroughly, and applying best practices, applicants can significantly enhance their chances of success. Embracing tools like pdfFiller can further streamline the process, making it accessible from anywhere and ensuring document management is as efficient as possible. Engage with these resources to confidently embark on your bonding journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete surety - mtaw insurance online?

Can I edit surety - mtaw insurance on an Android device?

How do I complete surety - mtaw insurance on an Android device?

What is surety - mtaw insurance?

Who is required to file surety - mtaw insurance?

How to fill out surety - mtaw insurance?

What is the purpose of surety - mtaw insurance?

What information must be reported on surety - mtaw insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.