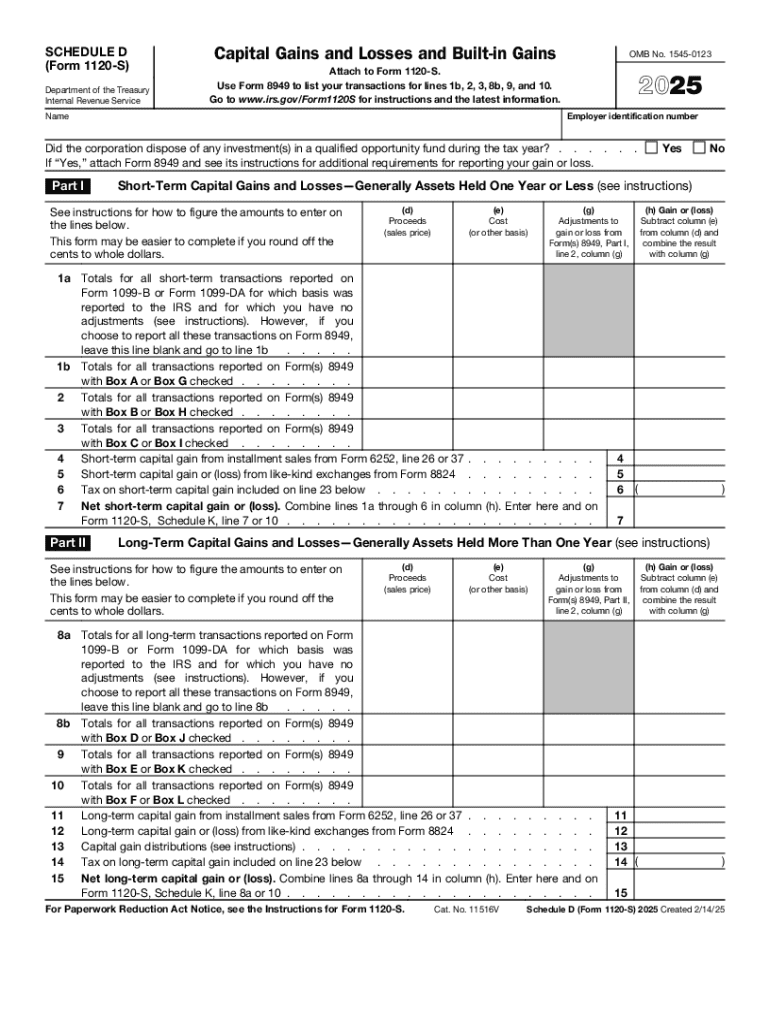

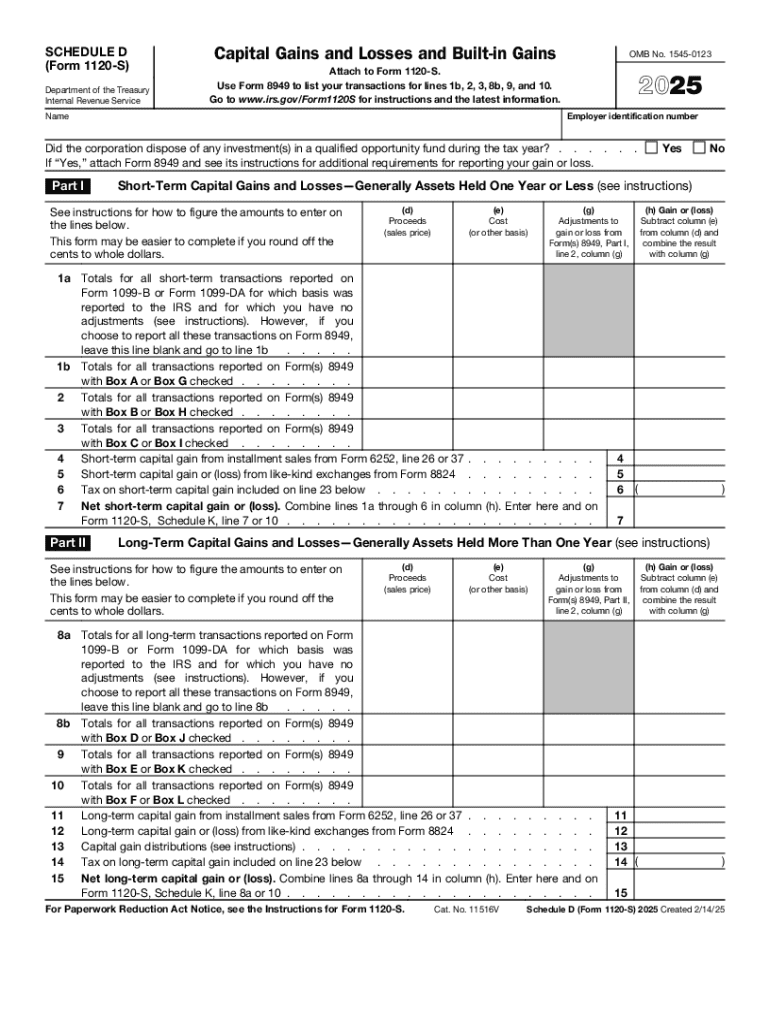

IRS 1120-S - Schedule D 2025-2026 free printable template

Get, Create, Make and Sign IRS 1120-S - Schedule D

How to edit IRS 1120-S - Schedule D online

Uncompromising security for your PDF editing and eSignature needs

IRS 1120-S - Schedule D Form Versions

How to fill out IRS 1120-S - Schedule D

How to fill out 2025 schedule d form

Who needs 2025 schedule d form?

A Comprehensive Guide to the 2025 Schedule Form

Overview of Schedule

Schedule D is a critical tax form used to report capital gains and losses to the IRS. As a taxpayer, it's essential to understand its purpose, which is to reconcile the gains and losses you've experienced from various investments over the year. Accurate reporting of these figures can impact your overall tax liability, so it's vital not to overlook this document.

Who needs to file Schedule ?

Understanding whether you need to file Schedule D is crucial, as not everyone is required to do so. Generally, individuals who have engaged in investment activities or had capital transactions during the tax year must file this form. This requirement extends to corporations and partnerships that also report capital gains.

Understanding capital gains and losses

Capital gains represent the profit from the sale of an asset, while capital losses occur when the sale of an asset results in a loss. Understanding the distinction between short-term and long-term capital gains is vital, as they are taxed differently based on how long you've held the investment.

Preparing to complete Schedule

Before you begin filling out the 2025 Schedule D form, it's essential to gather all necessary documents and records. These records will provide valuable information necessary for accurate tax reporting and can help you avoid potential audits.

Step-by-step guide to filling out Schedule

Completing Schedule D requires attention to detail and organization. Start by gathering necessary information about your investments, like types, dates, and amounts.

Interactive tools for Schedule

Leveraging interactive tools can streamline the process of filling out your Schedule D form. Online calculators for capital gains can help determine what taxes you’ll owe based on your investment activities.

Common mistakes to avoid

When filling out the 2025 Schedule D form, vigilance is necessary. Common pitfalls can lead to errors that may impact your tax situation significantly.

Filing Schedule : E-filing vs. paper

The method of filing your Schedule D form can influence the processing of your tax return. E-filing has become popular due to its efficiency compared to traditional paper filing.

FAQs about Schedule

Many taxpayers have questions about Schedule D, especially if it’s their first year filing. Understanding the answers can alleviate concerns and help ensure compliance.

Managing your tax documents with pdfFiller

Organizing your tax documents is crucial for compliance and future reference. pdfFiller provides a robust platform for managing all your essential tax forms.

Tips for future tax preparation

Maintaining an efficient approach to tax preparation can save time and reduce headache during tax season. By adopting proactive strategies now, you'll be better equipped for future filings.

People Also Ask about

Who must file form 8949?

Is Schedule D required for capital gain distributions?

Is Schedule D required if form 8949 is used?

Do I need to file Schedule D 2021?

What can be reported directly on Schedule D?

Is Schedule D required?

What transactions are eligible to be reported directly on Schedule D?

Is Schedule D the same as Form 1040?

Do all capital gain distributions have to be reported on Schedule D?

When can you use Schedule D instead of 8949?

Do I need to fill Schedule D?

When should I use Schedule D or form 8949?

How do I know if I need to file form 8949?

What are the requirements for filing a Schedule D?

Is form 8949 the same as Schedule D?

Can I file Schedule D without 8949?

What are the main example of Schedule D income?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 1120-S - Schedule D?

How can I edit IRS 1120-S - Schedule D on a smartphone?

How do I complete IRS 1120-S - Schedule D on an Android device?

What is 2025 schedule d form?

Who is required to file 2025 schedule d form?

How to fill out 2025 schedule d form?

What is the purpose of 2025 schedule d form?

What information must be reported on 2025 schedule d form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.