Get the free RTGS NEFT Application FormPDFFinancial Services

Get, Create, Make and Sign rtgs neft application formpdffinancial

Editing rtgs neft application formpdffinancial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rtgs neft application formpdffinancial

How to fill out rtgs neft application formpdffinancial

Who needs rtgs neft application formpdffinancial?

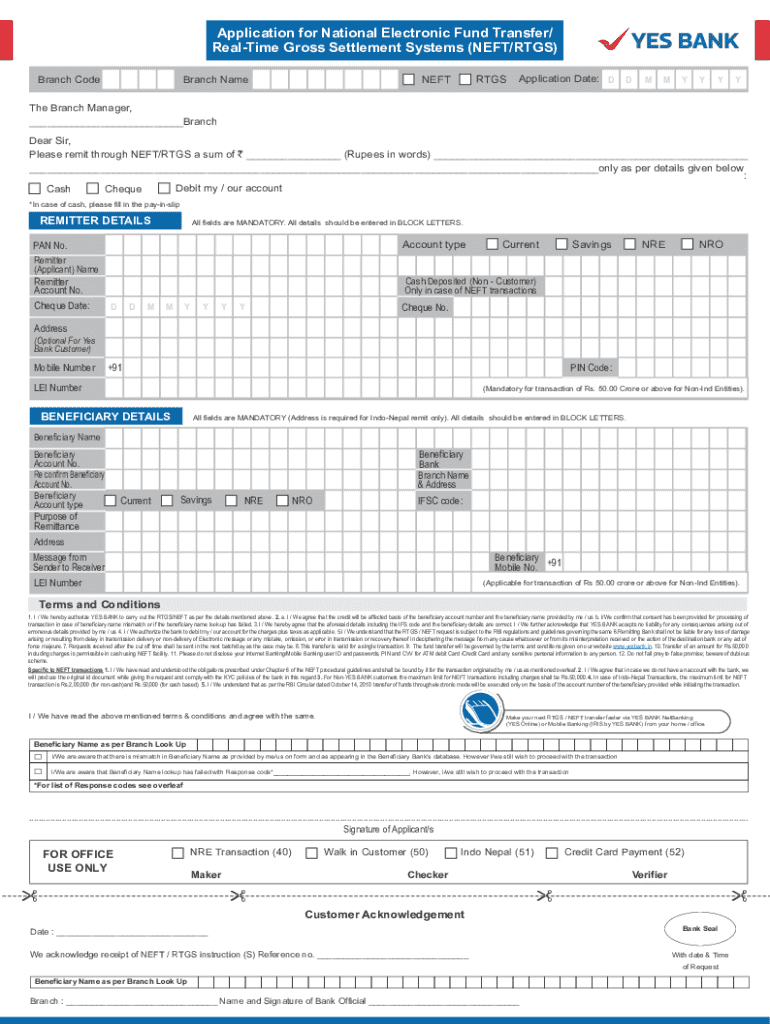

Comprehensive Guide to RTGS NEFT Application Form PDF Financial Form

Overview of RTGS and NEFT

RTGS (Real-Time Gross Settlement) and NEFT (National Electronic Funds Transfer) are crucial financial services provided by banks to facilitate the transfer of funds electronically. While both systems are designed for transferring money from one bank account to another, they differ significantly in terms of processing times and transaction limits.

RTGS is aimed at high-value transactions, offering real-time processing for transactions above a certain threshold, often set at ₹2 lakh in India. This makes the service suitable for urgent and large transactions. In contrast, NEFT allows transfers of any amount, albeit processed in a batch-wise manner, which typically results in slower fund availability.

Use cases of RTGS and NEFT

When deciding between RTGS and NEFT, understanding their use cases can streamline your banking experience. Opt for RTGS when you need to transfer a substantial amount urgently, such as for a real estate transaction or large business payments that require immediate settlement. On the other hand, NEFT is your go-to option for personal remittances, utility payments, or small business transactions where immediacy is less critical.

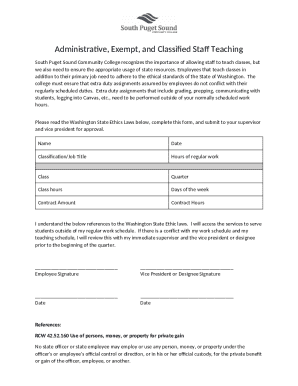

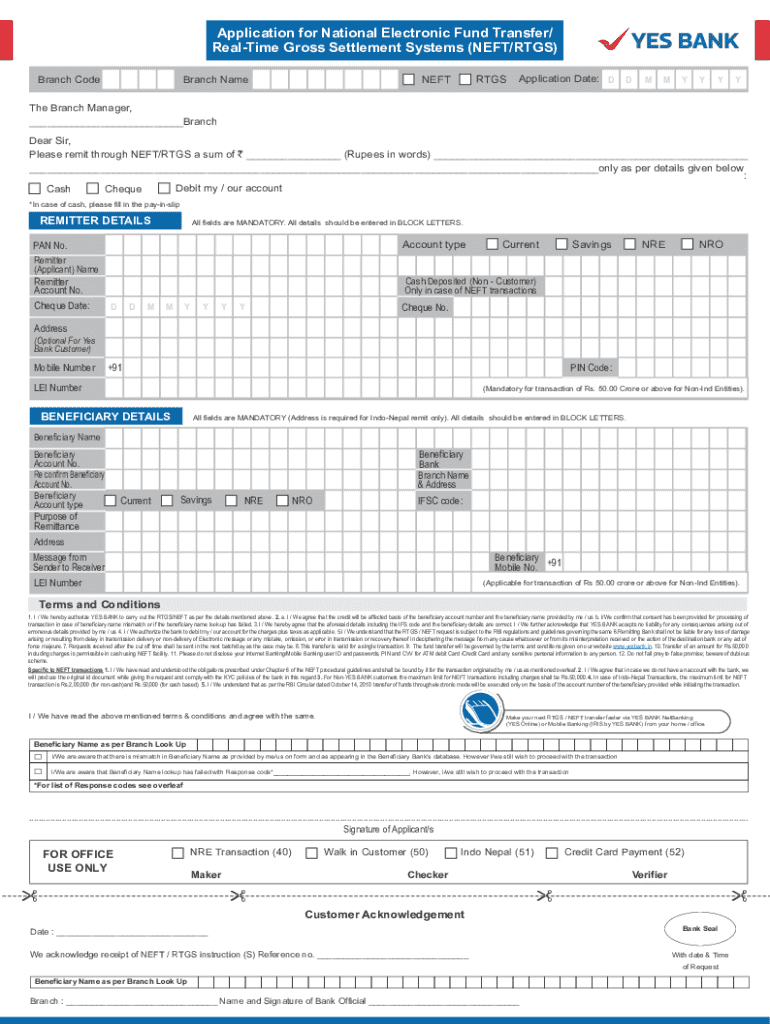

Understanding the application form

The RTGS NEFT application form is essential for initiating any transfer through these systems. Filling it out accurately ensures the bank processes your transaction without unnecessary delays. Key information typically required includes personal identifying details, bank account numbers, and the recipient’s bank details.

Understanding the type of application form you need is critical. There are generally two types: personal and corporate. Personal forms are straightforward, while corporate forms may require additional documentation to verify the entity’s identity and authority to initiate the transaction.

How to access the RTGS NEFT application form

Accessing the RTGS NEFT application form is simple. Most banks provide these forms on their official websites, ensuring ease of download for users. Typically, you can navigate to the bank’s 'Forms' or 'Downloads' section to locate the specific application you need.

Additionally, websites like pdfFiller offer a user-friendly platform to not only access but also to edit and manage these forms. pdfFiller provides features that allow you to fill in the necessary details interactively, making the completion process quick and efficient.

Detailed instructions for filling out the application form

When filling out the RTGS NEFT application form, it’s vital to provide accurate information to avoid delays. The form typically begins with your personal details including your name, address, and account number. Following this, you will need to provide the recipient's details, such as their name, bank name, and the IFSC code, which uniquely identifies the bank and branch of the recipient.

Specific fields in the form may require you to double-check entries, especially the IFSC code, as incorrect information could lead to payment failures. Additionally, ensure all required fields are complete to minimize the risk of rejection.

Editing and customizing your RTGS NEFT application form

With pdfFiller, editing your RTGS NEFT application form becomes unrivaled in ease and efficiency. Users can not only fill out their forms but also edit and customize them according to personal or specific requirements. This includes changing text fields and even adjusting formats for better clarity depending on the context of the transaction.

To edit a form in pdfFiller, users can upload their document, leverage various editing tools, and save their final rendition. This flexibility ensures that the application form is tailored precisely to the user's needs.

Adding digital signatures

The inclusion of a digital signature has become increasingly important in the financial world, providing authenticity and security to your forms. By utilizing pdfFiller, users can add their e-signature to the RTGS NEFT application form without the need for additional software.

This feature not only ensures the form is legally binding but also speeds up the submission process. To add a digital signature, users can follow a simple process to create and affix their electronic signature directly on the document.

Submitting the application form

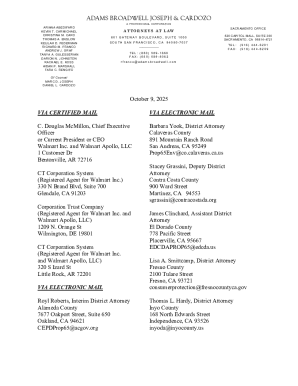

Once your RTGS NEFT application form is complete, the next step involves submission. Depending on your bank's policy, you may choose to submit the form online or in person. Many banks have online portals that allow for direct submission, which is often the most efficient method.

If opting for traditional submission, ensure you have any necessary supporting documentation attached. After submission, keeping track of your application status is crucial—most banks provide tracking options to confirm receipt and processing times.

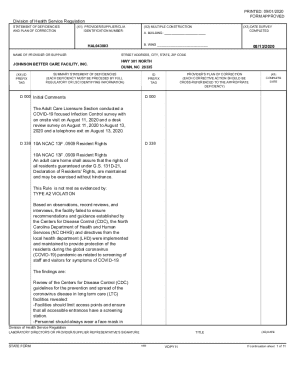

Troubleshooting common issues

After submitting your RTGS NEFT application form, issues may arise, such as form rejection or delays in processing. If your form faces rejection, reviewing the rejection notice can provide insight into what went wrong. Often, information discrepancies or missing details can be the culprit.

In these instances, don’t hesitate to reach out to your bank’s support team. They're typically capable of guiding you through rectifying issues effectively.

Utilizing pdfFiller for document management

pdfFiller also serves as a powerful document management platform. Once you've created and customized your RTGS NEFT application form, you can store it in the cloud, ensuring it’s accessible from anywhere. This cross-device capability is particularly advantageous for individuals and teams managing multiple financial forms.

In addition to storage, pdfFiller offers collaboration tools, enabling teams to work together seamlessly on shared documents in real time. This is particularly useful for businesses that require multiple approvals on financial forms before submission.

Legal and compliance aspects

Understanding the legalities surrounding RTGS and NEFT transactions is crucial for ensuring compliance with banking regulations. Financial institutions require users to fill out forms accurately to prevent fraud and maintain the integrity of electronic transactions. Therefore, vigilance is necessary when completing the RTGS NEFT application form.

Additionally, protecting sensitive information should be a top priority. Users should adopt best practices for secure electronic filings, including using trusted platforms like pdfFiller for managing sensitive financial documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit rtgs neft application formpdffinancial online?

How do I edit rtgs neft application formpdffinancial in Chrome?

How can I edit rtgs neft application formpdffinancial on a smartphone?

What is rtgs neft application formpdffinancial?

Who is required to file rtgs neft application formpdffinancial?

How to fill out rtgs neft application formpdffinancial?

What is the purpose of rtgs neft application formpdffinancial?

What information must be reported on rtgs neft application formpdffinancial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.