IRS 8653 2025-2026 free printable template

Get, Create, Make and Sign IRS 8653

Editing IRS 8653 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8653 Form Versions

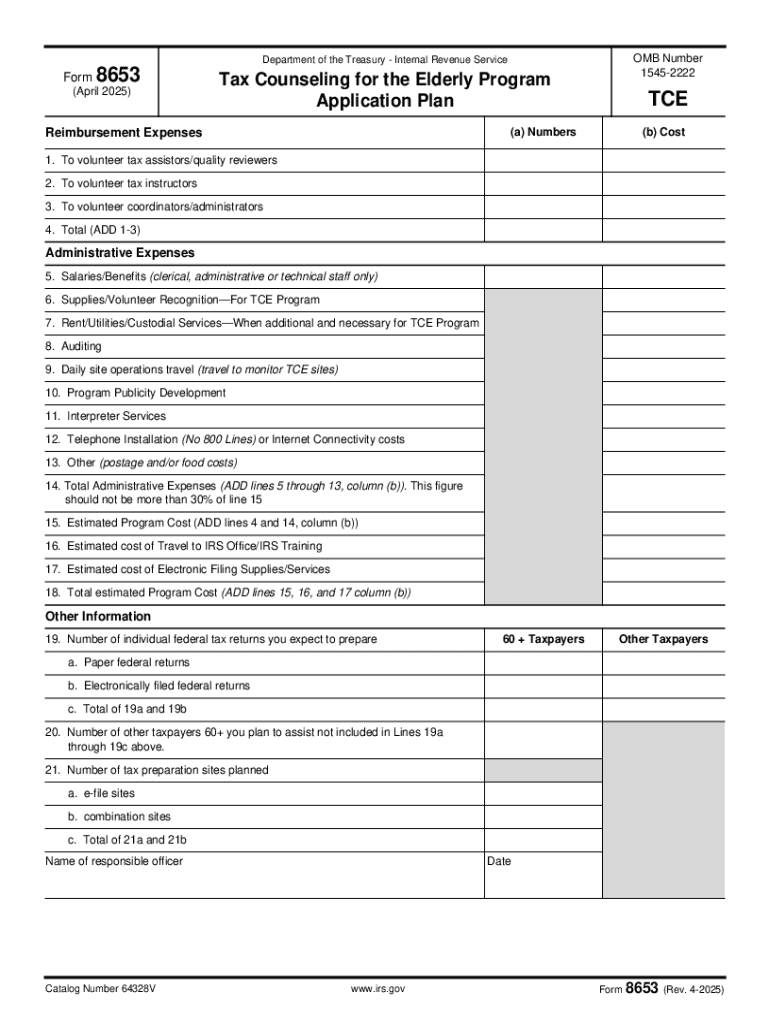

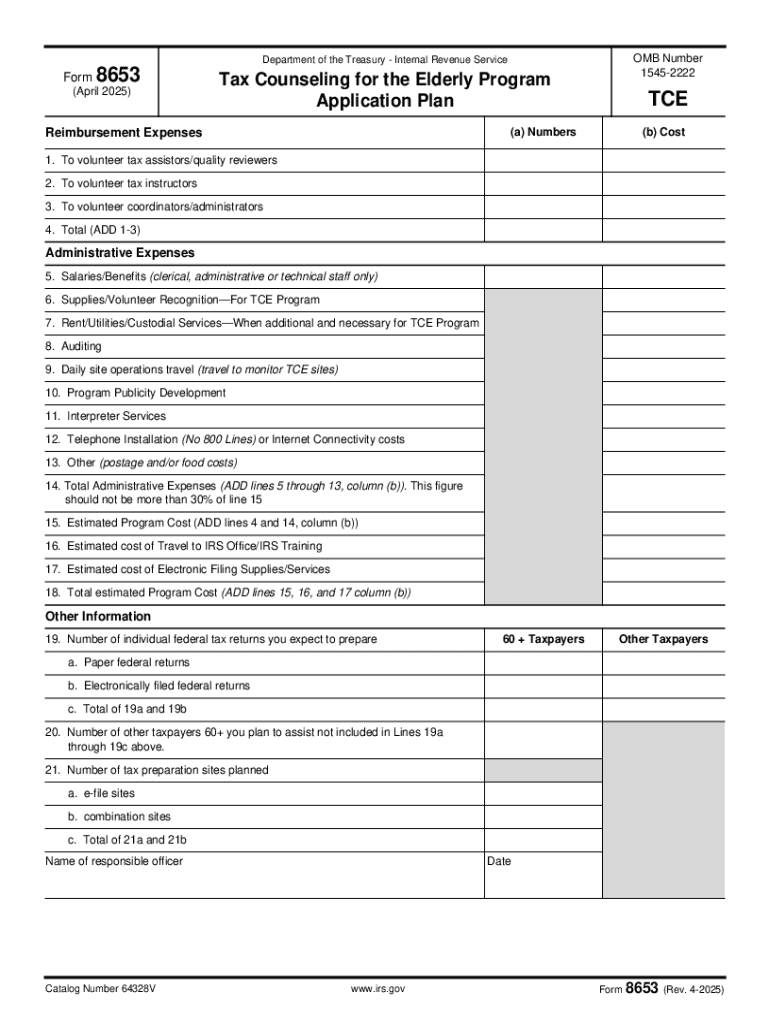

How to fill out IRS 8653

How to fill out form 8653 rev 4-2025

Who needs form 8653 rev 4-2025?

Form 8653 Rev 4-2025: A Complete Guide

Overview of Form 8653 Rev 4-2025

Form 8653 Rev 4-2025 is a crucial document used in the management of various administrative processes. Specifically designed for use by organizations and individuals, this form facilitates numerous operations, making it indispensable in today's fast-paced environment. The primary purpose of Form 8653 is to streamline communication and data management between parties, making sure that all necessary information is clearly outlined and easily accessible.

The 2025 revision has introduced several key features that significantly enhance user experience. Notably, the form has been restructured to improve clarity, thus reducing the chances of errors during completion. Improved instructions and a more intuitive layout set this version apart from its predecessors, ensuring that users can fill it out with minimal delay.

Understanding the use cases for Form 8653

There are specific situations where Form 8653 is essential. For instance, businesses may require the form to report certain compliance measures, while individual users might need it for personal administrative tasks. Whether you're filing for tax relief, reporting payroll information, or managing employee records, understanding when to utilize this form is essential for efficiency.

The users of Form 8653 predominantly include business owners, HR professionals, and compliance officers. Any individual or organization dealing with administrative reporting and compliance in regulated environments can benefit from this form. In particular, it's designed to cater to both large corporations and small businesses, optimizing processes irrespective of scale.

Step-by-step guide to completing Form 8653

Before you even begin filling out Form 8653, it’s crucial to gather all necessary information. Ensure you have your organizational details, relevant identification numbers, and any previous documentation that pertains to your current submission. This preparatory steps will ease the completion process and ensure accuracy.

The form is divided into several sections, each with specific requirements:

Common mistakes can be easily avoided by ensuring that all sections are filled out accurately. Double-check all entered information to prevent delays caused by re-submission.

Editing and updating Form 8653

Making changes after you have completed Form 8653 is straightforward. Once submitted, if you notice any errors or need to provide updates, you should have a plan for making those changes in a timely manner. Most organizations prefer electronic copies, which allow easier revisions.

Version control is essential for maintaining an accurate audit trail. As forms can undergo several revisions, follow best practices for managing updates: save copies with clear versioning, and keep detailed notes on any changes made.

Digital signing and submission process

Digital signature requirements for Form 8653 have become increasingly important. They enhance document security and ensure that all legal aspects of submission are upheld. A valid eSignature verifies the identity of the signatory and adds an extra layer of authenticity.

To eSign Form 8653 using pdfFiller, follow these steps:

Collaboration on Form 8653

When working on Form 8653 as a team, sharing the document for input can enhance collaboration and ensure comprehensive completion. pdfFiller's collaboration tools facilitate easy sharing among users, enabling real-time updates and edits.

To ensure feedback is managed effectively, keep track of all comments and revisions. Utilizing a centralized platform helps maintain clarity during discussions, as everyone can view and respond to feedback directly within the document.

Storing and managing Form 8653

Proper storage of Form 8653 is essential for long-term access and compliance. Utilize pdfFiller’s cloud storage solutions to organize your documents efficiently. Set up folders categorized by project, date, or department to streamline retrieval.

With cloud-based management, you can access Form 8653 from any device—be it mobile, tablet, or desktop—ensuring flexibility and convenience for remote teams.

Troubleshooting common issues

Many users have queries regarding Form 8653, often about submission errors, missing information, or digital signature validity. Addressing these frequently asked questions can significantly ease concerns and assist in the completion process.

If issues arise that cannot be solved through FAQs, reaching out for support is a critical step. pdfFiller offers customer service contacts for assistance with specific problems, enabling streamlined communication and resolution.

Resources for further assistance

In addition to Form 8653, pdfFiller provides a variety of tools and templates that can enhance your administrative workflows. Resources include related forms that complement Form 8653 and optimize processes.

The pdfFiller Learning Center is another invaluable resource, offering tutorials, webinars, and guides focused on document management solutions. Users can expand their understanding and become proficient in a range of document management tasks.

Legal considerations and compliance

Understanding the legal regulations associated with Form 8653 is vital for compliance. Failure to adhere to these regulations could result in penalties or complications with submissions. Always stay informed about the legal landscape that governs the use of this form.

As you fill out and submit Form 8653, ensure that you are compliant with all necessary requirements. This diligence protects both individuals and organizations from liabilities associated with non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 8653 without leaving Google Drive?

Can I create an eSignature for the IRS 8653 in Gmail?

How can I fill out IRS 8653 on an iOS device?

What is form 8653 rev 4-2025?

Who is required to file form 8653 rev 4-2025?

How to fill out form 8653 rev 4-2025?

What is the purpose of form 8653 rev 4-2025?

What information must be reported on form 8653 rev 4-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.