Get the free Monroe County Property Appraiser Office

Get, Create, Make and Sign monroe county property appraiser

Editing monroe county property appraiser online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monroe county property appraiser

How to fill out monroe county property appraiser

Who needs monroe county property appraiser?

Understanding the Monroe County Property Appraiser Form

Understanding the Monroe County Property Appraiser form

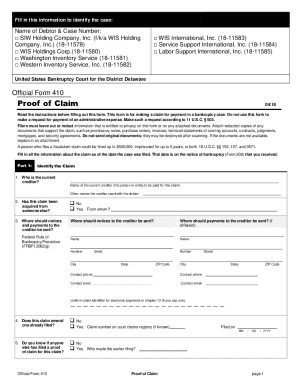

The Monroe County Property Appraiser plays a crucial role in determining the value of properties across Monroe County, Florida. This office is tasked with assessing properties fairly and accurately to ensure that taxes reflect true market values. The Monroe County Property Appraiser form is central to this assessment process. It collects necessary information that facilitates property valuation and substantives the tax implications that come with them.

Completing this form meticulously is essential for homeowners and property owners who wish to ensure they’re paying fair taxes based on accurate information. This form not only establishes ownership but also aids in determining if homeowners qualify for tax exemptions, all crucial for informed and equitable taxation.

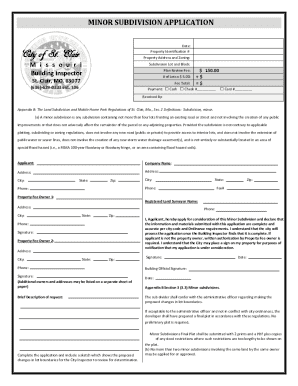

Types of Monroe County Property Appraiser forms

In Monroe County, various forms are associated with property appraisal, each serving a distinct purpose essential for appeals, exemptions, or general assessment. Understanding these forms can simplify the complex appraisal process and help you stay organized.

Step-by-step guide to filling out the Monroe County Property Appraiser form

Filling out the Monroe County Property Appraiser Form effectively involves several clear steps to ensure all required information is provided accurately. Here’s a detailed walkthrough:

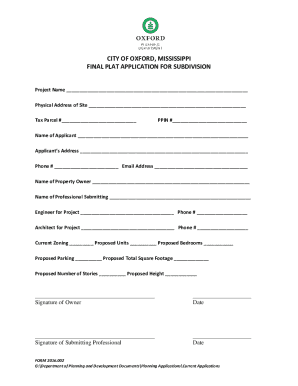

Personal Information Section

Start with your personal information where accurate details such as your name, mailing address, and contact information must be entered. Double-check to ensure these are correct, as inaccuracies can lead to processing delays.

Property Information Section

Identify your property by filling out details that describe its location and characteristics. This includes the property identification number, which can be found on previous tax documents or by contacting local property appraisers.

Valuation Details Section

Offering detailed property value alongside comparable property data can provide clarity in valuation. This may require some research into similar properties in your area.

Signatures and Date Section

Ensure that the form is correctly signed and dated. If necessary, consider whether a notary is required for your document to ensure validation.

Editing and preparing your Monroe County Property Appraiser form

Submissions are often one of the most critical phases in the property appraisal process—ensuring your Monroe County Property Appraiser form is correctly filled out is necessary. Use tools like pdfFiller for editing PDF forms to streamline this process.

Submitting your Monroe County Property Appraiser form

Once your form is filled out and edited, the next step is to submit it. Monroe County allows several methods of submission—keep in mind the preferred timeline for your application.

Be cognizant of deadlines associated with each submission method to avoid unnecessary delays.

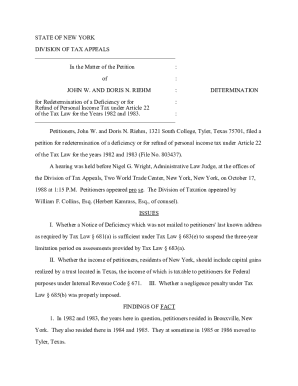

Understanding the appeals process related to property appraisals

Disputes over property valuation can warrant an appeal, granting the property owner a chance to present evidence against the assessment. It’s crucial to understand how this process operates in Monroe County.

Managing your property appraisal documents effectively

Effective document management is vital to navigate the complexities of property appraisal. Keeping records organized ensures you have all necessary information at hand when you need it.

Additional resources and support

For further assistance concerning the Monroe County Property Appraiser form, the Monroe County Property Appraiser's office can be an invaluable resource. Their contact information is often made available on their official website.

Ensuring compliance and staying updated

Keeping up-to-date with property appraisal laws and Monroe County policies is imperative for property owners. Often, new regulations and practices can significantly affect appraisal outcomes and tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the monroe county property appraiser in Gmail?

How do I edit monroe county property appraiser on an iOS device?

Can I edit monroe county property appraiser on an Android device?

What is Monroe County Property Appraiser?

Who is required to file Monroe County Property Appraiser?

How to fill out Monroe County Property Appraiser?

What is the purpose of Monroe County Property Appraiser?

What information must be reported on Monroe County Property Appraiser?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.