Get the free 2021-2025 form irs 8879-s fill online, printable, fillable ...

Get, Create, Make and Sign 2021-2025 form irs 8879-s

Editing 2021-2025 form irs 8879-s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021-2025 form irs 8879-s

How to fill out 2021-2025 form irs 8879-s

Who needs 2021-2025 form irs 8879-s?

A Comprehensive Guide to IRS Form 8879-S (2)

Understanding IRS Form 8879-S

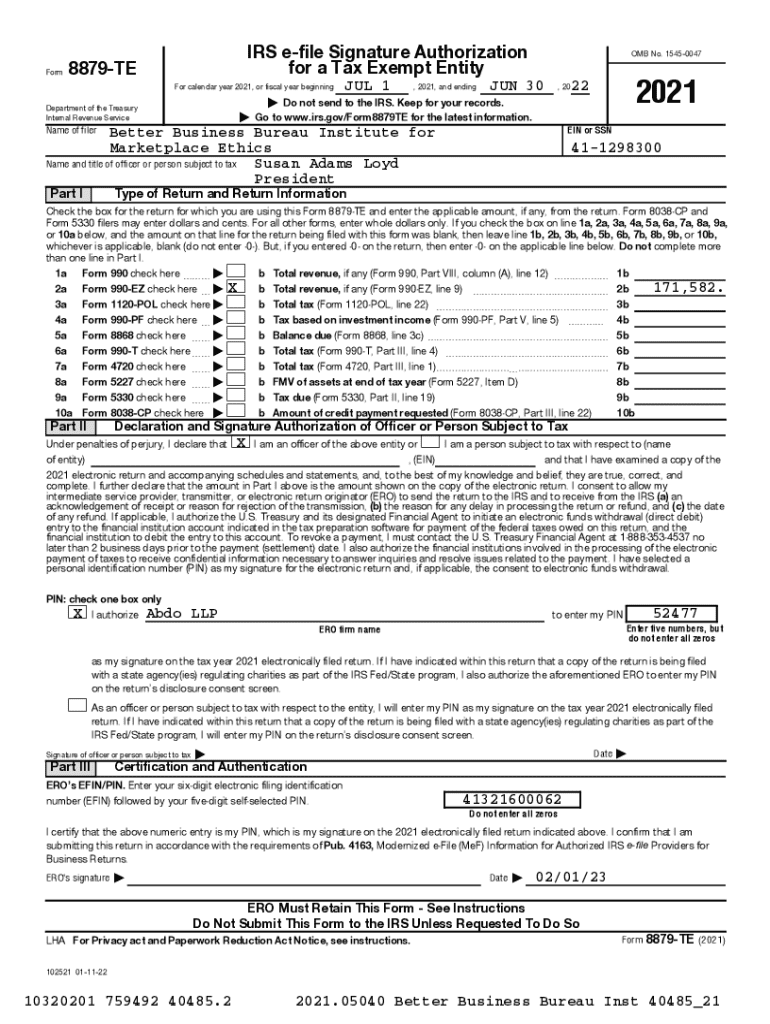

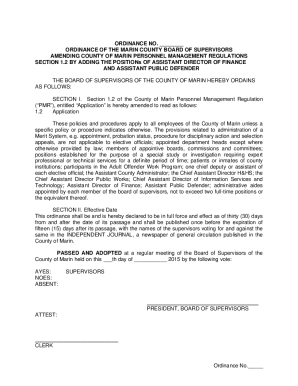

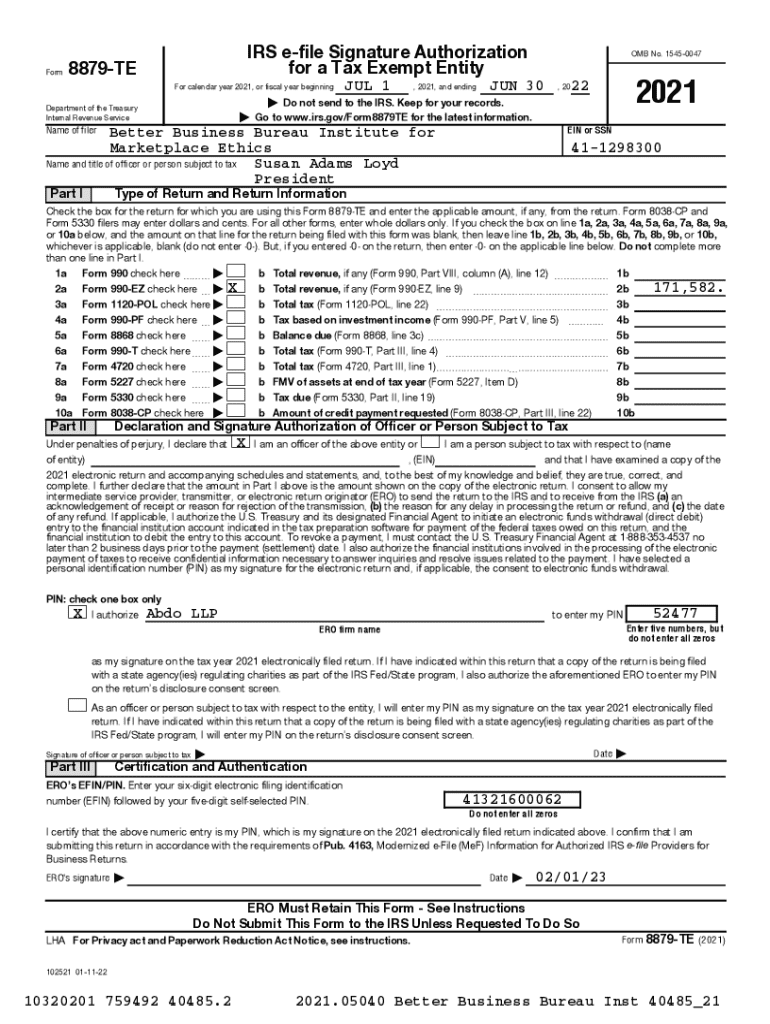

IRS Form 8879-S serves as the e-authorization document for S Corporations, allowing taxpayers to electronically sign their tax returns. This form facilitates the electronic filing process, enabling S Corporations to authorize their tax preparers to submit IRS Form 1120S and its accompanying schedules directly from the IRS. Essentially, it streamlines the filing process, ensuring compliance with IRS regulations while saving time for both tax professionals and business owners.

The requirement to file Form 8879-S primarily applies to S Corporations with taxable income. If you're running an S Corporation and opting for electronic tax filing, then using Form 8879-S is a crucial step in the tax return delivery system. Without it, your tax return cannot be submitted electronically.

Importance of Form 8879-S in tax filing

The role of Form 8879-S cannot be understated in the realm of tax filing for S Corporations. It allows for expedient processing of tax returns by allowing authorized representatives, like tax professionals, to electronically submit the required documentation. This not only reduces the likelihood of errors associated with manual submissions but also expedites the overall process, ensuring that Oregon, for example, meets its tax obligations efficiently.

Moreover, Form 8879-S adds a layer of security, as electronic signing verifies the taxpayer's consent to file their tax return. This is particularly important in a landscape where cybersecurity is a growing concern, making it essential that sensitive information, such as tax payments and personal identification, remains secure during submission.

Key features of IRS Form 8879-S

Form 8879-S consists of several key sections that each serve a specific purpose in the filing process. Understanding these sections can significantly enhance your ability to navigate the form effectively. The core components include Tax Return Information, Signature Information, and Submission Instructions, each guiding the user through various stages of the filing.

Importantly, one of the standout features of Form 8879-S is its electronic signature capability. This is a major benefit in today’s digital-first environment, as it allows taxpayers and their authorized representatives to sign documents remotely. This means that you can access and e-sign your forms from anywhere, making tax season more manageable for busy business owners.

Accessing Form 8879-S is simplified thanks to platforms like pdfFiller. The document management solutions offered by such services ensure that not only can you find the form easily, but you can also edit and manage it along with other authorization forms seamlessly. This can vastly improve the workflow of teams needing to collaborate on tax-related documents.

Step-by-step guide to filling out IRS Form 8879-S

Filling out IRS Form 8879-S requires careful preparation to ensure accuracy. First, gather all necessary documents and data that pertain to your S Corporation’s tax information, including past returns, income statements, and any relevant financial records. Ensuring all this information is at hand will simplify the process significantly.

For each section, follow these detailed instructions:

Common mistakes to avoid

Common errors while filling Form 8879-S can complicate your tax return experience. Misreporting data, such as incorrectly listing your S Corporation's income or deductions, is one of the most frequent pitfalls. This can trigger an audit or result in lost tax benefits. Additionally, neglecting to sign the form can render all previous efforts fruitless, as the IRS requires an authorized signature.

To prevent these mistakes, taking advantage of interactive tools available on platforms like pdfFiller is highly recommended. These tools not only guide you through the filling process but also alert you to potential issues and validate your entries before submission.

Benefits of using pdfFiller for your IRS Form 8879-S

pdfFiller stands out as a premier document management solution, especially for handling IRS Form 8879-S. Its seamless document management capabilities allow users to effortlessly edit, sign, and manage PDFs, eliminating the hassles typically associated with paper documentation. All features are designed to provide an intuitive user experience, enabling individuals and teams to collaborate effectively.

Time-saving features, such as auto-fill options, electronic signature integrations, and secure cloud storage, speed up the preparation process. Users can access their information securely from anywhere, ensuring that vital documents are organized and available when needed. Furthermore, collaboration tools enhance teamwork, allowing multiple parties to work on Form 8879-S simultaneously, minimizing delays in the tax filing process.

Frequently asked questions about IRS Form 8879-S

As you navigate your tax filing, queries about Form 8879-S often arise. For instance, what happens if you file without the 8879-S? Simply put, your e-filed return will be rejected, necessitating that you complete the form before aiming to refile electronically.

Many also wonder if they can amend their Form 8879-S. While you can amend your tax return, the authorization form itself remains unchanged once submitted. If additional changes are needed, a new Form 8879-S must accompany the latest tax return.

Finally, concerns about data security when submitting digitally are valid. pdfFiller ensures a high level of encryption and compliance with regulations, so your information remains safe during the submission process.

Conclusion: Empower your tax filing process

Embracing technology while managing your tax documents, especially the 2 Form IRS 8879-S, is essential for improved efficiency. By utilizing innovative solutions from pdfFiller, business owners can ensure their forms are correctly filled, securely signed, and promptly submitted. Thus, the entire tax filing experience can shift from stress to satisfaction, empowering individuals and teams to stay compliant while minimizing unnecessary work.

In the evolving landscape of tax management, making the most of tools and platforms available significantly enhances the process for everyone involved. Commit to leveraging these resources for a smoother and more productive tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2021-2025 form irs 8879-s in Gmail?

How do I execute 2021-2025 form irs 8879-s online?

How do I fill out 2021-2025 form irs 8879-s using my mobile device?

What is 2021-2025 form irs 8879-s?

Who is required to file 2021-2025 form irs 8879-s?

How to fill out 2021-2025 form irs 8879-s?

What is the purpose of 2021-2025 form irs 8879-s?

What information must be reported on 2021-2025 form irs 8879-s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.