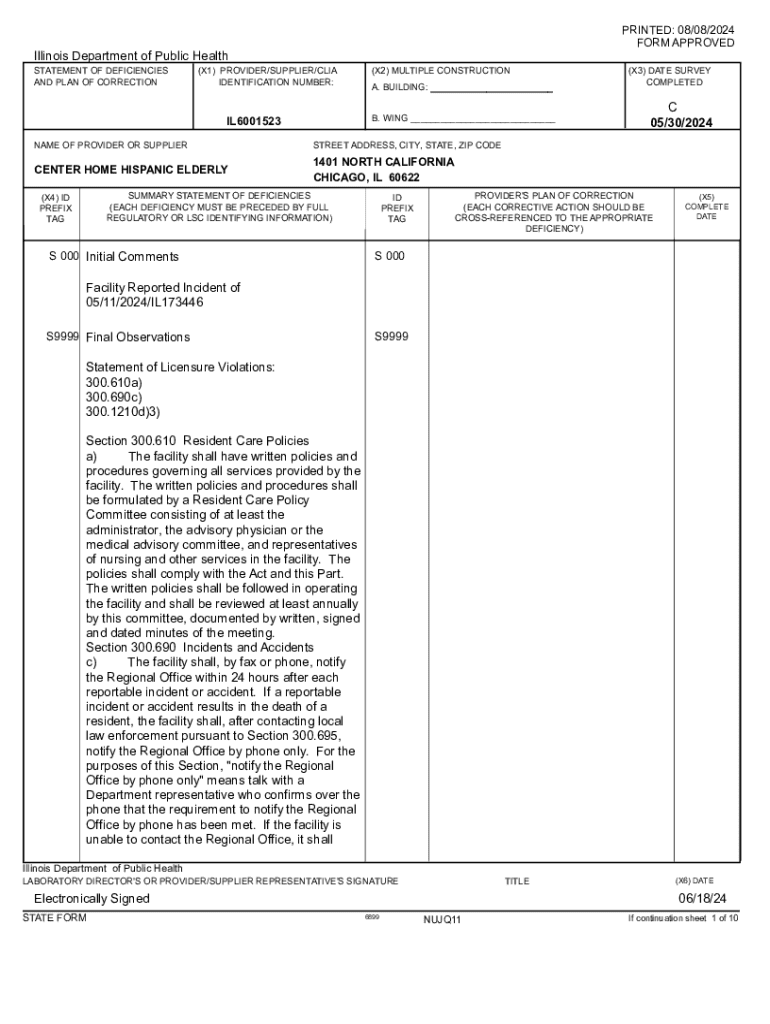

Get the free PRINTED: 07/30/2025 Illinois State ...

Get, Create, Make and Sign printed 07302025 illinois state

Editing printed 07302025 illinois state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out printed 07302025 illinois state

How to fill out printed 07302025 illinois state

Who needs printed 07302025 illinois state?

Your Complete Guide to the Printed 07302025 Illinois State Form

Understanding the 07302025 Illinois State Form

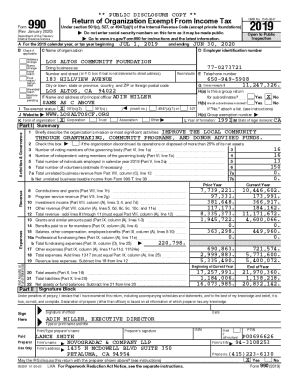

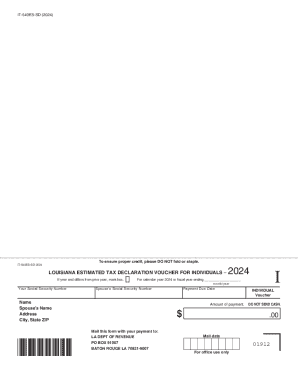

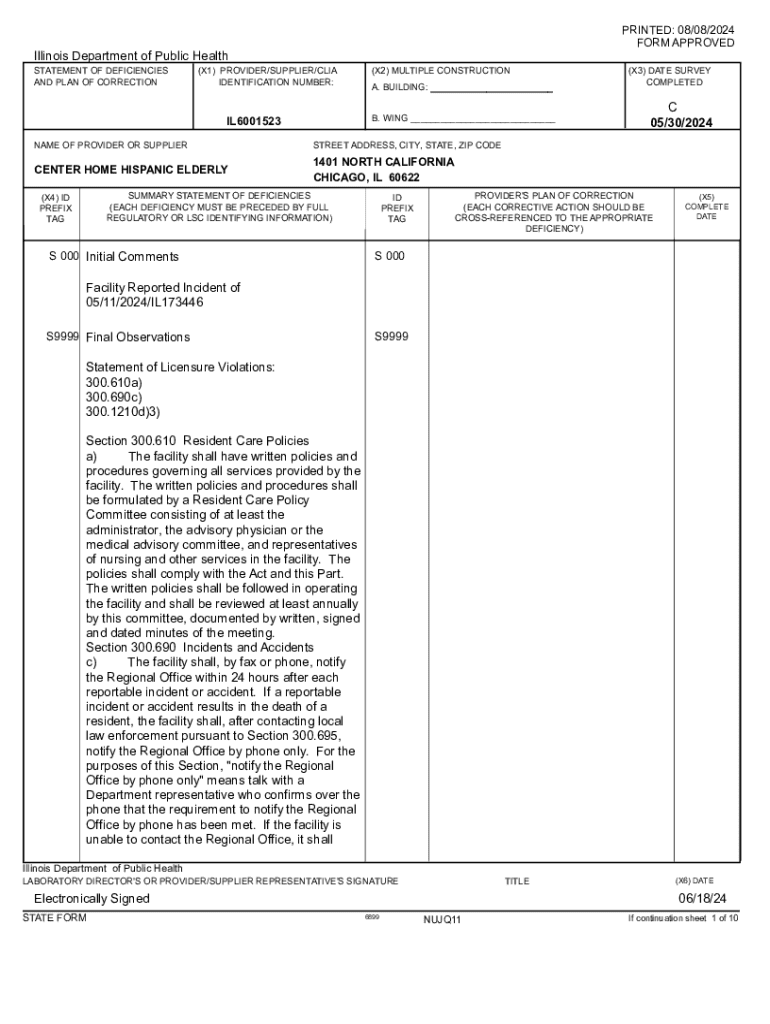

The printed 07302025 Illinois State Form serves a critical function in ensuring compliance with state regulations. Often referred to as the ‘Income Tax Return for Corporations,’ this document is essential for businesses operating within Illinois, providing necessary tax details to the state revenue department.

Businesses and organizations registered in Illinois must complete this form accurately and submit it according to the state's guidelines. Failure to do so can result in penalties or delays in processing.

Timeliness is key when it comes to tax submissions. The due date for filing the printed 07302025 Illinois State Form typically aligns with the federal tax deadline, ensuring synchronization between state and federal obligations. Missing these deadlines can have financial repercussions, making awareness of the filing schedule crucial.

Step-by-step guide to completing the 07302025 form

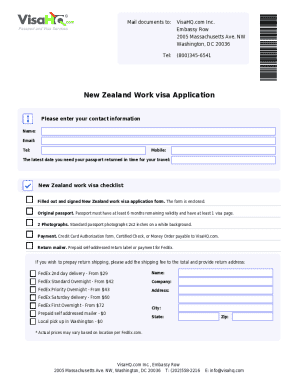

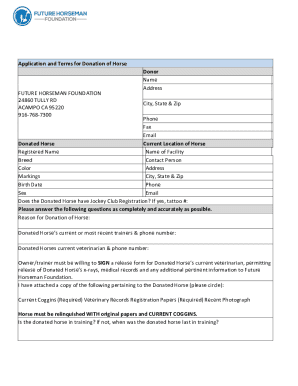

Successfully completing the printed 07302025 Illinois State Form requires both preparation and attention to detail. Begin by gathering all pertinent documents, including previous tax returns, financial statements, and any other supporting information that will help you fill out the form correctly.

Common mistakes can lead to inaccuracies, so be mindful of double-checking numerical values and ensuring all required fields are completed. These errors can result in processing delays or even penalties from the state.

Once you have the necessary documents, proceed to fill out the form by inputting your business information, financial data, and any applicable deductions or credits. Each section of the form is designed to collect specific information, making it vital that you refer to the accompanying instructions for guidance.

Before finalizing your submission, review your entries against a checklist, ensuring you've included all required information and making use of resources, such as the Illinois Department of Revenue, for any clarifications needed.

Editing and customizing your form

Utilizing pdfFiller allows for quick and seamless edits to the printed 07302025 Illinois State Form. This cloud-based platform simplifies document management, enabling users to modify the form according to their needs effortlessly.

To edit the form in pdfFiller, start by uploading your document into the platform. From here, you can use the editing tools to fill in the gaps, correct mistakes, or amend any details. The user-friendly interface ensures that these modifications can be made swiftly.

Additionally, pdfFiller allows you to add notes or comments directly to the document. This can be especially beneficial for collaboration with colleagues or accountants who may need to review the information before submission.

eSigning the 07302025 form

Signing the printed 07302025 Illinois State Form is a critical step that validates your submission. Utilizing an eSignature is not only legal but also streamlines the process, allowing for a swift completion without the need for physical signatures.

To ensure your eSignature is valid, it’s important to follow the regulations set forth by the state, which pdfFiller accommodates with precise eSignature integration.

After signing, ensure that you securely share the signed form with relevant parties. pdfFiller also offers encryption options for added security when sharing sensitive information, safeguarding your data during transit.

Submitting the 07302025 form

Understanding the various submission options available for the printed 07302025 Illinois State Form is crucial to ensure timely processing. Users can choose between digital submission via online portals or traditional physical mailing.

Digital submission is often faster, allowing for immediate confirmation of receipt, while mailing may take longer and requires planning for postal delivery times. Assess your needs and preferences before submitting.

After submission, it's important to keep a copy of the form and confirmation of submission for your records. This documentation is useful for any potential follow-up inquiries regarding your tax filings.

Managing your forms efficiently

With pdfFiller, managing your forms doesn’t stop at submission. The platform serves as a centralized document management system where users can store, access, and retrieve their forms with ease.

Organizing forms into designated folders can make retrieval straightforward. Effective document management is key in maintaining compliance and ensuring that deadlines are never missed.

Collaboration with team members is also made simple with pdfFiller. Share documents easily, facilitate feedback directly on the forms, and maintain a smooth workflow without needing endless email chains.

Frequently asked questions (FAQs)

Many users have questions about the printed 07302025 Illinois State Form. Common inquiries include how to handle mistakes made on submitted forms and how to update or amend previously submitted documents.

If you make an error after submitting the form, it is often permissible to file an amended return. Consult the Illinois Department of Revenue website for specific guidance on the amendment process.

For further clarification on any aspect of the form, you can access various resources available online, including detailed instructions from the Illinois Department of Revenue, which can provide specific guidance.

Keeping updated with changes to the 07302025 form

Remaining informed about updates or changes to the printed 07302025 Illinois State Form is vitally important for ongoing compliance. Tax laws and forms can evolve, and it’s in your best interest to stay informed.

Regularly checking the Illinois Department of Revenue’s website or subscribing to updates can provide timely notifications about changes that may affect your filing process.

User testimonials and success stories

The experience of using the printed 07302025 Illinois State Form can greatly differ between users. Many find that using pdfFiller has significantly improved their filing efficiency, with more streamlined processes and collaboration capabilities.

Positive testimonials from users alike highlight how pdfFiller's intuitive platform made it easy to navigate and edit the form, reducing stress during tax season significantly.

Sharing personal stories and experiences within your network can help foster a supportive community for better document management practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the printed 07302025 illinois state electronically in Chrome?

Can I create an eSignature for the printed 07302025 illinois state in Gmail?

How do I edit printed 07302025 illinois state on an Android device?

What is printed 07302025 illinois state?

Who is required to file printed 07302025 illinois state?

How to fill out printed 07302025 illinois state?

What is the purpose of printed 07302025 illinois state?

What information must be reported on printed 07302025 illinois state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.