Get the free Full Share $500.00 (entitles me to $550.00)Half ...

Get, Create, Make and Sign full share 50000 entitles

Editing full share 50000 entitles online

Uncompromising security for your PDF editing and eSignature needs

How to fill out full share 50000 entitles

How to fill out full share 50000 entitles

Who needs full share 50000 entitles?

Comprehensive Guide to the Full Share 50000 Entitles Form

Understanding the Full Share 50000 Entitles Form

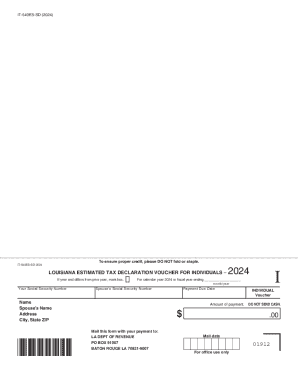

The Full Share 50000 Entitles Form is essential for individuals managing financial accounts that involve substantial deposits and insurance coverage. This form outlines a depositor's rights and establishes the legitimacy of their claims regarding deposit insurance under regulations from the Federal Deposit Insurance Corporation (FDIC). It’s crucial to understand the components of this form as it impacts how funds are managed and protected, especially in retirement accounts and health savings accounts (HSAs).

Understanding the importance of this form is vital for safeguarding your assets. Depositors must complete this form accurately to ensure their accounts remain fully insured, especially when maintaining joint accounts or trusts that may have multiple beneficiaries. This is where navigating the complexities of deposit insurance becomes paramount.

Key features of the Full Share 50000 Entitles Form

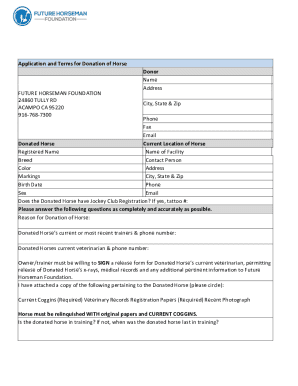

The Full Share 50000 Entitles Form features several essential components that make it uniquely beneficial for users. The primary purpose of the form is to provide a clear record of who is entitled to funds deposited in various accounts. This is particularly important for individuals managing accounts with large deposits, ensuring that all relevant parties are recognized in compliance with regulatory standards.

The form is designed to cater to a wide range of users, from individual account holders to teams managing joint accounts or trust funds. Essential fields include depositor information, the type of account, and details about beneficiaries that play a pivotal role in determining rights to funds.

Step-by-step guide to filling out the Full Share 50000 Entitles Form

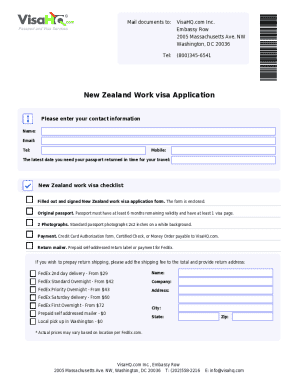

Completing the Full Share 50000 Entitles Form requires careful attention to detail. Prepare by gathering any necessary documents such as identification, account statements, and a comprehensive list of beneficiaries. This foundational step ensures that you are compliant with both internal banking policies and regulations set forth by the government.

Next, start filling in the required information. Each section should be approached methodically: start with your name and account number, followed by details regarding the nature of your deposits. Pay special attention to common pitfalls, such as misspelling names or inaccurately listing the relationships of beneficiaries.

Once all information is filled in, review meticulously. Utilize tools like pdfFiller’s editing features for effective proofreading. Tracking changes in your form history ensures no vital information is omitted.

The final step is to sign and submit the form. With pdfFiller's eSignature capabilities, you can sign digitally, streamlining the submission process. You can easily choose between submitting digitally or printing out the form for postal delivery, depending on your required preferences.

Managing your Full Share 50000 Entitles Form with pdfFiller

Once filled out, managing your Full Share 50000 Entitles Form for ongoing access is essential. Storing documents using cloud-based platforms like pdfFiller allows for easy retrieval and organization of essential materials, ensuring you always have the correct version at your fingertips.

Make use of folder structures, categorizing files based on usage, such as insurance forms, accounts for health savings, or documents related to federal regulations. This method promotes efficiency and ensures that nothing is overlooked, especially when dealing with joint accounts where multiple parties may need access to documents.

Advanced features of pdfFiller for Full Share 50000 Entitles Form users

PdfFiller isn’t just about filling out forms; its advanced features enrich the user experience significantly. Among these, editing capabilities allow you to add annotations, comments, and even multimedia elements to clarify complex information regarding your deposits and insurance coverage.

Additionally, the platform provides robust tracking functions that let you monitor document history. This feature is particularly beneficial for those managing joint accounts or trusts, allowing all parties involved to stay informed about changes and updates without confusion.

Troubleshooting common issues

Like any administrative task, filling out the Full Share 50000 Entitles Form may present challenges. An important step is understanding common issues that arise, such as submission errors or confusion surrounding beneficiary designations. Engaging with frequently asked questions can clarify doubts and assist in efficient form completion.

If you encounter technical difficulties, pdfFiller offers support options that can guide you through these obstacles. It's vital to resolve issues quickly, especially if immediate access to your accounts is necessary for personal financial management.

Real-world applications of the Full Share 50000 Entitles Form

The Full Share 50000 Entitles Form has practical applications across various sectors. For instance, case studies show that organizations utilizing this form can streamline compliance processes efficiently, ensuring that insured deposits meet FDIC requirements. This relevance extends to businesses managing health savings accounts that benefit from clearly defined beneficiary regulations.

Users have reported significant advantages when documenting account ownership, especially in environments involving joint accounts or trusts, where clarity on ownership substantially minimizes disputes over funds.

Best practices for optimizing use of the form

To maximize the benefits of the Full Share 50000 Entitles Form, adhering to best practices is crucial. First, ensure the accuracy of all entries, particularly concerning beneficiaries and deposit amounts, as even minor errors can lead to significant problems later. Establish practices that include regular reviews of your financial documents, which can help maintain compliance and safeguard your accounts.

In addition, time-saving techniques such as creating templates for frequently used forms can streamline the submission process, while making the use of pdfFiller's collaboration features can save time when working in teams. This ensures that all stakeholders stay informed and can act quickly if adjustments are necessary.

Staying informed about changes and updates

The regulatory landscape surrounding financial forms like the Full Share 50000 Entitles Form is subject to change. As such, staying informed about updates from sources such as the Federal Deposit Insurance Corporation is essential. Regularly checking their website or subscribing to newsletters can provide directors and stakeholders with timely information that influences asset management.

Engaging with communities or forums dedicated to deposit insurance and account management can also yield valuable insights. These platforms often discuss ongoing changes that could impact your accounts, ensuring that you're always at the forefront of necessary adjustments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my full share 50000 entitles directly from Gmail?

How do I make changes in full share 50000 entitles?

How do I complete full share 50000 entitles on an iOS device?

What is full share 50000 entitles?

Who is required to file full share 50000 entitles?

How to fill out full share 50000 entitles?

What is the purpose of full share 50000 entitles?

What information must be reported on full share 50000 entitles?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.