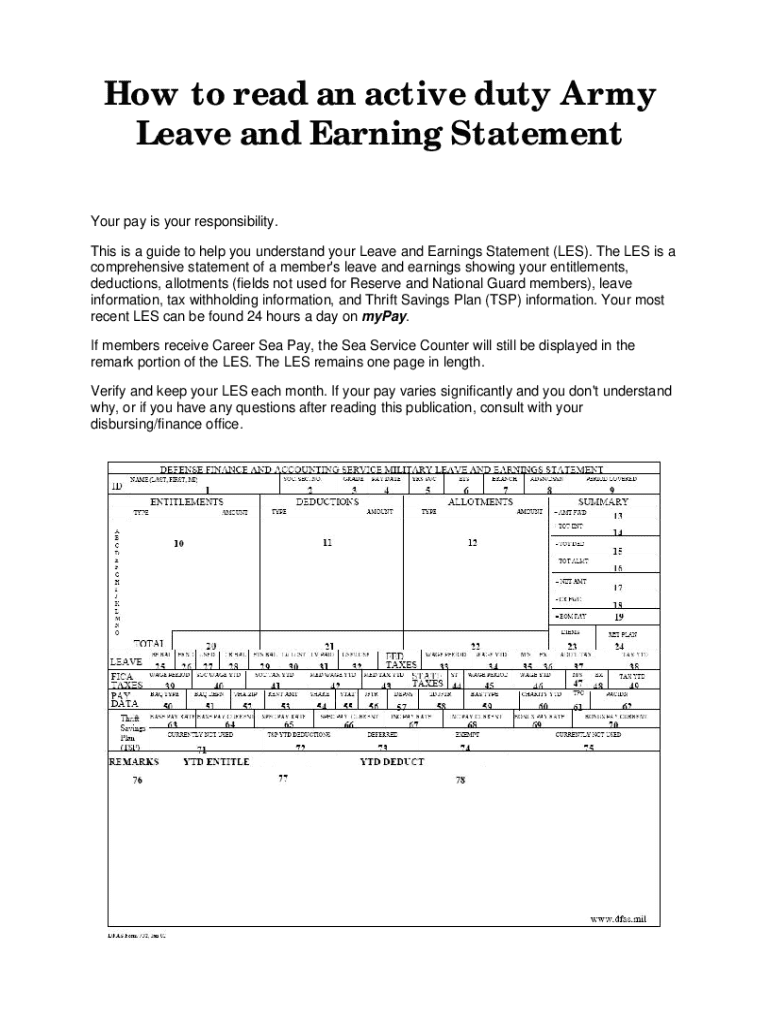

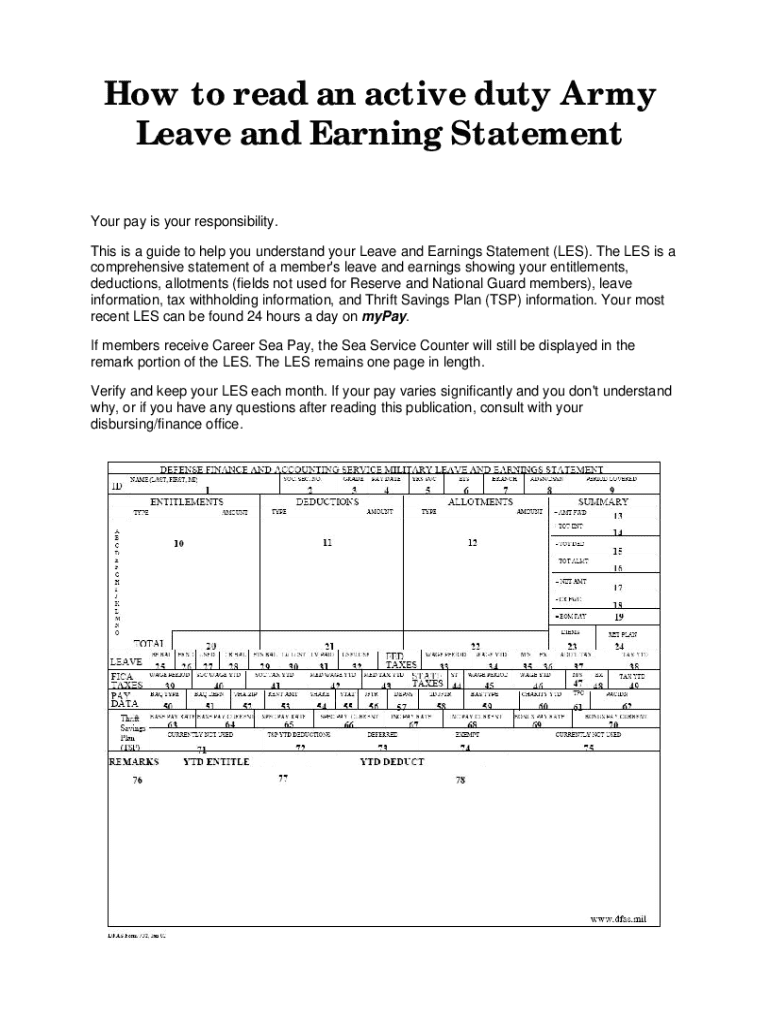

Get the free How to Read Your Leave and Earnings Statement (LES)

Get, Create, Make and Sign how to read your

How to edit how to read your online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to read your

How to fill out how to read your

Who needs how to read your?

How to read your form: A comprehensive guide

Understanding the importance of your form

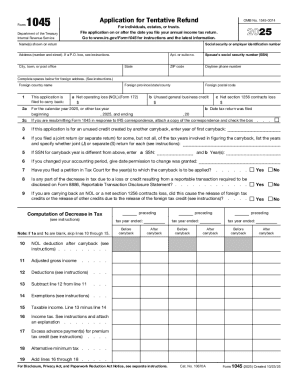

Reading forms accurately is not just a skill; it's a necessity in both personal and professional realms. Whether dealing with tax forms, medical documents, or legal agreements, misunderstanding the details can lead to significant errors. For instance, misinterpreting a tax form like the W-2 can result in incorrect tax returns, leading to financial penalties. Thus, learning how to read your form ensures compliance, accuracy, and peace of mind.

Common pitfalls include overlooking mandatory fields or misinterpreting instructions, which can cascade into larger issues. For example, failing to properly report wages as outlined in a tax form results in complications with the IRS. Understanding these myths and complexities allows you to navigate forms seamlessly and reduces the risk of mistakes.

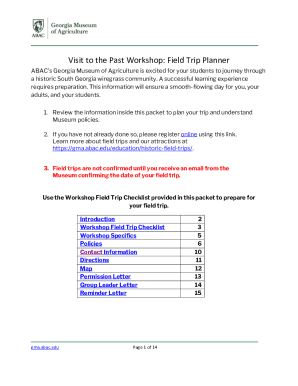

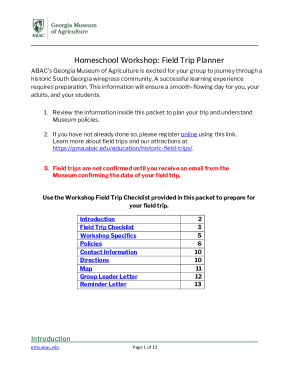

Overview of different form types

Forms come in many shapes and sizes, depending on their intended purpose. A broad understanding of the types of forms helps you know what to expect and what to focus on. Here are common categories:

Breaking down your form: key sections to focus on

To read your form effectively, it's crucial to dissect its key elements. Here are the main sections to pay attention to:

For example, on a tax form like the W-2, mandatory fields include your name, Social Security number, and wages, while optional fields, if any, might include additional information not required for processing your tax return.

Interactive tools for form reading

The digital age offers numerous tools, including pdfFiller, which enhance form reading and completion. These tools often feature interactive functionalities that simplify understanding complex forms.

Utilizing these features means you can stay organized and make fewer mistakes, as the platform provides alerts for missing or incorrect information.

Frequently asked questions about reading forms

When navigating forms, uncertain queries often arise. Here are some frequently asked questions that shed light on common concerns:

Addressing these questions helps build confidence and ensures you interact with your forms knowledgeably.

Real-world examples

Let’s dive into two case studies to illustrate the nuances of reading forms: a W-2 and medical insurance forms.

From these examples, one can appreciate the importance of accuracy and comprehension when interacting with these crucial documents.

Tips for effective form management

Organizing your forms efficiently prevents mismanagement and the frustration of misplaced documents. Here are some best practices:

With better organization and the right tools, managing forms can become a seamless aspect of your daily tasks.

Conclusion: Become a form reading expert

Mastering form reading is a vital skill in today’s documentation-heavy environment. Utilizing resources such as pdfFiller not only simplifies the process but empowers users with the knowledge to tackle forms confidently. As you become more adept at understanding forms, you'll see the personal and professional advantages manifest in efficiency, accuracy, and peace of mind. Make the commitment today to enhance your skills in reading your forms properly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my how to read your directly from Gmail?

How do I make changes in how to read your?

How can I fill out how to read your on an iOS device?

What is how to read your?

Who is required to file how to read your?

How to fill out how to read your?

What is the purpose of how to read your?

What information must be reported on how to read your?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.