Get the free " Compounding - isc idaho

Get, Create, Make and Sign compounding - isc idaho

Editing compounding - isc idaho online

Uncompromising security for your PDF editing and eSignature needs

How to fill out compounding - isc idaho

How to fill out compounding

Who needs compounding?

Compounding - ISC Idaho Form: A Comprehensive Guide

Understanding compounding in Idaho

Compounding in Idaho refers to the process of creating a legal agreement or financial arrangement that consolidates obligations or liabilities into a single entity. This often pertains to legal and financial repercussions, namely in cases involving judgments, claims, or arrears. In Idaho, just like in other jurisdictions, understanding compounding is crucial as it can impact how debts are managed and settled.

The importance of compounding in legal and financial contexts cannot be overstated. It allows parties to streamline their obligations, making it easier to track and manage payments or settlements. This process becomes vital in cases of default judgment or any scenario where remaining obligations must be clarified and resolved. Additionally, with the ISC Idaho Form, individuals and businesses can effectively document these compilations and formalize their agreements.

The ISC Idaho Form serves as a pivotal tool in this process, designed to aid users in detailing specific compounded claims or legal agreements. Understanding how to navigate this form is essential for anyone involved in such legal matters, ensuring compliance with Idaho laws while protecting their rights and interests.

ISC Idaho form overview

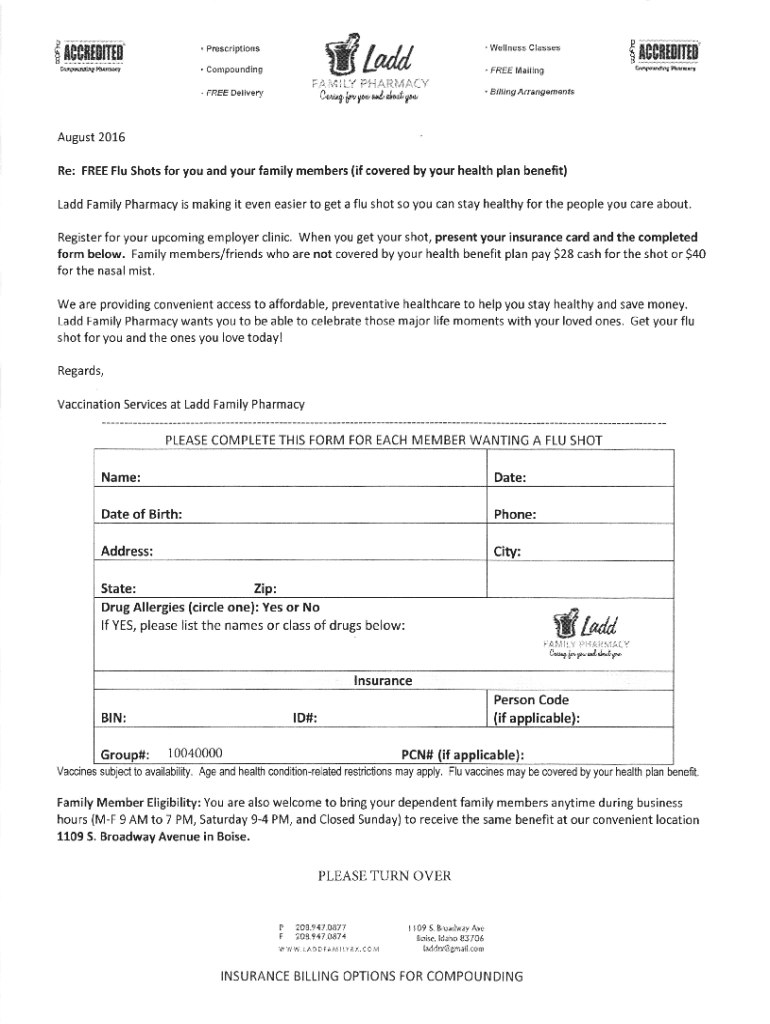

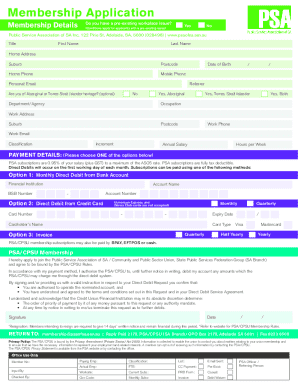

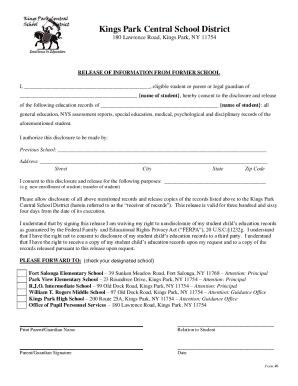

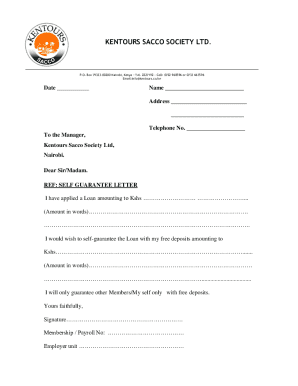

The ISC Idaho Form primarily serves the purpose of formally recording compounding agreements within the state of Idaho. Its structured format helps individuals document the details of default judgments or the resolution of claims efficiently. By having a designated form to fill out, parties can ensure that all necessary information is included and accurately presented.

Key features and components of the ISC Idaho Form include sections that request pertinent data such as the parties involved, the nature of the compounding, and specific amounts related to judgments or claims in question. Furthermore, the form outlines necessary legal jargon that reinforces the formality of the agreement, ensuring that it meets the judicial standards for acceptance.

Typically, anyone engaged in legal matters relating to debts, claims, or judgments in Idaho will find themselves needing to use the ISC Idaho Form. This includes individuals involved in legal disputes, attorneys representing clients in court, and financial professionals managing client obligations. Understanding who needs this form is critical, as it directly influences how effectively individuals can manage their legal processes.

Step-by-step guidance for completing the ISC Idaho form

Step 1: Gather required information

Before filling out the ISC Idaho Form, it's essential to gather all required information. This includes personal details of the parties involved, specific legal terms regarding the compounding, and relevant financial data such as amounts owed. Having these details ready will streamline the filling process and minimize errors.

A good approach is to organize your data by creating a checklist of the necessary documents, such as past judgments, communication records, and financial statements. This organization will not only expedite your progress but also ensure you won't miss any critical information needed for the form.

Step 2: Accessing the ISC Idaho form on pdfFiller

To find the ISC Idaho Form, simply visit pdfFiller’s website and use their search function. With pdfFiller’s user-friendly interface, you can enter 'ISC Idaho Form' in the search bar, and it will conveniently navigate you to the appropriate form.

pdfFiller offers multiple search tools, allowing you to easily filter results, helping you locate the ISC Idaho Form efficiently. This saves time and removes frustration in finding essential documents.

Step 3: Filling out the form

Filling out the ISC Idaho Form requires careful attention to detail. Start by reviewing the form’s sections — identify where personal information, claim details, and other specifics are to be filled. Each section is purposefully designed to gather necessary information that complies with Idaho guidelines.

Common mistakes to avoid while filling out the ISC Idaho Form include leaving sections blank, entering incorrect amounts, or failing to provide necessary supporting documents. To assist you, pdfFiller incorporates interactive features that highlight required fields and offer tips as you type, ensuring you don’t overlook vital information.

Step 4: Editing the ISC Idaho form

Utilizing pdfFiller’s editing tools is essential for refining the ISC Idaho Form after filling it out. You can easily add comments and annotations to clarify your entries or emphasize specific details. If changes are necessary, pdfFiller grants you the flexibility to edit fields directly within the platform.

Additionally, it’s wise to save your progress regularly to avoid losing any changes made. pdfFiller allows users to secure their work at any stage via its cloud-based system, facilitating easy access to updated versions without any stress.

Signing and finalizing your ISC Idaho form

Understanding the signing process

The signing process for the ISC Idaho Form is straightforward, especially with pdfFiller's eSign capabilities. By utilizing this feature, parties involved can easily provide their electronic signatures without needing to print or physically sign any documents. This modern solution streamlines the entire process and enhances efficiency.

The legal validity of eSignatures in Idaho aligns with national standards, meaning that properly executed digital signatures hold the same weight as traditional signatures in court. Therefore, understanding the signing process allows parties to confidently finalize their compounding agreements.

Final review before submission

Before submitting your ISC Idaho Form, conduct a thorough review. Begin by checking all entries to ensure there are no spelling errors or incorrect information. This review is crucial as inaccuracies can lead to delays or complications in processing.

Creating a checklist of items to review can be beneficial, including verifying amounts, confirming accurate party identification, and ensuring all supporting documentation is attached. Taking the time to ensure accuracy will significantly lessen the chances of encountering issues post-submission.

Managing your ISC Idaho form post-submission

Tracking the status of your form

After submitting your ISC Idaho Form, keeping track of its status is vital for managing your claims or obligations. Through pdfFiller, users can easily check the status of their submissions, providing peace of mind and ensuring that everything is on track.

Understanding response times for compounding forms can vary, and staying informed can help you prepare for the next steps. Regularly checking in on the status allows parties to remain proactive and address any potential delays.

What to do if you encounter issues?

Should any problems arise during the submission process, having a plan is essential. Common issues may include missing documents or response delays. pdfFiller’s customer support is equipped to help users navigate these problems efficiently, ensuring that you can resolve any hiccups promptly.

Knowing where to seek help can alleviate stress. Utilize pdfFiller’s support center, filled with resources and customer service representatives ready to assist you. This ensures you'll never feel alone in the compounding process.

Resources for further assistance

Helpful links

Various official resources are available for individuals seeking more information about the ISC Idaho Forms. Websites like the Idaho state's judicial branch provide comprehensive material that outlines forms and relevant legal processes involved in compounding.

Additionally, utilizing pdfFiller user guides and tutorials can enhance your understanding of how to leverage digital document management effectively. These resources cater specifically to individuals and teams planning to use the ISC Idaho Form.

FAQs about the ISC Idaho form and compounding

Addressing common questions around the ISC Idaho Form can provide clarity for users. Questions often include aspects like how the form is utilized for compounding, distinctions between forms, and the process of submitting claims and judgments in various situations. For anyone unfamiliar with the intricacies of legal documents, these FAQs can be extremely beneficial in navigating the landscape.

By understanding these basic inquiries, users can distinguish between different types of compounding forms needed for varying circumstances. This proactive approach can ensure compliance and minimize complications across future documentation efforts.

Best practices for future compounding forms

Employing best practices while managing compounding forms is crucial for efficiency and success. One effective strategy is to create a repository of document templates that can be reused for various needs. Maintaining organization within this digital library will save time for future submissions regarding the ISC Idaho Form or similar documents.

Leveraging pdfFiller’s tools also enhances overall documentation management. Users can customize templates, automate regular tasks, and utilize workflow tools to ensure proper documentation every time. Such approaches will streamline processes and ensure that all necessary documents are prepared accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find compounding - isc idaho?

How can I edit compounding - isc idaho on a smartphone?

How do I complete compounding - isc idaho on an iOS device?

What is compounding?

Who is required to file compounding?

How to fill out compounding?

What is the purpose of compounding?

What information must be reported on compounding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.