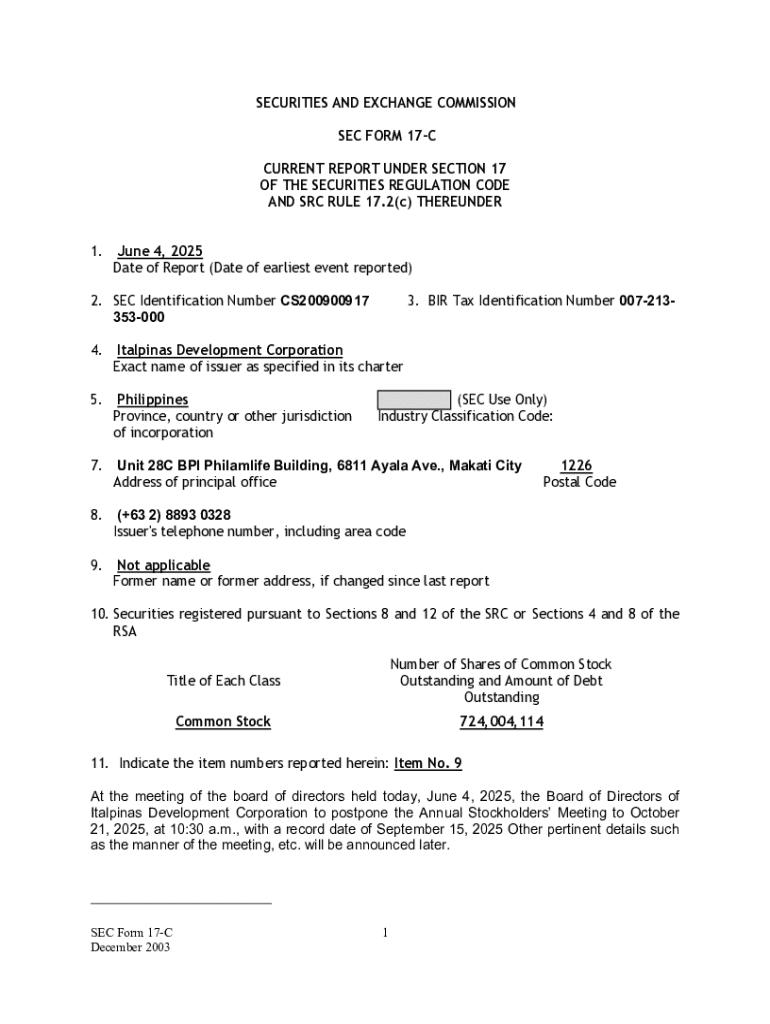

Get the free BIR Tax Identification Number 007-213-

Get, Create, Make and Sign bir tax identification number

How to edit bir tax identification number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bir tax identification number

How to fill out bir tax identification number

Who needs bir tax identification number?

Understanding the BIR Tax Identification Number Form

Understanding the BIR Tax Identification Number (TIN)

The Bureau of Internal Revenue (BIR) Tax Identification Number (TIN) is a unique identifier assigned to individuals and entities to monitor their tax obligations. It's crucial for identifying taxpayers and ensuring compliance with tax laws and regulations.

In the Philippines, obtaining a TIN is not just a legal requirement; it plays a significant role in the country's administration of tax revenues. Without a TIN, individuals and businesses struggle to comply with the necessary tax filings and payment obligations.

Having a TIN offers multiple benefits. For individuals, it streamlines employment processes as employers require it for income reporting. For businesses, a TIN is essential for registering the company, obtaining permits, and fulfilling Value Added Tax (VAT) registration requirements.

Types of BIR Tax Identification Numbers

The BIR assigns different types of TINs based on the taxpayer's category. The Individual Tax Identification Number is primarily for personal use, while the Business Tax Identification Number caters to various businesses.

An Individual TIN is available to anyone earning income, typically used for employment income reporting, while a Business TIN is designated for all kinds of business entities including sole proprietorships, partnerships, and corporations. This differentiation is crucial as it dictates how tax obligations are managed.

Do you need a BIR Tax Identification Number?

Several situations necessitate having a TIN. For employees, presenting a TIN to their employer is vital for income tax withholding and reporting, while businesses need a TIN to process registrations and secure operational permits.

Failure to obtain a TIN can lead to serious legal consequences. Individuals may face penalties or complications in employment, while businesses could encounter issues in securing necessary documentation to operate legally.

What is needed to apply for a BIR Tax Identification Number?

Applying for a TIN requires certain documents that vary depending on whether the applicant is an individual or a business. Individuals must present valid government-issued identification and social security or health insurance details.

For businesses, the requirement is more extensive, necessitating business permits and foundational documents like articles of incorporation. These documents substantiate the applicant's legitimacy and compliance with the Board of Inland Revenue.

Step-by-step guide to filling out the BIR TIN application form

To fill out the BIR TIN application form effectively, one should start by accessing the application on the BIR website or utilizing resources like pdfFiller, which offers an editable TIN form template.

When entering personal information, ensure that your name is accurately recorded, and provide a current address. Additionally, include your date of birth and other pertinent personal details, as each entry contributes to a complete profile.

Employment or business details should clearly indicate if you’re an employee or a business owner, as this affects tax reporting. Common pitfalls include inaccurate information leading to processing delays.

Is the BIR Tax Identification Number application available online?

The capability to apply for a TIN online offers significant advantages, including ease of access and streamlined processing. Utilizing online platforms like pdfFiller, users gain access to user-friendly features that make the TIN application process smoother.

Navigating the BIR online system provides applicants with tools to track their applications, edit forms seamlessly, and understand their tax obligations comprehensively.

Manage your BIR TIN documents with pdfFiller

pdfFiller stands out when it comes to managing BIR TIN documents. Users can edit forms directly, ensuring accuracy before submission and minimizing the chances of delays due to incorrect information.

Collaboration becomes effortless with pdfFiller, allowing team members to work on TIN-related documents simultaneously. The eSigning feature streamlines the approval processes, making it easier to move forward with tax obligations.

Common issues and how to resolve them

Understandably, applicants may encounter issues such as incorrect TINs or application denials. To tackle these challenges, promptly follow steps to correct mistakes and keep communication open with the BIR for assistance.

If you experience processing delays, it is advisable to follow up with the BIR. Knowing where to direct inquiries can expedite resolutions and ensure compliance with tax documentation.

Laws and policies surrounding the BIR TIN

The BIR governs TINs under specific tax laws in the Philippines, requiring that taxpayers keep their information up-to-date to comply with tax regulations. Inaccuracies or outdated details can lead to complications during tax filing.

It is essential for TIN holders to understand their rights and obligations under tax laws. Regularly reviewing laws and regulations helps maintain compliance and mitigate potential legal risks.

Additional tips for managing your BIR TIN information

For effective management of TIN information, it is advisable to actively monitor your TIN details for any updates or changes. This proactive approach ensures that all tax-related documentation remains current and minimizes troubleshooting down the line.

Best practices for recordkeeping and document management can significantly enhance your organization method. Using platforms like pdfFiller can streamline your tax-related forms and documentation, making future applications or filings much more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in bir tax identification number without leaving Chrome?

Can I edit bir tax identification number on an Android device?

How do I complete bir tax identification number on an Android device?

What is bir tax identification number?

Who is required to file bir tax identification number?

How to fill out bir tax identification number?

What is the purpose of bir tax identification number?

What information must be reported on bir tax identification number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.