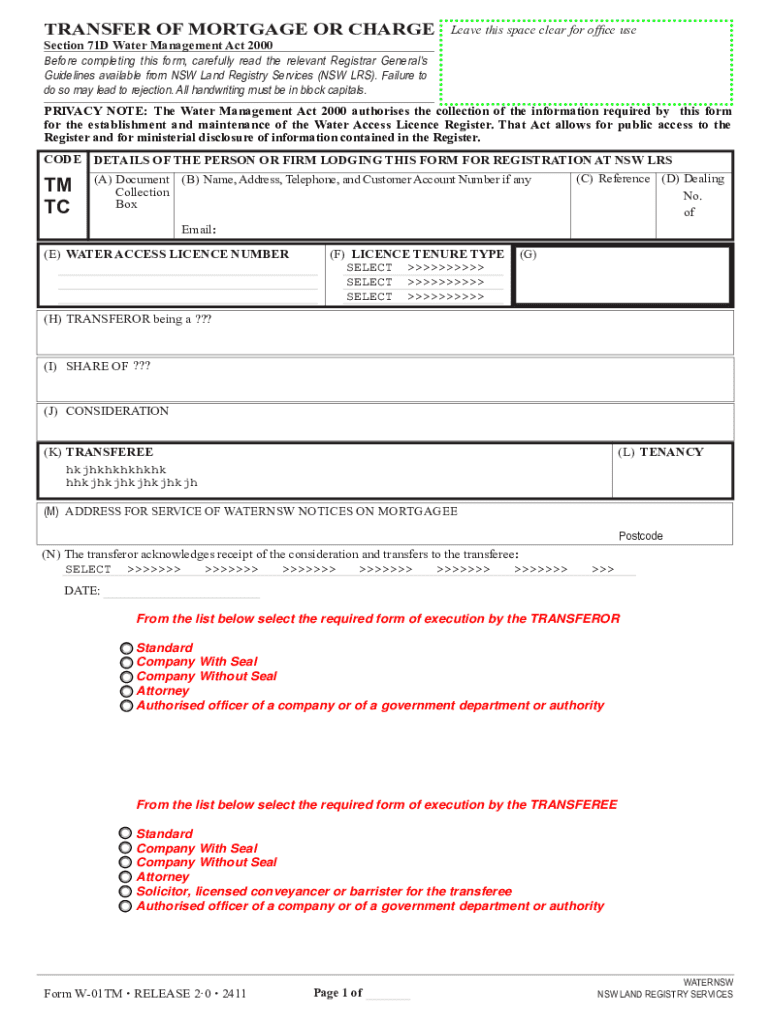

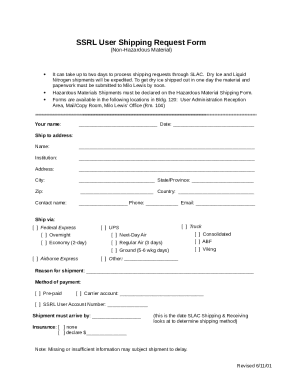

Get the free Transfer of mortgage or charge - Registrar General's Guidelines

Get, Create, Make and Sign transfer of mortgage or

Editing transfer of mortgage or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer of mortgage or

How to fill out transfer of mortgage or

Who needs transfer of mortgage or?

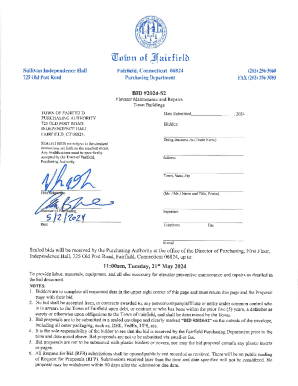

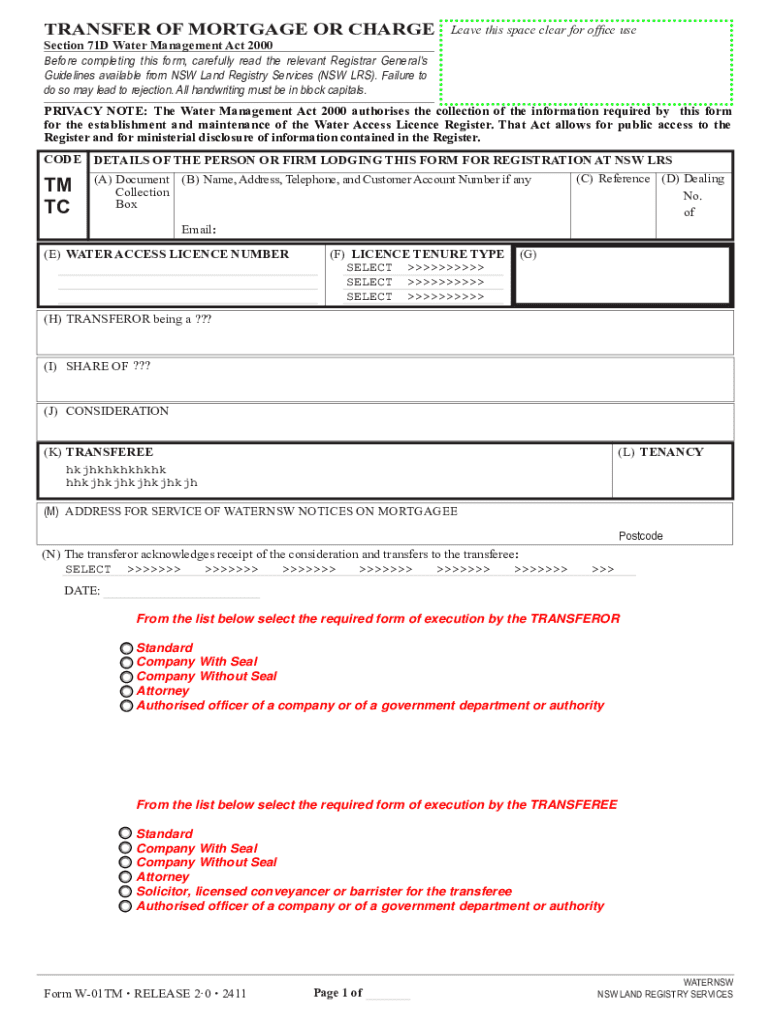

Understanding the Transfer of Mortgage or Form

Understanding mortgage transfer

A mortgage transfer refers to the process of transferring the obligations and rights of a mortgage from one party to another. This typically occurs when the borrower sells the property or when a co-borrower assumes the mortgage. The scope of mortgage transfer can vary based on the terms set forth in the original mortgage agreement, making it essential for parties involved to understand their rights and responsibilities.

Some common reasons for transferring a mortgage include selling a property, estate planning, or financial restructuring. Homeowners might seek a transfer if they are unable to meet their mortgage obligations, while buyers may want to step into a favorable mortgage agreement, especially if the original terms are more favorable than current market conditions.

Types of mortgage transfers

There are primarily two types of mortgage transfers: assumption of mortgage and novation. Both forms have distinct processes and implications.

Assumption of mortgage

Assumption of mortgage occurs when a new borrower takes over the existing mortgage from the original borrower, assuming all responsibilities and rights associated with the mortgage. This arrangement is beneficial for buyers as they can inherit potentially lower interest rates and favorable terms. However, it is essential to obtain the lender's approval since the original borrower may still be liable if the new borrower defaults.

Pros of mortgage assumptions include access to favorable mortgage terms and potentially lower closing costs. On the other hand, the cons may involve remaining liability for the original borrower and the challenge of navigating lender approval.

Novation

Novation is a legal process where the original mortgage agreement is extinguished and replaced with a new agreement, involving the lender's consent. Unlike an assumption, this process involves the original borrower no longer being liable for the mortgage after the transfer. Novation is typically preferred when buyers want a fresh start with terms that may differ from the original.

Choosing novation over assumption is wise when the buyer has higher creditworthiness, potentially allowing them to negotiate better terms directly with the lender.

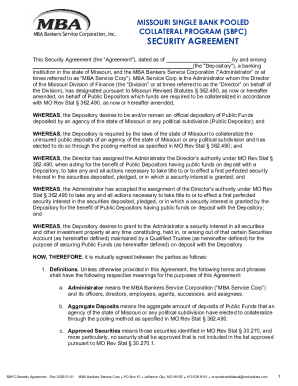

The legal aspects of transferring a mortgage

Transferring a mortgage involves several legal considerations. One of the most critical is understanding the requirements set forth by both state and federal regulations, which govern mortgage transfers. Key documents typically needed include the original loan agreement, transfer documents, and potentially a property deed.

Legal considerations also extend to disclosure laws and any outstanding liens on the property. Parties involved must ensure all debts attached to the property are settled to avoid complications during the transfer.

Involvement of lenders

Informing your lender about the intended transfer is crucial. Most lenders require written notice from the original borrower, detailing the reasons for the transfer and the identity of the new party assuming the mortgage. As part of this process, lenders may subject the new borrower to a credit check to assess their ability to meet mortgage obligations.

Additionally, lenders usually have specific conditions for approval, which may include satisfactory credit scores, a conflict-free loan application, and adequate income verification.

The mortgage transfer process

Understanding the mortgage transfer process can significantly ease the transition. Here is a step-by-step guide outlining what to expect:

While the process is straightforward, some common challenges may arise, such as issues with creditworthiness or missing documents. To overcome these potential roadblocks, maintain open communication with your lender and ensure all parties involved are on the same page.

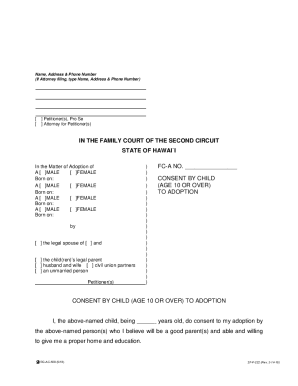

Transferring home ownership with a mortgage

Transferring home ownership that involves an existing mortgage requires additional steps. When selling a home with a mortgage, the seller must inform the buyer about the mortgage status openly. This includes disclosing any potential fees associated with transferring the warranty of the mortgage, which could impact the buyer's decision.

The rights of both the buyer and seller must be carefully navigated during the transfer. The seller retains the responsibility to ensure the mortgage is paid off or transferred accordingly, while the buyer must understand they are inheriting these obligations.

Co-ownership and joint mortgages

When multiple parties are involved in a mortgage, transferring a mortgage can become complex. In cases of co-ownership, all parties must consent to the transfer, especially concerning the mortgage terms. Responsibilities are often shared, meaning all parties might retain liability unless a novation is executed. Open communication and clear agreements among parties are essential to prevent misunderstandings.

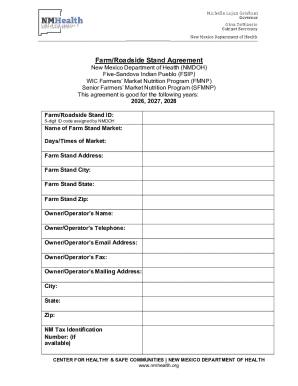

Financing options following a mortgage transfer

Transferring a mortgage can influence new financing options available to the buyer. In scenarios where a mortgage is assumed, buyers might have the opportunity to leverage favorable terms inherited from the seller’s original loan, compared to current market rates.

However, the transfer may open up new agreements with different lenders, offering a chance to negotiate better rates or terms that fit the buyer’s financial situation. Evaluating multiple options post-transfer is important to secure the best financing.

Potential implications for credit

The transfer of a mortgage can also affect the credit scores of both the seller and the buyer. For the seller, particularly if they had a negative equity situation, the transfer might resolve lingering debts thus positively impacting credit scores. Conversely, the buyer must ensure timely payments to avoid derailing their credit health after the transfer.

Maintaining good financial habits, such as monitoring credit utilization and ensuring timely payments, will help both parties manage their credit health following the transfer.

Tools and resources for managing mortgage transfers

For managing mortgage transfers effectively, tools like pdfFiller provide a user-friendly platform for creating, editing, and signing necessary documents online. Users can easily fill out mortgage transfer forms, ensuring they are complete and accurate before submission.

pdfFiller not only offers templates for common mortgage transfer documents but also provides guidance on eSigning, ensuring that all parties can collaborate seamlessly regardless of their location. With access-from-anywhere document management, users can navigate the transfer process more efficiently.

Exploring your mortgage options

Deciding when to transfer a mortgage involves assessing several scenarios. This may include favorable market conditions, changes in financial circumstances, or the desire to consolidate debts. Weighing the pros and cons against personal financial goals can help individuals determine if a transfer is the best path forward.

Consulting with financial advisors is advisable during this process. It’s vital for individuals to ask questions regarding the potential impacts of a mortgage transfer on their overall financial health and future mortgage options.

Frequently asked questions (FAQs)

Common queries surrounding the transfer of mortgage often revolve around legalities, potential financial implications, and specific procedures involved. For instance, many wonder whether they can transfer a mortgage without lender approval. Most cases require formal notification and possibly consent from the lender for a transfer to take place.

Addressing misconceptions about mortgage transfers is equally important. Understanding the distinction between assumption and novation, along with the liabilities that each entails, can guide parties effectively through the transfer process. Awareness of these key points helps mitigate risks associated with mortgage transfers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete transfer of mortgage or online?

How do I edit transfer of mortgage or straight from my smartphone?

How do I edit transfer of mortgage or on an iOS device?

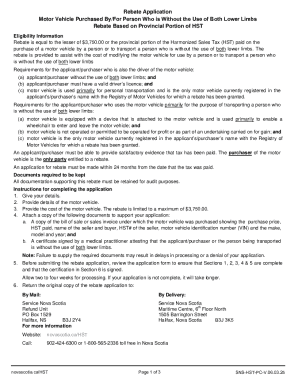

What is transfer of mortgage or?

Who is required to file transfer of mortgage or?

How to fill out transfer of mortgage or?

What is the purpose of transfer of mortgage or?

What information must be reported on transfer of mortgage or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.