Get the free Mortgagee notice of registration of security interest issue to ...

Get, Create, Make and Sign mortgagee notice of registration

Editing mortgagee notice of registration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgagee notice of registration

How to fill out mortgagee notice of registration

Who needs mortgagee notice of registration?

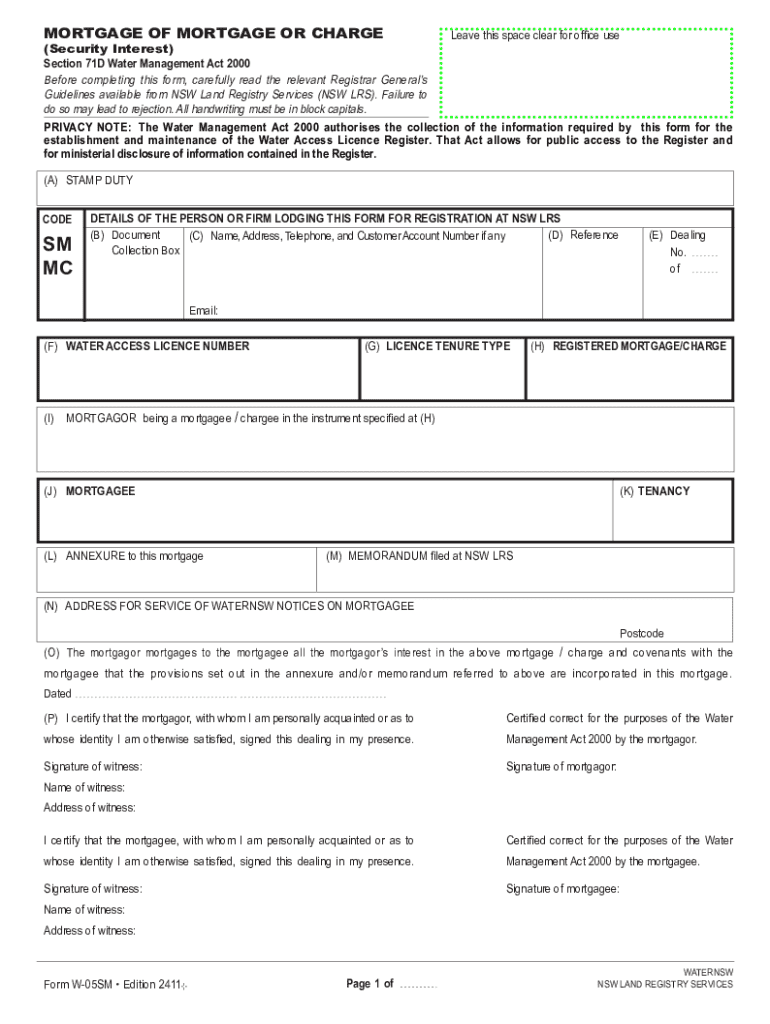

Understanding the Mortgagee Notice of Registration Form

Overview of the mortgagee notice of registration form

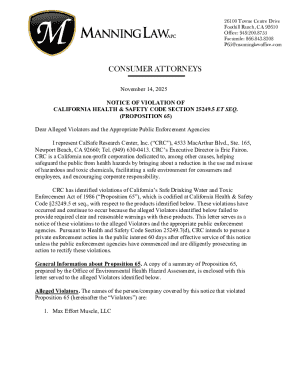

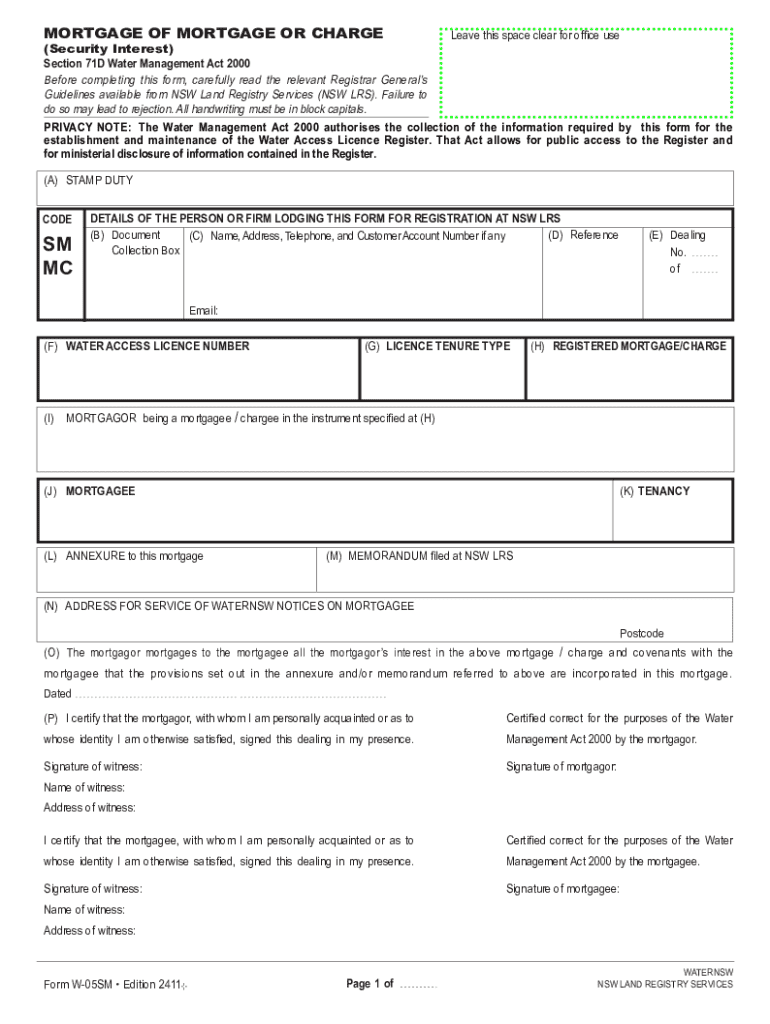

A Mortgagee Notice of Registration Form is a crucial document in the mortgage process, serving as a formal notice to all parties concerning the registration of a mortgage. This document is essential for protecting the mortgagee’s interest in the property, ensuring that they are legally recognized as the lender against the property in question.

The importance of this form cannot be understated; it acts as a safeguard for lenders by providing them the legal backing necessary to claim their rights in the eventuality of default or property dispute. By registering the mortgage, the lender ensures their place in the foreclosure line, effectively impacting property ownership and transfer rights.

Who needs to use the mortgagee notice of registration form?

Several parties must utilize the Mortgagee Notice of Registration Form, including homeowners, mortgage lenders, and legal professionals. Homeowners and mortgagors are primarily responsible for ensuring the accuracy of the information provided. They have an obligation to disclose all necessary details to avoid legal complications, especially during the mortgage registration.

Mortgage lenders and financial institutions play a critical role in the registration process. They guide borrowers through submitting the form and ensuring that all requirements are met. Real estate agents and legal professionals also have a vested interest in this documentation, as compliance and accuracy are essential to protect their clients' interests.

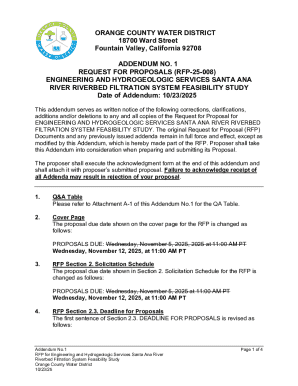

Key components of the mortgagee notice of registration form

The Mortgagee Notice of Registration Form consists of several key components that provide details about all parties involved. This includes sections for Borrower Information, Mortgage Information, Property Details, and Registration Details. Each field must be completed accurately to ensure proper registration of the mortgage.

Understanding common terms like ‘mortgagee’ and ‘mortgagor’ is also vital. The mortgagee is the lender, while the mortgagor is the borrower. Clarity regarding these terms impacts the registration process and the responsibilities each party holds.

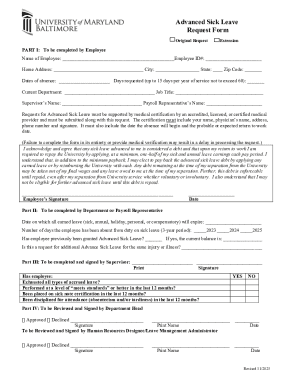

How to fill out the mortgagee notice of registration form

Filling out the Mortgagee Notice of Registration Form requires careful attention. First, gather all the necessary information, including identification documents and the mortgage agreement. This preparation phase helps ensure accurate completion, reducing the likelihood of errors during processing.

Editing and managing your mortgagee notice of registration form

Using pdfFiller can significantly streamline the process of editing and managing your Mortgagee Notice of Registration Form. This platform allows for easy uploads, enabling users to edit forms directly from their devices, ensuring that any necessary changes can be made efficiently.

The eSignature feature of pdfFiller ensures that your document is signed securely. Using this feature significantly reduces the chances of fraud while providing a legally recognized signature.

Interactive tools for enhanced document handling

To facilitate mortgage registration and management, pdfFiller incorporates a suite of interactive tools, enabling users to effortlessly handle their documents. Notably, calculators and checklists for mortgage calculations assist users in understanding their financial commitments.

Troubleshooting common issues with the mortgagee notice of registration form

Despite careful preparations, issues may still arise when dealing with the Mortgagee Notice of Registration Form. If you encounter incorrect information, it's imperative to address it promptly; contact your local registrar's office for guidance on the corrections needed. Resolving these discrepancies swiftly avoids potential legal complications.

Understanding when to seek professional assistance is also valuable. Engaging legal support can be beneficial in navigating complex scenarios involving mortgage registration.

Importance of monitoring your registration status

Once the Mortgagee Notice of Registration Form is submitted, monitoring your registration status becomes crucial. This can safeguard against disputes regarding property ownership in the future. Verify your registration regularly through local registries or land records to ensure your mortgage is officially recorded.

Maintaining proper documentation organization is a recommended practice. This helps in easily accessing all necessary documents should any issues arise in the future.

Additional considerations for homeowners and lenders

Legal implications stemming from incorrect registrations can be significant. It is of utmost importance for both homeowners and lenders to adhere to best practices in maintaining accurate records. This involves regularly reviewing all documentation associated with the mortgage and addressing any discrepancies immediately to prevent legal complications down the road.

Homeowners and lenders should also stay informed about potential updates in mortgage registration processes to adapt effortlessly and maintain compliance.

Related forms and documents

Several related forms and documents exist alongside the Mortgagee Notice of Registration Form, such as mortgage agreement templates and property transfer documents. Familiarity with these related documents helps all parties involved understand the broader context of mortgage processes.

Access to these forms is readily available on pdfFiller, where users can find templates that meet their specific needs effortlessly.

Best practices for completing and maintaining your forms

Regular updates and maintenance of your Mortgagee Notice of Registration Form are crucial elements in property transactions. Keeping your documents current not only protects your legal rights but also simplifies the process in case of any future disputes.

In summary, leveraging pdfFiller's features for efficient document management and ensuring compliance with registration processes can empower both homeowners and lenders in the constantly evolving landscape of real estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mortgagee notice of registration online?

How do I make edits in mortgagee notice of registration without leaving Chrome?

How do I complete mortgagee notice of registration on an Android device?

What is mortgagee notice of registration?

Who is required to file mortgagee notice of registration?

How to fill out mortgagee notice of registration?

What is the purpose of mortgagee notice of registration?

What information must be reported on mortgagee notice of registration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.