Get the free DISCHARGE OF MORTGAGE (Security Interest)

Get, Create, Make and Sign discharge of mortgage security

Editing discharge of mortgage security online

Uncompromising security for your PDF editing and eSignature needs

How to fill out discharge of mortgage security

How to fill out discharge of mortgage security

Who needs discharge of mortgage security?

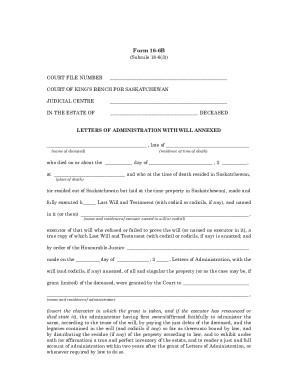

Understanding the Discharge of Mortgage Security Form

Understanding the discharge of mortgage security form

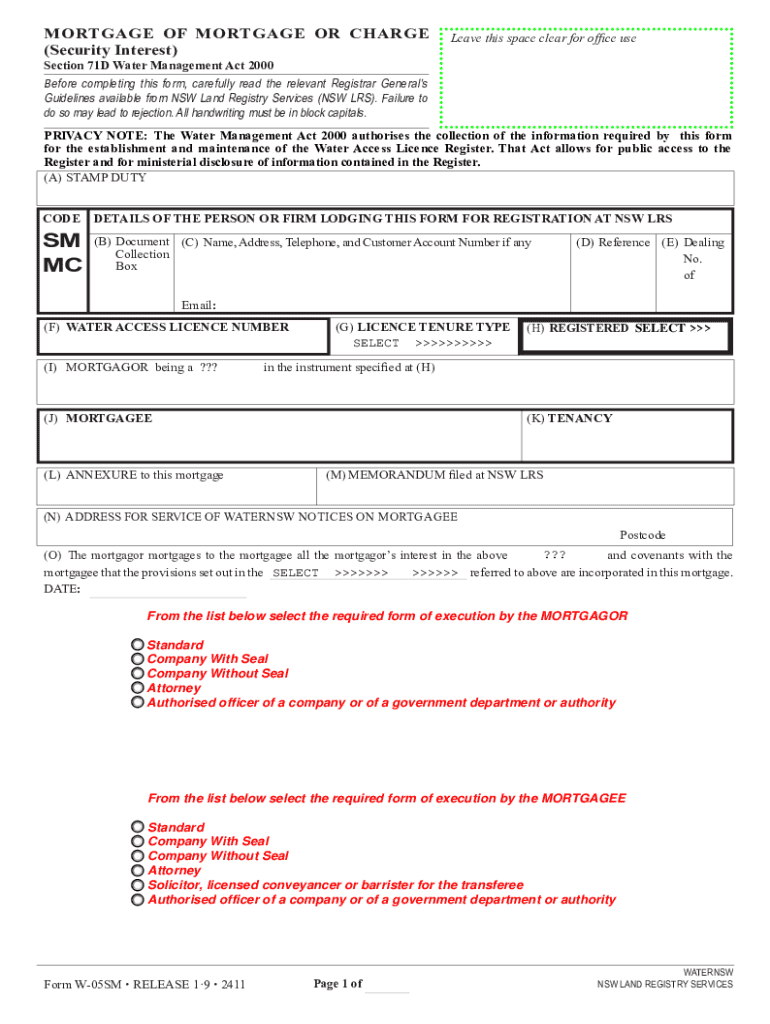

A discharge of mortgage security form is a crucial document used to release a mortgage lien on a property once the loan has been paid in full. Essentially, it marks the end of the borrower's obligation to the lender, signifying that the mortgage has been satisfied. The importance of this document cannot be overstated. It provides clarity and peace of mind to the property owner, affirming that they now own the property free and clear of the mortgage encumbrance.

Legally, the discharge of mortgage security form carries significant implications. Once the discharge is executed, the lender relinquishes their claim to the property, impacting the rights and obligations of the parties involved. Notably, the property title is updated to reflect this shift, ensuring that future buyers or lenders can trust that there are no existing mortgage claims against the property. This process is vital in maintaining clear legal standing over real estate assets.

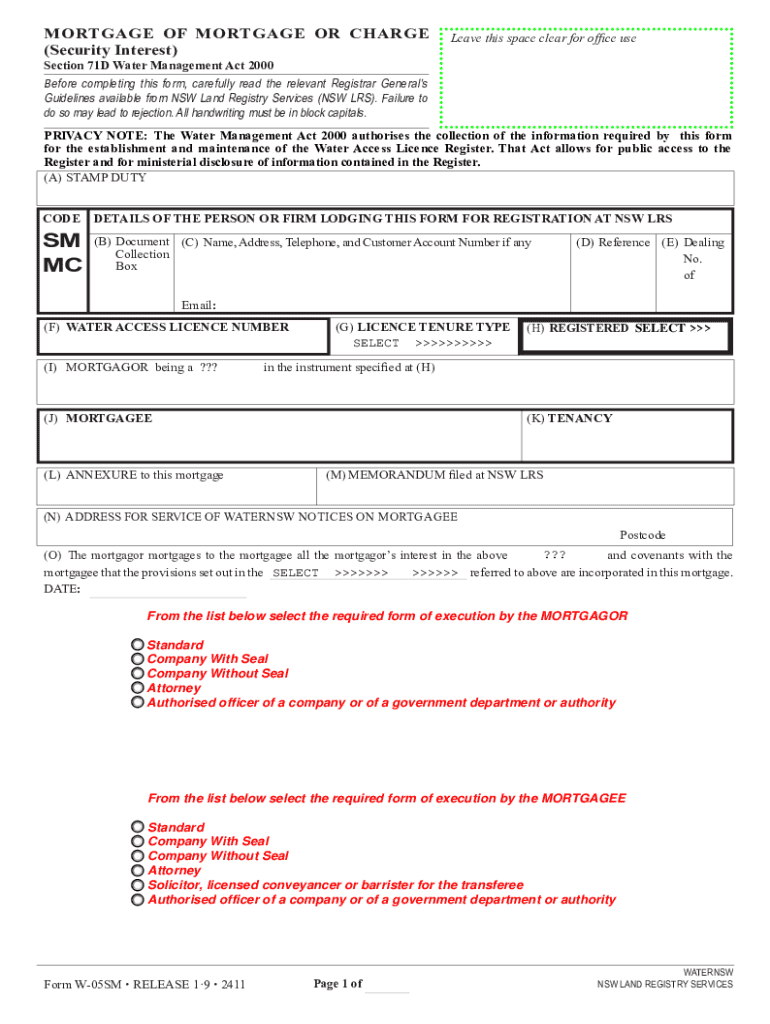

Key components of the discharge of mortgage security form

The discharge of mortgage security form includes several essential components that must be accurately filled out. Key information required includes borrower and lender details, the specific loan information, and a comprehensive description of the property involved. Each detail is pivotal in ensuring that the discharge is recognized legally and efficiently.

Common terminology associated with the discharge includes 'discharge,' which means the cancellation of the lender's claim, and 'secured interests,' indicating rights the lender had until the mortgage was paid off. Understanding these terms is critical to navigating the discharge process effectively.

Step-by-step guide: How to complete a discharge of mortgage security form

Completing a discharge of mortgage security form involves several clear steps to ensure it is filled out correctly. The process begins with gathering necessary documents, such as the original mortgage agreement and proof of payment, which are crucial for verification purposes.

Following these steps thoroughly will ensure that your discharge is processed without unnecessary delays. Each task contributes crucially to the overall accuracy and legality of the document.

Common mistakes to avoid when filing a discharge of mortgage

Filing the discharge of mortgage security form may seem straightforward, yet numerous common mistakes can impede the process. One of the primary pitfalls is providing incomplete information. Every field in the form should be addressed, as omissions can lead to rejection of the document.

By avoiding these common errors, you can smooth the path to successfully discharging your mortgage.

State-specific requirements for discharge of mortgage forms

Discharge requirements for mortgage security forms can vary significantly from state to state. Understanding these nuances is crucial for compliance and efficient processing. Documentation requirements may differ, as might the filing fees and processing times. For instance, while some states may accept electronic submissions, others require physical forms to be submitted via postal mail.

Notably, being aware of highlighted differences can help in mitigating errors that could arise from misunderstandings about local practices. For individuals and teams, having a clear strategy in mind can save both time and resources.

What happens after submitting the discharge of mortgage security form?

Once you’ve submitted the discharge of mortgage security form, there’s a processing period to anticipate. Typically, this can take anywhere from a few days to several weeks, depending on state-specific procedures and the volume of applications being handled. Being aware of this timeline is essential for planning anytime you are dealing with property sales or re-financing.

The confirmation documents received are vital, as they serve as official proof that the discharge has been processed. Keeping these documents in a safe place is essential for future reference, especially when selling or refinancing the property.

Frequently asked questions (FAQ)

Navigating the discharge of mortgage security form process can raise many questions. Here are some frequently asked questions that may help dispel confusion.

Understanding these FAQs can demystify the discharge process, easing the concerns of individuals and teams alike.

Using pdfFiller for a seamless document management experience

Managing the discharge of mortgage security form efficiently is crucial. pdfFiller provides powerful tools to facilitate this process, enabling users to edit and customize their forms seamlessly. Whether you are navigating a complex mortgage discharge or simply need to fill out standard forms, pdfFiller enhances usability with a user-friendly interface.

Ultimately, using pdfFiller for tasks like completing the discharge of mortgage security form not only simplifies the process but also enhances the overall experience of document management.

Final thoughts on the importance of a timely discharge of mortgage

Discharging your mortgage is a pivotal step in property ownership. By understanding the necessary steps and utilizing efficient tools like pdfFiller, you can ensure that this process is executed smoothly and correctly. Maintaining timely discharge not only secures your property title but also significantly impacts your financial standing.

In conclusion, embracing these practices can foster confidence and competence when handling essential documents like the discharge of mortgage security form, paving your path toward successful property ownership and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in discharge of mortgage security without leaving Chrome?

Can I create an electronic signature for the discharge of mortgage security in Chrome?

How do I edit discharge of mortgage security on an Android device?

What is discharge of mortgage security?

Who is required to file discharge of mortgage security?

How to fill out discharge of mortgage security?

What is the purpose of discharge of mortgage security?

What information must be reported on discharge of mortgage security?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.