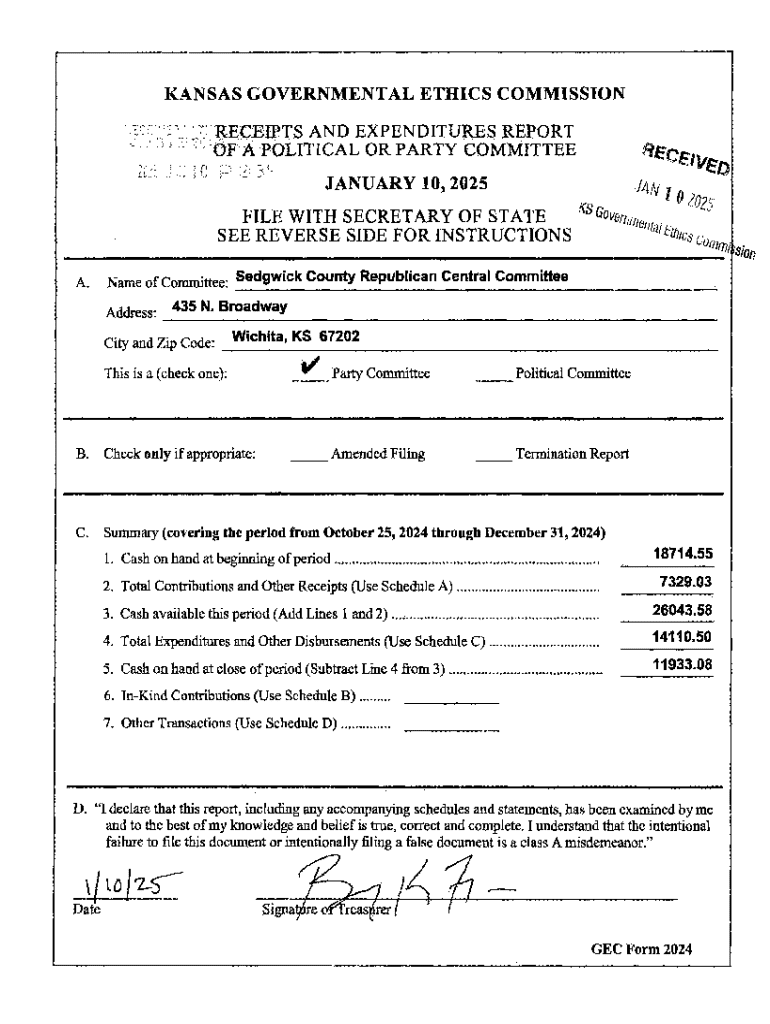

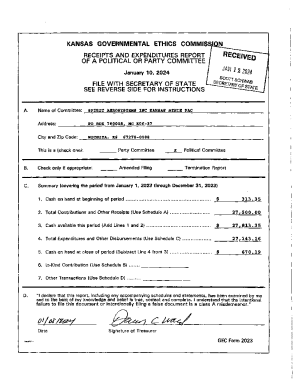

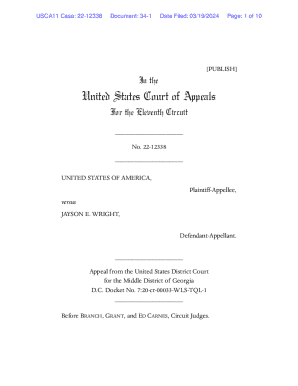

Get the free -:,":" ::: -:- RECEIPTS AND EXPENDITURES REPORT

Get, Create, Make and Sign receipts and

How to edit receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out receipts and

How to fill out receipts and

Who needs receipts and?

Receipts and Form: A Comprehensive How-to Guide

Understanding receipts and forms

Receipts play a crucial role in our financial transactions. A receipt is a document that confirms a purchase or a payment made, serving as proof of the transaction. It is essential not only for personal finance management but also for businesses that require accurate records for audits and tax filings. Additionally, receipts can vary in form; they can be digital, sent via email, or paper-based, given to customers at the point of sale.

Forms, on the other hand, are structured documents used for various purposes, including applications, registrations, or financial reporting. Common types of forms include tax forms, medical consent forms, and reimbursement requests. Each form serves a specific function and often requires accompanying documentation, such as receipts.

The relationship between receipts and forms

Receipts are not just pieces of paper; they serve as critical evidence in financial tracking and audits. Keeping a record of your receipts enables individuals and businesses to have accurate documentation that can support expense claims and assist in budgeting. In many cases, forms will explicitly require the submission of receipts to validate expenses or claims.

For instance, when filling out an expense reimbursement form, you will likely need to attach corresponding receipts as proof of payment. This not only supports the legitimacy of the expenses claimed but also streamlines the processing of reimbursements.

Step-by-step guide to filling out common forms with receipt attachments

Filling out forms correctly is vital for ensuring that all necessary information is communicated effectively. Here's how to prepare and fill out common forms with attachments of receipts.

Preparing to fill out forms

Start by gathering all necessary receipts relevant to the form you will be filling out. Make sure they are organized and legible. Identify which specific form you need—this could be an expense reimbursement form, a tax form, or a different type of form that may vary based on your requirements.

Filling out a simple expense reimbursement form

Completing tax forms with receipts

Editing and managing receipts and forms

When handling receipts and forms, maintaining accuracy is paramount. Utilizing tools like pdfFiller allows users to edit PDF documents seamlessly. You can update the details on forms, ensuring all data is current and accurate.

With pdfFiller, you can easily enhance the visibility and legibility of receipt data, making it simpler for whoever reviews your submissions. This is particularly determined in environments where paperwork can easily accumulate.

eSigning forms and receipts

In today's digital world, eSignatures have an increasing role in the management of documents. They provide an added layer of authenticity, confirming that the person approved the document or form. To eSign documents using pdfFiller, simply open the document, select the eSignature option, and follow the prompts to ensure that your signature is affixed properly.

Collaborating on forms with team members

Collaboration is vital in any workplace, particularly when dealing with receipts and forms. Sharing forms and receipts can enhance transparency and streamline processes. Utilize cloud-based solutions that allow team members to access and edit forms in real-time.

Requesting feedback on filled forms is easy with interactive tools offered by platforms like pdfFiller. Team members can leave comments or suggestions directly on the document, facilitating an efficient review process.

Best practices for receipt management

Effective receipt management can save you time and hassle. Consider adopting a digital tracking system, which allows for simplified record-keeping. By utilizing pdfFiller, you can create, edit, and store receipts in a central location, reducing the risk of lost paperwork.

For those who still manage paper receipts, regular backups and organized filing systems are essential. Ensure that receipts are stored in an easily accessible manner, potentially categorizing them by date or type.

Staying compliant with record-keeping regulations

Records must be maintained for varying lengths of time depending on the type of receipt. For instance, tax-related receipts should be kept for a minimum of three years, while receipts associated with the purchase of real estate may need to be retained longer. Understanding these requirements ensures compliance and ease during audits.

Common mistakes to avoid when handling receipts and forms

Handling receipts and forms can be straightforward, but certain common mistakes can lead to complications. One frequent issue is overlooking necessary information while filling out forms—ensuring all requested fields are completed precisely is vital.

Additionally, ensure that you’re attaching the correct receipts to each form. Misplaced documentation can slow down processing times, and in some cases, can result in denial of claims. Make sure receipts are clearly labeled and easy to match to their corresponding forms.

Advanced tools and future trends in receipt and form management

The realm of receipt and form management is evolving rapidly, with emerging technologies such as artificial intelligence and automation making significant impacts. These advancements allow for easier processing and organization of receipts, reducing manual entry and errors.

The future seems promising for digital receipts and forms—with innovations like QR codes and blockchain technology offering secure and efficient ways to handle transactions. As these technologies continue to develop, users will enjoy enhanced flexibility and control over their documentation processes.

You may also like

If you're keen on streamlining your document processes further, check out other insightful articles on tax season tips and document management strategies. User stories can provide real-life examples of how others have navigated similar challenges and found solutions that work best for them.

Additional tools for your document needs

pdfFiller offers a wide range of features designed to enhance your document management experience. With templates for common forms, users can quickly create essential documents and reduce time spent on repetitive tasks. PDF conversion tools are also available, allowing you to easily change the format of your documents to meet specific requirements.

Interactive tools within pdfFiller can boost productivity further, making it easy to create and store receipts quickly. These features streamline the complex world of receipt and form management, supporting users in keeping track of important documents effortlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete receipts and online?

How do I make changes in receipts and?

How do I complete receipts and on an Android device?

What is receipts and?

Who is required to file receipts and?

How to fill out receipts and?

What is the purpose of receipts and?

What information must be reported on receipts and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.