Get the free Life Insurance Plan Enrollment/Change Request Form

Get, Create, Make and Sign life insurance plan enrollmentchange

How to edit life insurance plan enrollmentchange online

Uncompromising security for your PDF editing and eSignature needs

How to fill out life insurance plan enrollmentchange

How to fill out life insurance plan enrollmentchange

Who needs life insurance plan enrollmentchange?

Life Insurance Plan Enrollment Change Form How-to Guide

Understanding life insurance and its importance

Life insurance is a contract between an individual and an insurance company, designed to provide financial protection for beneficiaries upon the death of the insured. This pivotal financial tool ensures that loved ones are not left with overwhelming debts or financial burdens in the event of an unforeseen tragedy.

The benefits of having a life insurance plan are numerous. They provide peace of mind, allowing individuals to focus on their daily lives without the anxiety of financial uncertainties. Additionally, life insurance policies can be leveraged for savings, securing loans, or even as part of an estate plan.

Overview of the enrollment change process

Changes to a life insurance plan may be necessary due to various life events, such as marriage, birth of a child, or changes in financial circumstances. Knowing when and why to make changes is crucial for maximizing the benefits of your life insurance policy.

Before enrolling or making any changes, it is essential to consider several key factors, including personal financial goals, family needs, and the specific terms of your current policy. Evaluating these factors can guide you in making informed decisions regarding your life insurance.

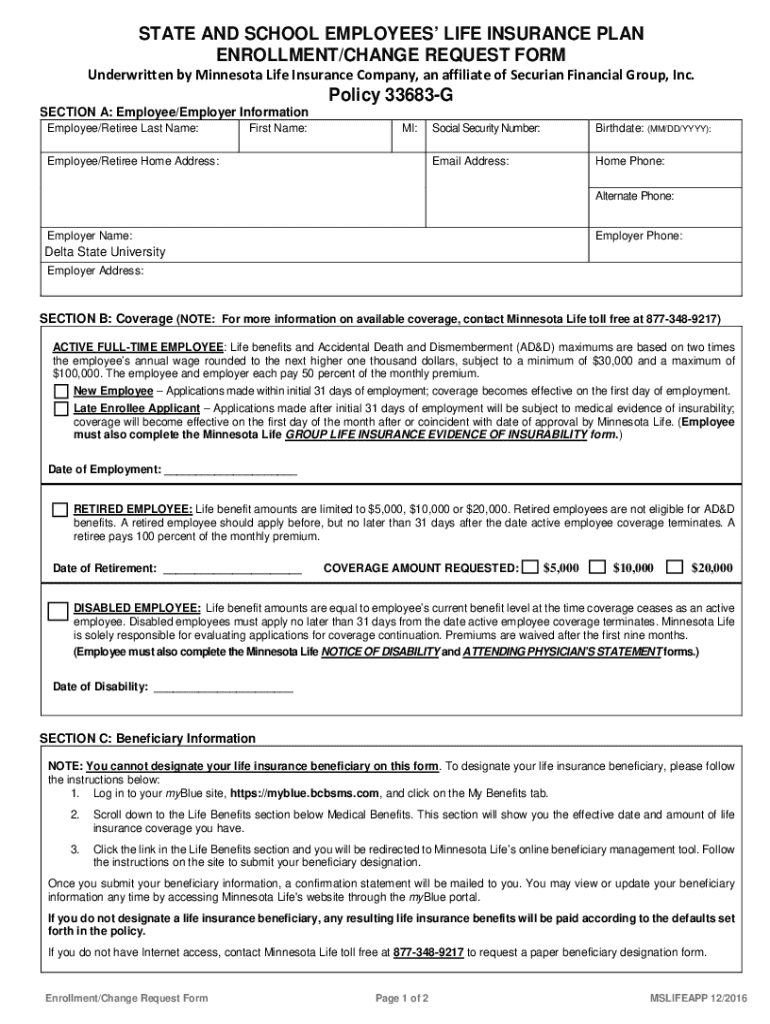

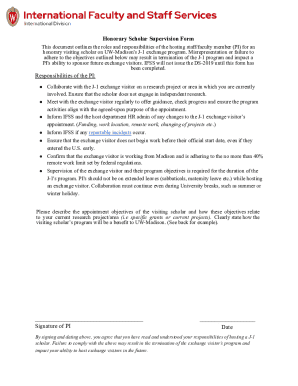

What is a life insurance plan enrollment change form?

The life insurance plan enrollment change form is a document designed to facilitate modifications to your existing policy. Its primary purpose is to document changes in personal circumstances, beneficiary designations, or policy coverage.

While initial enrollment forms focus on setting up a new policy, enrollment change forms are specifically for adjustments, ensuring that your coverage aligns with your current situation.

Preparing to fill out the enrollment change form

Before you begin filling out the enrollment change form, gather all necessary documentation to ensure an efficient process. Required items usually include your personal information, current policy details, and updated beneficiary information.

Organizing your documents can significantly streamline the process. Having everything in one place reduces the likelihood of missing critical information and avoids unnecessary delays.

Common mistakes to avoid include misplacing documents, omitting crucial information, or providing outdated details. By taking the time to prepare, you can minimize errors that may hinder your application.

Step-by-step instructions for completing the enrollment change form

Completing the form accurately is vital. Follow these detailed steps to ensure you cover all necessary information.

Submitting the enrollment change form

Once completed, you’ll need to submit your enrollment change form. The method of submission can greatly impact the efficiency of processing your changes.

Digital submission is often faster and easier, allowing for eSigning and immediate tracking of your changes. Alternatively, traditional mail or fax can also be used, although these methods may introduce delays.

What happens after submission?

After you submit your enrollment change form, the next phase involves confirmation of changes. Your insurance provider should update your records based on the information provided.

You can track your changes through customer service or your online account interface. Expect updates to process within a week, but timing can vary based on the insurer’s policies.

Frequently asked questions (FAQs)

Understanding your options within your life insurance plan can involve nuanced questions. Here are some commonly inquired topics.

Additional tools and resources available on pdfFiller

pdfFiller offers various interactive tools designed to simplify the management of your life insurance documents. These resources can enhance the experience and ensure seamless transitions when making changes.

With customizable templates for life insurance forms, you can easily modify your documents to meet your needs. Document management features help you keep track of all pertinent paper trails, while collaborative tools enable teams managing life insurance policies to work efficiently.

Contacting support for assistance

If you encounter issues or have questions while using the enrollment change form, reaching out to customer service is a pivotal step. Support teams are trained to help guide you through any hurdles you might face.

Implementing best practices for reaching out can yield the best results. Have your policy details handy, articulate your concerns clearly, and be prepared to follow up as necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete life insurance plan enrollmentchange online?

How do I fill out life insurance plan enrollmentchange using my mobile device?

Can I edit life insurance plan enrollmentchange on an Android device?

What is life insurance plan enrollment change?

Who is required to file life insurance plan enrollment change?

How to fill out life insurance plan enrollment change?

What is the purpose of life insurance plan enrollment change?

What information must be reported on life insurance plan enrollment change?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.