Get the free 1'/y

Get, Create, Make and Sign 1039y

How to edit 1039y online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1039y

How to fill out 1039y

Who needs 1039y?

A comprehensive guide to the 1039y form

Understanding the 1039y form

The 1039y form is a specialized document tailored for specific financial reporting and regulatory compliance needs. This form is employed primarily by individuals and businesses to systematically present and document essential financial information. Originating from standard practices in document management, the 1039y form serves a fundamental role in ensuring accurate submissions to authorities and stakeholders.

Its importance cannot be overstated, as having a well-structured form can streamline communication and clarity regarding financial statuses. Without proper documentation, individuals and organizations may face complications during assessments, audits, or other legal examinations. Thus, the 1039y form offers a means of fostering compliance and accountability through meticulous documentation.

Who needs to use the 1039y form?

The application of the 1039y form spans a diverse range of users. Individuals seeking financial aid or submitting tax-related documents may find this form indispensable for clear information transfer. For instance, homeowners applying for loans often need to provide such a form to validate their financial histories.

On the flip side, businesses also utilize the 1039y form primarily during financial audits or while preparing regulatory submissions. For companies, meeting compliance and ensuring accurate financial statements is critical. Additionally, scenarios like mergers, acquisitions, or funding proposals specially necessitate the detailed information captured within this form.

Step-by-step guide to filling out the 1039y form

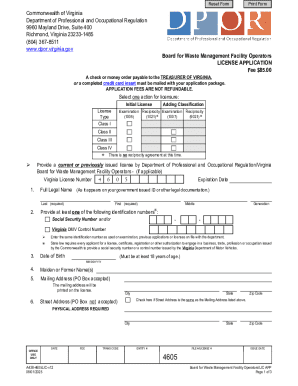

Before embarking on completing the 1039y form, it is essential to prepare all necessary documents. Gathering required information — such as personal identification details, financial records, and supporting backup documentation — is crucial. For example, tax returns, bank statements, and historical financial records serve as vital references while filling out this form.

Next, understanding the fields of the 1039y form is instrumental in ensuring accuracy. The form generally comprises sections for personal information, income records, deductions, and specific financial data presentation. Clarity on what each section requires significantly reduces the possibility of errors during data entry.

The filling process itself can be broken down into a few pivotal steps:

Avoiding common mistakes such as data entry errors, omissions, or misinterpretations of requirements is crucial for error-free submissions. Double-checking against the assembled documents acts as an effective checkpoint.

Editing the 1039y form

Editing a 1039y form can be accomplished with user-friendly tools such as pdfFiller. The platform facilitates easy uploading of PDFs, allowing users to make necessary adjustments efficiently. This flexibility is indispensable, especially when updates or modifications are needed after the initial completion.

Once uploaded, users can utilize various editing tools available on pdfFiller. Features that enhance document clarity, such as annotating text, adding images, or including comments, turn cumbersome editing processes into seamless experiences. Keeping track of changes through version control mechanisms is another beneficial aspect.

In addition, users often have questions about the editing process. Common inquiries surround the capabilities of the platform, including how to save progress, how to recover previous versions, and more.

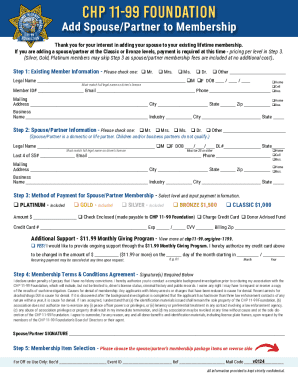

Signing the 1039y form

The process of signing the 1039y form is a crucial element that validates the agreement represented by the document. The signature signifies that the individual or organization acknowledges the accuracy of the information provided and consents to the terms outlined within the form.

To enhance convenience, pdfFiller offers eSignature features that simplify this process. Users can create a personalized electronic signature directly on the platform, which can then be applied easily to their 1039y form. This not only expedites the signing phase but also aligns with legal standards for electronic documentation.

Collaborating on the 1039y form

Collaboration is an essential aspect of document management, particularly for teams working on joint projects or submissions. pdfFiller facilitates the sharing of the 1039y form, enabling team members to access and contribute to the document seamlessly. This function is advantageous during preparation phases for large proposals or financial audits.

Real-time collaboration tools included on pdfFiller support interactive discussions and adjustments, addressing feedback instantaneously. Additionally, these tools allow users to track changes and comments, ensuring that clarity and transparency remain at the forefront of collaborative efforts.

Managing the 1039y form after completion

Once the 1039y form is completed, managing its storage becomes key. Users can securely store their form in the cloud through pdfFiller, providing peace of mind and easy access from virtually anywhere. This feature enhances organizational efficiency, allowing users to retrieve documents with minimal hassle.

Accessing your 1039y form anytime ensures that you are never disconnected from essential information. Furthermore, pdfFiller provides multiple options for sharing and distributing the completed form, including emailing, downloading, or printing it for physical submission. This versatility caters to a variety of situations where documentation delivery may differ.

Troubleshooting common issues with the 1039y form

Handling common issues that arise with the 1039y form can alleviate stress and ensure that documentation is always up to standard. Frequent errors often stem from misinterpretations, incomplete submissions, or technical glitches while using editing platforms like pdfFiller.

Fortunately, pdfFiller provides extensive support resources to guide users through any challenges. Contacting support is straightforward, and accessing user community forums can open avenues for shared solutions and personalized tips from others who have navigated similar situations.

Keeping up-to-date with changes to the 1039y form

Staying informed about updates to the 1039y form and its associated requirements is vital for ongoing compliance and accuracy. Regular updates are often necessitated by changes in regulatory guidelines and financial best practices, making it essential to be proactive in leveraging accurate information.

To facilitate this, pdfFiller provides automated alerts, ensuring users receive notifications regarding changes that could impact their form usage. Having access to timely updates equips users to modify their documents accordingly and ensures they remain compliant with any new standards.

Maximizing pdfFiller features with the 1039y form

To optimize your experience with the 1039y form, leveraging the additional tools offered by pdfFiller can play a critical role. The platform presents numerous features that enhance document management, such as templates for quick form creation or integrations with other applications to streamline the workflow.

Best practices include not only utilizing automated templates but also tapping into advanced editing tools, which facilitate efficient document creation and amendments. Adopting these practices ensures that the use of the 1039y form becomes more effective and time-efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 1039y from Google Drive?

How can I fill out 1039y on an iOS device?

How do I edit 1039y on an Android device?

What is 1039y?

Who is required to file 1039y?

How to fill out 1039y?

What is the purpose of 1039y?

What information must be reported on 1039y?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.