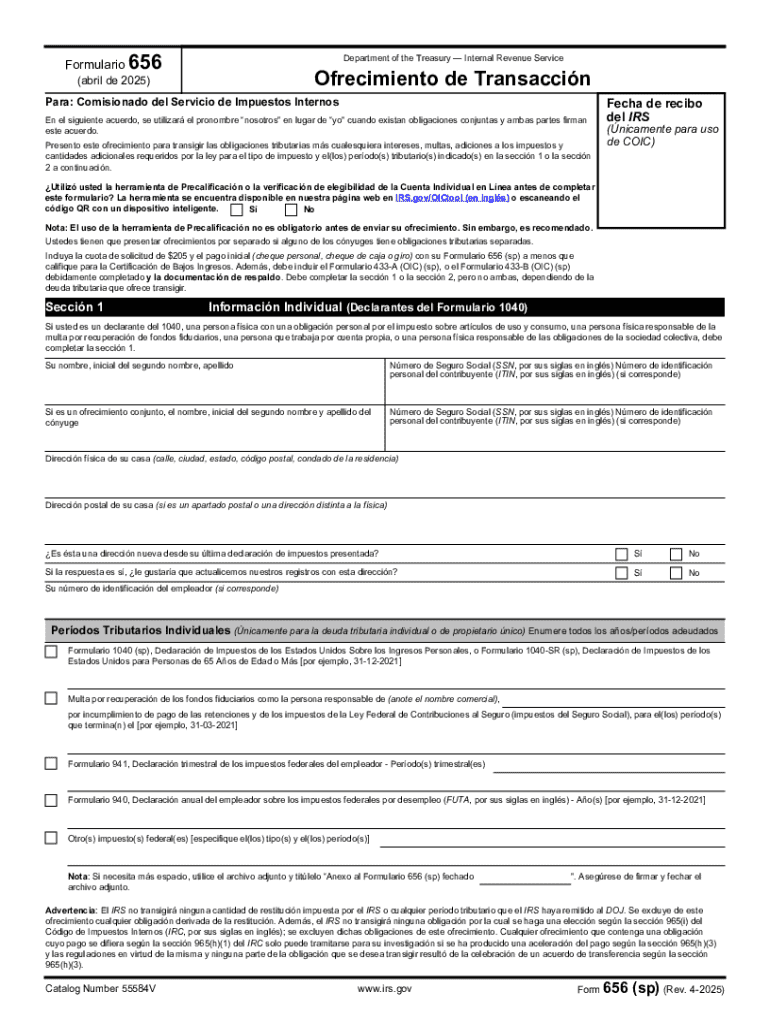

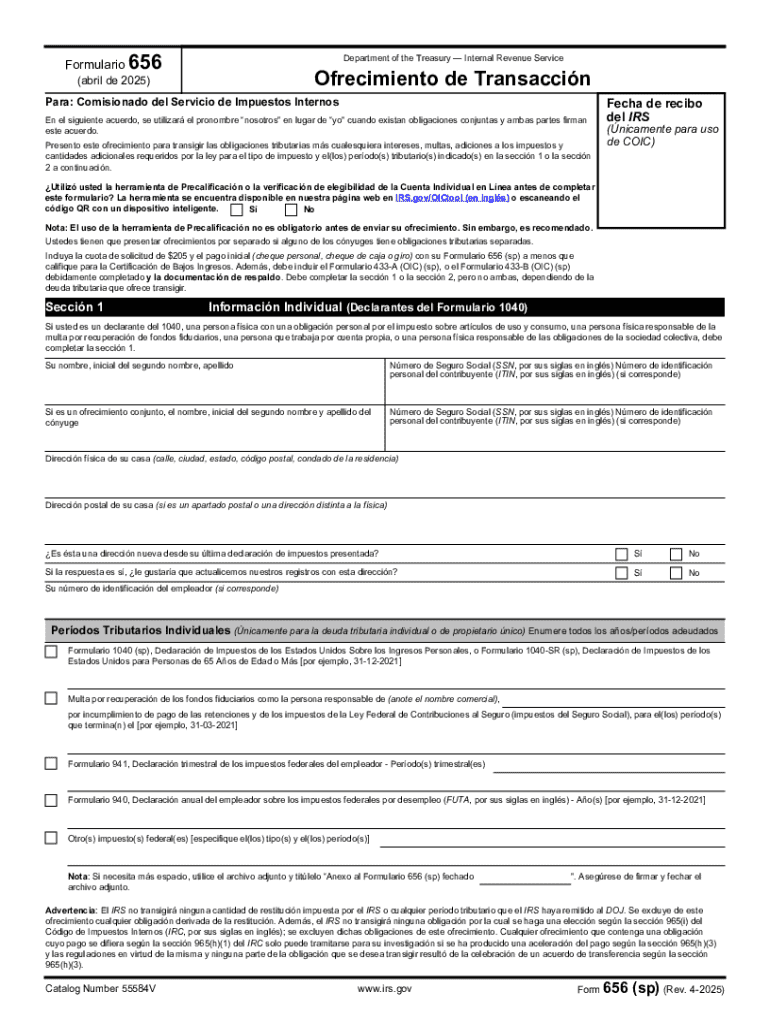

Get the free Form 656 (sp) (Rev. 4-2025). Offer in Compromise (Spanish Version)

Get, Create, Make and Sign form 656 sp rev

How to edit form 656 sp rev online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 656 sp rev

How to fill out form 656 sp rev

Who needs form 656 sp rev?

How to Guide: Form 656 SP Rev Form

Overview of Form 656 SP Rev Form

Form 656 SP Rev is an essential document used by taxpayers to propose an offer in compromise (OIC) to the IRS, specifically designed for Spanish-speaking individuals. This form allows taxpayers to settle their tax debts for less than the full amount owed, providing a much-needed opportunity for those facing financial hardships.

The significance of the Form 656 SP Rev lies in its ability to serve as a lifeline for taxpayers struggling with tax debts. It allows individuals to formally present their financial situation and negotiate a settlement amount that is more manageable based on their current financial standing. This process can be a game-changer, rendering an overwhelming tax burden into an achievable resolution.

Preparation steps before completing Form 656 SP Rev

Before diving into the completion of the Form 656 SP Rev, meticulous preparation is crucial. Gathering essential documentation is the first step to ensure that all information submitted is accurate and substantiated. The critical documents include your Tax Identification Number (TIN), which uniquely identifies you within IRS records, and income statements that reflect your financial status.

Moreover, asset evaluations provide insight into what you own, while current financial statements will detail your financial stability. Understanding the qualification criteria is equally vital. Taxpayers must meet specific financial hardship requirements and consider the total amount of their tax debts when offering a settlement through the form.

A step-by-step guide to completing Form 656 SP Rev

Completing the Form 656 SP Rev requires careful attention to detail. Start with entering your personal information, including your name, address, and contact details to ensure that the IRS can reach you. Following that, disclosure of tax information about your tax liabilities, such as the type and the amount owed, will provide clarity on your tax situation.

Next, you need to provide comprehensive financial details. Listing all sources of income and estimation of assets will aid the IRS in understanding your financial capabilities. A pivotal part of the process is determining a reasonable offer amount for compromise based on what you can realistically pay. Finally, ensure that you sign and date the form, verifying its contents; notarization may also be required in certain circumstances.

Common mistakes to avoid when filling out Form 656 SP Rev

Filling out the Form 656 SP Rev can be fraught with pitfalls if one is not careful. Incomplete or incorrect information is a leading cause of denial of offers. It’s imperative to provide full details and ensure that all sections of the form are filled out accurately. Many taxpayers underestimate their offer amount, thinking that a lower proposal will guarantee acceptance; however, this can backfire by making the offer seem unrealistic to the IRS.

Moreover, failing to attach required documentation supports your claims and can lead to delayed processing or rejection of the offer. Proper preparation and checks will help mitigate these issues, helping you to navigate this process smoothly.

Submitting Form 656 SP Rev

Once the Form 656 SP Rev is completed, proper submission is crucial. Consider best practices such as whether to mail or submit online, as each has its benefits. Mailing provides a physical record, whereas online submission can offer quicker processing times. Tracking your submission is recommended so that you can confirm receipt and monitor the status of your offer.

After the submission, it is essential to know what to expect. The average processing time for an offer can vary, often taking several months. Being proactive in understanding potential outcomes and next steps is vital. Reapproved offers may lead to customized payment plans, while rejected offers can present opportunities for reconsideration.

Editing and managing your Form 656 SP Rev

Flexibility in editing and managing your Form 656 SP Rev is essential, particularly if adjustments are required post-submission. Accessing and modifying your submitted form ensures accuracy and compliance with IRS requirements. Tools like pdfFiller provide seamless document management solutions, allowing users to edit PDF forms easily, enabling quick corrections.

In addition, pdfFiller offers collaborative features that facilitate teamwork, particularly beneficial for tax professionals working with clients. Utilizing these tools not only fosters efficiency but also ensures that document security is prioritized, protecting sensitive financial information throughout the process.

Troubleshooting common issues with Form 656 SP Rev

Navigating the complexities of Form 656 SP Rev can lead to some challenges. If your offer is rejected, it's vital to understand your options; you may adjust your offer amount or provide additional documentation to support your financial claims. Responding promptly and accurately to any IRS inquiries can help resolve discrepancies and prevent further issues.

Common issues also arise from misunderstandings about the negotiation process. Taxpayers may not be fully informed about the compromise options available to them. Clarifying these points can make a significant difference in achieving a favorable outcome.

eSignature for Form 656 SP Rev

In today’s digital age, utilizing eSignature for Form 656 SP Rev enhances the submission process. Adopting secure eSigning solutions, such as those available through pdfFiller, provides both convenience and security. This feature allows users to sign documents quickly, ensuring that the form is completed in a timely manner.

Implementing an eSignature not only streamlines the overall process but also provides an added layer of legitimacy. This is crucial for taxpayers who need assurance that their documents are signed and can be submitted without delay.

FAQs regarding Form 656 SP Rev

Taxpayers often have pressing questions about the Form 656 SP Rev. Common inquiries might include eligibility criteria, potential tax debt amounts that can be settled, and the timeframe for IRS decisions. Clarifying these points can empower individuals to make informed decisions about their offers in compromise.

Furthermore, understanding the nuances of what the IRS looks for in an OIC could significantly affect how taxpayers craft their proposals. Engaging with tax professionals or utilizing resources available on websites like pdfFiller can provide valuable insights and guidance throughout the process.

Additional tools provided by pdfFiller

pdfFiller is equipped with several interactive tools that streamline the process of dealing with forms and tax documents. Features include financial calculation calculators that help assess potential offer amounts, ensuring taxpayers are informed about their negotiation capabilities. Templates for related IRS forms further simplify the process, guiding users effectively.

Moreover, document sharing and collaboration features empower both individuals and teams to work together effortlessly. This not only enhances productivity but also ensures that all parties are aligned when it comes to the details of tax negotiations.

Contact information and support

When navigating the complexities of Form 656 SP Rev, access to reliable customer support can make all the difference. pdfFiller offers dedicated customer assistance to guide users through inquiries related to the form and the submission process. Whether it’s seeking clarification on specific sections or troubleshooting issues post-submission, customer support teams are equipped to provide the necessary guidance.

Getting assistance with form queries not only fosters confidence during the process but also aids in achieving successful negotiations with the IRS. Engaging with the support team ensures that users are taking the best steps toward resolving their tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 656 sp rev in Chrome?

Can I edit form 656 sp rev on an Android device?

How do I complete form 656 sp rev on an Android device?

What is form 656 sp rev?

Who is required to file form 656 sp rev?

How to fill out form 656 sp rev?

What is the purpose of form 656 sp rev?

What information must be reported on form 656 sp rev?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.